Crowd Analytics Market Size 2024-2028

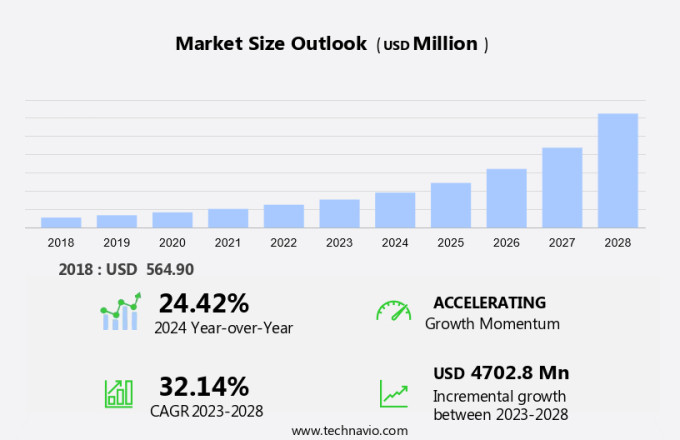

The crowd analytics market size is forecast to increase by USD 4.70 billion at a CAGR of 32.14% between 2023 and 2028. The market is experiencing significant growth due to the increasing need for proactive risk management in various sectors, including transportation and public safety. With the rise in domestic crime and potential risks from terrorist acts, there is a growing demand for advanced crowd analytics solutions. Companies are deploying incident analytics software to help identify suspects and prevent incidents before they occur. Data integration and data quality tools are crucial for effective crowd analytics. Hyper-personalization, AI, and automation are key trends in the market, enabling real-time threat detection and response. The manufacturing and retail sectors are major adopters of crowd analytics for client retention and risk management.

The market is gaining significance in various sectors, including transportation hubs, retail establishments, and large public venues. This technology leverages sensors, cameras, and telecom operators' data to analyze crowd behavior and customer preference patterns in real-time. Airports and train stations are major adopters of crowd analytics. By monitoring foot traffic, queue management, and passenger flow, these organizations can enhance operational efficiency and provide better services. Sensors and cameras installed at these facilities help in tracking crowd behavior and identifying potential bottlenecks, ensuring a smooth passenger experience. City malls and retail stores also benefit from crowd analytics.

Additionally, understanding customer footfall, preferences, and shopping trends can lead to targeted marketing campaigns and improved store layouts. Modern restaurant management is another sector that can benefit from this technology. The National Restaurant Association reports that efficiency gains are a top priority for the restaurant industry. Enhanced video analytics can help in optimizing kitchen workflows, reducing wait times, and improving overall customer experience. Conference centers and stadiums are other significant users of crowd analytics. Public safety and defense organizations also leverage this technology for surveillance purposes. Filmed visuals can be analyzed to identify suspects and maintain security. City planning and public transport are other areas where crowd analytics plays a crucial role.

Further, real-time data on crowd behavior can help in optimizing public transport routes, reducing congestion, and improving overall infrastructure management. Retail malls and commercial buildings also benefit from this technology by ensuring safety and security while providing a seamless customer experience. In conclusion, the market offers numerous benefits to various industries, from transportation and retail to public safety and city planning. By analyzing crowd behavior and customer preferences, organizations can optimize their operations, enhance safety, and improve overall customer experience. Sensors, cameras, and telecom operators' data are the key enablers of this technology, providing valuable insights into crowd dynamics and trends.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Cloud

- On-premises

- End-user

- Transportation

- Retail

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Deployment Insights

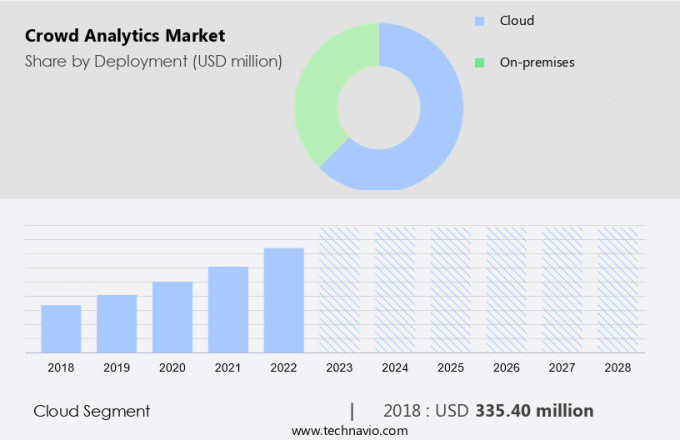

The cloud segment is estimated to witness significant growth during the forecast period. The market encompasses the use of business intelligence solutions to analyze and gain insights from the behavior of large groups of people in various public spaces, including airports, train stations, city malls, retail stores, conference centers, and stadiums. The Internet of Things (IoT) adoption and advanced IT infrastructure are key drivers propelling the growth of this market. In terms of deployment models, the cloud holds the largest market share due to its flexibility and accessibility. Cloud-based crowd analytics enables data collection, analysis, storage, and sharing through cloud-based services and applications, making it easier for researchers to collaborate and enhance models and predictions.

The scalability of cloud computing, combined with advanced crowd analytics, is fueling the demand for cloud-based solutions. Crowd flow management and mobility tracking are critical applications of crowd analytics, particularly in transportation and transportation hubs. By analyzing customer preference patterns and trends, businesses can optimize operations, improve customer experiences, and gain a competitive edge. Cloud-based crowd analytics is revolutionizing the way organizations approach data analysis and decision-making, ultimately leading to better outcomes for both businesses and the public.

Get a glance at the market share of various segments Request Free Sample

The cloud segment accounted for USD 335.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

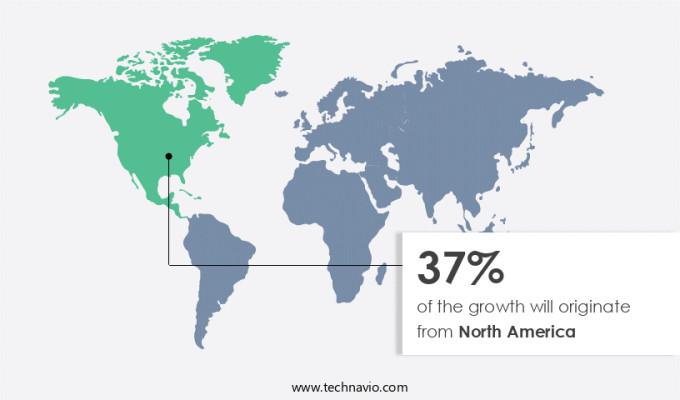

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to the increasing adoption of cloud-based crowd analytics solutions by organizations. The advantages of cloud-based deployment, including cost-effectiveness and ease of availability, are driving this trend. Major market companies in the region, including international players, are supplying solutions to various industries such as retail, e-commerce, healthcare, and entertainment. In particular, retail industries are extensively deploying crowd analytics for incident detection using technologies like facial recognition and artificial intelligence approaches. City governments and international airports are also leveraging these solutions for operational efficiencies. The IT, banking, telecommunications, media and entertainment sectors are also adopting crowd analytics solutions to enhance customer experience and improve security.

Further, deployment types include on-premises, hybrid, and cloud-based solutions, with cloud-based solutions gaining popularity due to their flexibility and scalability. The use of internet technology further enhances the capabilities of crowd analytics, enabling real-time data processing and analysis.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising number of airline and train passengers is the key driver of the market. The escalating use of public transportation, particularly in air and rail travel, has resulted in a significant need for effective crowd management and infrastructure planning to handle large groups of passengers at common transit hubs, such as airports and train stations, across regions including APAC, North America, Europe, and others. For instance, Indian airlines reported a notable increase in domestic passenger numbers, with 123.2 million passengers in 2022 compared to 83.8 million in 2021. US airlines also experienced a substantial rise in scheduled service passengers, with 46.3 million in January 2022, representing a 33.2% increase from the same month in 2021.

In response to this wave in passenger traffic, the demand for advanced crowd analytics solutions has grown. Companies like Thales are addressing this need through their Distributed Intelligent Video Analytics technology, which utilizes computer vision algorithms to extract people counting data from CCTV cameras, enhancing safety and efficiency in public transportation, retail malls, vital infrastructure, commercial buildings, and other public spaces. This technology aids in crowd control, public surveillance, group transportation planning, and fraud prevention for carriers, train passengers, defense organizations, and city planning agencies.

Market Trends

Rising strategic activities by companies is the upcoming trend in the market. Advanced crowd analytics technologies have gained significant traction in numerous industries due to the heightened focus on crowd safety during the COVID-19 pandemic. The increasing importance of network security and maintaining strong safety protocols will drive the adoption of crowd analytics solutions in the coming years. Market participants are responding to this trend by launching new products and engaging in strategic activities to stay competitive. This collaboration will enable more effective crowd management and contribute to the growth of the market. Other companies are also pursuing organic and inorganic growth strategies, such as product innovation and mergers and acquisitions, to strengthen their market position.

Market Challenge

Lack of expertise and knowledge of cloud resources and architecture is a key challenge affecting the market growth. The market for crowd analytics is experiencing significant growth due to the increasing need for proactive risk management in various sectors, particularly in relation to suspects and potential risks associated with domestic crime and terrorist acts. This demand is driven by the desire to mitigate potential threats and ensure public safety. However, the shortage of qualified data analytics professionals, including mathematicians, statisticians, data scientists, and data analysts, poses a challenge for companies in meeting the growing needs of their client base. To address this issue, innovative solutions are being introduced, such as the deployment of data integration and data quality tools, as well as the use of visualization, hyper-personalization, AI, and automation in incident analytics software.

These technologies enable organizations in the manufacturing and retail sectors to enhance client retention and risk management, respectively. By leveraging these advanced analytics capabilities, organizations can gain valuable insights to inform their strategies and make informed decisions in real-time.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

AGT International: The company offers crowd analytics for agriculture and rural development, environment and energy, and agro-Industry, and marketing and trade.

- Ajna Labs Pvt. Ltd.

- ARCUS Applied Artificial Intelligence GmbH

- Crowd Analytics Ltd.

- Crowd Dynamics International Ltd

- CrowdANALYTIX

- CrowdVision Ltd.

- Datum Consultants FzCO

- Divine Space Pvt. Ltd.

- Geodan B.V.

- Multimodal Data Fusion and Analytics Group

- NEC Corp.

- Nokia Corp.

- Savannah Simulations AG

- SmartinfoLogiks LLP

- Spoken Thought Inc.

- STRATACACHE

- TAKELEAP DMCC

- Verizon Communications Inc.

- Xtreme Media Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Crowd analytics is an essential component of business intelligence solutions that enables organizations to gain valuable insights from the behavior and patterns of large groups of people in various public spaces. This technology is increasingly being adopted in sectors such as airports, train stations, city malls, retail stores, conference centers, stadiums, and hospitality and tourism industries. The deployment model for crowd analytics can be cloud-based or on-premises, with advanced analytic software utilizing IoT sensors, cameras, and telecom operators' data to monitor crowd dynamics. Crowd analytics plays a crucial role in managing crowd flow and mobility tracking in transportation, enabling group transportation planning and operational efficiencies. It also enhances public safety by detecting criminal activity and potential risks through intelligent surveillance systems, pattern recognition, and facial recognition using artificial intelligence approaches.

Further, the retail industry, including restaurants and the National Restaurant Association, benefits from crowd analytics for modern restaurant management, client retention, and risk management. The IT infrastructure required for crowd analytics includes scalable cloud computing, data integration, data quality tools, and visualization capabilities. Crowd analytics is also relevant to verticals such as banking, IT and telecommunications, media and entertainment, manufacturing, and retail sector. The technology's applications extend to incident analytics software, digital signage, and in-store analytics.

Additionally, defense organizations and city planning bodies use crowd analytics for public safety and security hygiene. The cloud deployment paradigm offers flexibility and cost savings, with cloud-delivered endpoints, L3 chips, OSDome sensors, and Cloudera's SaaS version enabling real-time data handling and analysis. Overall, crowd analytics is a vital tool for organizations seeking to optimize operational efficiencies, enhance customer experience, and ensure a safe and secure environment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.14% |

|

Market growth 2024-2028 |

USD 4.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.42 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, UK, China, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGT International, Ajna Labs Pvt. Ltd., ARCUS Applied Artificial Intelligence GmbH, Crowd Analytics Ltd., Crowd Dynamics International Ltd, CrowdANALYTIX, CrowdVision Ltd., Datum Consultants FzCO, Divine Space Pvt. Ltd., Geodan B.V., Multimodal Data Fusion and Analytics Group, NEC Corp., Nokia Corp., Savannah Simulations AG, SmartinfoLogiks LLP, Spoken Thought Inc., STRATACACHE, TAKELEAP DMCC, Verizon Communications Inc., and Xtreme Media Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch