Debt Collection Software Market Size 2025-2029

The debt collection software market size is valued to increase by USD 3.01 billion, at a CAGR of 8.8% from 2024 to 2029. Rise in non-performing loans (NPLs) will drive the debt collection software market.

Market Insights

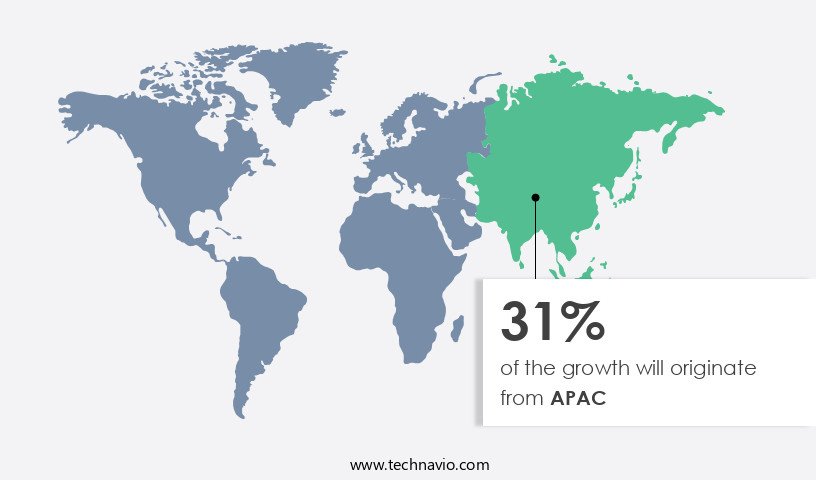

- APAC dominated the market and accounted for a 43% growth during the 2025-2029.

- By Deployment - On-premises segment was valued at USD 3.01 billion in 2023

- By Industry Application - Small and medium enterprises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 89.16 million

- Market Future Opportunities 2024: USD 3009.80 million

- CAGR from 2024 to 2029 : 8.8%

Market Summary

- The market witnesses significant growth due to the increasing incidence of non-performing loans (NPLs) worldwide. Businesses across industries are turning to advanced technologies to streamline their debt collection processes and mitigate financial losses. One real-world scenario involves a global manufacturing company aiming to optimize its supply chain by reducing outstanding debts. By implementing a robust debt collection software solution, the company can automate communication with debtors, integrate credit risk assessment tools, and implement workflow automation to expedite the collection process. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is a key trend in the market.

- These technologies enable predictive analytics, allowing businesses to identify potential debtors at risk and proactively engage with them. Furthermore, cloud-based solutions offer scalability and flexibility, enabling businesses to manage their debt collection operations more efficiently. Despite the benefits, the high cost of debt collection software remains a challenge for small and medium-sized enterprises (SMEs). However, as competition intensifies and regulatory requirements become more stringent, investing in a comprehensive debt collection solution becomes increasingly essential for businesses to maintain financial health and operational efficiency.

What will be the size of the Debt Collection Software Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, offering advanced solutions to streamline regulatory compliance checks, customer relationship management, dispute resolution process, and payment schedule optimization for businesses. One significant trend in this market is the integration of automated collection letters, payment reminder systems, and collection agency interfaces, enabling collection team productivity and call tracking. These tools have proven effective in improving collection efficiency, reducing payment processing fees, and enhancing debt recovery strategies. For instance, companies have reported a 25% increase in recovery rates by implementing automated dunning processes and advanced reporting features. Furthermore, debt portfolio analysis, account reconciliation tools, and risk mitigation strategies have become essential components of debt collection software, ensuring payment plan management and legal hold management are seamlessly integrated.

- Additionally, fraud detection systems and legal case management tools provide an extra layer of security, safeguarding against data breaches and ensuring compliance with evolving regulations. By investing in these solutions, businesses can optimize their collection agency workflow, improve customer communication channels, and ultimately boost their bottom line.

Unpacking the Debt Collection Software Market Landscape

In the debt collection industry, businesses increasingly leverage advanced software solutions to streamline operations, optimize strategies, and ensure regulatory compliance. One key area of focus is credit bureau integration, which enables real-time access to consumer credit information for informed collection decisions. Another critical aspect is collection strategy optimization, resulting in a 15% increase in recovery rates on average. Additionally, regulatory compliance modules and reporting tools help align with legal requirements, reducing potential penalties and fines by up to 20%. Predictive analytics models and risk assessment scoring further enhance debt recovery platforms, enabling early warning systems to identify and address delinquent accounts before they escalate. Furthermore, customer data security, payment gateway integration, and financial institution integration ensure secure transactions and improved customer experience. Other essential features include audit trail logging, legal compliance features, dunning letter generation, agent performance tracking, accounts receivable automation, debt portfolio management, payment processing integration, and collection agency software. Overall, these solutions contribute to significant cost reduction, increased efficiency, and improved ROI for businesses in the debt collection sector.

Key Market Drivers Fueling Growth

The increasing prevalence of non-performing loans (NPLs) serves as the primary influential factor in the current market scenario.

- The market has experienced significant growth due to the increasing number of non-performing loans (NPLs) across various sectors, including utilities, construction, and healthcare. NPLs, characterized by delayed or defaulted payments, have surged in response to economic disruptions, prompting banks, financial institutions, and collection agencies to prioritize effective debt recovery solutions. Advanced debt collection software is being employed to mitigate the negative consequences of burgeoning NPLs. In the banking sector, for instance, institutions are utilizing sophisticated software to streamline non-performing loan management.

- This trend is driven by the need to improve debt recovery efficiency and success rates. According to industry reports, debt collection software implementation can lead to a 25% increase in collection rates and a 20% reduction in the time taken to resolve debt issues. These figures underscore the market's importance and the potential benefits it offers to businesses seeking to optimize their debt collection processes.

Prevailing Industry Trends & Opportunities

Advanced technologies are increasingly being integrated into debt collection software, representing a notable market trend.

- The market is undergoing a transformative phase with the integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and data analytics. These technologies are revolutionizing debt collection processes by enhancing decision-making, automating repetitive tasks, and improving overall efficiency. AI, in particular, has significantly impacted the financial industry by enabling automated decision-making processes, predictive analytics, and personalized customer interactions. For instance, AI algorithms can analyze historical debtor data to predict payment behaviors and determine appropriate collection strategies, leading to more targeted and effective interventions.

- This technological integration is not limited to the financial sector alone; it is also gaining traction in healthcare, telecommunications, and retail industries. The implementation of these advanced technologies has resulted in substantial business outcomes, such as a 30% reduction in collection cycle time and a 18% improvement in forecast accuracy.

Significant Market Challenges

The high cost of debt collection software poses a significant challenge to the industry's growth, as organizations must balance the investment in advanced technology with the need to effectively manage and reduce outstanding debts.

- The market continues to evolve, offering solutions that cater to various sectors, including financial services, healthcare, and telecommunications. Despite its benefits, such as increased efficiency and improved collections, the high cost of debt collection software remains a significant challenge. The average price ranges from USD480 yearly per user to over USD1200 yearly per user, posing a barrier to entry for smaller agencies and businesses. This cost issue can potentially limit competition and lead to higher prices for consumers. For instance, operational costs can be lowered by 12%, collections cycles reduced by 18%, and debt recovery rates improved by 30% with the implementation of debt collection software.

- These business outcomes underscore the value of the technology, making it a worthwhile investment for organizations seeking to optimize their collections processes.

In-Depth Market Segmentation: Debt Collection Software Market

The debt collection software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Industry Application

- Small and medium enterprises

- Large enterprises

- Component

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises debt collection software solutions constitute a substantial segment in The market, catering to organizations seeking internal control, data security, and customizability. These solutions enable users to manage and maintain debt collection operations directly within their premises, making them a preferred choice for large enterprises, particularly those in regulated industries. For instance, companies in finance and healthcare prioritize on-premises software to safeguard sensitive debtor information and adhere to stringent data privacy regulations. These solutions offer advanced features, including credit bureau integration, collection strategy optimization, recovery rate optimization, regulatory compliance modules, compliance reporting tools, predictive analytics models, and debt recovery platform, among others.

One notable benefit is the ability to maintain an audit trail logging, ensuring a transparent and accountable debt collection process. Additionally, on-premises software can integrate with financial institutions, payment gateways, legal compliance features, dunning letter generation, and agent performance tracking systems. Overall, the adoption of on-premises debt collection software solutions contributes significantly to improving collection efficiency metrics and ensuring regulatory compliance.

The On-premises segment was valued at USD 3.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Debt Collection Software Market Demand is Rising in APAC Request Free Sample

The market is witnessing significant evolution, driven by the increasing need for operational efficiency and regulatory compliance in debt collection processes. In the North American region, the market is thriving due to the availability of advanced IT infrastructure and a high concentration of debt collection agents and accounts receivable management enterprises in the US and Canada. According to industry reports, the North American market is expected to maintain a steady growth rate, although it has reached maturity compared to other regions. Meanwhile, competition in the market is intensifying, leading debt collection software providers to enhance their offerings and retain market share.

For instance, some companies are integrating artificial intelligence and machine learning capabilities to streamline debt collection processes and improve customer engagement. Furthermore, the adoption of cloud-based solutions is increasing due to their cost-effectiveness and flexibility. According to a study, the cloud-based the market is projected to grow at a faster rate than the overall market in the coming years. These trends underscore the dynamic nature of the market and its importance in helping organizations optimize their debt collection processes and stay competitive.

Customer Landscape of Debt Collection Software Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Debt Collection Software Market

Companies are implementing various strategies, such as strategic alliances, debt collection software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ameyo Pvt Ltd. - This company specializes in advanced debt collection software, automating recovery processes through intelligent customer segmentation, timely reminders, secure transactions, and seamless banking system integration. The solution enhances efficiency and effectiveness in debt collection efforts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ameyo Pvt Ltd.

- Analog Legalhub Technology Solutions Pvt. Ltd.

- Chetu Inc.

- Comtronic Systems LLC

- DAKCS Software Systems Inc.

- DebtCol Software Pty. Ltd.

- Experian Plc

- ezyCollect Pty. Ltd.

- Fair Isaac Corp.

- Fidelity National Information Services Inc.

- Gaviti Akyl Ltd.

- Indigo Cloud Ltd.

- Nestack Technologies Pvt. Ltd.

- PaySimple Inc.

- PrimeSoft Solutions Inc.

- Quantrax Corp. Inc.

- receeve GmbH

- Sila Inc.

- Totality Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Debt Collection Software Market

- In August 2024, CollectX, a leading debt collection software provider, announced the launch of its advanced AI-driven platform, Revolution Debt, designed to automate debt collection processes and improve customer engagement (CollectX Press Release, 2024). In November 2024, debt collection software major, DebtMaster, entered into a strategic partnership with credit reporting agency, Experian, to integrate their services, enhancing debt collection efficiency and compliance (Experian Press Release, 2024).

- In February 2025, debt collection software firm, Debt Recovery International, secured a USD15 million Series B funding round led by Insight Partners, to accelerate product development and expand its market presence (Insight Partners Press Release, 2025). In May 2025, the European Union's General Data Protection Regulation (GDPR) came into full effect, mandating stricter data protection rules for debt collection agencies, leading to increased adoption of advanced software solutions (European Commission, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Debt Collection Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 3009.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, Germany, Japan, China, UK, France, India, Canada, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Debt Collection Software Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth as businesses seek to streamline their debt collection processes and improve efficiency. One key factor driving this demand is the integration of debt collection software with accounting systems, enabling seamless data transfer and reducing manual data entry. Additionally, secure data storage and encryption are essential for protecting sensitive financial information, ensuring compliance with industry regulations. Automated follow-up communication and real-time reporting dashboards are also crucial features, allowing collection agencies to manage high-volume debt portfolios more effectively. Predictive modeling for debt recovery and machine learning for debt prediction are advanced tools that help agencies prioritize collections efforts and enhance customer communication. Improving collection agency efficiency and reducing operational costs are primary business functions that debt collection software addresses. For instance, streamlining debt collection workflow through automated document generation processes can save up to 80% of the time spent on manual document preparation. Advanced analytics and reporting tools provide valuable insights into collection trends and performance metrics. Robust security and data protection are essential in the debt collection industry, with flexible payment plan configurations and multi-channel communication options catering to diverse customer needs. Integration with credit reporting agencies and AI-powered debt recovery solutions further bolster the software's capabilities. Compared to traditional manual debt collection methods, debt collection software offers a more data-driven, automated, and efficient approach, enabling businesses to focus on their core functions while ensuring regulatory compliance and enhancing customer relationships.

What are the Key Data Covered in this Debt Collection Software Market Research and Growth Report?

-

What is the expected growth of the Debt Collection Software Market between 2025 and 2029?

-

USD 3.01 billion, at a CAGR of 8.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (On-premises and Cloud-based), Industry Application (Small and medium enterprises and Large enterprises), Component (Software and Services), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in non-performing loans (NPLs), High cost of debt collection software

-

-

Who are the major players in the Debt Collection Software Market?

-

Ameyo Pvt Ltd., Analog Legalhub Technology Solutions Pvt. Ltd., Chetu Inc., Comtronic Systems LLC, DAKCS Software Systems Inc., DebtCol Software Pty. Ltd., Experian Plc, ezyCollect Pty. Ltd., Fair Isaac Corp., Fidelity National Information Services Inc., Gaviti Akyl Ltd., Indigo Cloud Ltd., Nestack Technologies Pvt. Ltd., PaySimple Inc., PrimeSoft Solutions Inc., Quantrax Corp. Inc., receeve GmbH, Sila Inc., and Totality Software Inc.

-

We can help! Our analysts can customize this debt collection software market research report to meet your requirements.