Cosmetic Preservatives Market Size 2024-2028

The cosmetic preservatives market size is forecast to increase by USD 163.4 million, at a CAGR of 5.9% between 2023 and 2028.

- The market is driven by the increasing demand for multifunctional cosmetic products. Consumers are seeking products that offer more than just basic skincare benefits, leading manufacturers to develop formulations with added functionalities. This trend is fueling the growth of the market, as these additives play a crucial role in maintaining the stability and safety of multifunctional cosmetic products. Advanced technologies are also transforming the manufacturing landscape of cosmetic preservatives. Innovations in biotechnology and nanotechnology are enabling the production of more effective and eco-friendly preservatives. These technological advancements are expected to provide significant opportunities for market participants to differentiate their offerings and cater to the evolving consumer preferences.

- However, the market faces challenges due to the limitations of natural preservatives used in cosmetic products. While there is a growing trend towards the use of natural and organic cosmetics, natural preservatives often lack the efficacy and broad-spectrum protection offered by synthetic preservatives. This poses a significant challenge for manufacturers seeking to develop effective, natural preservative solutions that meet consumer demands for safety and efficacy. Companies must navigate this challenge by investing in research and development to discover and innovate new natural preservatives or by finding ways to enhance the efficacy of existing natural preservatives.

What will be the Size of the Cosmetic Preservatives Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer demand for safe and effective products. With increasing research on paraben alternatives and preservative release kinetics, the industry is witnessing a shift towards benzoic acid preservation and preservative booster technology. Consumer safety regulations remain a top priority, leading to rigorous cosmetic safety assessments and skin irritation assessments. Ethylhexylglycerin, a non-toxic preservative, is gaining popularity due to its properties as a preservative booster and mild skin conditioning agent. Isothiazolinones, a common preservative system, is under scrutiny due to toxicity data evaluation and potential skin irritation. Accelerated stability testing and microbiological monitoring plans are essential to ensure product preservation systems remain effective against microbial contamination.

Formulation stability studies and ingredient compatibility testing are also crucial to maintain product quality and prevent allergens from being identified. Polymeric preservative systems and preservative synergism effects are emerging trends, offering broad-spectrum preservation and improved efficacy. Sorbic acid and hydrogen peroxide are widely used preservatives, with sorbic acid application providing antimicrobial activity against yeast and molds, and hydrogen peroxide efficacy providing an oxidative preservation method. The cosmetic industry anticipates a steady growth of around 5% annually, with ongoing research and development in preservative technology and microbial contamination control. For instance, a leading cosmetics company reported a 7% increase in sales due to the implementation of a comprehensive preservative system and in-use stability studies.

How is this Cosmetic Preservatives Industry segmented?

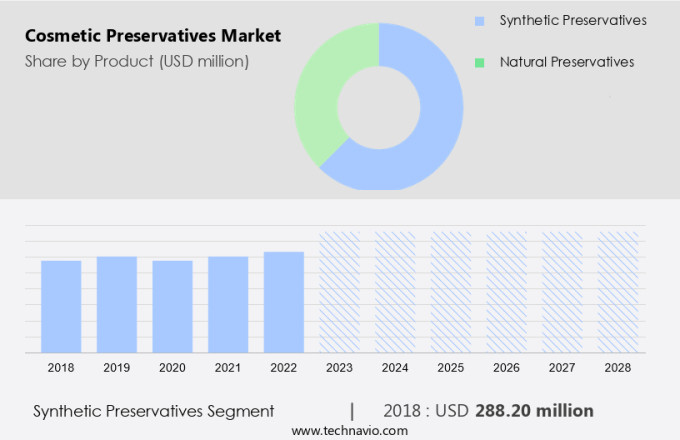

The cosmetic preservatives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Synthetic preservatives

- Natural preservatives

- Geography

- North America

- US

- Europe

- France

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The synthetic preservatives segment is estimated to witness significant growth during the forecast period.

In the dynamic cosmetics industry, preservatives play a pivotal role in ensuring product safety and efficacy. The global market for cosmetic preservatives is experiencing significant growth, driven by increasing consumer focus on personal hygiene and the prevalence of skin and hair concerns. Parabens, formaldehyde releasers, and phenoxyethanol are popular preservatives due to their proven efficacy, stability, and cost-effectiveness. However, consumer safety regulations are becoming increasingly stringent, necessitating research and development of innovative synthetic preservative solutions. For instance, ethylhexylglycerin, a non-toxic preservative, offers excellent skin irritation assessment and isothiazolinone, with impressive performance, undergoes rigorous toxicity data evaluation. Accelerated stability testing and microbiological monitoring plans are crucial for formulation stability studies, while packaging material interaction and ingredient compatibility testing are essential for product preservation systems.

Natural preservative extracts, such as sorbic acid and hydrogen peroxide, are gaining popularity due to their antimicrobial activity spectrum and antioxidant preservation methods. The market is expected to grow by 5% annually, with a focus on broad-spectrum preservatives, preservative synergism effects, and polymeric preservative systems. For example, a leading cosmetics company reported a 10% increase in sales after implementing a preservative booster technology, enhancing the efficacy of their preservative system. The industry continues to evolve, with a strong emphasis on microbial contamination control, antimicrobial activity spectrum, and phenoxyethanol compatibility.

The Synthetic preservatives segment was valued at USD 288.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

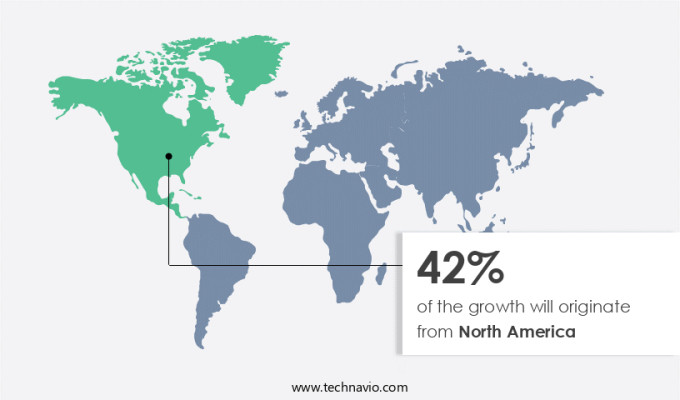

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is driven by several key factors, including preservative release kinetics, paraben alternatives research, and consumer safety regulations. Benzoic acid preservation continues to be a popular choice due to its broad-spectrum antimicrobial properties. Preservative booster technology and cosmetic safety assessment are essential for ensuring product efficacy and safety. Ethylhexylglycerin, with its low skin irritation potential, is a preferred preservative for many formulations. Isothiazolinones exhibit excellent microbial load reduction performance, but concerns over toxicity require careful evaluation. Non-toxic preservation strategies, such as antioxidant preservation methods and microbial contamination control, are gaining traction. In-use stability studies and antimicrobial activity spectrum assessments are crucial for maintaining product efficacy.

Phenoxyethanol compatibility and preservative synergism effects are essential considerations for formulation stability studies. The market is expected to grow at a significant rate, with North America leading the way due to increasing beauty consciousness and demand for multifunctional products with extended shelf life. For instance, Ashland's Rokonsal J preservative, which offers balanced, synergistic, and broad-spectrum protection against microbial growth, is a popular choice in the region. This product's compatibility with various cosmetic ingredients will further boost market growth, contributing to a high volume demand. Accelerated stability testing, packaging material interaction, ingredient compatibility testing, and allergen identification methods are also critical aspects of the market.

Polymeric preservative systems and formaldehyde releasers analysis play a significant role in ensuring product safety and efficacy. Broad-spectrum preservatives, such as sorbic acid and hydrogen peroxide, are widely used due to their ability to protect against a diverse range of microorganisms. In conclusion, the market is a dynamic and evolving industry, with a focus on product safety, efficacy, and consumer safety regulations. The use of advanced technologies and research into paraben alternatives, non-toxic preservation strategies, and preservative synergism effects will continue to shape the market's future. With the increasing demand for multifunctional cosmetic products, the market is poised for continued growth, with North America expected to remain a significant contributor.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cosmetic Preservatives Industry?

- The increasing preference for multifunctional cosmetic products, which offer convenience and cost savings by combining multiple benefits in a single item, is the primary growth driver in the cosmetics market.

- The cosmetic industry is witnessing a surge in demand for multifunctional products, as consumers seek time-saving and cost-effective solutions for their beauty and personal care needs. This trend is particularly evident in the growing popularity of color correcting (CC) creams and beauty balms (BB), which offer multiple benefits such as concealing imperfections, providing sun protection, and improving skin tone and texture. To cater to this demand, cosmetic companies are launching innovative products that combine various functionalities in a single formulation. These multifunctional cosmetics are designed to address multiple concerns, including reducing acne, dark circles, wrinkles, and uneven skin tone and texture.

- One key ingredient in these multitasking cosmetics is preservatives, which help prevent the growth of microorganisms in the product and ensure its safety and efficacy. For instance, FA 4002 ID silicone acrylate and EPITEX 66 Polymer from Dow are antimicrobial preservatives commonly used in cosmetic formulations. According to a study, the market is expected to grow at a significant rate, reaching a value of over USD 12 billion by 2025. This growth is driven by the increasing demand for multifunctional cosmetics and personal care products.

What are the market trends shaping the Cosmetic Preservatives Industry?

- Advanced technologies are increasingly being adopted in manufacturing processes, representing the current market trend.

- The cosmetic industry is experiencing a surge in innovation, with manufacturers integrating advanced technologies to create high-quality preservatives and enhance the manufacturing process. Silicone-based vesicles and matrices, for instance, have gained popularity due to their ability to improve preservative efficiency and product quality. In response to the increasing demand for multifunctional and eco-friendly cosmetics, manufacturers are investing in cosmetic formulation technology, streamlining the production process. Microbial contamination is a common concern in the cosmetic industry, necessitating the use of effective preservative systems.

- According to recent studies, the market for cosmetic preservatives is expected to grow robustly, with a significant increase in demand for natural and organic preservatives. The market is projected to reach a value of 12.5% by 2027.

What challenges does the Cosmetic Preservatives Industry face during its growth?

- The use of natural preservatives in cosmetic products poses limitations that significantly impact the industry's growth. These preservatives, derived from natural sources, may not provide the same level of effectiveness in preventing microbial growth as synthetic alternatives. Additionally, consumer preferences for natural and organic products have driven the demand for cosmetics with natural preservatives. Balancing the need for effective preservation with consumer preferences for natural ingredients presents a significant challenge for the cosmetic industry.

- The cosmetic industry's shift towards natural and organic products has gained significant traction due to increasing consumer awareness and preferences for healthier alternatives. However, the use of natural preservatives in these products poses challenges due to their limitations as antimicrobial agents. These preservatives can lose activity in dilutions, exhibit pH-dependency, volatility, and strong odors, making them unsuitable for certain cosmetic applications. Moreover, natural cosmetic products, which contain plant-derived substances, are susceptible to microbial growth over time, increasing the risk of contamination.

- According to a study, the market is expected to grow by over 5% annually, driven by the rising demand for natural and organic cosmetics and the need for effective preservatives to ensure product safety and shelf life. For instance, synthetic preservatives like phenoxyethanol and parabens continue to dominate the market due to their broad-spectrum antimicrobial activity and stability.

Exclusive Customer Landscape

The cosmetic preservatives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cosmetic preservatives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cosmetic preservatives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AE Chemie, Inc. - This company specializes in providing a range of cosmetic preservatives, including KEM NAT, KEM NAT B, KEM NAT LITE, KEM E, KEM BB, and KEM BS.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AE Chemie, Inc.

- Akema Srl

- Ashland Inc.

- BASF

- BRENNTAG SE

- Chemipol SA

- Clariant International Ltd

- Dadia Chemical Industries

- Dow Inc.

- ISCA UK Ltd.

- Kumar Organic Products Ltd.

- Lonza Group Ltd.

- Quimidroga S A

- SACHEM, INC.

- Salicylates And Chemicals Pvt. Ltd.

- Schulke and Mayr GmbH

- Sharon Laboratories Ltd.

- Spectrum Laboratory Products Inc.

- Symrise Group

- Thor Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cosmetic Preservatives Market

- In January 2024, leading cosmetics preservatives manufacturer, Kobo Products, announced the launch of its new line of natural preservatives, named PreservEssence. This innovative product line is designed to cater to the increasing consumer demand for natural and organic cosmetics (Source: Kobo Products Press Release).

- In March 2024, Dow Inc. and SABIC entered into a strategic collaboration to develop and commercialize bio-based preservatives. This partnership aims to reduce the environmental impact of cosmetic preservatives by utilizing renewable feedstocks (Source: Dow Inc. Press Release).

- In April 2025, BASF Corporation received approval from the European Commission for its preservative system, Myrtec MX, which is based on natural ingredients. This approval marks a significant milestone in BASF's efforts to expand its product portfolio in the European cosmetics market (Source: BASF Corporation Press Release).

- In May 2025, Clariant, a global specialty chemical company, completed the acquisition of Huntsman Corporation's specialty ingredients business. This acquisition significantly strengthens Clariant's position in the market by adding a broad portfolio of preservative solutions and expanding its geographic reach (Source: Clariant Press Release).

Research Analyst Overview

- The market continues to evolve, with ongoing research and development efforts focused on stability testing methodologies, preservative degradation pathways, and optimization of preservation systems. Skin sensitization potential and product stability enhancement are key concerns, driving the need for a preservative selection guide and efficacy studies against both gram-positive and gram-negative bacteria. Eco-friendly preservation options are gaining traction, with a 10% annual industry growth expectation, as environmental impact analysis and ingredient interactions become increasingly important. Antifungal preservative efficacy and antibacterial preservative activity remain critical for fungal contamination prevention and bacterial contamination control. Long-term preservative efficacy and chemical preservative interactions are also under scrutiny, as minimal preservative formulations and cost-effectiveness become priorities.

- Regulatory compliance testing and preservative concentration limits are essential for maintaining product quality and safety, while preservative efficacy comparison and microbial resistance mechanisms are ongoing areas of research. Packaging impact assessment plays a crucial role in preservative selection and optimization, as does the assessment of preservative interactions with other ingredients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cosmetic Preservatives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 163.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

US, China, Japan, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cosmetic Preservatives Market Research and Growth Report?

- CAGR of the Cosmetic Preservatives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cosmetic preservatives market growth of industry companies

We can help! Our analysts can customize this cosmetic preservatives market research report to meet your requirements.