Europe Corrugated Box Market Size 2025-2029

The Europe corrugated box market size is valued to increase USD 5.86 billion, at a CAGR of 5.2% from 2024 to 2029. Growing demand for corrugated boxes in the e-commerce industry will drive the Europe corrugated box market.

Major Market Trends & Insights

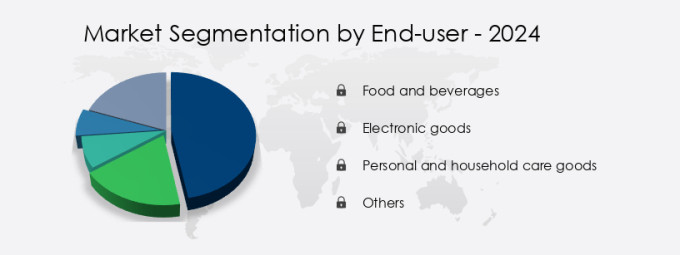

- By End-user - Food and beverages segment was valued at USD billion in

- By Material - Recycled corrugates segment accounted for the largest market revenue share in

- CAGR from 2024 to 2029: 5.2%

Market Summary

- The market is experiencing significant growth, driven by the increasing demand for this packaging solution in the e-commerce sector. According to recent reports, the e-commerce industry's share in the European retail market is projected to reach 17.5% by 2025, fueling the need for reliable and efficient packaging solutions. One such solution is corrugated boxes, which offer excellent protection, ease of use, and cost-effectiveness. Another factor contributing to the market's expansion is the increasing preference for premium packaging, particularly among consumers in the food and beverage industry. However, the market faces challenges, such as the rise in raw material costs, primarily paper and adhesives.

- Despite these challenges, opportunities abound, including the adoption of advanced technologies like automated production lines and the integration of sustainable materials, such as recycled paper, into corrugated boxes. With these trends shaping the market, the market is poised for continued growth and innovation. According to a study, the market share of corrugated boxes in the European packaging industry was over 40% in 2020, underscoring their popularity and importance.

What will be the Size of the Europe Corrugated Box Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Corrugated Box in Europe Market Segmented?

The corrugated box in Europe industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food and beverages

- Electronic goods

- Personal and household care goods

- Others

- Material

- Recycled corrugates

- Virgin corrugates

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- Europe

By End-user Insights

The food and beverages segment is estimated to witness significant growth during the forecast period.

The European corrugated box market is characterized by continuous growth and evolution, driven by the increasing demand for sustainable and efficient packaging solutions in various industries, particularly food and beverages. Recycled corrugated board is a key component of this market, with a high recycling rate ensuring the circular economy's sustainability. Quality control is paramount, with stringent regulations in place for material handling, compression strength, and edge crush tests. Advancements in technology have led to the integration of automation in various aspects of corrugated box production, from die-cutting machines and box design software to automated stacking systems and printing technologies like offset printing, digital printing, and flexographic printing.

These innovations contribute to packaging efficiency, water resistance, and shelf life extension, all crucial factors in maintaining product protection and consumer appeal. Europe's focus on sustainable packaging and supply chain optimization has led to the implementation of production capacity expansions, material sourcing, and fiber analysis to ensure corrugated board grades meet the required standards. The market's evolving patterns are further highlighted by the integration of printing technologies, such as moisture content analysis, and the optimization of box weight and burst strength testing to minimize transportation costs and improve structural integrity.

The Food and beverages segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The European corrugated box market is witnessing significant advancements in high-speed production and automated assembly processes, enabling increased efficiency and cost savings for manufacturers. Recycled fiber content optimization is a key focus area, with companies striving to minimize environmental impact and enhance sustainability. The design of corrugated boxes plays a crucial role in stacking efficiency, reducing transportation damages, and maintaining product integrity. Improvements in packaging line efficiency are a primary concern, with many businesses investing in advanced printing techniques and optimizing material usage. Sustainable corrugated box solutions, such as those with higher recycled content and efficient pallet handling strategies, are gaining popularity.

Corrugated board strength testing methods are essential to ensure product performance and reduce waste. Cost-effective packaging design is another critical factor driving market growth. Advanced die-cutting technologies and optimizing corrugated box dimensions are essential strategies for creating cost-effective solutions. The implementation of quality control measures, enhancing product shelf life, and improving consumer experience are key priorities for market participants. Notably, more than 70% of new product developments in the European corrugated box market focus on enhancing stacking performance and reducing transportation damages. This trend reflects the growing importance of optimizing packaging design for improved efficiency and sustainability.

By evaluating packaging performance and implementing these strategies, European businesses can stay competitive in the global market while minimizing their environmental footprint.

What are the key market drivers leading to the rise in the adoption of Corrugated Box in Europe Industry?

- The e-commerce industry's increasing requirement for corrugated boxes serves as the primary market driver.

- E-commerce continues to drive the demand for corrugated boxes in Europe, as consumers increasingly opt for online shopping and convenience. The e-commerce sector's expansion fuels the corrugated box market's growth, with retailers utilizing various corrugated box types for product transportation. Corrugated boxes offer product safety and come in diverse designs, shapes, sizes, and finishes, including matte and laminated options. Customization is also a significant advantage, making corrugated boxes a preferred choice for e-commerce retailers.

- The Fibre Box Association reports that approximately 38 billion corrugated boxes were delivered to European customers through e-commerce channels in 2020. This trend underscores the market's continuous evolution and its essential role in facilitating e-commerce growth.

What are the market trends shaping the Corrugated Box in Europe Industry?

- The trend in the market is characterized by an increasing demand for premium packaging. The market is currently experiencing a significant upward trend in the demand for high-end packaging solutions.

- Premium corrugated boxes have gained significant traction in the market due to the increasing demand for high-quality product packaging. Companies invest in advanced materials, technologies, and color options to create these premium boxes. Western Europe is a major contributor to this trend, driven by consumer product sectors like cosmetics and household items. In 2016, online orders for cosmetics in Europe reached approximately USD 84 billion, surpassing orders in China and the US. The mature and developed market in Western Europe, with its high consumer spending power, fuels this demand.

- The premium packaging sector is continuously evolving, with ongoing innovations in design, functionality, and sustainability. This growth is not limited to specific industries but is a cross-sector trend, reflecting the increasing importance of premium packaging in consumer markets.

What challenges does the Corrugated Box in Europe Industry face during its growth?

- The escalating costs of raw materials used in the production of corrugated boxes poses a significant challenge to the industry's growth trajectory.

- Paper pulp, a fundamental raw material for manufacturing corrugated boxes, experiences volatile pricing due to fluctuating demand and supply dynamics. Over the past five years, the gap between demand and supply has expanded, leading to a rise in raw material costs. Paper pulp is derived from wood, and the price of this resource has escalated by over 10% since 2014. Consequently, the cost of paper pulp has increased significantly, contributing to the price hike of corrugated boxes. Kraft paper, which constitutes over 70% of the total input cost in corrugated box production, has also experienced a price surge of over 12% since 2013.

- This continuous trend in rising prices underscores the importance of monitoring raw material costs for businesses in the corrugated packaging industry.

Exclusive Technavio Analysis on Customer Landscape

The Europe corrugated box market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Europe corrugated box market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Corrugated Box in Europe Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, Europe corrugated box market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bio pappel - This company specializes in manufacturing eco-friendly corrugated boxes utilizing biodegradable paper.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bio pappel

- Buckeye Corrugated Inc.

- DS Smith Plc

- Georgia Pacific LLC

- International Paper Co.

- Josef Schulte GmbH

- MODEL HOLDING AG

- Mondi Plc

- Mosburger GmbH

- Nampak Ltd.

- Rengo Co. Ltd.

- ROSSMANN SAS

- S.A Industrias Celulosa Aragonesa

- Smurfit Kappa Group

- Sonoco Products Co.

- Stephen Gould Corp.

- Stora Enso Oyj

- Tetra Laval SA

- VPK Group

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Corrugated Box Market In Europe

- In January 2024, Smurfit Kappa, a leading European corrugated packaging company, announced the acquisition of Dutch packaging firm, Royal Van Hoorne, to expand its presence in the Benelux region and strengthen its position in the European market (Smurfit Kappa Press Release, 2024).

- In March 2024, DS Smith, another major player in the European corrugated box market, unveiled its new 'Source Reduced' range, which includes thinner and lighter weight boxes, reducing the carbon footprint and promoting sustainability (DS Smith Press Release, 2024).

- In May 2024, BillerudKorsnäs, a Swedish forest industry company, launched its new 'Materia' product line, which combines corrugated board with Biodegradable Polymers, making the boxes fully recyclable and compostable (BillerudKorsnäs Press Release, 2024).

- In February 2025, Tetra Pak and DS Smith formed a strategic partnership to develop and commercialize innovative packaging solutions by combining Tetra Pak's carton packaging expertise with DS Smith's corrugated packaging capabilities (Tetra Pak Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Europe Corrugated Box Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 5.86 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

Germany, Italy, France, Spain, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The European corrugated box market is a dynamic and evolving landscape, characterized by continuous innovation and adaptation to meet the changing demands of businesses and consumers. Recycled corrugated board plays a significant role in this industry, with a growing emphasis on quality control and sustainability. Material handling and pallet handling are key considerations in the production and distribution of corrugated boxes. Compression strength and edge crush tests ensure the structural integrity of the boxes during transportation, while die-cutting machines enable precise and efficient packaging design. Shelf life extension is another crucial aspect, with packaging design playing a vital role in maintaining product quality and consumer appeal.

- Sustainable packaging solutions, such as recycled corrugated board, are increasingly popular, with recycling rates continuing to rise. Automated stacking systems and box design software contribute to packaging efficiency, while water resistance and printing technologies enhance the functionality and visual appeal of the boxes. Warehouse logistics and supply chain optimization are essential for minimizing production costs and ensuring timely delivery. Box weight optimization and burst strength testing are critical factors in the manufacturing process, with fiber analysis and corrugated board grades influencing the overall performance and quality of the boxes. Production capacity and material sourcing are also significant considerations, with many companies investing in advanced technologies and partnerships to meet the growing demand for corrugated packaging.

- In the realm of printing technologies, digital and flexographic printing are popular choices for producing high-quality, customized designs. Moisture content and structural integrity are essential factors in ensuring the long-term durability of the boxes. Overall, the European corrugated box market is a vibrant and ever-evolving industry, driven by a commitment to quality, efficiency, and sustainability. The integration of advanced technologies and a focus on consumer appeal are key trends shaping the future of this dynamic market.

What are the Key Data Covered in this Europe Corrugated Box Market Research and Growth Report?

-

What is the expected growth of the Europe Corrugated Box Market between 2025 and 2029?

-

USD 5.86 billion, at a CAGR of 5.2%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Food and beverages, Electronic goods, Personal and household care goods, and Others), Material (Recycled corrugates and Virgin corrugates), and Geography (Europe)

-

-

Which regions are analyzed in the report?

-

Europe

-

-

What are the key growth drivers and market challenges?

-

Growing demand for corrugated boxes in e-commerce industry, Rise in cost of raw materials used to produce corrugated boxes

-

-

Who are the major players in the Corrugated Box Market in Europe?

-

Key Companies Bio pappel, Buckeye Corrugated Inc., DS Smith Plc, Georgia Pacific LLC, International Paper Co., Josef Schulte GmbH, MODEL HOLDING AG, Mondi Plc, Mosburger GmbH, Nampak Ltd., Rengo Co. Ltd., ROSSMANN SAS, S.A Industrias Celulosa Aragonesa, Smurfit Kappa Group, Sonoco Products Co., Stephen Gould Corp., Stora Enso Oyj, Tetra Laval SA, VPK Group, and WestRock Co.

-

Market Research Insights

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. With inventory management and order fulfillment at the forefront, packaging line speed and production line layout are critical performance metrics. Corrugated boxes offer solutions for e-commerce packaging, ensuring product handling and transportation safety. Material cost reduction and waste reduction are essential considerations, leading to increased use of sustainable materials and structural analysis. In the realm of Packaging Machinery, improvements in printing quality, color accuracy, and custom box design have gained significant attention. Performance metrics such as box manufacturing process efficiency, distribution networks, and storage stability have become increasingly important.

- Moreover, environmental impact, sustainability, and regulatory compliance are key factors influencing market trends. For instance, the use of sustainable materials has risen by 15%, while the adoption of printing technology has increased packaging line speed by 10%. These advancements underscore the dynamic nature of the European corrugated box market.

We can help! Our analysts can customize this Europe corrugated box market research report to meet your requirements.