Defense Logistics Market Size 2025-2029

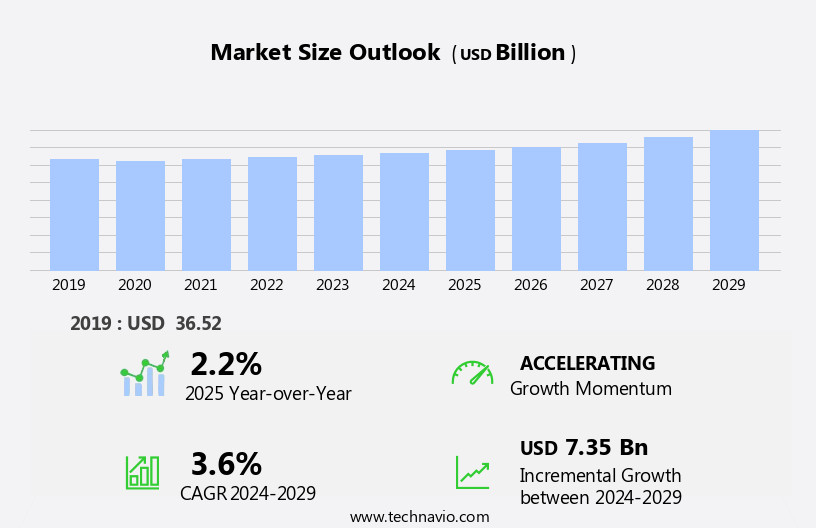

The defense logistics market size is forecast to increase by USD 7.35 billion, at a CAGR of 3.6% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing number of military vehicles and the adoption of a more collaborative logistics approach.

Major Market Trends & Insights

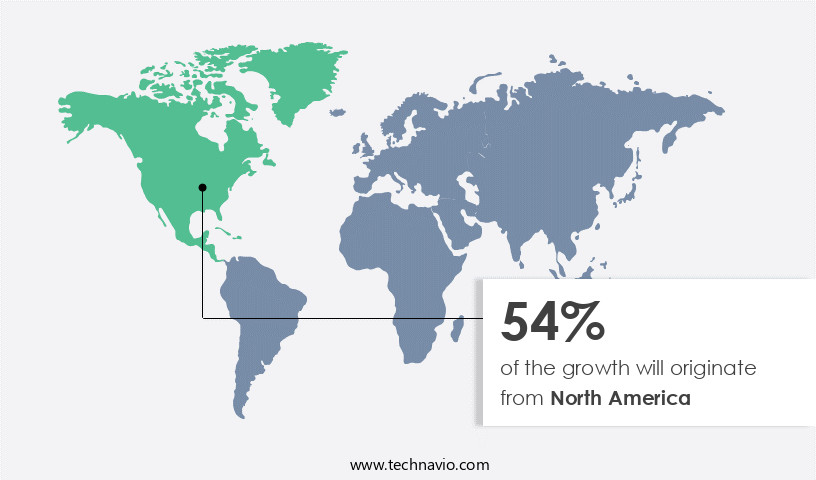

- North America dominated the market and accounted for a 54% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

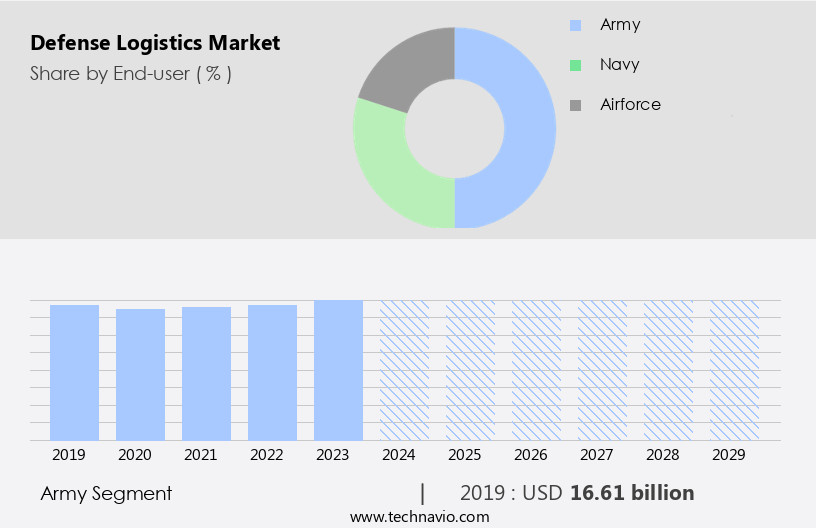

- Based on the End-user, the army segment led the market and was valued at USD 17.15 billion of the global revenue in 2023.

- Based on the Solution, the military infrastructure segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 38.45 Billion

- Future Opportunities: USD 7.35 Billion

- CAGR (2024-2029): 3.6%

- North America: Largest market in 2023

Logistics automation and artificial intelligence are transforming the defense supply chain, enhancing operational efficiency and enabling swift response to evolving mission requirements. Spare parts management and medical supplies logistics are critical components, requiring precise planning and execution. Joint operations necessitate seamless communication and coordination between military branches, necessitating advanced command and control systems and logistics support. The Internet of Things and data analytics offer further opportunities for efficiency gains, while logistics optimization continues to be a key focus for defense procurement and mission support.

What will be the Size of the Defense Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the complexities of military operations and the need for supply chain resilience. This dynamic market encompasses various sectors, including combat support, humanitarian aid, and disaster relief. Logistics optimization plays a crucial role, with entities such as defense contractors and government agencies integrating advanced technologies like 3D printing, inventory management systems, and logistics software to streamline operations. Logistics execution and planning are essential for military readiness, with predictive maintenance and risk management strategies ensuring operational effectiveness. Big Data and cloud computing enable real-time supply chain visibility, allowing for cost reduction and improved mission support. The navy segment is the second largest segment of the End-user and was valued at USD 11.97 billion in 2023.

The proliferation of military vehicles necessitates an expansive and efficient logistics network to ensure their operational readiness. This trend is further fueled by the evolving nature of military conflicts, which demands agile and responsive logistics capabilities. However, this digital transformation brings challenges, including cybersecurity concerns and the need for data security. Cybersecurity concerns pose a significant threat, as the digitalization of logistics processes increases the vulnerability of sensitive data. Adversaries may exploit these weaknesses to disrupt supply chains, compromise military intelligence, or launch cyber-attacks on critical infrastructure.

As a result, stakeholders must prioritize robust cybersecurity measures to secure their logistics networks and mitigate potential risks.

How is this Defense Logistics Industry segmented?

The defense logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Army

- Navy

- Airforce

- Solution

- Military infrastructure

- Military logistics services

- Military FMS

- Service Type

- Transportation & Freight Management

- Warehousing & Distribution

- Inventory Management

- Maintenance, Repair, and Overhaul (MRO)

- Supply Chain Planning & Optimization

- Lifecycle Management

- Deployment

- On-shore

- Off-shore

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The army segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 17.15 billion in 2023. It continued to the largest segment at a CAGR of 2.97%.

In the dynamic market, military operations encompass three distinct supply chains. The first involves the swift transportation of essentials like food, medicine, and clothing. The second focuses on the movement and extended maintenance of major weapons systems. Lastly, the deployment chain facilitates the rapid mobilization of large troop forces. Enhancing supply chain resilience is crucial, achieved through digitizing inventories, employing advanced technology for real-time monitoring, and outsourcing repair and maintenance services. Over 85% of materials are transported commercially, underlining the importance of supply chain optimization. Military readiness relies on logistics planning, execution, and automation, utilizing predictive maintenance, risk management, and cost reduction strategies.

Big data, cloud computing, and artificial intelligence play significant roles in improving operational effectiveness, while humanitarian aid and joint operations necessitate seamless collaboration between defense contractors, government agencies, and field support. The Internet of Things and data analytics contribute to efficiency gains in material handling and supply chain analytics. Military branches prioritize mission support, command and control, and medical supplies, all of which require robust and harmonious logistics systems.

The Army segment was valued at USD 16.61 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, driven by significant military spending from the US, has been a major contributor to global defense logistics. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 7.35 billion. With the US accounting for approximately 24% of the world's GDP and over 40% of global defense spending in 2023, the region plays a pivotal role in military operations, disaster relief, and defense procurement. The US government's commitment to military readiness is evident through its continuous investment in military logistics, supply chain management, and optimization. Advancements in technology have significantly impacted the defense logistics landscape. Predictive maintenance, risk management, logistics planning, and logistics execution are being enhanced through artificial intelligence, cloud computing, big data, and the Internet of Things.

Supply chain visibility and inventory management are being streamlined with the help of logistics software and 3D printing. Military branches rely on logistics support for mission success, and joint operations require seamless coordination between various agencies and defense contractors. Humanitarian aid and combat support are essential components of military logistics, with supply chain analytics playing a crucial role in ensuring operational effectiveness and cost reduction. Despite being the largest military spender, North America's military spending is projected to experience flat growth due to the US's withdrawal from Iraq in 2011. However, the focus on logistics automation, military equipment, and defense procurement remains unwavering, ensuring the region's continued dominance in the market.

Market Dynamics

"The global defense logistics market is propelled by the integration of AI and autonomous technologies for enhanced supply chain efficiency, with North America leading due to its 54% market share in 2023."

- Rahul Somnath, Assistant Research Manager, Technavio

The market encompasses the provision of goods and services required for the effective and efficient operation of military forces. This vital sector includes transportation, warehousing, supply chain management, maintenance, repair, and overhaul of military equipment. Defense logistics providers ensure the timely delivery of critical supplies, such as fuel, food, water, and spare parts, to military bases and personnel. They employ advanced technologies, including real-time tracking systems and predictive analytics, to optimize supply chain operations and mitigate risks. Additionally, they offer value-added services, such as repair and maintenance, to extend the life cycle of military assets. Defense logistics plays a crucial role in ensuring military readiness and enhancing operational capabilities. It is a dynamic and complex market, influenced by factors such as geopolitical tensions, military modernization, and technological advancements.

What are the key market drivers leading to the rise in the adoption of Defense Logistics Industry?

- The significant growth in the demand for military vehicles serves as the primary market driver.

- The market experiences significant growth due to the increasing focus on logistics evaluation and supply chain resilience to support military operations and disaster relief efforts. With the prioritization of supply chain visibility and management, there is a heightened emphasis on predictive maintenance and risk management to ensure the uninterrupted availability of logistics support. Weapons systems require robust logistics planning to maintain their operational readiness, with many militaries investing in modernizing their fleets. For instance, the Indian Air Force intends to expand its fighter jet fleet by 400 new aircraft by 2030, including orders for 72 Sukhoi-30 fighters and 36 Rafale fighters.

- Similarly, the Chinese Peoples Liberation Army operates approximately 2,942 aircraft, with close to 60% considered modern, underlining the importance of efficient logistics systems for military aviation.

What are the market trends shaping the Defense Logistics Industry?

- The collaborative logistics approach is gaining significant traction in the market as an emerging trend. This strategy, which emphasizes cooperation and coordination among supply chain partners, is increasingly being adopted to enhance efficiency and reduce costs.

- The market has seen significant growth and innovation in recent years, driven by the need for logistics optimization in the defense sector. Key trends include the adoption of advanced technologies such as 3D printing for combat support and humanitarian aid, as well as the implementation of logistics software for inventory management and logistics execution. Defense contractors and government agencies are increasingly leveraging big data and analytics to improve field support and combat readiness. The use of 3D printing technology enables the production of spare parts and equipment on-demand, reducing the need for extensive inventory and improving overall efficiency.

- Logistics software solutions enable real-time tracking and monitoring of inventory levels, transportation routes, and delivery schedules, ensuring that resources are deployed effectively and efficiently. Geopolitical instability continues to be a significant challenge for the defense logistics industry, with countries collaborating around military transportation and logistics to address regional conflicts and territorial disputes. The UAE, for instance, has emerged as a strategic partner due to its investments in infrastructure and state-owned enterprises, providing essential transportation and logistics services to various countries.

What challenges does the Defense Logistics Industry face during its growth?

- Cybersecurity concerns represent a significant challenge to the growth of various industries, as ensuring the protection of digital information and systems is essential in today's technology-driven business landscape.

- The market plays a crucial role in military operations by ensuring the timely delivery of spare parts and supplies to military branches. However, this digitalized and interconnected defense supply chain faces significant challenges, particularly in the realm of cybersecurity. With the increasing adoption of cloud computing and logistics automation, defense logistics systems are becoming more vulnerable to cyber threats. In 2023, a Chinese hacking group compromised critical communication and transportation infrastructure in the US DoD, highlighting the potential risks. Such attacks can disrupt operations, compromise sensitive data, and endanger national security. As military equipment relies on these logistics networks, the consequences of a successful cyberattack could be catastrophic for military readiness and operational effectiveness.

- To mitigate these risks, artificial intelligence and advanced cybersecurity measures must be prioritized. Cost reduction and efficiency gains through automation must be balanced with robust security protocols to ensure the integrity and confidentiality of defense logistics data.

Exclusive Customer Landscape

The defense logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the defense logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, defense logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aramark Corporation - This company specializes in defense logistics, delivering advanced engineering, technology solutions, and mission support to bolster military readiness and safeguard national security.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aramark Corporation

- BAE Systems plc

- Boeing Company

- CACI International Inc

- Ceva Logistics AG

- DHL Supply Chain (Deutsche Post DHL Group)

- DynCorp International (Amentum Services, Inc.)

- Exelis Inc. (Harris Corporation)

- Federal Express Corporation (FedEx)

- General Dynamics Corporation

- KBR, Inc.

- Leidos Holdings, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Parsons Corporation

- Raytheon Technologies Corporation

- Rolls-Royce Holdings plc

- Serco Group plc

- SNC-Lavalin Group Inc.

- XPO Logistics, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Defense Logistics Market

- In January 2024, Lockheed Martin Corporation and Raytheon Technologies announced a merger, forming a new entity named Constellis Technologies, to strengthen their defense logistics capabilities (Lockheed Martin Corporation Press Release, 2024). This strategic collaboration aimed to streamline supply chain management, enhance technology integration, and provide comprehensive logistics services to defense and civil customers.

- In March 2024, the U.S. Department of Defense (DoD) awarded a five-year, USD12.2 billion contract to Amazon Web Services (AWS) for cloud computing services, marking a significant technological advancement in defense logistics (U.S. Department of Defense Press Release, 2024). This initiative aimed to modernize the DoD's IT infrastructure, improve data analysis, and enhance overall operational efficiency.

- In May 2024, Boeing Defense, Space & Security and Safran signed a strategic partnership to develop and produce next-generation propulsion systems for defense applications (Boeing Press Release, 2024). This collaboration aimed to leverage Safran's expertise in advanced propulsion technologies and Boeing's defense market presence to offer innovative solutions for defense logistics and sustainment.

- In April 2025, General Dynamics Land Systems received a USD3.8 billion contract from the U.S. Army to produce the next generation of the Stryker combat vehicle, which includes advanced logistics capabilities (General Dynamics Press Release, 2025). This significant investment in defense logistics technology demonstrates the U.S. Military's commitment to modernizing its fleet and improving its supply chain management capabilities.

Research Analyst Overview

- The market encompasses a range of solutions and services, from military logistics optimization and infrastructure to logistics analytics platforms and defense warehousing solutions. Military logistics strategies prioritize innovation, such as logistics simulation and supply chain leadership, to enhance performance measurement and responsiveness. Defense logistics services also integrate defense technology, logistics modernization, and supply chain digitization for improved sustainability and agility. Logistics regulations and standards play a crucial role in ensuring compliance, while military logistics intelligence and contingency planning mitigate risks. Defense logistics policy and integration facilitate seamless transportation management and workforce development. Logistics training and certification are essential components of a skilled defense logistics workforce.

- Green logistics and logistics sustainability are growing trends, as is logistics outsourcing for cost savings and expertise. Logistics talent and supply chain ethics are increasingly important considerations for organizations striving for operational excellence. Future trends include logistics certification, logistics future trends, and logistics innovation, all contributing to the evolving landscape of defense logistics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Defense Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2025-2029 |

USD 7.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Defense Logistics Market Research and Growth Report?

- CAGR of the Defense Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the defense logistics market growth of industry companies

We can help! Our analysts can customize this defense logistics market research report to meet your requirements.