Menswear Market Size 2025-2029

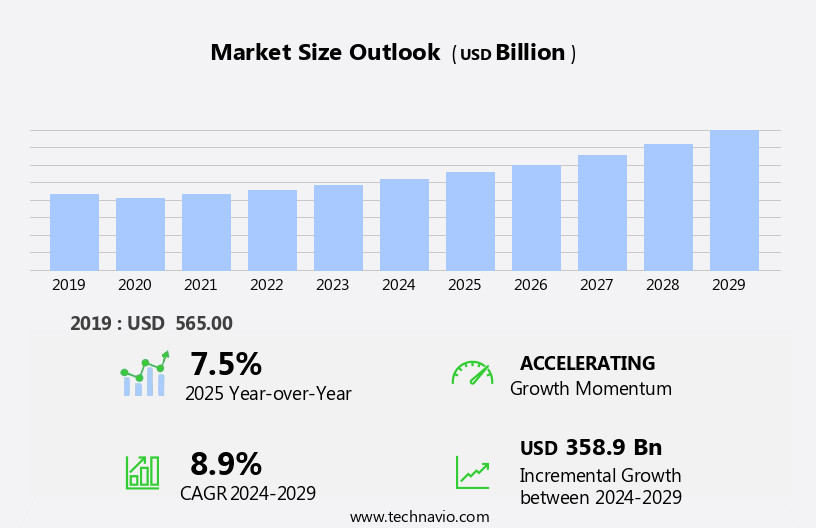

The menswear market size is forecast to increase by USD 358.9 billion at a CAGR of 8.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by an increasing number of promotional activities and the rising demand for organic menswear. The former is a strategic initiative adopted by various brands to attract and retain customers, leading to increased sales and market penetration. The latter trend reflects consumers' growing awareness and preference for sustainable fast fashion, which is expected to continue shaping market dynamics. However, the market is not without challenges. Trade policy reforms, as mentioned, pose a significant obstacle. Changes in trade policies can impact import and export costs, potentially disrupting supply chains and increasing operational expenses for manufacturers and retailers.

- Companies must stay informed of these developments and adapt their strategies accordingly to mitigate any negative impact on their business. Effective supply chain management, exploring alternative sourcing options, and maintaining strong relationships with suppliers and customers will be crucial in navigating these challenges and capitalizing on the market's growth opportunities.

What will be the Size of the Menswear Market during the forecast period?

- The market continues to evolve, with dynamic market activities unfolding across various sectors. Fashion technology, such as augmented reality and virtual fashion, is revolutionizing the way consumers engage with brands and explore new styles. Affordable fashion and Fast Fashion continue to dominate the landscape, while designer fashion and luxury brands maintain their appeal for those seeking high-end offerings. Influencer marketing and social media marketing are key drivers of consumer behavior, with men's fashion influencers and bloggers shaping trends and driving sales. Sustainable fashion and circular fashion are gaining traction, as consumers demand more eco-friendly and ethical options. Men's haircare and grooming are increasingly important, with personalized recommendations and data analytics enhancing the customer experience.

- Fashion design is embracing diversity and inclusion, with size inclusivity and body positivity becoming essential considerations. Trade shows and fashion shows provide opportunities for brands to showcase their latest collections and connect with buyers and media. Fabric sourcing and pattern making are critical components of the supply chain, with an emphasis on eco-friendly and sustainable practices. Men's fashion magazines and online shopping platforms offer a wealth of information and convenience, while fashion forecasting helps retailers stay ahead of trends. Men's accessories, from watches to wallets, add finishing touches to outfits and reflect personal style. The shopping experience is being enhanced through technology, with virtual try-on features and personalized recommendations.

- The ongoing evolution of the market ensures a dynamic and exciting landscape for both consumers and industry professionals.

How is this Menswear Industry segmented?

The menswear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Top wear

- Bottom wear

- CJS

- Accessories

- Intimate and sleep wear

- Distribution Channel

- Offline

- Online

- Material

- Cotton

- Synthetic fabrics

- Wool

- Blended fabrics

- Linen

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

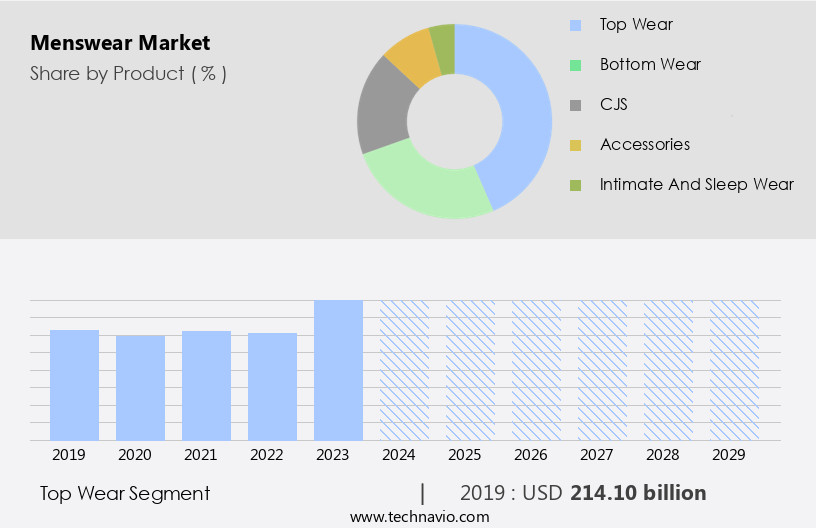

The top wear segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities that shape the industry's dynamics and trends. Augmented reality technology enhances the shopping experience, allowing men to virtually try on clothes before purchasing. Vintage fashion continues to gain popularity, with many men embracing unique, timeless pieces. Men's skincare and grooming have become essential, leading to an increase in demand for high-quality products. Data analytics and artificial intelligence enable personalized recommendations based on customer preferences and style trends. Fast fashion dominates the market, offering affordable prices and quick turnaround times. Digital marketing strategies, including social media and influencer marketing, significantly impact sales. Circular fashion and sustainability are growing concerns, leading to the adoption of eco-friendly materials and ethical manufacturing practices.

Fashion design continues to evolve, with a focus on size inclusivity, diversity, and body positivity. Men's fashion influencers and bloggers shape style trends, while fashion shows and trade shows showcase the latest collections. Fabric sourcing and pattern making are crucial aspects of the supply chain, with an emphasis on innovation and quality. Men's accessories, such as watches, belts, and ties, complement the wardrobe. Virtual Metaverse fashion forecasting provide insights into future trends. Men's fashion magazines and online shopping platforms cater to the convenience of modern consumers. Men's haircare and fragrances are essential grooming essentials. Fashion cycles remain influential, with seasonal trends and classic styles shaping men's wardrobes. Overall, the market is a dynamic and evolving industry, with a focus on innovation, sustainability, and customer experience.

The Top wear segment was valued at USD 214.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

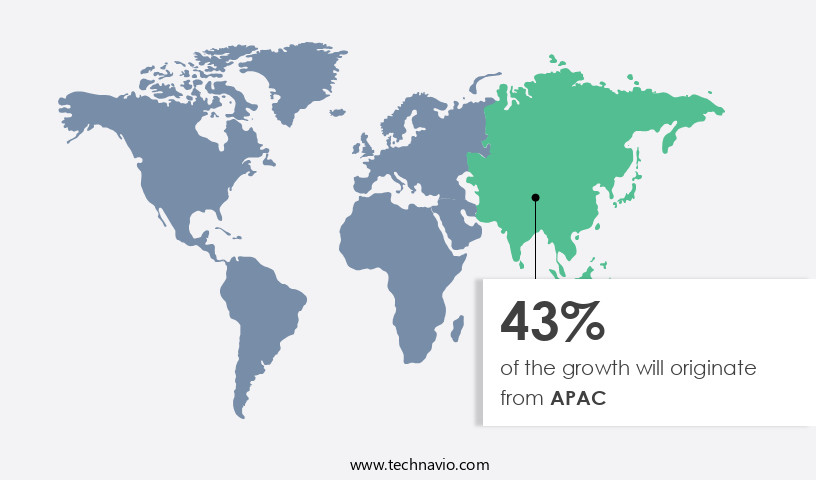

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, with China, India, Japan, Australia, and South Korea leading the charge. Brands like Levi Strauss, Nike, UNIQLO, and Edwin are capitalizing on this trend, offering affordable, high-quality menswear to a burgeoning consumer base. Urbanization and rising disposable income are key drivers, as customers seek out the latest fashion trends and prioritize personal style. Augmented reality technology is revolutionizing the shopping experience, allowing men to try on virtual outfits before making a purchase. Vintage fashion and sustainable styles are also gaining traction, as consumers prioritize eco-friendly and ethical options. Men's grooming and skincare are no longer an afterthought, with data analytics and artificial intelligence powering personalized recommendations.

Fast fashion continues to dominate, but circular fashion is on the rise, with men embracing the concept of renting and reselling clothing. Digital marketing and social media are essential tools for reaching consumers, with men's fashion influencers and bloggers driving engagement and sales. Luxury fashion remains a desirable category, but affordability and accessibility are increasingly important. Fashion shows and trade shows are evolving, with virtual events and pattern making software streamlining the design process. Fabric sourcing and supply chain transparency are becoming essential considerations for ethical and sustainable production. Men's haircare, accessories, and fragrances are also growing categories, as men seek out complete grooming solutions.

Size inclusivity, diversity, and body positivity are becoming non-negotiables for consumers, with retailers responding by offering a wider range of sizes and styles. Fashion cycles are faster than ever, with fashion forecasting and trend analysis essential for staying competitive. Online shopping and men's fashion magazines continue to shape consumer behavior and preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Menswear Industry?

- The increasing prevalence of promotional activities serves as the primary catalyst for market growth. The market is experiencing significant growth due to the increasing importance of marketing and branding in the apparel industry. Companies are utilizing various channels to engage customers, with social media platforms, such as Facebook and Instagram, being a popular choice. In-store marketing also plays a crucial role, utilizing signages, audiovisual media, and mobile applications to promote sales. Digital marketing is a key driver of growth, with the widespread use of the Internet, smartphones, and tablets providing easy access to menswear information. Sustainable fashion, affordable fashion, and fashion technology are emerging trends in the market. Influencer marketing is also becoming increasingly important, with men's fashion influencers playing a significant role in shaping consumer preferences.

- Luxury fashion brands are leveraging technology to offer immersive and harmonious shopping experiences. Men's haircare is another segment of the market that is witnessing growth, with companies focusing on innovation and premium offerings. Overall, the market is dynamic and competitive, with companies continually seeking to differentiate themselves through marketing, advertising, and promotional activities.

What are the market trends shaping the Menswear Industry?

- The increasing interest in organic clothing is a notable trend in the market. This demand for sustainable and eco-friendly fashion options reflects a growing consumer consciousness towards healthier and more environmentally responsible choices.

- The market is experiencing significant growth, with a focus on size inclusivity, diversity, and inclusion becoming increasingly important. Department stores and retail stores are responding to this trend by expanding their offerings to cater to a wider range of body types and styles. Ethical fashion is also gaining traction, as consumers demand more transparency in fabric sourcing and production processes. This includes a preference for organic and natural materials, which are free from synthetic chemicals and artificial dyes that can cause skin irritation and allergies.

- Fashion shows continue to showcase the latest men's styles, with an emphasis on accessories that complement the clothing. The shopping experience is becoming more immersive and harmonious, with retailers prioritizing customer satisfaction and creating a welcoming atmosphere. These market dynamics reflect the evolving needs and preferences of modern consumers, as they seek out sustainable, inclusive, and stylish options in the market.

What challenges does the Menswear Industry face during its growth?

- Trade policy reforms pose a significant challenge to the growth of various industries. It is essential for businesses to closely monitor and adapt to these reforms to mitigate potential negative impacts and maximize opportunities for expansion.

- The market is influenced by various factors, including fashion trends, pattern making, and supply chain management. Eco-friendly fashion is a growing trend in the industry, with consumers increasingly seeking sustainable and ethical clothing options. Virtual fashion and fashion forecasting are also key areas of focus, as technology continues to disrupt traditional retail models. Men's fashion bloggers and magazines play a significant role in shaping consumer preferences and driving sales. Personalized recommendations and online shopping have become the norm, making it essential for companies to invest in digital capabilities. Men's fragrances remain a popular category, with many companies investing in research and development to launch innovative products.

- However, changes in policies and regulations, particularly those related to trade, can adversely impact the business environment for companies in the market. The US, being a key contributor to the market, is particularly affected by regulatory changes. Companies must stay agile and adapt to these changes to remain competitive. In conclusion, the market is dynamic and constantly evolving, with various trends and factors shaping its growth. Companies must stay informed about the latest developments and adapt to changing consumer preferences and regulatory environments to succeed.

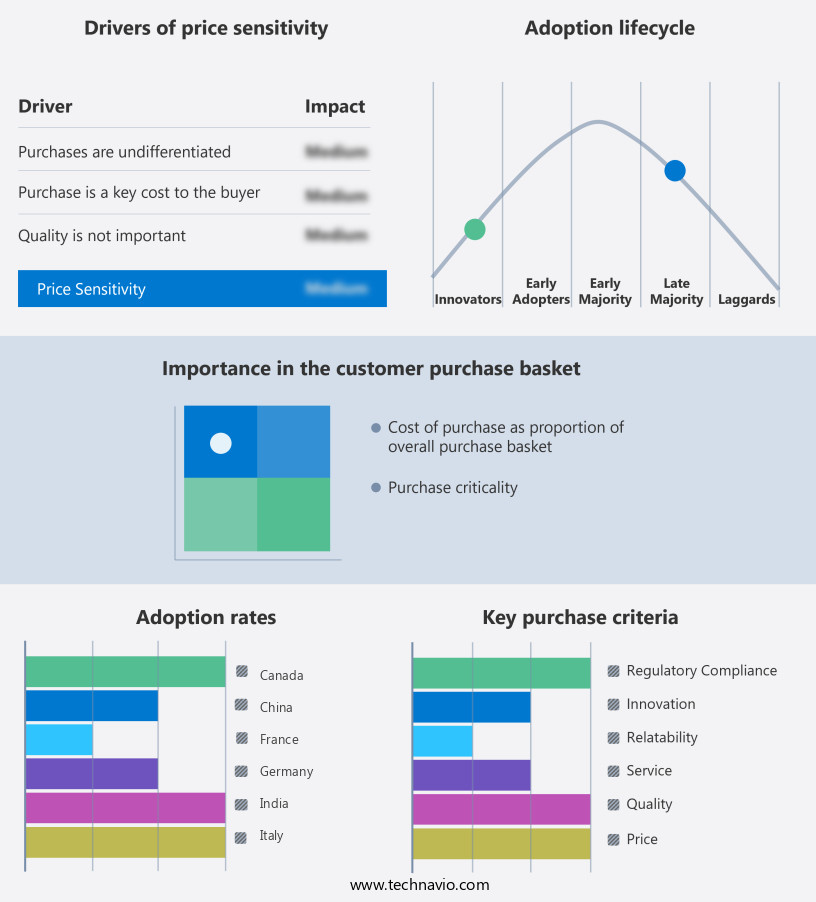

Exclusive Customer Landscape

The menswear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the menswear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, menswear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in providing a range of high-quality menswear items. Our product offerings include t-shirts and tank tops, joggers and track pants, cricket and football jerseys and pants, hoodies, sweatshirts, and more. Each piece is designed with attention to detail and superior craftsmanship, ensuring a comfortable and stylish fit for the modern man. By utilizing innovative materials and manufacturing techniques, we aim to elevate the menswear experience, enhancing our customers' wardrobes and confidence. Our commitment to originality and quality sets US apart, attracting a diverse and discerning clientele.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- AG Adriano Goldschmied Inc.

- Burberry Group Plc

- Capri Holdings Ltd.

- Guess Inc.

- H and M Hennes and Mauritz GBC AB

- Hermes International SA

- Hugo Boss AG

- Industria de Diseno Textil SA

- Kering SA

- Kontoor Brands Inc.

- Levi Strauss and Co.

- LVMH Moet Hennessy Louis Vuitton SE

- Nike Inc.

- OTB Spa

- Patagonia Inc.

- PVH Corp.

- Ralph Lauren Corp.

- The Gap Inc.

- VF Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Menswear Market

- In February 2024, H&M, a leading global fashion retailer, introduced its new sustainable line, "CONSCIOUS EXPLORER," exclusively for men. This collection, made from recycled and organic materials, signaled the brand's commitment to reducing its environmental footprint (H&M Press Release, 2024).

- In May 2025, Adidas and Allbirds, two major players in the menswear industry, announced a strategic partnership to develop sustainable footwear. This collaboration aimed to combine Adidas' manufacturing expertise with Allbirds' innovative materials, creating eco-friendly shoes that catered to a broader customer base (Adidas Press Release, 2025).

- In July 2024, Tommy Hilfiger, an iconic American clothing brand, raised USD100 million in a funding round led by Shamrock Capital. This investment was earmarked for the expansion of Tommy Hilfiger's digital capabilities and global growth strategies (Tommy Hilfiger Press Release, 2024).

- In October 2025, Zara, a Spanish fast-fashion retailer, launched its first store in Nigeria, marking its entry into Africa's largest economy. This strategic expansion aimed to tap into the growing middle class and increasing demand for affordable fashion in the region (Industry Europe, 2025).

Research Analyst Overview

In the dynamic the market, tailored fit and slim fit continue to dominate the scene, with Wearable Technology integration becoming increasingly popular. Fashion photographers capture these trends for fashion media, showcasing functional clothing made from sustainable materials like recycled and organic cotton. Subscription boxes offer personalized styling services, delivering curated outfits to consumers. Social responsibility is a key driver, with fashion retailers embracing fair trade, sustainable materials, and ethical production methods. Fashion schools and fashion institutes train the next generation of designers, pushing boundaries with smart clothing, breathable fabrics, and wrinkle-resistant materials.

Multi-brand retailers stock a diverse range of performance fabrics, water-resistant and stain-resistant, catering to the active consumer. Style consultants and fashion editors collaborate on fashion events and fashion weeks, promoting the latest trends and influencing consumer behavior. Vegan leather and stretch fabrics add versatility to the market, meeting the demand for fashionable, sustainable alternatives.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Menswear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 358.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, Canada, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Menswear Market Research and Growth Report?

- CAGR of the Menswear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the menswear market growth of industry companies

We can help! Our analysts can customize this menswear market research report to meet your requirements.