Southeast Asia Data Center Cooling Market Size 2024-2028

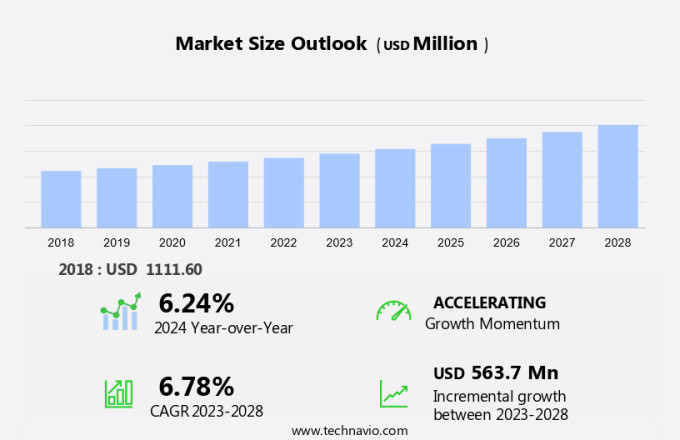

The southeast Asia data center cooling market size is forecast to increase by USD 563.7 million at a CAGR of 6.78% between 2023 and 2028.

- In Southeast Asia, the data center cooling market is experiencing significant growth due to several key trends. The increasing adoption of mini data centers is one such trend, as organizations seek to reduce IT infrastructure costs and improve efficiency. Data center cooling solutions are the solutions used for cooling IT equipment, from small network closets to enterprise data centers, server room environments, and heating, ventilation, and air conditioning (HVAC) systems. Another trend is the rising adoption of Data Center Infrastructure Management (DCIM) solutions, which enable better management of cooling systems and overall data center operations. Additionally, different operational regulations are driving the need for advanced cooling technologies to ensure compliance and maintain optimal temperature levels. These factors, among others, are expected to fuel market growth In the region.

What will be the size of the Southeast Asia Data Center Cooling Market during the forecast period?

- The market is experiencing significant growth due to the increasing demand for energy-efficient data centers to support the proliferation of data generation from various industries, including Ott platforms and streaming services. With the growth in data volumes from IT infrastructure and the adoption of cloud services and big data analytics, the need for specialized infrastructure to manage heat and power consumption has become crucial. Cooling equipment is a vital component of data center operations, and manufacturers are investing heavily in technology to improve energy efficiency and reduce carbon emissions. The market is driven by the rising adoption of connected devices and the resulting increase in data generation.

- Furthermore, the healthcare sector, in particular, is generating large amounts of data, necessitating the need for advanced cooling solutions. High investment costs and safety measures are key challenges, but the latest trends indicate a shift towards modular and scalable cooling solutions that offer greater flexibility and security. The services segment, which includes maintenance and consulting, is also gaining traction as organizations seek expert advice on cooling issues and the implementation of the latest technology.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Room cooling

- Rack and row cooling

- Technology

- Liquid-based cooling

- Air-based cooling

- Component

- Air conditioners

- Economizers

- Cooling towers

- Chillers

- Others

- Geography

- Southeast Asia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Rest of Southeast Asia

- Southeast Asia

By Type Insights

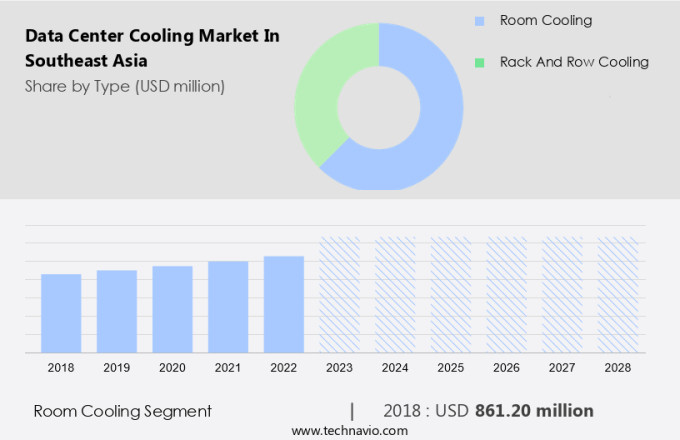

- The room cooling segment is estimated to witness significant growth during the forecast period.

Data centers in Southeast Asia are essential infrastructure for supporting the growing demand for energy-efficient data centers, data generation from OTT platforms and streaming services, and the increasing volumes of data from cloud services, big data, and connected devices. Power consumption in data centers is a significant concern due to the generation of heat, necessitating the use of specialized cooling equipment. Cooling solutions include air conditioners, precision air conditioners, and specialized infrastructure. The integration of IT infrastructure, such as pre-engineered cooling modules, precision cooling capabilities, and scalable designs, is crucial for high-density computing and energy consumption. The pandemic has accelerated the adoption of digital services, increasing the need for cooling solutions that ensure safety measures, flexibility, and scalability.

The latest trends include innovative solutions like non-raised floor, containment, and rack-based cooling. The high investment costs associated with cooling solutions have led to a focus on environmental sustainability and energy efficiency. The services segment, including installation and deployment and maintenance services, is expected to grow significantly In the coming years.

Get a glance at the market share of various segments Request Free Sample

The room cooling segment was valued at USD 861.20 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Southeast Asia Data Center Cooling Market?

The rising adoption of mini data centers is the key driver of the market.

- In Southeast Asia, the data center cooling market is experiencing significant growth due to the increasing demand for Energy-efficient data centers driven by the generation of massive Data volumes from OTT platforms, Streaming services, Cloud services, Big data, and Connected devices. This region's IT infrastructure requires specialized infrastructure to address Cooling issues and ensure Safety measures, particularly In the context of the Pandemic. Mini data centers, which can support up to 250 kW, are gaining popularity due to their scalability, Flexibility, and High investment costs savings. These self-contained systems integrate Power, Heat removal, and IT infrastructure, making them an attractive solution for businesses seeking to reduce Energy consumption and Carbon emissions. Mini data centers offer various cooling solutions, including Air conditioners, Precision air conditioners, Rack-based cooling, Row-based cooling, and Room-based cooling. Data-intensive applications, such as Cloud computing and Digital services, require innovative solutions like Pre-engineered cooling modules and Precision cooling capabilities to maintain optimal temperatures and ensure Environmental sustainability.

- Furthermore, the Services segment, including Installation & deployment and Maintenance service, is a significant contributor to the market's growth. Non-raised floor and Raised floor cooling systems are popular choices, with Containment and IT & telecom sectors driving demand. In summary, the market presents Regional opportunities for growth, particularly In the areas of Energy, Scalability, Security, and Flexibility. The Latest trends In the market include the adoption of specialized cooling equipment and solutions tailored to meet the unique demands of various industries, such as Manufacturing, Healthcare, and Education.

What are the market trends shaping the Southeast Asia Data Center Cooling Market?

Increasing adoption of DCIM solutions is the upcoming trend in the market.

- Data centers in Southeast Asia are witnessing significant growth due to the increasing data generation from OTT platforms, streaming services, and the adoption of cloud services, big data, and connected devices. This growth poses cooling challenges as data centers consume large amounts of power, leading to substantial heat generation. Cooling equipment is essential to maintain optimal operating temperatures and ensure the IT infrastructure's safety and reliability. companies are addressing these challenges by offering energy-efficient solutions, such as precision air conditioners and pre-engineered cooling modules with high-density computing capabilities. DCIM (Data Center Infrastructure Management) plays a crucial role in managing cooling systems remotely, reducing energy consumption by over 20% and increasing cooling efficiency by about 40%. DCIM adoption offers a scalable design and flexibility to accommodate future growth, ensuring environmental sustainability in data center operations. The market is driven by factors such as the rising adoption of advanced technologies, the growing need for energy efficiency, and the increasing demand for high-performance computing.

- Additionally, the latest trends include specialized infrastructure for healthcare, manufacturing, and IT & telecom sectors, requiring innovative solutions to meet their unique cooling requirements. Despite the high investment costs, the benefits of DCIM adoption, such as safety measures, technology advancements, and energy savings, make it a worthwhile investment. The services segment, including installation & deployment and maintenance, is also gaining traction as organizations seek expert assistance to optimize their cooling systems. Air conditioners, precision air conditioners, rack-based cooling, row-based cooling, and room-based cooling are popular component solutions, catering to various data-intensive applications and cloud computing requirements. The market is expected to continue its growth trajectory, driven by the increasing demand for digital services and the need for energy efficiency and environmental sustainability.

What challenges does Southeast Asia Data Center Cooling Market face during the growth?

The rise in different operational regulations is a key challenge affecting the market growth.

- In Southeast Asia, the Data Center Cooling Market is experiencing significant growth due to the increasing demand for Energy-efficient data centers driven by the generation of massive Data volumes from OTT platforms, streaming services, cloud services, big data, and connected devices. IT infrastructure, including data-intensive applications and cloud computing, relies heavily on data center operations, leading to a higher demand for cooling equipment. However, the market faces challenges such as High investment costs, cooling issues, and carbon emissions. To address these challenges, innovative solutions like pre-engineered cooling modules with Precision cooling capabilities and scalable design are gaining popularity. These solutions cater to high-density computing and energy consumption concerns, ensuring environmental sustainability.

- The services segment, including Installation & deployment, and Maintenance service, is also witnessing growth due to the need for flexibility and scalability in IT & telecom infrastructure. Despite these opportunities, the market growth is affected by various factors such as safety measures, component failures, and the need for specialized infrastructure. The latest trends in the market include rack-based cooling, row-based cooling, and room-based cooling, offering solutions for data center operations. Overall, the market presents significant opportunities for growth In the energy, technology, manufacturing, healthcare, and digital services sectors.

Exclusive Southeast Asia Data Center Cooling Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AIRSYS Refrigeration Engineering Technology Co. Ltd.

- Alfa Laval AB

- Alphabet Inc.

- Amazon.com Inc.

- Cisco Systems Inc.

- Daikin Industries Ltd.

- Dell Technologies Inc.

- Emerson Electric Co.

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Lenovo Group Ltd.

- Mitsubishi Electric Corp.

- Modine Manufacturing Co.

- NEC Corp.

- Nortek

- Oracle Corp.

- Quanta Computer Inc.

- Schneider Electric SE

- Vertiv Holdings Co.

- Wiwynn Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for IT infrastructure and digital services. With the proliferation of energy-intensive applications, such as cloud computing and big data analytics, the need for efficient and sustainable cooling solutions is becoming more pressing. Data centers generate large amounts of heat as a byproduct of their operations. This heat must be effectively managed to maintain optimal operating temperatures and ensure the reliability and performance of IT equipment. Cooling systems play a crucial role in this process, consuming a substantial portion of a data center's energy budget. Several trends are shaping the market. Hybrid Cooling Towers are an innovative addition to these systems, integrating both direct and indirect evaporative cooling techniques to optimize energy usage and maintain optimal temperatures.

One trend is the adoption of energy-efficient cooling technologies, such as precision air conditioners and pre-engineered cooling modules. These solutions offer improved cooling capabilities and reduced energy consumption, making them an attractive option for data center operators. Another trend is the shift towards specialized infrastructure for specific industries, such as healthcare and finance. These industries require high levels of security and compliance, as well as scalability and flexibility. Cooling solutions that can meet these requirements are in high demand. The cost of cooling is a significant challenge for data center operators in Southeast Asia. High investment costs for cooling equipment and maintenance services can put a strain on budgets.

However, innovative solutions, such as non-raised floor and containment cooling systems, are helping to address this issue. These solutions offer more efficient cooling and lower energy consumption, making them cost-effective In the long run. The pandemic has also had an impact on the market. With the increase in remote work and digital services, there has been a growth in data volumes. This has put pressure on data center operators to ensure their infrastructure can handle the demand. Cooling solutions that can scale quickly and adapt to changing workloads are in high demand. Environmental sustainability is becoming a key consideration for data center operators in Southeast Asia.

Cooling solutions that minimize carbon emissions and adhere to safety measures are becoming increasingly important. Manufacturers are responding to this trend by developing cooling technologies that are more energy-efficient and use renewable energy sources. In summary, the market is experiencing significant growth due to the increasing demand for IT infrastructure and digital services. Cooling solutions that offer energy efficiency, scalability, and flexibility are in high demand. Innovative technologies, such as precision cooling capabilities and pre-engineered cooling modules, are helping to address the challenges of high investment costs and cooling issues. Environmental sustainability is also becoming a key consideration, with cooling solutions that minimize carbon emissions and adhere to safety measures gaining popularity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 563.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Southeast Asia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch