High Performance Computing (HPC) Market Size 2025-2029

The high performance computing (hpc) market size is forecast to increase by USD 23.45 billion, at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing utilization of big data analytics in various industries. Businesses are recognizing the value of processing large datasets to gain insights that can inform strategic decision-making and improve operational efficiency. A key trend driving this growth is the shift towards cloud-based HPC systems, which offer greater flexibility, scalability, and cost savings compared to traditional on-premises solutions. However, the high investments and costs associated with HPC systems remain a challenge for many organizations. These systems require significant resources, including powerful hardware, advanced software, and skilled personnel, to effectively harness their capabilities.

- Additionally, ensuring data security and managing complex workflows are ongoing concerns for companies adopting HPC technologies. To capitalize on the opportunities presented by the HPC market, businesses must carefully consider their strategic objectives, available resources, and the specific challenges of their industry when implementing these technologies. By addressing these challenges and leveraging the power of HPC systems, organizations can gain a competitive edge and unlock new opportunities in data-driven industries.

What will be the Size of the High Performance Computing (HPC) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing demand for processing power and data storage across various sectors. Applications of HPC span from weather forecasting and academic institutions to automotive design and energy research. The need for efficient cooling systems and heat dissipation is paramount as processor cores and memory bandwidth continue to advance. Data centers, a key player in HPC, face the challenge of managing big data and distributed computing, requiring high-speed networking and open source software solutions. In the realm of scientific computing, HPC is essential for climate modeling, material science, and drug discovery. Artificial intelligence (AI) and machine learning are revolutionizing HPC, with deep learning and neural networks requiring massive processing power.

Hybrid cloud solutions offer flexibility and energy efficiency, while edge computing brings processing closer to the data source. Software development and programming frameworks play a crucial role in HPC, with parallel processing and GPU acceleration becoming increasingly popular. Fault tolerance and data security are critical concerns, with operating systems and hardware companies providing solutions. Energy efficiency is a key focus area, with hardware upgrades and server farms optimized for performance and power consumption. The public sector, including government agencies, relies on HPC for research and development, while the private sector leverages it for financial modeling and engineering simulation. Support services and system integration are essential for the successful implementation and optimization of HPC systems.

The ongoing unfolding of market activities and evolving patterns underscore the continuous dynamism of the HPC market.

How is this High Performance Computing (HPC) Industry segmented?

The high performance computing (hpc) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Server

- Storage

- Application

- Services

- Middleware

- Deployment

- On-premises

- Cloud

- End-user

- Enterprises

- Government and military

- Academic/research

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

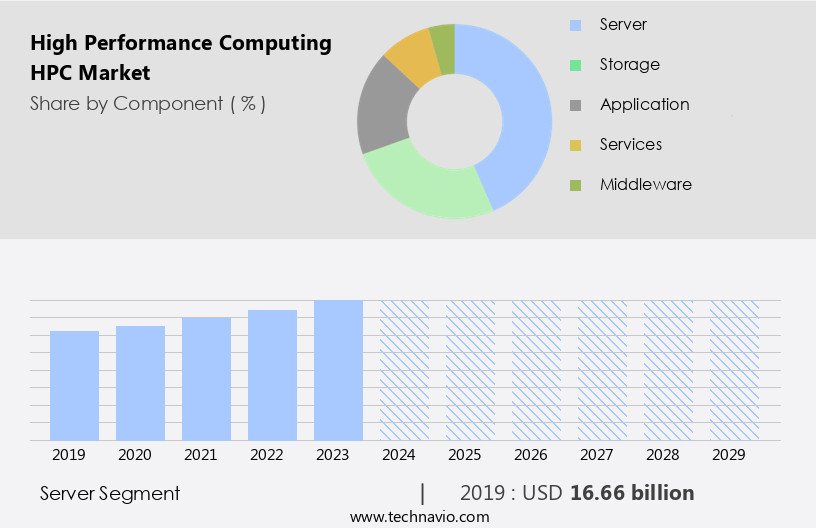

The server segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for advanced computing solutions in various industries and academic institutions. Cooling systems are essential for HPC systems to manage heat dissipation and maintain optimal performance. In data centers, distributed computing and parallel processing are key trends, enabling the handling of big data and complex simulations. Supercomputers, divisional systems, departmental systems, and workgroup systems make up the server segment of the HPC market. Companies are capitalizing on this expansion by selling pre-configured clusters, as cluster-based supercomputing gains popularity in sectors like oil and gas, energy, and manufacturing.

Academic institutions and research centers are also heavily investing in HPC systems for predictive modeling and research in areas such as energy, material science, climate modeling, and artificial intelligence (AI). Drug discovery, financial modeling, and engineering simulation are other significant applications of HPC technology. Cloud computing, hybrid cloud, and edge computing are increasingly being adopted to enhance processing speed and reduce power consumption. Programming frameworks like MPI, OpenMP, and CUDA, along with programming languages like Python, Fortran, and C++, are crucial for parallel processing and GPU acceleration. Operating systems like Linux and Windows, software applications, and proprietary software are essential components of HPC systems.

Fault tolerance, data security, and performance benchmarks are critical factors influencing the market. Energy efficiency and server farms are also key considerations, as HPC systems consume substantial power. Government agencies, automotive design, aerospace engineering, machine learning, and deep learning are among the sectors leveraging HPC technology. Software companies and hardware companies offer support services and system integration to cater to the evolving needs of the market. The future of HPC lies in its ability to address the demands of the public and private sectors, including scientific computing, data analytics, and AI applications.

The Server segment was valued at USD 16.66 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

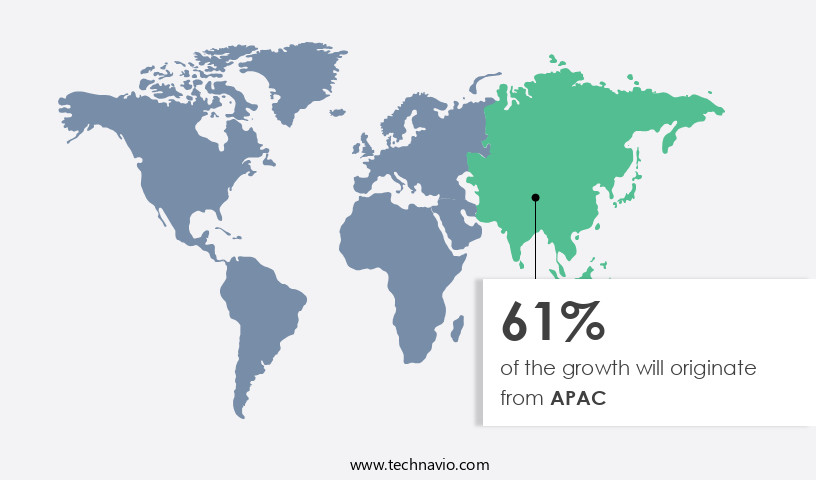

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by technology-focused nations such as China, Japan, and South Korea. China, in particular, has become a major player in HPC, investing heavily in developing advanced systems, including supercomputers, after restrictions on exporting hardware components. The Chinese government's commitment to supercomputing and research extends to various sectors, from life sciences to manufacturing, benefiting local companies. India is another emerging nation making strides in HPC, focusing on applications like weather forecasting and seismic analysis. Japan and Singapore also contribute to the region's HPC market growth, with a focus on energy research, distributed computing, and data centers.

Academic institutions and government agencies are key consumers of HPC technology, while private sector industries, including automotive design, financial modeling, and engineering simulation, are increasingly adopting HPC for processing large data sets and improving performance. The HPC market in APAC is further fueled by advancements in parallel processing, gpu acceleration, and fpga acceleration, as well as the adoption of cloud computing, hybrid cloud, and edge computing. The region's HPC market is also shaped by the development of programming frameworks, operating systems, and software applications, as well as the growing importance of energy efficiency, fault tolerance, and data security.

The market is served by various hardware and software companies, with a focus on delivering high-speed networking, storage capacity, and system integration solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of High Performance Computing (HPC) Industry?

- The significant expansion in the application of big data analytics is the primary catalyst fueling market growth.

- The demand for high-performance computing (HPC) solutions has escalated due to the increasing utilization of big data analytics in various industries. Supercomputers, with their vast storage capacity and high processing speed, are essential for handling data-intensive workloads. The trend of deriving insights from big data in real-time necessitates advanced computing infrastructure. Hardware upgrades, including GPU acceleration and parallel processing, are crucial for enhancing the capabilities of HPC systems. Data visualization tools enable businesses to gain valuable insights from complex data sets. Cloud computing offers flexibility and cost savings, making it an attractive option for many organizations.

- Software applications, such as proprietary software and programming languages designed for HPC, facilitate efficient processing. Fault tolerance is a vital feature, ensuring uninterrupted operations. Operating systems specifically designed for HPC optimize resource utilization and improve performance. Industries like drug discovery and financial modeling in research institutions heavily rely on HPC for their computational needs. Supercomputers enable rapid simulations, complex modeling, and data analysis, driving innovation and competitive advantage. In conclusion, the growth of HPC is fueled by the need for advanced data analytics, real-time insights, and the ability to handle large data volumes.

- The market dynamics include hardware upgrades, data visualization, cloud computing, software applications, and fault tolerance. These factors contribute to the ongoing development and adoption of HPC solutions.

What are the market trends shaping the High Performance Computing (HPC) Industry?

- The increasing adoption of cloud-based High Performance Computing (HPC) systems represents a significant market trend. Cloud-based HPC systems offer numerous benefits, including increased flexibility, scalability, and cost savings, making them an attractive option for organizations seeking to enhance their computational capabilities.

- High Performance Computing (HPC) in the US market is experiencing significant growth due to the increasing demand for advanced computing capabilities across various industries. Cloud-based HPC solutions are gaining popularity as they offer organizations access to on-demand computing resources, eliminating the need for expensive hardware and software infrastructure. Major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, offer a range of HPC services, including high-performance virtual machines and storage solutions. The rising need for computer-intensive workloads in sectors like research, engineering, finance, and climate modeling is driving the adoption of HPC. These industries require large amounts of data processing and analysis, which can be efficiently handled by HPC systems.

- Furthermore, the integration of technologies like high-speed networking, open source software, edge computing, FPGA acceleration, artificial intelligence (AI), and deep learning in HPC solutions is expanding their applications. The public sector, including weather forecasting and material science research, is also leveraging HPC to advance their initiatives. The hybrid cloud model, which combines both private and public cloud resources, is becoming increasingly popular as it offers the benefits of both worlds â the security and control of a private cloud and the flexibility and cost savings of a public cloud. In conclusion, the US HPC market is witnessing a surge in demand due to the availability and affordability of cloud computing services and the increasing need for advanced computing capabilities across various industries.

What challenges does the High Performance Computing (HPC) Industry face during its growth?

- The significant investments and costs linked to High Performance Computing (HPC) systems pose a substantial challenge to the industry's growth trajectory.

- High Performance Computing (HPC) systems, which include supercomputers and server farms, are essential tools for various industries, particularly engineering simulation, scientific computing, and machine learning. However, the significant investments and ongoing operational expenses associated with HPC systems present challenges for their adoption. Energy efficiency is a critical concern, as these systems consume substantial power and require frequent upgrades to maintain processing power, leading to increased energy requirements. The operational costs also include maintenance and hiring technicians. Network infrastructure is another essential factor, as HPC systems require robust and reliable connectivity to ensure optimal performance. Performance benchmarks are crucial in evaluating the effectiveness of HPC systems, with hardware companies continually competing to offer the most powerful and efficient solutions.

- Data security is a significant consideration, with sensitive data requiring protection from cyber threats. Cloud orchestration offers a potential solution, enabling firms to access HPC capabilities on demand while reducing the need for in-house infrastructure. Aerospace engineering, scientific research, and machine learning are just a few industries that benefit from HPC systems' capabilities. Support services and system integration are essential to ensure the successful implementation and operation of HPC systems. As the private sector continues to invest in HPC technologies, the demand for these services is expected to grow. In conclusion, while HPC systems offer numerous benefits, their high costs and energy requirements necessitate careful consideration and planning.

Exclusive Customer Landscape

The high performance computing (hpc) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high performance computing (hpc) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high performance computing (hpc) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - The company delivers high-performance computing (HPC) solutions, powered by AMD EPYC processors, AMD 3D VCache technology, and AMD Instinct MI200 series accelerators. These advanced technologies enable enhanced processing capabilities, accelerating complex workloads and driving innovation. AMD's HPC offerings cater to various industries, including scientific research, engineering, and finance, providing significant improvements in performance and efficiency. By integrating AMD technologies, the company's solutions enable customers to tackle their most demanding computational challenges and achieve breakthrough discoveries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Amazon.com Inc.

- Atos SE

- Cisco Systems Inc.

- Dassault Systemes SE

- Dell Technologies Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Intel Corp.

- International Business Machines Corp.

- Lenovo Group Ltd.

- Microsoft Corp.

- NEC Corp.

- NetApp Inc.

- NVIDIA Corp.

- Oracle Corp.

- Super Micro Computer Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in High Performance Computing (HPC) Market

- In January 2024, IBM announced the launch of its new Power10 processor, designed specifically for High Performance Computing (HPC) applications, promising a 50% improvement in performance per watt compared to its predecessor (IBM Press Release). In March 2024, NVIDIA and Google Cloud formed a strategic partnership to provide on-demand access to NVIDIA's HPC and AI technologies on Google Cloud Platform, enabling researchers and developers to run large-scale simulations and machine learning workloads (NVIDIA Press Release).

- In April 2024, Hewlett Packard Enterprise (HPE) and Microsoft collaborated to offer HPE Cray EX supercomputers with Microsoft Azure Stack HCI, allowing organizations to run HPC workloads both on-premises and in the cloud (HPE Press Release). In May 2025, Lenovo revealed its acquisition of the HPC business unit of Atos, significantly expanding Lenovo's presence in the European HPC market and adding over 2,000 HPC customers to its portfolio (Lenovo Press Release).

Research Analyst Overview

- The market continues to evolve, integrating advanced technologies to enhance IT infrastructure capabilities. Solid-state drives (SSDs) and cache memory are revolutionizing data access, providing faster processing times and improved system responsiveness. High availability (HA) solutions ensure uninterrupted operations, while data encryption safeguards sensitive information. Network security and system monitoring are essential components, mitigating cyber threats and optimizing performance. Regulatory compliance, data governance, and data compliance are critical for businesses operating in regulated industries. Quantum computing and neuromorphic computing are emerging trends, offering exponential processing power and machine learning capabilities. Industry standards, best practices, and capacity planning are crucial for ensuring business continuity and disaster recovery.

- Virtual memory and performance monitoring enable efficient resource utilization, while data backup and data recovery solutions protect against data loss. Tape storage remains a cost-effective option for long-term data retention. As HPC systems become more complex, prioritizing regulatory compliance, security, and performance monitoring is essential. Adhering to industry standards and implementing data governance best practices are key to managing the risks and challenges associated with HPC environments.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled High Performance Computing (HPC) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 23.45 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High Performance Computing (HPC) Market Research and Growth Report?

- CAGR of the High Performance Computing (HPC) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high performance computing (hpc) market growth of industry companies

We can help! Our analysts can customize this high performance computing (hpc) market research report to meet your requirements.