Cufflinks Market Size 2024-2028

The cufflinks market size is is forecast to increase by USD 1.70 billion, at a CAGR of 6.29% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends. One notable trend is the increasing popularity of online retail, which allows for greater convenience and accessibility for consumers. Additionally, the number of experience centers for cufflinks is on the rise, providing customers with unique shopping experiences. Another factor fueling market growth is the increased demand from millennials, who value fast fashion and personal style. Furthermore, several social media platforms are leveraged by prominent companies for marketing campaigns. Hence, such factors are driving the market growth in Europe during the forecast period. However, the market also faces challenges from the presence of local and unorganized companies, which can impact the quality and consistency of products offered. Overall, the market is poised for continued growth, driven by these trends and the enduring appeal of this classic accessory.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market is a niche segment within the fashion industry, focusing on the production and sale of cufflinks for formal attire, primarily used with tuxedos and dress shirts. Cufflinks come in various materials such as glass, stone, metal, and precious metals, adding an element of elegance and self-expression to the wearer. Monogrammed cufflinks, a popular choice for personalization, have gained significant traction in the market. Manufacturing units use a range of materials, including precious metals, gemstones, enamel, and fabrics, to create customized cufflinks that cater to the diverse needs of the fashion sector. Corporate culture and fashion designers have also prioritize the importance of customized clothes, leading to an increase in demand for customized cufflinks. Jewelers and manufacturing units are the key players in the market, providing a wide range of designs and materials to meet the needs of consumers. The market is expected to grow as the trend towards personalization and self-expression continues to influence the fashion industry. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

One of the key factors driving the market growth is the rise in demand for French cuff shirts. There is a growing popularity for French cufflinks among consumers as it is an essential component in European and American men's formal wear. The increasing demand for French cuff shirts among working professionals is significantly contributing to the market growth.

Moreover, the declining trend of wearing ties has fuelled dress shirts that require cufflinks, such as French cuff shirts. As a result, it has significantly fuelled the sales of French cuff shirts as well as cufflinks. Hence, such factors are positively impacting the market. Therefore, it is expected to drive the market growth during the forecast period.

Significant Market Trends

A key factor shaping the market growth is the popularity of cufflinks as a gift item. There is an increase in the trend of gifting cufflinks as gift items for various events and occasions, such as birthdays, anniversaries, and weddings, which is significantly contributing to the market growth. In addition, there is a growing popularity for personalized cufflinks such as those with photos of the bride and groom.

Moreover, several companies have a dedicated section for cufflinks offered as gifts. In addition, factors such as the versatility of cufflink designs and the endless personalization options have fuelled its popularity as a gifting item. Hence, such factors are positively impacting the market which in turn will drive the market growth during the forecast period.

Major Market Challenge

Rising labor costs and fluctuating raw material prices are some of the key challenges hindering market growth. There are several companies that have established their factories in Asian countries, such as China, Indonesia, Bangladesh, and Vietnam. due to low labor costs in these regions. There is an increase in production costs in several international countries which is significantly impacting the profit margin of companies in this region.

Moreover, some of the key materials that are used in the manufacturing of cufflinks include brass, silver, copper, aluminum, textiles or leather, base metal alloys, and metals plated with gold or silver. There is a significant fluctuations in prices of these raw materials which is adding to the production cost and impacting the profit margin of manufacturers. Hence, such factors are negatively impacting the market. Therefore, it is expected to hinder the market growth during the forecast period.

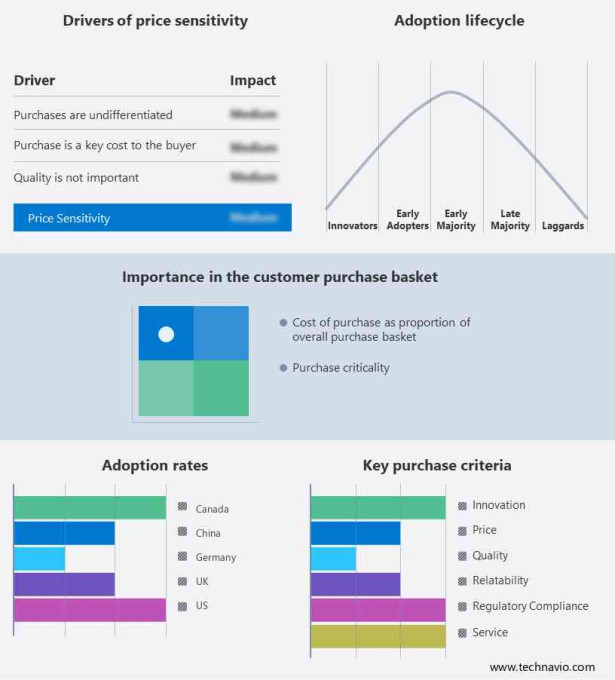

Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Boucheron Holding SAS: The company offers cufflinks such as Boucheron paris crystal gold bar cufflinks, coral gold bar cufflinks, carved lapis gold cufflinks, and more.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Bulgari S.p.A

- Burberry Group Plc

- Cartier SA

- Chanel Ltd.

- Christian Dior SE

- Cufflinks LLC

- David Yurman Enterprises LLC

- Dolce and Gabbana SRL

- Georg Jensen

- Giorgio Armani S.p.A.

- Guccio Gucci Spa

- Hugo Boss AG

- K. Mikimoto and Co. Ltd.

- Montblanc

- Paul Smith Ltd.

- Prada Spa

- Ralph Lauren Corp.

- Salvatore Ferragamo Spa

- Tiffany and Co

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Largest-Growing Segments in the Market?

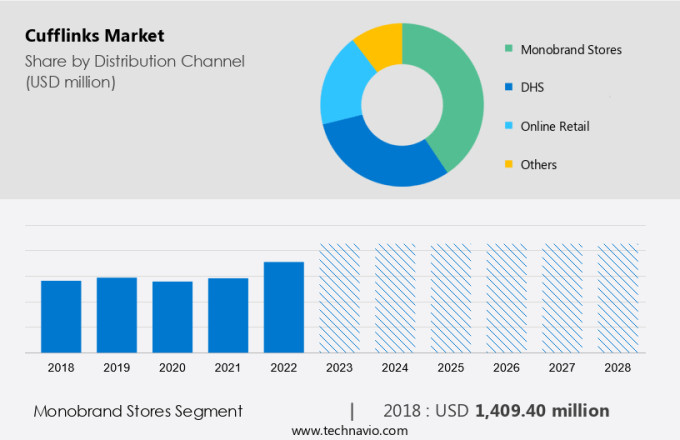

The monobrand stores segment is estimated to witness significant growth during the forecast period. Monobrand stores, which offer a wide range of premium cufflinks, have become popular due to their exclusivity and extensive product choices. Stainless steel, gold, crystal, and various fabrics and stones are commonly used in the manufacturing of these accessories. Customized clothes and personalized cufflinks have also gained popularity for special celebrations and formal wear. Jewelers and fashion designers continue to innovate, offering classic, common, gemstone, funny, and personalized types of cufflinks to cater to diverse consumer preferences.

Get a glance at the market contribution of various segments View the PDF Sample

The monobrand stores segment was the largest segment and was valued at USD 1.41 billion in 2018. Offline stores also continue to play a role in the market, providing an opportunity for customers to touch and feel the products before purchasing. The fashion culture surrounding shirt cuffs and cufflinks remains strong, with manufacturing units working tirelessly to meet the demand for these luxury items.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

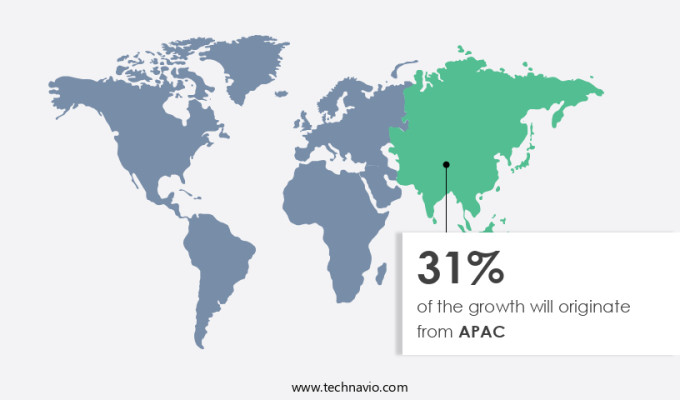

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Another region offering significant growth opportunities to market players is Europe. One of the main factors that are significantly contributing to the market in Europe is the traditional adoption of cufflinks as part of formal wear. Some of the main countries in Europe which are significant contributors to the market growth are the UK, France, and Germany. In addition, the availability of the product is high in the region which is positively impacting the market.

Furthermore, there is an increasing preference by customers for online platforms for purchasing expensive products such as cufflinks. As a result, several specialty jewelry stores are introducing online platforms for their advertising campaigns and virtual stores. Furthermore, several social media platforms are leveraged by prominent companies for marketing campaigns. Hence, such factors are driving the market growth in Europe during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- Premium cufflinks

- Mass cufflinks

- Distribution Channel Outlook

- Monobrand stores

- Department stores

- Hypermarkets

- Supermarkets

- Online retail

- Others

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is a niche segment of the luxury fashion accessories industry, focusing on the production and distribution of these sophisticated designer accessories. Cufflinks, an essential component of formal attire, are often worn with tuxedos and dress shirts to add a touch of elegance and sophistication. Cufflinks are available in various materials, including glass, stone, metal, and precious metals. Monogrammed cufflinks, a popular choice for personalization, add a unique touch to any outfit. Precious stones like blue sapphires, rubies, opal, topaz, and peridots, as well as garnets, add an extra layer of luxury and charm. Product innovations, such as interchangeable cufflinks, cater to customer preferences and the desire for self-expression.

Social media marketing, celebrity endorsement, and online retailing have increased the market, making these designer accessories accessible to a wider audience. Cufflinks exporters play a crucial role in the market, supplying these luxury fashion accessories to various parts of the world. Heritage cufflinks, with their unique designs, continue to be a favorite among fashion-forward men. Corporate culture and professional attire have prioritized the importance of these accessories, making customized cufflinks a popular choice for businesses looking to enhance their corporate image. Personalization, whether through monograms or unique designs, adds to the allure of cufflinks as a form of self-expression.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.29% |

|

Market growth 2024-2028 |

USD 1.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.55 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 31% |

|

Key countries |

US, Germany, Canada, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Boucheron Holding SAS, Bulgari S.p.A, Burberry Group Plc, Cartier SA, Chanel Ltd., Christian Dior SE, Cufflinks LLC, David Yurman Enterprises LLC, Dolce and Gabbana S.r.l., Georg Jensen, Giorgio Armani S.p.A., Guccio Gucci Spa, Hugo Boss AG, K. Mikimoto and Co. Ltd., Montblanc, Paul Smith Ltd., Prada Spa, Ralph Lauren Corp., Salvatore Ferragamo Spa, and Tiffany and Co |

|

Market dynamics |

Parent market analysis, market growth analysis, market research and growth, Market forecasting, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028.

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across Europe, APAC, North America, South America, and the Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.