Data Center UPS Market Size 2025-2029

The data center UPS market size is forecast to increase by USD 7.47 billion at a CAGR of 12.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of modular UPS systems and the use of lithium ion UPS batteries. Modular UPS systems offer scalability and flexibility, making them an attractive option for data centers seeking to accommodate expanding power requirements. Meanwhile, lithium-ion UPS batteries provide longer runtime and faster recharge times compared to traditional lead-acid batteries, enhancing data center resilience and reliability. However, the market is not without challenges. UPS battery failure remains a persistent issue, with aging batteries posing a significant risk to data center operations. As such, data center operators must prioritize regular maintenance and replacement of batteries to mitigate potential downtime and associated costs. Additionally, the increasing complexity of data center infrastructure and the need for energy efficiency continue to shape the strategic landscape of the market. Companies seeking to capitalize on these opportunities must stay abreast of emerging trends and invest in innovative solutions to meet evolving power management requirements.

What will be the Size of the Market during the forecast period?

- The market plays a crucial role in ensuring uninterrupted power supply for data centers, mitigating the risks and costs associated with power interruptions. With the digital age's continued expansion and the increasing adoption of edge computing, data center reliability has become a paramount concern for critical facility customers. As remote working culture gains traction and cloud infrastructure becomes more prevalent, the demand for backup power solutions has increased. Power usage and operating costs, coupled with the need for carbon footprint reduction, have driven the market's growth. UPS systems provide essential power backup during power outages, ensuring business continuity and minimizing downtime.

- Remote monitoring and control solutions enable real-time management and maintenance, further enhancing the market's appeal. The evolving economies and increasing IT spending worldwide have contributed to the market's expansion. UPS systems are integral to maintaining the integrity of digital infrastructure, making them indispensable in today's interconnected world. The UPS market is poised for continued growth as businesses prioritize uninterrupted power and data center reliability.

How is this Data Center UPS Industry segmented?

The data center ups industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Centralized UPS

- Zone UPS

- Rack-mount UPS

- Application

- Tier 3 data center

- Tier 1 and 2 data center

- Tier 4 data center

- Battery Type

- VRLA batteries

- Lithium-ion batteries

- Other batteries

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

The centralized UPS segment is estimated to witness significant growth during the forecast period. Data centers require uninterrupted power supply to ensure the reliability of critical digital infrastructure, particularly in the context of increasing power interruptions and the remote working culture. Centralized UPS systems, capable of powering entire data center floor spaces with a capacity exceeding 1,000 kVA, remain popular for larger facilities. However, these systems come with the disadvantage of extensive cabling to every rack and IT load. To address this issue, modular UPS systems and independent power modules have gained traction, offering enhanced efficiency, improved reliability, and energy-saving modes. Edge computing and cloud infrastructure have further complicated power requirements, necessitating scalability solutions and backup energy.

Get a glance at the market report of share of various segments Request Free Sample

The centralized UPS segment was valued at USD 3.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is primarily driven by the US, which accounts for approximately 80% of the revenue in the region. The construction of new data centers is on the rise in this country, with significant contributions coming from communication service providers (CSPs) and colocation providers. The increasing demand for data centers and servers is the primary reason for the market growth. For instance, Schneider Electric, JLL, and Lumen Technologies collaborated in October 2023 to offer modular data centers to clients across the US. Power interruptions and utility outages pose a significant challenge to data center reliability, necessitating the adoption of uninterrupted power supply (UPS) systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Data Center UPS Industry?

- Increase in adoption of modular UPS systems is the key driver of the market. The markets encompass a range of systems, including centralized, zone, and rack-mount UPS solutions. Centralized UPS systems offer larger capacities, while rack-mount UPS systems are modular and come in lower capacities, such as 20 kVA. These modular systems are increasingly adopted due to concerns over power fluctuations and outages.

- The modular approach offers flexibility to scale capacity as needed and reduces maintenance costs. Data center operators can initially size their UPS systems and then expand as their IT load grows. This approach is particularly beneficial for enterprises seeking to optimize their power management and mitigate potential downtime.

What are the market trends shaping the Data Center UPS Industry?

- Use of lithium-ion UPS systems is the upcoming market trend. Data centers rely on Uninterruptible Power Supply (UPS) systems to ensure uninterrupted power delivery and prevent downtime during power outages. The most common type of batteries used in UPS systems is Valve-Regulated Lead-Acid (VRLA), also known as sealed lead-acid batteries.

- These batteries are preferred due to their reliability and cost-effectiveness. However, their maintenance is a significant challenge for data center operators, as they require regular monitoring and replacement every three to five years. An alternative to lead-acid batteries is flywheel-based UPS systems. While these systems offer advantages such as a smaller footprint and lower environmental impact, they have a lower backup time compared to lead-acid batteries.

What challenges does the Data Center UPS Industry face during its growth?

- UPS battery failure is a key challenge affecting the industry growth. Data centers face significant challenges with UPS battery failures, accounting for approximately 55% of downtime incidents. Power fluctuations are common, making utility power supply a reliance for operators. Most power outages last only a few seconds, but the consequences can be severe.

- A single hour of downtime can cost data center operators up to USD 500,000. In a notable instance, Salesforce experienced a global outage in November 2024, affecting users across five data centers. Proper UPS battery maintenance is essential, especially during prolonged power outages, to minimize downtime and associated financial losses.

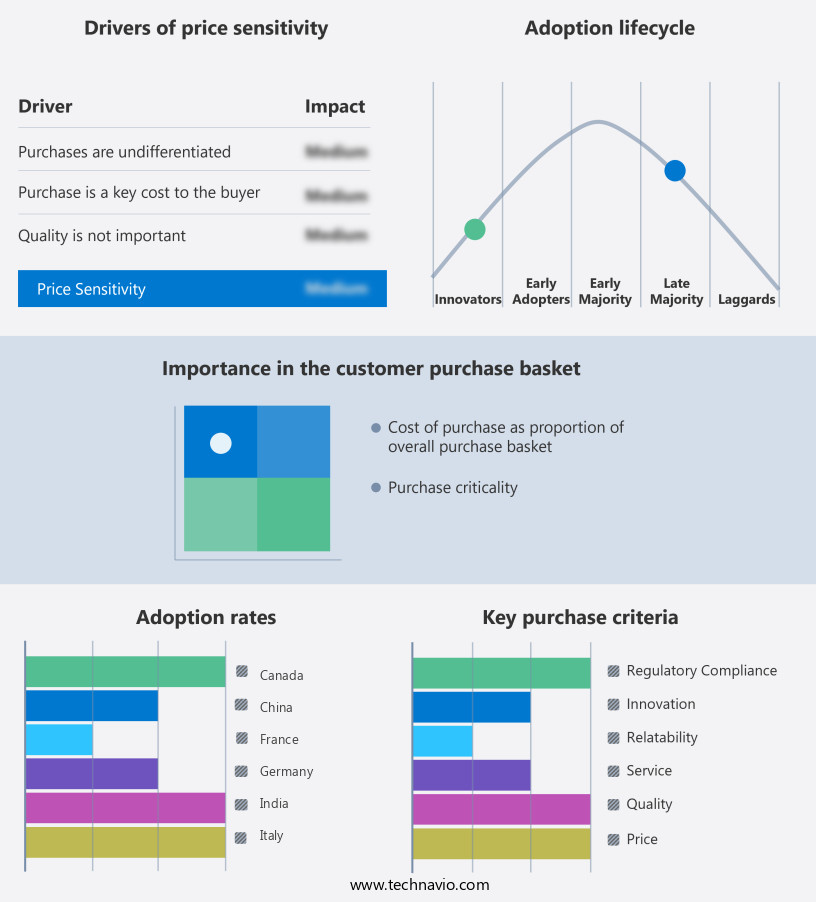

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. The company offers data center UPS such as MV UPS, Relays and modular UPS.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Centiel Global

- Cyber Power Systems Inc.

- Delta Electronics Inc.

- Eaton Corp. plc

- Enconnex LLC

- EverExceed Corp.

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- HITEC Power Protection BV

- Kohler Co.

- Legrand SA

- Mitsubishi Electric Corp.

- RPS Spa

- Schneider Electric SE

- SolarEdge Technologies Inc.

- Toshiba Corp.

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The data center industry continues to experience significant growth as businesses increasingly rely on digital infrastructure to support their operations. However, ensuring the reliability and uninterrupted power supply of these facilities remains a critical challenge. Power interruptions, whether caused by utility outages or other factors, can lead to costly downtime and negatively impact business continuity. Edge computing, a decentralized approach to data processing, has emerged as a potential solution to mitigate the risks associated with power interruptions. By bringing data processing closer to the source, edge computing can reduce the need for large, centralized data centers and the associated power requirements.

In addition, the importance of uninterrupted power supply in data centers is further prioritized by the remote working culture that has become prevalent in the wake of the global health crisis. With more employees working from home, the need for reliable and efficient data center infrastructure has become even more critical. Independent power modules and other energy-saving modes are becoming increasingly popular in data center facilities to enhance efficiency and improve reliability. These solutions allow data centers to continue operating during power fluctuations and utility outages, minimizing downtime and reducing operating costs. The power infrastructure of data centers is a significant financial challenge for both large enterprises and smaller businesses.

Furthermore, high initial costs and ongoing energy usage make power infrastructure a significant expense. However, the widespread adoption of cloud infrastructure and cloud computing services has led to more eco-friendly and sustainable power solutions becoming available. The power electronics industry has responded to these evolving industry needs with a range of innovative products and solutions. Industrial UPS systems, Stallion battery chargers, and Socomec India's sustainable power solutions are just a few examples of the advanced technology available to critical facility customers. Backup power and remote management solutions are essential components of any reliable power infrastructure. Remote monitoring and control solutions enable data center operators to quickly identify and address power issues before they lead to downtime.

Moreover, the resilient power systems market is expected to continue growing as the digital economy expands and the demand for uninterrupted power supply increases. However, the financial challenge of implementing these solutions remains a barrier for some organizations. The power usage and carbon footprint of data centers are also becoming increasingly important considerations. Scalability solutions and AI and ML optimization are being adopted to improve energy efficiency and reduce the environmental impact of data centers. Independent power modules, energy-saving modes, and eco-friendly solutions are just a few of the innovations driving the market forward. The power electronics industry is responding to these challenges with advanced products and solutions that enable data centers to operate reliably and sustainably.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.8% |

|

Market growth 2025-2029 |

USD 7.47 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.5 |

|

Key countries |

US, China, Germany, Canada, UK, France, Japan, The Netherlands, India, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Data Center UPS industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.