Degenerative Disc Disease Market Size 2024-2028

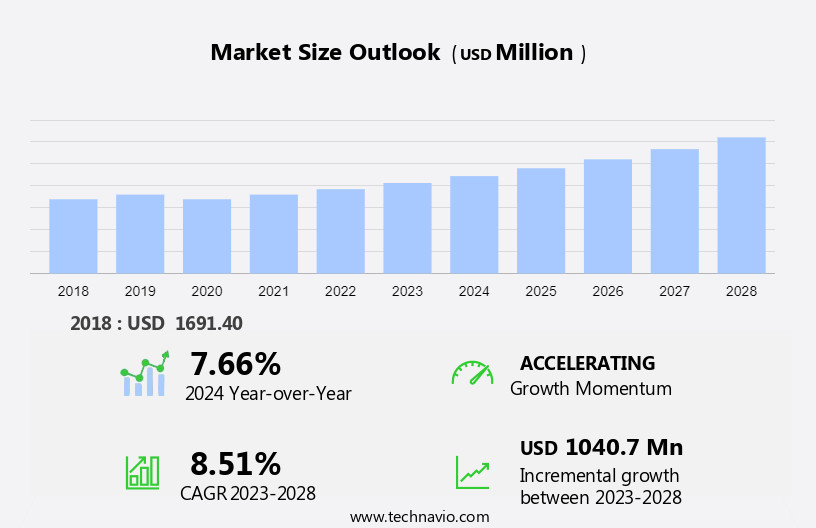

The degenerative disc disease market size is forecast to increase by USD 1.04 billion at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The aging population in North America is a major driver, as the prevalence of this condition increases with age. Additionally, the launch of innovative products and advancements in technology are contributing to market expansion. The market is experiencing growth due to the increasing demand for advanced healthcare services and the rising adoption of ambulatory surgical centers, which offer minimally invasive procedures for treating spine-related disorders. Furthermore, the availability of alternative therapies, such as physical therapy and minimally invasive surgeries, is providing patients with more options for treatment. These trends are expected to continue shaping the market in the coming years. Despite these growth opportunities, challenges remain, including the high cost of treatment and the need for long-term management strategies. Overall, the market is poised for continued growth, driven by a growing patient population and advancements in technology and treatment options.

What will be the Size of the Degenerative Disc Disease Market During the Forecast Period?

- The market encompasses a range of conditions affecting the spine, including spondylolisthesis, retrospondylolisthesis, and lumbar spinal stenosis. This market is driven by an aging population and the increasing prevalence of these conditions, particularly in the lumbar, cervical, and thoracic spine regions. Biopharmaceutical companies are exploring various therapeutic approaches, such as oral treatments with peripherally acting analgesics and shock absorbers, as well as advanced technologies like artificial disc replacement and spinal fusion. Hospitals and clinics play a significant role in the delivery of care, with a growing emphasis on minimally invasive procedures and personalized treatment plans. Research institutions are also contributing to the market through innovative research and development, including the use of conjoint analysis to better understand patient preferences and needs. Overall, the market is expected to continue growing, driven by the increasing burden of these conditions and the ongoing development of new treatments and technologies.

How is this Degenerative Disc Disease Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Drugs

- Devices

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

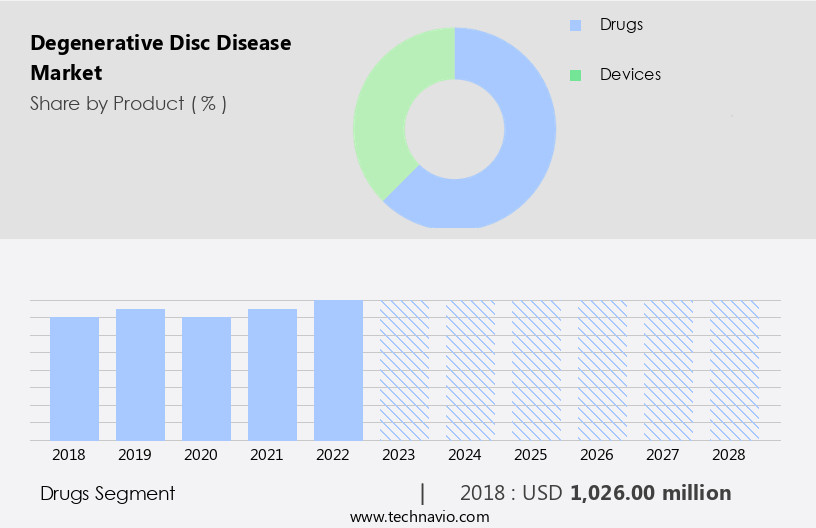

- The drugs segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the Drugs segment due to the increasing incidence of DDD among the geriatric population. With aging being a normal part of life, approximately 70% to 80% of individuals under 50 and over 90% of those over 60 exhibit DDD. Initially, this condition is managed through conservative treatments, including over-the-counter and prescription drugs, such as nonsteroidal anti-inflammatory drugs (NSAIDs). However, severe pain may necessitate prescription medications like corticosteroid injections, neuropathic agents, muscle relaxants, or opioids. Biopharmaceutical companies are focusing on developing novel therapeutic approaches to address the unmet needs in the market.

These include peripherally acting analgesics, artificial disc replacement, and spinal fusion. Hospitals and clinics remain significant end-users, while conjoint analysis is employed to understand patient preferences and treatment choices. The market encompasses the Cervical Spine, Lumbar Spine, and Thoracic Spine, with current treatment practices undergoing continuous evolution. Spondylolisthesis and Retrospondylolisthesis are common complications, while Lumbar Spinal Stenosis is a significant unmet need. Pipeline products, such as shock absorbers, are under development to improve patient outcomes.

Get a glance at the market report of share of various segments Request Free Sample

The Drugs segment was valued at USD 1.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

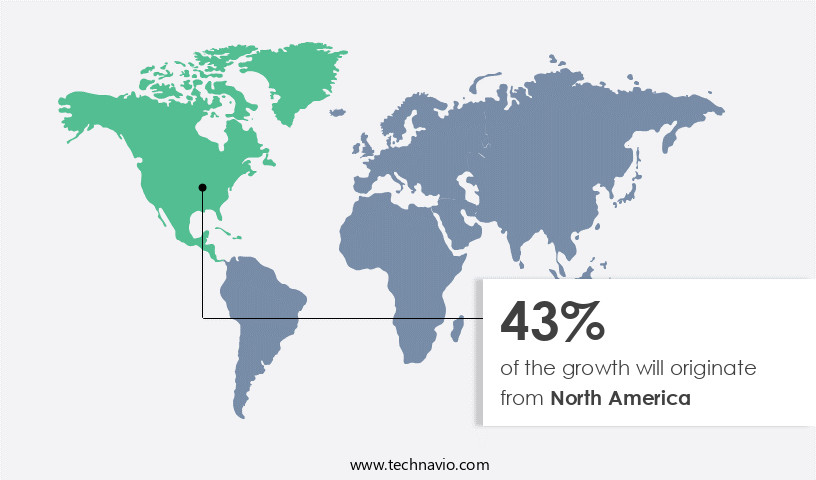

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds a prominent position in the market, driven by factors such as an aging population, technological advancements, product launches, and increasing healthcare expenditures. The US and Canada are the primary contributors to the regional market's revenue growth. The US market is anticipated to experience significant expansion due to the increasing geriatric population and subsequent prevalence of DDD. Other factors, including the implementation of early disease diagnosis programs and high healthcare spending, further fuel market growth in North America. The market encompasses various therapeutic approaches, including Spondylolisthesis, Retrospondylolisthesis, Lumbar spinal stenosis, and treatments like Oral treatment, Peripherally acting analgesics, Artificial Disc Replacement, Spinal Fusion, and Cervical, Lumbar, and Thoracic Spine treatments.

Biopharmaceutical companies are actively investing in research and development to address the unmet needs in this market. Hospitals and clinics are significant end-users of DDD treatments. Conjoint analysis is a common method used to understand patient preferences and determine the optimal therapeutic approach. The market's pipeline includes products from various companies, such as Metabolic Program, Disc/Spine Program, and Shock absorbers. The market's growth is influenced by ongoing research and advancements in technology, including the development of minimally invasive procedures and biomaterials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Degenerative Disc Disease Industry?

The growing geriatric population is the key driver of the market.

- The aging population's increased susceptibility to degenerative disc disease (DDD) has fueled significant demand for diagnostic, assistive, maintenance, and therapeutic solutions in the healthcare industry. Age-related degenerative changes in human intervertebral discs contribute to common impairments and disabilities, including spine stiffness, neck pain, and back pain. Biopharmaceutical companies are exploring various therapeutic approaches to address the unmet needs of DDD patients. Peripherally acting analgesics, shock absorbers, and artificial disc replacement are among the pipeline products being developed to alleviate pain and improve spine function.

- Spinal fusion, a current treatment practice, is also undergoing advancements, with companies investing in their Disc/Spine and Metabolic Programs, respectively. Lumbar spinal stenosis, a common condition associated with DDD, affects the cervical, thoracic, and lumbar spine. Hospitals and clinics are integrating advanced imaging technologies and minimally invasive procedures to improve diagnostic accuracy and patient outcomes. Conjoint analysis is a valuable tool used to understand patient preferences and inform decision-making in the development of new treatments.

What are the market trends shaping the Degenerative Disc Disease Industry?

Launch of innovative products is the upcoming market trend.

- The market witnesses ongoing innovation from biopharmaceutical companies, introducing advanced treatments for conditions such as spondylolisthesis, retrospondylolisthesis, and lumbar spinal stenosis. This surgical procedure involves placing a bone or bone-like material in the space between the affected vertebrae. Peripherally acting analgesics are another therapeutic approach gaining traction in the market. The market's focus extends to the cervical, lumbar, and thoracic spine, with a growing emphasis on artificial disc replacement and spinal fusion procedures.

- Hospitals and clinics are significant end-users in the market. Conjoint analysis is a popular research method used to understand patient preferences and unmet needs. Current treatment practices include a combination of pharmacological and surgical interventions. Shock absorbers and metabolic programs are emerging as potential solutions to address the challenges associated with DDD. The pipeline includes various product profiles, each with unique advantages.

What challenges does the Degenerative Disc Disease Industry face during its growth?

Availability of alternative therapies is a key challenge affecting the industry growth.

- The market faces hindrance due to the increasing preference for alternative therapies, such as physiotherapy and special exercises, among the patient population. According to research published in the Toronto Physiotherapy Journal, physiotherapy is the most common first-line treatment for DDD in the aging population. While standard conservative care includes physiotherapy, it may also involve anti-inflammatory drugs and, in severe cases, epidural injections. The growing awareness about the side effects of medications has led many individuals to opt for non-pharmacological approaches. Peripherally acting analgesics, a type of oral treatment, are some of the biopharmaceutical companies' offerings in the market.

- Other therapeutic approaches include spinal fusion, shock absorbers, and artificial disc replacement for advanced cases of DDD. The market dynamics are further influenced by unmet needs, pipeline product profiles, and current treatment practices in hospitals and clinics. Conjoint analysis is a valuable tool used to understand the patient population's preferences and treatment decisions. The market encompasses various therapeutic approaches for the Lumbar, Thoracic, and Cervical Spine, including Metabolic Programs, Disc/Spine Programs, and Spinal Fusion procedures.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, degenerative disc disease market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AnGes Inc

- Ankasa

- B.Braun SE

- BIOPHARM GmbH

- BioRestorative Therapies Inc

- BioSenic SA

- Biosplice Therapeutics Inc.

- CalSpine MD

- Cousin Biotech

- DiscGenics Inc.

- Globus Medical Inc.

- Johnson and Johnson Services Inc.

- Medtronic Plc

- Pfizer Inc.

- RTI Surgical Inc.

- Smith and Nephew plc

- Ulrich Medical USA Inc.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Degenerative disc disease (DDD) is a condition characterized by the natural wear and tear of intervertebral discs in the spine. This condition is prevalent in various populations worldwide, affecting both the cervical, lumbar, and thoracic regions of the spine. As the global population ages, the prevalence of DDD is expected to increase, leading to a significant demand for effective therapeutic approaches. Currently, the treatment landscape for DDD is diverse, encompassing both surgical and non-surgical options. Surgical interventions include spinal fusion and artificial disc replacement, while non-surgical treatments consist of oral treatments, such as peripherally acting analgesics, and minimally invasive procedures.

The biopharmaceutical industry has been actively investing in research and development to address the unmet needs of the DDD patient population. Several companies have launched pipeline products aimed at providing more effective and less invasive treatment options. The market is expanding as biotech innovations and biopharmaceutical analytical testing services play a crucial role in developing new treatments and ensuring the safety and efficacy of therapies for spinal disorders. These products include shock absorbers, designed to maintain the height and functionality of affected discs, and metabolic programs, which focus on addressing the underlying causes of DDD. Despite the availability of various treatment options, current treatment practices for DDD face several challenges. One of the primary challenges is the variability in patient response to treatments, leading to the need for personalized treatment plans.

Conjoint analysis, a research method used to understand patient preferences and treatment decisions, is increasingly being employed to address this challenge. Lumbar spinal stenosis, a common condition associated with DDD, poses unique challenges in treatment. The condition is characterized by narrowing of the spinal canal, leading to compression of the nerves in the lower back. Treatment for lumbar spinal stenosis often involves a combination of surgical and non-surgical interventions. In the cervical spine, DDD can lead to conditions such as retrospondylolisthesis, a condition characterized by backward displacement of one vertebra over another. The treatment for retrospondylolisthesis is similar to that for other forms of DDD, with surgical and non-surgical options available.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 1.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.66 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Degenerative Disc Disease Market Research and Growth Report?

- CAGR of the Degenerative Disc Disease industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the degenerative disc disease market growth of industry companies

We can help! Our analysts can customize this degenerative disc disease market research report to meet your requirements.