Conveyor Sorting Systems Market Size 2024-2028

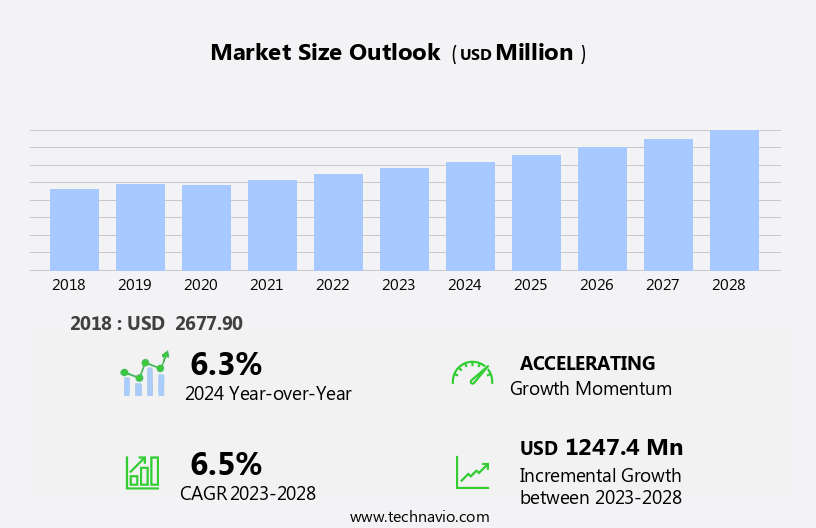

The conveyor sorting systems market size is forecast to increase by USD 1.25 billion, at a CAGR of 6.5% between 2023 and 2028.

- The market is witnessing significant growth, driven by the expansion of manufacturing activities across various industries. The increasing demand for automation and efficiency in material handling processes is fueling the adoption of conveyor sorting systems. Companies are introducing new products to cater to this demand, offering advanced features such as high-speed sorting, improved accuracy, and integration with other automation systems. However, the market faces challenges, primarily due to the substantial initial investment requirements. Integration of these systems with existing infrastructure and the need for skilled labor to operate and maintain them can add to the overall cost.

- Additionally, the implementation of sorting systems may require significant changes to existing workflows and processes, posing operational challenges for businesses. Companies seeking to capitalize on the market opportunities must carefully consider these factors and plan their implementation strategies accordingly. Effective project management, including thorough planning and budgeting, can help mitigate the challenges and ensure a successful deployment of conveyor sorting systems.

What will be the Size of the Conveyor Sorting Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for automation and efficiency in various sectors. Weight-based sorting and conveyor belt tracking systems have gained significant traction, enabling precise sorting and streamlined production lines. System integration services play a crucial role in optimizing conveyor control systems and motor control systems, ensuring seamless communication between components. Conveyor safety standards and process optimization techniques are essential considerations, with sensor integration and vibration sorting technology improving conveyor system reliability and reducing error rates. Energy efficiency improvements and recycling process optimization are key trends, with data acquisition systems and predictive maintenance enabling real-time analysis and optimization of material handling processes.

For instance, a leading manufacturing company implemented a high-speed sorting system, achieving a 30% increase in throughput capacity and reducing material handling costs. Industry growth is expected to reach double digits, with industrial automation solutions, product inspection systems, and precise sorting technologies leading the charge. Moreover, the integration of object detection systems, material flow analysis, and roller conveyor design innovations contribute to the continuous enhancement of conveyor sorting systems. Failure analysis techniques and maintenance scheduling systems ensure conveyor systems operate at optimal performance levels, while PLC programming and remote monitoring systems facilitate real-time system adjustments. In summary, the market is characterized by continuous innovation and the integration of advanced technologies to improve production line efficiency, conveyor system reliability, and waste management systems.

How is this Conveyor Sorting Systems Industry segmented?

The conveyor sorting systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- RFID-based sorting

- Vision-based sorting

- Barcode-based sorting

- Weight-based sorting

- Others

- End-user

- E-commerce and retail

- Food and beverage

- Pharmaceutical

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

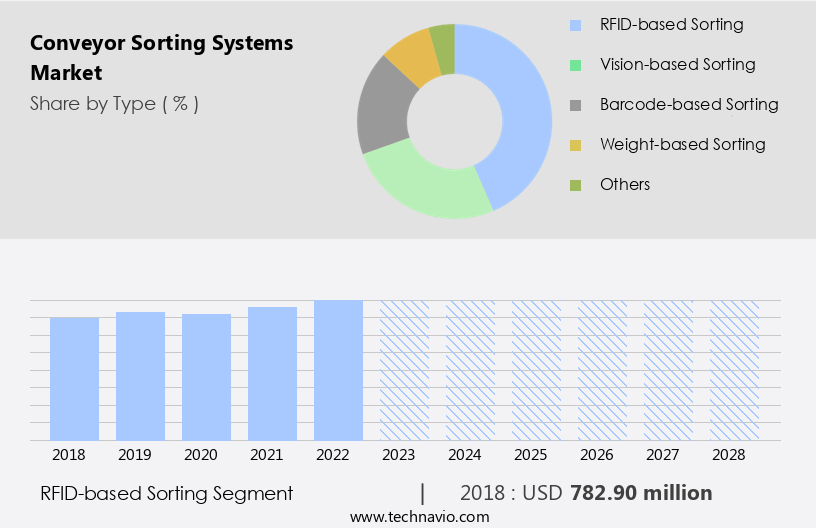

The rfid-based sorting segment is estimated to witness significant growth during the forecast period.

The market encompasses various types, with RFID-based sorting gaining prominence due to its advanced capabilities. Traditional sorting methods, characterized by labor-intensive and time-consuming processes, have given way to automated systems, enhancing production line efficiency and accuracy. RFID systems utilize electromagnetic fields to automatically identify and track tags attached to objects, offering real-time tracking and inventory management. Their ability to handle large volumes with high precision makes them indispensable in industries like logistics and retail. Automation in conveyor sorting systems extends to control systems, motor control, sensor integration, and safety standards. Energy efficiency improvements, error rate reduction, and conveyor speed optimization are essential considerations.

Material handling automation, data acquisition systems, and recycling process optimization are key trends. Predictive maintenance, object detection systems, material flow analysis, and vibration sorting technology are integral to system reliability. Precise sorting technologies, maintenance scheduling, and PLC programming conveyors further optimize performance. According to recent industry reports, the market is expected to grow by over 10% annually, driven by the increasing demand for automation and efficiency in various sectors. For instance, a leading logistics company reported a 25% increase in throughput capacity after implementing an RFID-based sorting system. These systems enable shape recognition algorithms, quality control, and product inspection, ensuring consistent output and reducing waste.

Roller conveyor design, size-based separation, and industrial automation solutions are other essential components of the market.

The RFID-based sorting segment was valued at USD 782.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

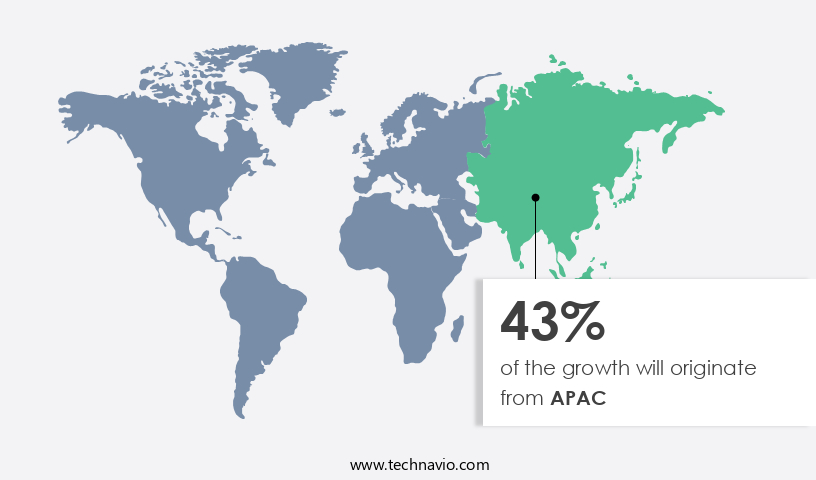

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia-Pacific (APAC) region, where the expanding e-commerce sector is driving demand. In China, online retail sales surged by 9.8% year-on-year to reach approximately USD 996 billion in the first half of 2024. India's e-commerce industry is also projected to reach around USD 330 billion by 2030. This growth necessitates efficient sorting and distribution systems to manage the increasing volume of orders. Conveyor sorting systems play a crucial role in this process, enabling weight-based sorting, conveyor belt tracking, system integration services, production line efficiency, and material handling automation. Advanced technologies such as sensor integration, motor control systems, shape recognition algorithms, and optical sorting sensors enhance sorting mechanism efficiency and reduce error rates.

Additionally, predictive maintenance, energy efficiency improvements, and material flow analysis contribute to conveyor system reliability and throughput capacity improvement. The market is expected to grow at a rate of over 10% annually due to the increasing adoption of industrial automation solutions, conveyor control systems, and recycling process optimization. For instance, a leading logistics company implemented a conveyor sorting system that increased throughput capacity by 30% and reduced error rates by 25%.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient and high-throughput material handling solutions. Conveyor systems, a key component of this market, are being designed with advanced features to meet the unique challenges of various industries. Optical sorting technology, for instance, is increasingly being used for sorting irregularly shaped objects, ensuring accurate and consistent sorting results. To improve conveyor belt tracking system accuracy and optimize conveyor speed for material handling, advanced control algorithms are being implemented. Integration of advanced sensor technologies, such as weight sensors and size sensors, is another trend in the market, enabling real-time monitoring and improved sorting accuracy. Conveyor system maintenance scheduling and data acquisition and analysis for predictive maintenance are essential for ensuring optimal uptime and reducing downtime. Designing robust and reliable conveyor systems is crucial for reducing energy consumption and minimizing conveyor system failure. Conveyor system failure analysis and prevention are also critical to maintaining production line efficiency. Selection criteria for effective conveyor system components include factors such as cost-effectiveness, reliability, and compatibility with existing production lines. Implementing quality control systems for conveyor sorting and optimizing material flow analysis for process optimization are also essential for ensuring the success of conveyor sorting systems. Weight-based sorting system calibration and optimization are important considerations for achieving accurate sorting results. Advanced sensor integration and real-time monitoring systems are also key to ensuring conveyor system performance and maintaining a competitive edge in the market. Overall, the market is driven by the need for efficient, accurate, and cost-effective material handling solutions.

What are the key market drivers leading to the rise in the adoption of Conveyor Sorting Systems Industry?

- The expansion of manufacturing activities serves as the primary catalyst for market growth.

- The market is witnessing significant growth due to the expanding manufacturing sector. This expansion is driven by globalization and the increasing demand for faster production and distribution cycles. According to recent data, global manufacturing output grew by 1.5% in the last quarter of 2023 compared to the same period in 2022. This growth signifies a positive trend in the manufacturing sector, which is a crucial factor for the growth of the market. The adoption of automated sorting solutions is becoming increasingly essential for manufacturers as they strive to enhance efficiency and meet rising demand.

- For instance, the implementation of conveyor sorting systems in the food and beverage industry led to a 10% increase in production efficiency and a 5% reduction in labor costs. The market is expected to grow at a robust pace in the coming years, with industry analysts projecting a growth rate of over 10%.

What are the market trends shaping the Conveyor Sorting Systems Industry?

- Introducing new products is the current market trend for companies. Companies are embracing innovation by introducing new products to the market.

- The market is experiencing a surge in growth due to the increasing demand for efficient and automated sorting solutions across various industries. In response to this trend, companies are introducing innovative products to enhance operational efficiency and meet industry demands. For instance, Interroll launched its High-Performance Conveyor Platform (HPP) in April 2023, catering to the logistics sector's growing need for faster and more reliable delivery solutions. This platform, designed for courier, express, and parcel service providers, incorporates advanced technology to optimize throughput and performance.

- The HPP platform's introduction marks a significant development in the parcel industry, as it streamlines sorting processes and enables service providers to meet the escalating demands for efficiency and reliability in delivery operations. The market is expected to grow robustly in the coming years, with innovations continuing to drive market expansion.

What challenges does the Conveyor Sorting Systems Industry face during its growth?

- The significant initial investment requirements pose a substantial challenge to the industry's growth trajectory.

- The market encounters a substantial investment for implementing these systems, serving as a significant challenge. The cost spectrum for a fundamental conveyor sorting system in a small-scale warehouse lies between USD 100,000 and USD 300,000. However, advanced and automated systems, incorporating technologies such as robotic arms or AI-based sorting, can cost anywhere from USD 500,000 to USD 2 million. Customized features, including multi-level sorting, Warehouse Management System (WMS) integration, and energy-efficient motors, can significantly increase these expenses. Furthermore, the installation costs for belt conveyor systems amount to approximately USD 1,500 per linear foot.

- Despite these costs, the market is expected to grow robustly, with industry analysts projecting a growth rate of over 10% annually. For instance, a medium-sized e-commerce company reported a 25% increase in order fulfillment efficiency after implementing an advanced conveyor sorting system.

Exclusive Customer Landscape

The conveyor sorting systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the conveyor sorting systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, conveyor sorting systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bastian Solutions LLC - Conveyor sorting systems are a specialized solution for efficient automation in various industries. The company provides innovative systems, including shoe sorters, cross belt sorters, and tilt tray sorters, enhancing productivity and accuracy in material handling processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bastian Solutions LLC

- Beumer Group GmbH and Co. KG

- Daifuku Co. Ltd.

- Eaglestone Equipment

- Falcon Autotech Pvt Ltd

- FIVES SAS

- FMH Conveyors International Ltd

- FORTNA Inc.

- General Kinematics Corp.

- Honeywell International Inc.

- Hytrol Conveyor Co.

- Interroll Holding AG

- Jungheinrich AG

- Kardex Holding AG

- Key Technology Inc.

- KION GROUP AG

- Murata Machinery Ltd.

- Siemens AG

- SSI Schafer IT Solutions GmbH

- Vanderlande Industries BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Conveyor Sorting Systems Market

- In January 2024, Swisslog, a leading global automation solutions provider, announced the launch of its new SynQ Lifecycle Services solution for conveyor sorting systems. This offering enables predictive maintenance and real-time performance optimization, enhancing the efficiency and reliability of sorting systems (Swisslog Press Release).

- In March 2024, Honeywell Intelligrated, a material handling solutions company, entered into a strategic partnership with FANUC Corporation, a leading robotics manufacturer. The collaboration aimed to integrate FANUC's robotic arms with Honeywell's conveyor sorting systems, offering advanced automation solutions for various industries (Honeywell Intelligrated Press Release).

- In April 2025, Dematic, a global supplier of integrated automated technology, logistics, and engineering solutions, announced the acquisition of Sorting Systems GmbH, a German company specializing in sortation technology. The acquisition expanded Dematic's portfolio and strengthened its position in the European market (Dematic Press Release).

- In May 2025, SSI Schaefer, a global supplier of integrated material flow and storage solutions, unveiled its new generation of 3D Shuttle XL conveyor-based AS/RS systems. These systems featured increased capacity and improved energy efficiency, setting a new benchmark in automated storage and retrieval solutions (SSI Schaefer Press Release).

Research Analyst Overview

- The market for conveyor sorting systems continues to evolve, driven by the constant pursuit of throughput optimization and process control strategies in various sectors. Efficient conveyor design, safety protocols, and cost-benefit analysis are key considerations in the selection and implementation of these systems. System diagnostics tools, advanced sorting algorithms, and production line optimization enable real-time data analysis and system upgrade planning, leading to improved sorting accuracy and system performance metrics. Capacity planning and system lifecycle management are essential for ensuring regulatory compliance and maintaining reliable conveyor operation. Industrial safety standards, conveyor belt maintenance, and component optimization are integral to the successful implementation of automated sorting solutions.

- According to recent industry reports, the global conveyor systems market is expected to grow by over 5% annually, underpinned by material flow improvement and supply chain optimization initiatives. For instance, a leading manufacturing company reported a 15% increase in sales due to the implementation of a new conveyor sorting system featuring advanced control algorithms and sensor network design.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Conveyor Sorting Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2024-2028 |

USD 1247.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.3 |

|

Key countries |

US, China, Germany, Japan, UK, Canada, India, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Conveyor Sorting Systems Market Research and Growth Report?

- CAGR of the Conveyor Sorting Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the conveyor sorting systems market growth of industry companies

We can help! Our analysts can customize this conveyor sorting systems market research report to meet your requirements.