Desalination Market Size 2025-2029

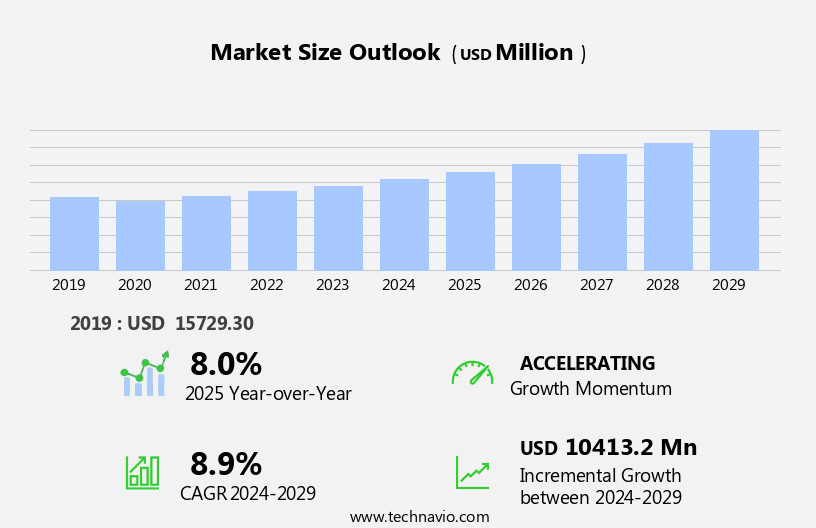

The desalination market size is forecast to increase by USD 10.41 billion, at a CAGR of 8.9% between 2024 and 2029.

- The market is driven by the escalating population growth and subsequent surge in demand for consumable water. As water scarcity becomes a pressing issue, desalination emerges as a viable solution to meet the increasing water demands. Additionally, the integration of renewable energy sources in desalination processes is gaining traction, contributing to the market's momentum. However, the high initial investment costs associated with setting up desalination plants pose a significant challenge for market growth. Despite this hurdle, companies can capitalize on the growing demand for water and the trend towards renewable energy integration by developing cost-effective desalination technologies and collaborating with energy providers to optimize the use of renewable power sources. Also, the presence of excess salts and minerals in feedwater sources poses challenges in the desalination process.

- By addressing these challenges, market participants can effectively navigate the competitive landscape and capitalize on the opportunities presented by the market.

What will be the Size of the Desalination Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Desalination, a critical solution in addressing water scarcity, continues to evolve as market dynamics unfold. The desalination industry encompasses various technologies, including reverse osmosis (RO), thermal desalination, and membrane distillation, among others. Each technology presents unique advantages and challenges in terms of water quality, capital costs, and energy efficiency. Water recovery rate and salt rejection are crucial factors in evaluating desalination plants' performance. RO membranes, a common choice, filter water through semipermeable membranes, rejecting salts and impurities. Thermal desalination processes, such as vapor compression distillation and multi-effect distillation, heat seawater to produce steam, which then condenses into fresh water.

Membrane distillation separates water through temperature difference, minimizing the need for chemicals. Desalination projects face various challenges, including high capital costs, energy consumption, and environmental impact. Integrating desalination with renewable energy sources and improving energy efficiency through energy recovery devices is a significant focus. Pretreatment systems, including intake structures and cleaning agents, are essential for maintaining water quality and minimizing fouling. Desalination applications span municipal and agricultural sectors, particularly in arid regions and coastal communities, where water security is paramount. Mineral composition, total dissolved solids, and brine management are essential considerations for desalination plants. Technological advancements, such as forward osmosis, capacitive deionization, and tubular modules, offer potential solutions to optimize desalination processes and reduce costs.

Remote monitoring and process control systems enable real-time data analytics, ensuring desalination plants operate efficiently and effectively. The market's continuous evolution reflects the industry's commitment to addressing water scarcity and ensuring water security.

How is this Desalination Industry segmented?

The desalination industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Membrane

- Thermal

- Application

- Municipal

- Industrial

- Others

- Source

- Seawater

- Brackish water

- Plant Type

- Large Scale

- Medium Scale

- Small Scale

- Mobile/Containerized

- Component

- Pumps

- Membranes

- Energy Recovery Devices

- Pre-treatment Systems

- Post-treatment Systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

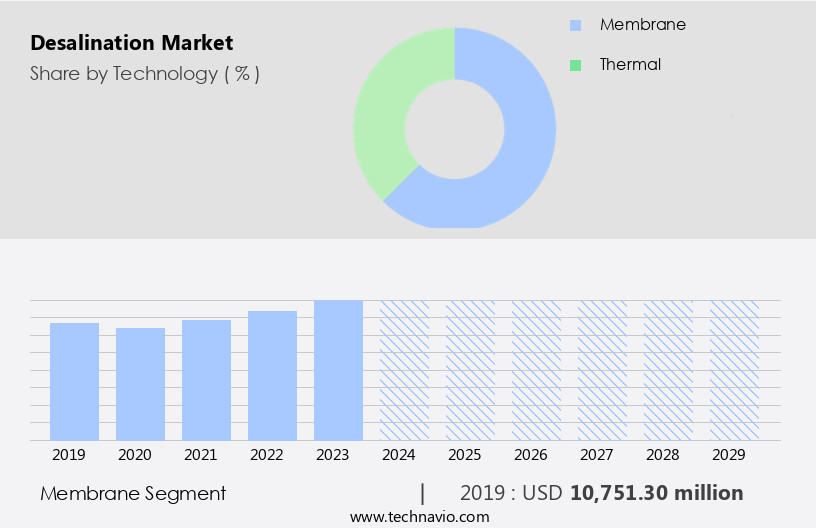

The membrane segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing water scarcity in coastal communities and arid regions. Membrane technology, a significant segment of this market, dominates with its ability to provide high water purity and suitability for areas with water stress and limited energy resources. Reverse osmosis (RO), a popular membrane technique, is widely used due to its high salt rejection rate and energy efficiency. Data analytics plays a crucial role in optimizing operational costs by predicting maintenance requirements and improving process control. Desalination capacity expansion through desalination projects is on the rise, with thermal desalination and multi-stage flash distillation being common techniques.

Energy consumption is a concern, but energy recovery devices and advances in membrane technology are mitigating this issue. Brine management, including brine discharge and brine management systems, is another challenge. Desalination plants employ various intake structures, including seawater intake and intake structures with pretreatment systems, to maintain water quality. Mineral composition and total dissolved solids are critical factors in desalination technology, with desalination chemicals used to address mineral imbalances. Capacitive deionization and forward osmosis are emerging techniques offering energy efficiency and drought resilience. Capital costs remain a significant barrier, but advancements in membrane distillation and vapor compression distillation are reducing costs.

Environmental impact is a concern, with focus on reducing the use of cleaning agents and high-pressure pumps. Agricultural applications are also expanding the market scope.

The Membrane segment was valued at USD 10.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

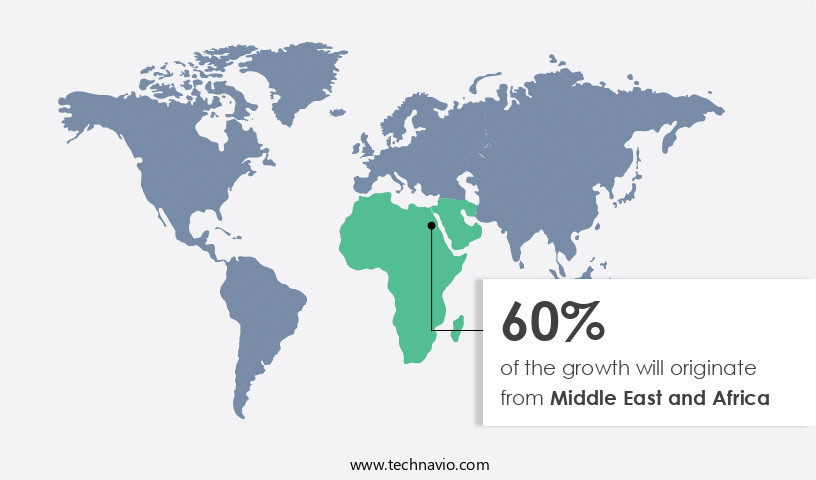

Middle East and Africa is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in regions with water scarcity, such as the Middle East and Africa. Desalination technologies, including reverse osmosis, vapor compression distillation, multi-effect distillation, and thermal desalination, are increasingly being adopted to address the challenge of insufficient freshwater resources. Reverse osmosis membranes play a crucial role in this process by filtering out total dissolved solids and salt, ensuring water purity. Desalination plants employ various intake structures and pretreatment systems to maintain water quality and minimize environmental impact. Operational costs, energy efficiency, and brine management are critical factors influencing the market. Energy recovery devices and thermal desalination techniques help reduce energy consumption.

Capacitive deionization and electrodialysis reversal are emerging technologies that offer energy savings and improved water recovery rates. Desalination projects are being implemented in municipal applications, agricultural areas, and coastal communities to ensure water security and drought resilience. Data analytics and process control enable remote monitoring and optimization of desalination plants. Desalination chemicals, such as cleaning agents and desalination membrane cleaning solutions, are essential for maintaining plant efficiency and performance. The market for desalination technology is expected to continue growing due to the increasing demand for clean water and the availability of advanced desalination solutions. Despite the benefits, desalination faces challenges, including high capital costs, environmental concerns, and the need for effective brine management.

As desalination capacity increases, it is essential to address these challenges and ensure sustainable desalination practices. The market is expected to remain dynamic, with ongoing research and innovation in desalination membranes, desalination technology, and desalination chemicals.

Market Dynamics

The Global Desalination Market is expanding rapidly, driven by the increasing need for fresh water amidst growing water scarcity solutions. Desalination technologies, particularly Reverse Osmosis (RO) desalination plants utilizing advanced desalination membranes, are crucial for converting seawater desalination and brackish water desalination into potable resources. These plants serve vital municipal water supply and industrial water treatment (desalination) needs. Innovations in renewable energy integration (desalination) and energy recovery devices (ERDs) are enhancing efficiency and sustainability. The Middle East & Africa Desalination Market holds the largest share, while the Asia Pacific Desalination Market is the fastest-growing. Leading desalination plant operators and desalination equipment manufacturers are continually innovating in membrane filtration systems (desalination) and thermal desalination technology. Managing brine management solutions and developing portable desalination units are also significant aspects of the evolving global desalination market trends.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Desalination Industry?

- The primary drivers of the market are the escalating population growth and the subsequent rise in demand for consumable water.

- The market is experiencing significant growth due to the increasing global population and the resulting demand for safe, consumable water. By 2050, the global population is projected to reach 9.73 billion, and only half of that number had access to safe water as of 2022. Freshwater reserves are unevenly distributed, making desalination an essential solution for meeting the world's water needs. Despite the abundance of water in nature, much of it is not potable due to contaminants such as industrial waste, pollutants, and pathogens. Desalination technologies, including forward osmosis, multi-stage flash distillation, and membrane filtration, are effective in removing these contaminants, making seawater a viable source of safe water.

- Energy efficiency is a critical consideration in desalination projects, with energy recovery devices and intake structures designed to minimize energy usage. Salt rejection is also a crucial factor, with advanced technologies such as reverse osmosis membranes and multi-effect distillation achieving high salt rejection rates. Environmental impact is a significant concern in the desalination industry, and efforts are being made to minimize it through the use of renewable energy sources, such as solar and wind, and the implementation of closed-loop systems. Remote monitoring and automation technologies are also being employed to optimize plant performance and reduce operational costs.

- Overall, the market is driven by the urgent need to provide safe, consumable water to a growing global population, and advancements in technology are making desalination increasingly energy-efficient, cost-effective, and environmentally sustainable.

What are the market trends shaping the Desalination Industry?

- The increasing adoption of renewable power sources is a significant market trend. This shift towards sustainable energy solutions is a professional and informed response to the growing demand for environmentally friendly and cost-effective energy solutions.

- Desalination technology is a critical solution to address water scarcity issues, especially in regions experiencing droughts. However, the energy-intensive nature of desalination processes contributes significantly to their high costs. To mitigate this challenge, key players are focusing on establishing desalination plants powered by renewable energy sources. The global energy demand is escalating due to expanding manufacturing sectors, population growth, and rapid industrialization and urbanization. Renewable energy, such as solar and wind, offers a viable solution to reduce desalination's energy consumption.

- Capacitive deionization, high-pressure pumps, tubular modules, and spiral wound modules are some desalination technologies that can operate efficiently with renewable energy. Brine management and the use of cleaning agents are essential considerations for the successful implementation of renewable energy in desalination plants. By adopting renewable energy sources, desalination plants can contribute to energy savings and promote drought resilience for agricultural applications.

What challenges does the Desalination Industry face during its growth?

- The significant initial investment costs associated with desalination plant establishment represent a major challenge impeding the industry's growth.

- Desalination, a critical solution for water security in arid regions and coastal communities, remains an essential yet costly water treatment process. Capital costs for desalination plants remain substantial due to the complex technologies involved, such as thermal desalination and membrane distillation. These processes require significant energy consumption, with seawater desalination accounting for over 50% of the total operating cost. Energy sources, plant capacity, and water recovery rates are significant factors influencing the cost of desalination. Desalination chemicals are also essential for effective pretreatment systems, which address mineral composition and ensure water quality.

- The energy-intensive nature of desalination necessitates a focus on energy efficiency and cost reduction strategies. Despite these challenges, desalination plays a crucial role in securing water resources in various regions. Electrodialysis reversal and other advanced desalination technologies continue to evolve, offering potential for cost savings and increased efficiency.

Exclusive Customer Landscape

The desalination market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the desalination market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, desalination market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acciona SA

- Asahi Kasei Corp.

- Bechtel Corp.

- Biwater Holdings Ltd.

- Consolidated Water Co. Ltd.

- Doosan Corp.

- DuPont de Nemours Inc.

- Ferrovial SA

- IDE Water Technologies

- Kurita Water Industries Ltd

- Mitsubishi Heavy Industries Ltd.

- Osmoflo

- Poseidon Water LLC

- ProMinent GmbH

- RAI Amsterdam Aquatech

- TEMAK SA

- Toyobo Co. Ltd.

- Veolia Environnement SA

- Webuild

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Desalination Market

- In January 2024, IDE Technologies, a leading desalination technology provider, announced the successful commissioning of the world's largest reverse osmosis desalination plant in Israel, with a capacity of 250 million gallons per day (MGD) (IDE Technologies Press Release, 2024). This marked a significant advancement in large-scale desalination capabilities.

- In March 2024, Veolia Water Technologies and Mitsubishi Heavy Industries (MHI) formed a strategic partnership to jointly develop and commercialize innovative desalination technologies, combining Veolia's expertise in water treatment and MHI's engineering capabilities (Veolia Water Technologies Press Release, 2024).

- In May 2024, the Abu Dhabi National Oil Company (ADNOC) and the Abu Dhabi Water & Electricity Authority (ADWEA) signed a Memorandum of Understanding (MoU) to collaborate on desalination projects, aiming to increase the emirate's water self-sufficiency and reduce reliance on fossil fuels for water production (ADNOC Press Release, 2024).

- In April 2025, the Saudi Arabian desalination company, Marafiq, raised USD500 million in a bond issuance to fund the expansion of its desalination capacity, highlighting the growing investor interest in the sector (Bloomberg, 2025).

Research Analyst Overview

- The market is driven by the increasing demand for high-quality water treatment solutions, particularly in regions with water scarcity issues. Material science advancements continue to improve permeate quality, enabling more efficient water treatment processes. Pretreatment optimization and osmotic pressure management are key areas of focus for desalination plant operators, requiring skill development and regulatory compliance. Renewable energy integration and hybrid desalination systems are gaining traction, reducing reliance on traditional energy sources and improving system efficiency. Public acceptance is a critical factor in market growth, necessitating effective communication and transparency regarding water reuse, greywater treatment, and water rights. Economic analysis, lifecycle assessment, and financial modeling are essential tools for desalination plant developers, ensuring optimal system performance and long-term profitability.

- Energy recovery technologies, such as pump efficiency and hydraulic pressure optimization, play a significant role in reducing energy consumption and costs. Regulatory compliance, water allocation, and process engineering are crucial aspects of desalination plant operation, requiring ongoing system optimization and membrane cleaning cycles. Membrane life and chemical dosage management are essential for maintaining membrane performance and minimizing rejection rates. Pressure vessels, energy storage, and wastewater reclamation are integral components of desalination systems, requiring careful management and maintenance. Water pricing and social impact are also important considerations, as desalination projects can have significant economic and societal implications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Desalination Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 10413.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Saudi Arabia, US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Desalination Market Research and Growth Report?

- CAGR of the Desalination industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, North America, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the desalination market growth of industry companies

We can help! Our analysts can customize this desalination market research report to meet your requirements.