Industrial Wastewater Treatment Equipment Market Size 2025-2029

The industrial wastewater treatment equipment market size is valued to increase USD 7.6 billion, at a CAGR of 7.5% from 2024 to 2029. An increase in global energy demand will drive the industrial wastewater treatment equipment market.

Major Market Trends & Insights

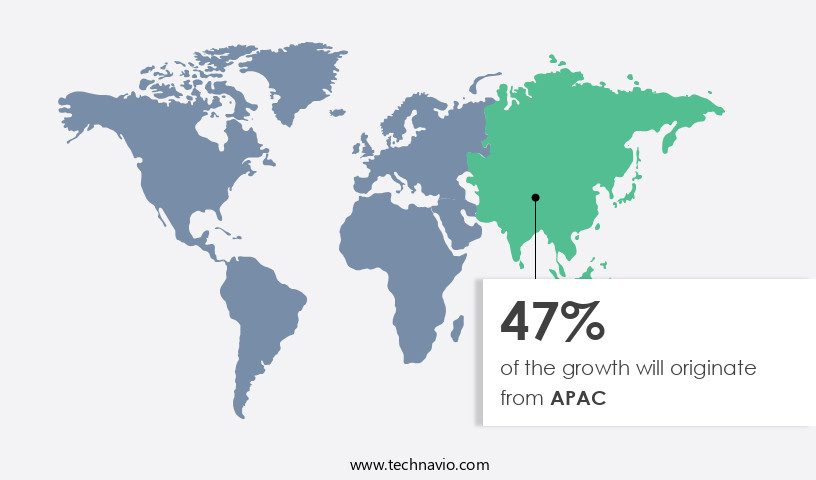

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By End-user - Manufacturing segment was valued at USD 7.57 billion in 2023

- By Product Type - Filtration equipment segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 75.36 million

- Market Future Opportunities: USD 7.6 billion

- CAGR : 7.5%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, sales, and installation of technologies and systems designed to purify industrial wastewater before its release into the environment. This market is driven by the increasing global focus on water conservation and the need to meet stringent environmental regulations. Core technologies, such as membrane filtration and activated carbon adsorption, continue to evolve, offering enhanced treatment capabilities and improved energy efficiency. Applications span various industries, including textiles, food and beverage, pharmaceuticals, and oil and gas. Service types range from equipment sales to installation, maintenance, and upgrades. Regulations, such as the Clean Water Act in the US and the European Union's Water Framework Directive, are major drivers, pushing industries to invest in advanced wastewater treatment solutions.

- The market is forecasted to grow significantly in the coming years, with increasing adoption rates in developing regions like the Asia Pacific and the Middle East. For instance, the Middle East and Africa market is projected to grow at a steady pace due to the increasing demand for water treatment technologies in the oil and gas sector. Despite these opportunities, challenges remain, including high capital and operational costs, complex regulatory landscapes, and the need for continuous innovation to address emerging contaminants. However, advances in industrial wastewater treatment technology, increasing adoption of renewable energy sources, and the growing need to reduce water usage and improve resource efficiency present significant opportunities for market growth.

What will be the Size of the Industrial Wastewater Treatment Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Industrial Wastewater Treatment Equipment Market Segmented and what are the key trends of market segmentation?

The industrial wastewater treatment equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Manufacturing

- Energy

- Others

- Product Type

- Filtration equipment

- Membrane equipment

- Thermal distillation equipment and evaporator

- Disinfection equipment

- Type

- Secondary treatment

- Primary treatment

- Tertiary treatment

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The manufacturing segment is estimated to witness significant growth during the forecast period.

The market encompasses various technologies, including aeration systems, ozonation disinfection, sedimentation tanks, industrial pretreatment, and solids handling equipment. These solutions play a crucial role in enhancing the efficiency of the activated sludge process, chlorination disinfection, and automation technologies. The market is marked by the increasing adoption of water reuse systems in wastewater treatment plants and the integration of advanced technologies like membrane bioreactor systems, UV disinfection systems, and advanced oxidation processes. The manufacturing sector, which includes the food and beverage (F&B), paper and pulp (P&P), pharmaceutical, microelectronics, steel, textile, and automotive industries, is a significant contributor to the market's growth.

The F&B industry, in particular, is a major employer and has a significant impact on public health. Given its reliance on water in production processes, the industry generates substantial wastewater. According to recent studies, the F&B sector's wastewater treatment equipment market share is projected to expand by 25% by 2026. Moreover, the growing focus on process optimization, nitrogen removal, and energy efficiency measures is driving the market's expansion. For instance, chemical precipitation, biological nutrient removal, and anaerobic digestion processes are increasingly being adopted to improve effluent quality and meet stringent effluent discharge permits. Additionally, the integration of SCADA systems, rotating biological contactors, and process control systems is enabling better process management and sludge management.

The Manufacturing segment was valued at USD 7.57 billion in 2019 and showed a gradual increase during the forecast period.

Furthermore, the market is expected to witness substantial growth in the coming years, with wastewater characterization and sludge dewatering gaining prominence. The market is projected to expand by 18% by 2027. This growth is attributed to the increasing demand for water reuse and the need for effective wastewater treatment solutions to meet regulatory requirements and ensure sustainable industrial practices. In conclusion, the market is witnessing robust growth due to the increasing focus on water reuse, process optimization, and regulatory compliance. The market's expansion is being driven by the manufacturing sector, with the F&B industry being a significant contributor.

The integration of advanced technologies and the growing emphasis on energy efficiency measures are also fueling the market's growth.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Wastewater Treatment Equipment Market Demand is Rising in APAC Request Free Sample

In the Asia-Pacific (APAC) region, China, India, and Japan were the significant contributors to the market in 2024. The market's growth is primarily driven by population expansion, urbanization, and industrialization. Rapid industrialization and growth in construction sectors in Southeast Asia and Central China lead the market. Australia, South Korea, Taiwan, Singapore, Vietnam, and Japan are expected to fuel the market's growth during the forecast period due to accelerating industrial and infrastructural development.

The region's market faces a pressing need due to escalating water pollution. With water bodies filled with effluents, there is a dire requirement for effective wastewater treatment solutions. The market's expansion is a response to this pressing issue.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of technologies and processes designed to address the complex challenges of managing wastewater generated by various industries. One critical aspect of this market involves the design and optimization of industrial wastewater treatment plants, which necessitates a deep understanding of various treatment systems and their performance metrics. Membrane bioreactor systems, for instance, have gained popularity due to their high biomass retention and efficient nutrient removal capabilities. Optimizing these systems requires careful control strategies, such as activated sludge process control, to maintain optimal operational conditions. Another area of focus in the market is anaerobic digestion and biogas utilization.

The selection criteria for trickling filter media, for example, play a crucial role in ensuring efficient biogas production. Performance evaluations of rotating biological contactors are also essential to optimize anaerobic digestion processes. Disinfection systems, such as UV disinfection and chlorination, are key components of industrial wastewater treatment. UV disinfection system effectiveness testing is critical to ensure adequate disinfection, while chlorination disinfection necessitates careful control to minimize the formation of disinfection byproducts. Energy consumption is a significant consideration in the market, with ozonation disinfection and aeration systems being notable energy consumers. Aeration system oxygen transfer efficiency is a crucial metric in optimizing energy usage.

Maintenance schedules for solids handling equipment and sludge dewatering methods are essential to ensure plant efficiency and minimize downtime. Comparatively, sludge dewatering methods like centrifugation and filtration offer higher solids content and lower water content compared to gravity belt thickening and lime precipitation (centrifugation: 20% solids content vs. Gravity belt thickening: 3% solids content). Effluent quality monitoring data analysis and BOD removal efficiency improvement techniques are essential for maintaining regulatory compliance and optimizing treatment processes. Cod removal efficiency factors, nitrogen removal biological processes, and phosphorus removal chemical additives are critical considerations in achieving optimal treatment results.

Advanced oxidation processes, such as UV and ozone, are increasingly being adopted for industrial wastewater treatment due to their high oxidation potential. Water reuse system design considerations, including membrane filtration and reverse osmosis, are essential to maximize water recovery and minimize wastewater discharge.

What are the key market drivers leading to the rise in the adoption of Industrial Wastewater Treatment Equipment Industry?

- The escalating global energy demand serves as the primary market driver.

- In the ever-evolving global economy, the demand for energy continues to escalate, with emerging economies such as China and India leading the charge. According to the International Energy Agency, energy consumption is projected to expand by approximately 30% by 2040 compared to 2017. This surge in demand is driven by population growth and economic development. Meanwhile, advancements in technology have significantly impacted the energy sector. For instance, the application of horizontal drilling and hydraulic fracturing has revolutionized the US energy landscape, increasing natural gas resources by a factor of two compared to the previous decade.

- These technological innovations contribute to the ongoing evolution of the energy market and its applications across various sectors. The energy sector is a critical component of the global economy, and its continuous growth and adaptation to new technologies are essential for meeting the increasing demand for energy. By focusing on the latest trends and developments, we can gain a comprehensive understanding of the energy market's dynamics and its role in driving economic growth.

What are the market trends shaping the Industrial Wastewater Treatment Equipment Industry?

- Advances in industrial wastewater treatment technology are currently shaping market trends. Industrial wastewater treatment technology continues to evolve, setting new standards for sustainable and efficient processes.

- Membrane technologies have gained prominence in the fields of wastewater treatment and energy sustainability. Industrial processes generate significant volumes of wastewater, necessitating advanced treatment methods. Membrane technologies, including Membrane Bioreactors (MBR) for wastewater treatment, Reverse Osmosis (RO) desalination, and membrane-based fuel cells, are increasingly adopted due to their sustainability attributes. These technologies offer adaptability, ease of use, minimal environmental impact, efficient land usage, and flexibility. Notable advancements in membrane technology include desalination, recovery of rare earth elements and heavy metals from saline wastewater, industrial wastewater reclamation and reuse, and microfiltration. The industrial wastewater treatment sector has transitioned from a treat-to-discharge approach to a recycle, reuse, and zero liquid discharge (ZLD) strategy.

- Companies provide hybrid ZLD processes, which integrate membrane treatment and thermal equipment for effective wastewater recycling and ZLD implementation. Membrane technologies offer substantial improvements in industrial processes, enabling businesses to minimize water consumption, reduce waste, and enhance overall sustainability. The integration of these technologies continues to evolve, offering potential for further advancements and applications across various industries.

What challenges does the Industrial Wastewater Treatment Equipment Industry face during its growth?

- The expansion of renewable energy sources' usage poses a significant challenge to the industry's growth trajectory.

- In the global energy landscape, renewable energy sources have emerged as a significant contributor to the increasing energy demand. According to the International Energy Agency (IEA), renewable energy use in electricity generation experienced a remarkable growth spurt in 2023, accounting for over 40% of the total energy demand expansion. This trend is driven primarily by emerging economies like China and India. The IEA reports that renewables are the only fuel type experiencing continuous growth in contrast to other fuels. Renewable energy sources encompass biomass, wind, solar, geothermal, and landfill waste.

- These sources have gained substantial traction due to increasing clean energy initiatives and subsidies. The IEA underscores the importance of this shift, emphasizing the need for a more sustainable energy future. Renewable energy's increasing prominence in the global energy mix underlines its potential to transform the energy sector and contribute to a more sustainable future.

Exclusive Customer Landscape

The industrial wastewater treatment equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial wastewater treatment equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Industrial Wastewater Treatment Equipment Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial wastewater treatment equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALAR Engineering Corp. - The company specializes in providing advanced industrial wastewater treatment solutions, featuring the BioMOD MBBR Moving Bed Biofilm Reactor, BioMOD MBR Membrane Bioreactor, HERO High Efficiency Reverse Osmosis, and MoVap mobile evaporation systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALAR Engineering Corp.

- Anuj Enterprises

- Aquatech International LLC

- Condorchem Envitech SL

- DuPont de Nemours Inc.

- Ecolab Inc.

- Fluence Corp. Ltd.

- Kanadevia Corp.

- Kingspan Group Plc

- KURARAY Co. Ltd.

- Kurita Water Industries Ltd

- Metso Outotec Corp.

- Ovivo Inc.

- Pentair Plc

- SERECO Srl

- SWA Water Holdings Pty Ltd.

- Trojan Technologies

- Veolia Environnement SA

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Wastewater Treatment Equipment Market

- In January 2024, Veolia Water Technologies, a global leader in water and wastewater solutions, announced the launch of its new industrial wastewater treatment solution, AQUAVISTA, designed to optimize energy consumption and reduce operational costs for clients in the mining sector (Veolia Water Technologies Press Release, 2024).

- In March 2024, Siemens Water Technologies and Suez signed a strategic partnership to jointly develop and commercialize advanced membrane filtration technologies, aiming to enhance their market presence and cater to the growing demand for water reuse and wastewater treatment (Siemens Water Technologies Press Release, 2024).

- In May 2024, Evoqua Water Technologies completed the acquisition of US Filter Corporation, a leading provider of water and wastewater treatment solutions, significantly expanding its product portfolio and market reach (Evoqua Water Technologies Press Release, 2024).

- In February 2025, the European Union approved the Horizon Europe research and innovation program, which includes a € 1 billion investment in circular economy initiatives, including the development and deployment of advanced wastewater treatment technologies (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Wastewater Treatment Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 7604.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Australia, Germany, Canada, India, Russia, Japan, UK, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market witnesses dynamic activities as businesses continually seek innovative solutions to address evolving water quality regulations and operational efficiency demands. Aeration systems and ozonation disinfection are increasingly adopted for their energy efficiency and improved COD removal efficiency. Sedimentation tanks remain a staple in wastewater treatment, while industrial pretreatment processes, such as activated sludge and chemical precipitation, undergo optimization to enhance nitrogen and phosphorus removal. Automation technologies, including SCADA systems and process control systems, are transforming wastewater treatment plants by streamlining operations and improving effluent quality monitoring. Advanced oxidation processes, such as UV disinfection systems and membrane bioreactor systems, are gaining traction for their ability to address complex contaminants.

- Water reuse systems are becoming essential for industries seeking to minimize water usage and reduce their environmental footprint. Wastewater characterization plays a crucial role in determining the most effective treatment methods and technologies. Trickling filter systems and rotating biological contactors are key components of biological nutrient removal processes, ensuring regulatory compliance and enhancing effluent discharge permits. Sludge management, including sludge dewatering and energy efficiency measures, is a critical focus area for wastewater treatment plant operators. Filtration systems are integral to the overall wastewater treatment process, ensuring the removal of suspended solids and enhancing effluent quality. As the market evolves, the emphasis on energy efficiency, automation, and regulatory compliance continues to shape the industrial wastewater treatment equipment landscape.

What are the Key Data Covered in this Industrial Wastewater Treatment Equipment Market Research and Growth Report?

-

What is the expected growth of the Industrial Wastewater Treatment Equipment Market between 2025 and 2029?

-

USD 7.6 billion, at a CAGR of 7.5%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Manufacturing, Energy, and Others), Product Type (Filtration equipment, Membrane equipment, Thermal distillation equipment and evaporator, and Disinfection equipment), Type (Secondary treatment, Primary treatment, and Tertiary treatment), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increase in global energy demand, Increasing adoption of renewable energy sources

-

-

Who are the major players in the Industrial Wastewater Treatment Equipment Market?

-

Key Companies ALAR Engineering Corp., Anuj Enterprises, Aquatech International LLC, Condorchem Envitech SL, DuPont de Nemours Inc., Ecolab Inc., Fluence Corp. Ltd., Kanadevia Corp., Kingspan Group Plc, KURARAY Co. Ltd., Kurita Water Industries Ltd, Metso Outotec Corp., Ovivo Inc., Pentair Plc, SERECO Srl, SWA Water Holdings Pty Ltd., Trojan Technologies, Veolia Environnement SA, and Xylem Inc.

-

Market Research Insights

- The market encompasses a diverse range of technologies and processes designed to address various water quality parameters in industrial effluents. Two significant market trends include the increasing adoption of chemical treatment methods for pH control and organic pollutants removal, and the growing implementation of reverse osmosis systems for disinfection byproducts reduction. According to industry estimates, chemical treatment accounts for approximately 45% of the total capital costs in the market, while reverse osmosis systems represent around 25% of the operational costs. As regulatory compliance becomes increasingly stringent, the demand for advanced treatment technologies, such as biological treatment, effluent polishing, and membrane filtration, continues to rise.

- Energy recovery, sustainable practices, and remote monitoring are also gaining traction to minimize operational costs and enhance process efficiency. Additionally, waste heat recovery, sludge thickening, and biogas production are emerging trends to address environmental concerns and promote circular economy principles. Data logging, permitting requirements, and process monitoring are essential components of the market, ensuring regulatory compliance and optimizing treatment plant performance.

We can help! Our analysts can customize this industrial wastewater treatment equipment market research report to meet your requirements.