Debt Settlement Market Size 2024-2028

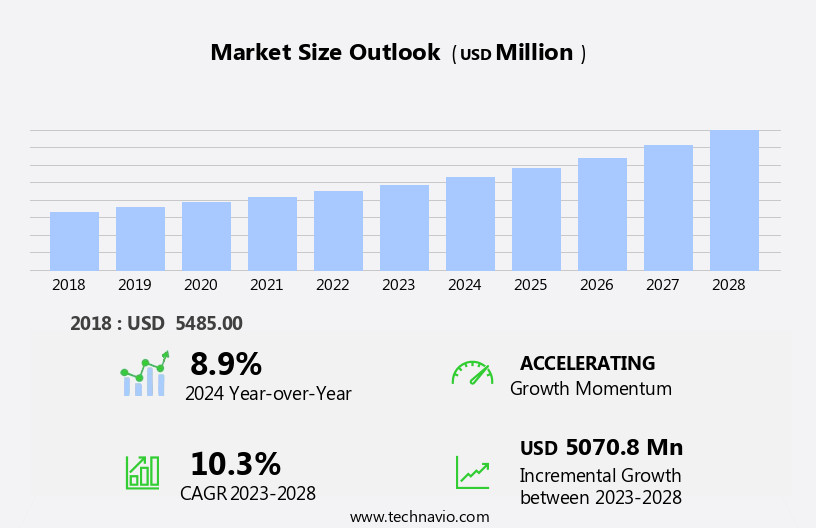

The debt settlement market size is forecast to increase by USD 5.07 billion at a CAGR of 10.3% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing trend of consumers seeking relief from mounting credit card debts. One-time debt settlement has gained popularity as an effective solution for individuals looking to reduce their outstanding debt balances. However, the time-consuming nature of negotiations between debtors and creditors poses a challenge for market expansion. Despite this, the market's strategic landscape remains favorable for companies offering debt settlement services. Key drivers include the rising number of consumers struggling with debt, increasing awareness of debt settlement as a viable debt relief option, and the growing preference for affordable and flexible debt repayment plans.

- Companies seeking to capitalize on market opportunities should focus on streamlining the negotiation process, leveraging technology to enhance customer experience, and building trust and transparency with clients. Effective operational planning and strategic partnerships with creditors can also help companies navigate the challenges of a competitive and complex market.

What will be the Size of the Debt Settlement Market during the forecast period?

- The market encompasses a range of companies offering financial wellness programs to help consumers manage and reduce their debt. These programs include medical Debt collection, consumer debt relief, and financial education resources. Online financial resources and debt management software are increasingly popular, providing consumers with affordable debt solutions and debt negotiation strategies. However, it's crucial for consumers to be aware of debt settlement scams and their settlement success rates. Debt consolidation loans and financial planning tools are also viable options for responsible debt management. Furthermore, financial literacy education and workshops are essential for consumers to understand debt reduction calculators and credit reporting errors.

- Consumer financial protection agencies offer financial counseling services and financial planning advice to promote financial wellness strategies and responsible borrowing. Student loan forgiveness programs are also gaining traction in the market. Overall, the market for debt settlement and financial wellness solutions continues to evolve, with a focus on providing accessible and effective debt relief options for consumers.

How is this Debt Settlement Industry segmented?

The debt settlement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Credit card debt

- Student loan debt

- Medical debt

- Auto loan debt

- Unsecured personal loan debt

- Others

- End-user

- Individual

- Enterprise

- Government

- Distribution Channel

- Online

- Offline

- Hybrid

- Service Type

- Debt Settlement

- Debt Consolidation

- Debt Management Plans

- Credit Counseling

- Provider Type

- For-profit Debt Settlement Companies

- Non-profit Credit Counseling Agencies

- Law Firms

- Financial Institutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Rest of World (ROW)

- North America

By Type Insights

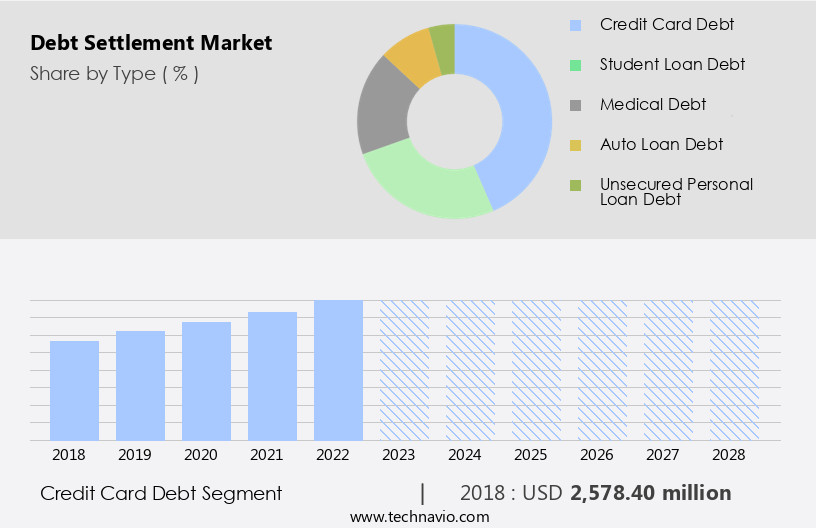

The credit card debt segment is estimated to witness significant growth during the forecast period.

The market experiences significant activity due to the escalating credit card debt among consumers. In India, for instance, the rising financial hardships faced by borrowers are evident in the increasing credit card defaults. The latest data indicates that credit card defaults in India reached 1.8% in June 2024, a notable increase from 1.7% six months prior and 1.6% in March 2023. This trend underscores the mounting financial pressures on consumers. The outstanding credit card debt in India mirrors this trend, with approximately USD3.25 billion in outstanding balances as of June 2024, a slight increase from the previous year.

Debt elimination and negotiation strategies, such as debt relief programs and debt consolidation, have become increasingly popular among consumers seeking financial relief. Credit reporting agencies play a crucial role in this process, as they maintain and report consumers' credit histories to lenders. Student loan debt, medical debt, tax debt, and payday loans are other significant contributors to the market. Consumers often turn to debt validation, credit repair, and financial coaching for guidance in managing their debts. Online platforms, mobile apps, and budgeting tools have become essential resources for consumers seeking to improve their financial literacy and stability. Collection agencies and debt collectors employ various tactics, including artificial intelligence and legal representation, to recover outstanding debts.

Consumer advocacy groups and credit counseling organizations offer valuable resources and support services for individuals navigating the complex debt settlement process. Compliance regulations, consumer protection laws, and credit monitoring services ensure that debt settlement practices remain transparent and fair for all parties involved. As consumers continue to grapple with mounting debts, the demand for debt settlement services is expected to grow. Financial education programs and credit score improvement strategies will become increasingly important tools for consumers seeking financial freedom and stability. personal loans, creditor communication, credit bureau disputes, and bankruptcy alternatives are among the various debt reduction strategies available to consumers.

Identity theft protection and consumer empowerment are essential components of the debt settlement landscape, as consumers seek to safeguard their financial information and assert their rights.

Get a glance at the market report of share of various segments Request Free Sample

The Credit card debt segment was valued at USD 2.58 billion in 2018 and showed a gradual increase during the forecast period.

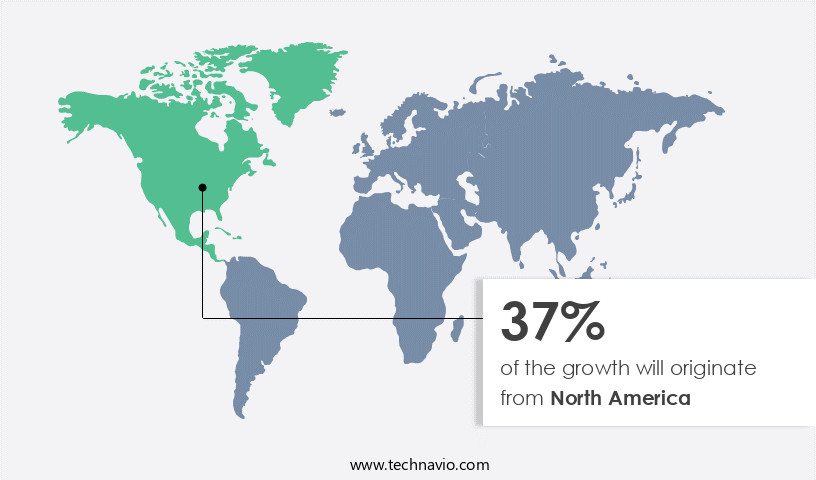

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is marked by substantial activity and strategic financial maneuvers. Deveron Corp., a prominent agriculture services and data company, recently demonstrated this trend by settling USD701,050 of its debt through the issuance of 6,146,341 common shares at a price of USD0.11406 per share in June 2024. This transaction adheres to applicable securities legislation, with the issued shares subject to a statutory hold period of four months plus one day. This debt settlement strategy using equity issuance is prevalent among North American companies. Other financial literacy initiatives, such as debt elimination, debt negotiation, and debt relief programs, are also integral components of the market.

Credit card debt, payday loans, student loan debt, medical debt, tax debt, and financial hardship are common reasons for seeking debt settlement. Collection agencies, credit reporting agencies, credit counseling, and consumer advocacy organizations play crucial roles in this landscape. Debt validation, credit score improvement, debt management plans, and legal representation are essential services for consumers navigating the debt settlement process. Compliance regulations, consumer protection laws, and credit monitoring ensure fair practices in the market. Additionally, technological advancements, including artificial intelligence and online platforms, streamline the debt settlement process. Companies offering debt consolidation, budgeting tools, mobile apps, and foreclosure prevention services also contribute to the market's evolution.

Overall, the market in North America remains dynamic, with various stakeholders collaborating to provide effective debt reduction strategies for consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Debt Settlement Industry?

- Increasing credit card debts is the key driver of the market.

- The market is experiencing notable growth due to the increasing trend of consumers relying on credit cards. In the US, the number of consumers applying for credit card limit extensions has risen, with 29% reporting applications in October 2023, compared to 27.1% in October 2022. This trend is reflected in other regions as well. For instance, in India, the number of outstanding credit cards reached 97.9 million in December 2023, with a record 1.6 million new cards issued that month.

- These statistics from the Reserve Bank of India underscore the significant increase in credit card usage. The availability and accessibility of credit cards, coupled with the convenience they offer, have led to a rise in consumer spending and subsequently, an increase in debt. As debt levels continue to climb, the demand for debt settlement services is expected to grow.

What are the market trends shaping the Debt Settlement Industry?

- Popularity of one-time debt settlement is the upcoming market trend.

- The market is experiencing a significant shift towards one-time debt settlements (OTS) as an effective solution for resolving outstanding debts. This trend is gaining momentum among various entities, including public and private organizations, due to the demand for efficient and conclusive debt resolution mechanisms. A recent development in this regard is the Maharashtra cabinet's directive instructing the Mumbai Metropolitan Region Development Authority (MMRDA) to pursue an OTS for the debt owed by Mumbai Metro One Pvt. Ltd. (MMOPL). Following a meeting in Mumbai on June 26, 2024, MMOPL finalized an agreement with its lenders for debt settlement in March 2024.

- This trend signifies the increasing preference for OTS as a viable option for debt resolution in the market.

What challenges does the Debt Settlement Industry face during its growth?

- Time-consuming nature of negotiations is a key challenge affecting the industry growth.

- The market encounters notable complexities, primarily due to the intricate negotiation process. For instance, the prolonged discussions between McLeod Russel India Ltd and Carbon Resources, initiated in July 2024, underscore the time-consuming nature of debt settlements. These negotiations, aimed at reaching a one-time settlement for McLeod Russel's debt with its lenders, reveal the intricacies and extensive duration involved in debt settlements. The intricacies of debt settlement negotiations stem from the necessity of comprehensive financial evaluations and the establishment of mutually acceptable terms. These processes require extensive time and resources, as all parties involved must carefully assess their financial positions and address any outstanding issues.

- This complexity is a significant challenge for the market, necessitating a professional and meticulous approach.

Exclusive Customer Landscape

The debt settlement market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the debt settlement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, debt settlement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Americor Funding LLC - The company specializes in negotiating debt settlements for clients seeking resolution on unsecured debts, including credit card balances. Through strategic negotiations, we help individuals reduce their outstanding debt obligations and work towards financial recovery. Our approach prioritizes communication and transparency, ensuring clients are well-informed throughout the process. By leveraging industry expertise and a client-focused approach, we aim to provide effective debt relief solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Americor Funding LLC

- Beyond Finance LLC

- Century Support Services LLC

- City Credit Management LLP

- ClearOne Advantage LLC

- CreditAssociates LLC

- CuraDebt Systems LLC.

- DMB FINANCIAL LLC

- Enterslice Inc.

- Freedom Debt Relief LLC

- Liberty Debt Relief LLC

- Lifeline Debt Relief Inc

- Loansettlement

- National Debt Relief LLC

- New Era Debt Solutions

- Oak View Law Group LLC

- Pacific Debt Inc

- Premier Debt Services LLC

- Rescue One Financial

- The JG Wentworth Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve as consumers seek effective solutions for managing and eliminating various types of debt. Debt elimination strategies, such as debt negotiation and debt consolidation, have gained popularity as individuals strive for financial freedom. Credit card debt, payday loans, student loan debt, tax debt, and medical debt are among the most common forms of debt that individuals face. One critical aspect of debt management is understanding the debt-to-income ratio. This metric helps assess an individual's ability to meet their financial obligations. Debt relief programs, debt management plans, and credit counseling are some of the strategies employed to improve this ratio and reduce overall debt.

Credit reporting agencies play a crucial role in the market. They maintain and update credit information, which can significantly impact an individual's ability to secure loans or credit. Consumer advocacy organizations and financial planning resources offer valuable guidance on credit reporting and credit score improvement. Consumer education and financial literacy initiatives are essential in helping individuals make informed decisions about debt elimination strategies. Financial coaching, budgeting tools, and mobile apps are increasingly popular resources for managing personal finances. Online platforms and artificial intelligence have revolutionized the debt settlement industry, offering more accessible and efficient services. Debt validation, debt collectors, and collection agencies are integral components of the debt settlement process.

Effective communication with creditors and adherence to legal compliance regulations are essential for successful debt settlement negotiations. Legal representation and credit bureau disputes may also be necessary in certain situations. Consumer protection laws and compliance regulations govern the debt settlement industry. Credit monitoring and identity theft protection are essential services that help individuals safeguard their financial information. Bankruptcy alternatives, such as payment plans and settlement agreements, offer viable options for individuals facing significant debt. Financial hardship and financial stability are key considerations in the market. Consumer empowerment and financial wellness are essential for long-term financial success.

Credit score improvement, credit repair, and credit monitoring are essential components of any effective debt elimination strategy. Settlement offers, legal fees, and settlement fees are important factors to consider when evaluating debt settlement services. Effective customer service and creditor communication are crucial for successful debt settlement negotiations. Compliance with consumer education requirements and financial literacy initiatives is essential for maintaining trust and transparency in the market. The market is a dynamic and evolving industry. Effective debt elimination strategies, consumer education, and financial literacy initiatives are essential for individuals seeking to improve their financial situation.

Credit reporting agencies, debt relief programs, and debt management plans are among the most popular solutions for managing various types of debt. Effective communication with creditors, legal compliance, and consumer protection are essential for successful debt settlement negotiations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.3% |

|

Market growth 2024-2028 |

USD 5070.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.9 |

|

Key countries |

US, China, UK, Japan, Germany, Canada, India, France, Italy, South Korea, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Debt Settlement Market Research and Growth Report?

- CAGR of the Debt Settlement industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the debt settlement market growth of industry companies

We can help! Our analysts can customize this debt settlement market research report to meet your requirements.