Diaphragm Pump Market Size 2025-2029

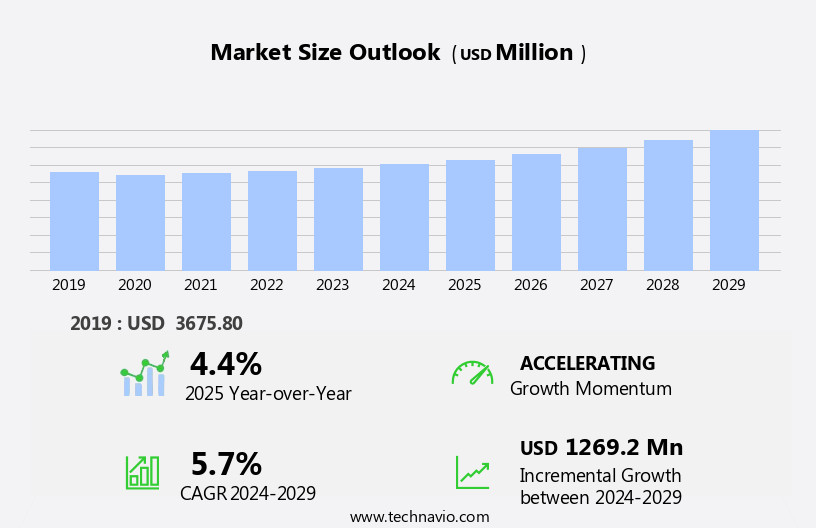

The diaphragm pump market size is forecast to increase by USD 1.27 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for water and wastewater treatment solutions. This sector relies heavily on diaphragm pumps due to their ability to handle corrosive and abrasive fluids without contamination. Another key trend is the introduction of new products, such as self-priming and air-operated diaphragm pumps, which offer increased efficiency and ease of use. However, challenges persist in the form of concerns over diaphragm breakage in Air-Operated Double Diaphragm (AODD) pumps. This issue can lead to costly downtime and decreased productivity.

- To capitalize on market opportunities and navigate challenges effectively, companies must focus on enhancing diaphragm durability and improving maintenance practices. By addressing these concerns, market participants can differentiate themselves and gain a competitive edge in the market.

What will be the Size of the Diaphragm Pump Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse demands of various sectors. Positive displacement pumps, with their reliability and ability to handle a wide range of fluids, remain a popular choice in chemical processing. Abrasion resistance and chemical resistance are key considerations for pumps in this application, as they must withstand the rigors of industrial processes. In agriculture, diaphragm pumps are integral to the operation of agricultural equipment, ensuring efficient fluid transfer and metering for irrigation and livestock applications. The importance of pump reliability and fluid compatibility cannot be overstated in this context. Construction equipment also relies on diaphragm pumps for fluid transfer systems, with pump motor and discharge head playing crucial roles in ensuring optimal performance.

In the realm of fluid handling, process control is a critical factor, with automation systems and dosing systems enabling precise fluid metering and chemical dosing. The mining industry requires pumps with high pressure rating and material compatibility, as well as pump optimization and design for efficient operation in harsh environments. Fluid dynamics and pump sizing are essential considerations for mining operations, as is pump safety and installation in challenging locations. The market is further characterized by ongoing advancements in pump design, automation, and pump troubleshooting. Centrifugal pumps, rotary pumps, and peristaltic pumps each offer unique advantages in different applications, from water treatment to pharmaceutical manufacturing.

The continuous unfolding of market activities underscores the importance of staying abreast of evolving trends and patterns in the market.

How is this Diaphragm Pump Industry segmented?

The diaphragm pump industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Air operated

- Electrically operated

- End-user

- Oil and gas

- Water and wastewater

- Chemicals

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

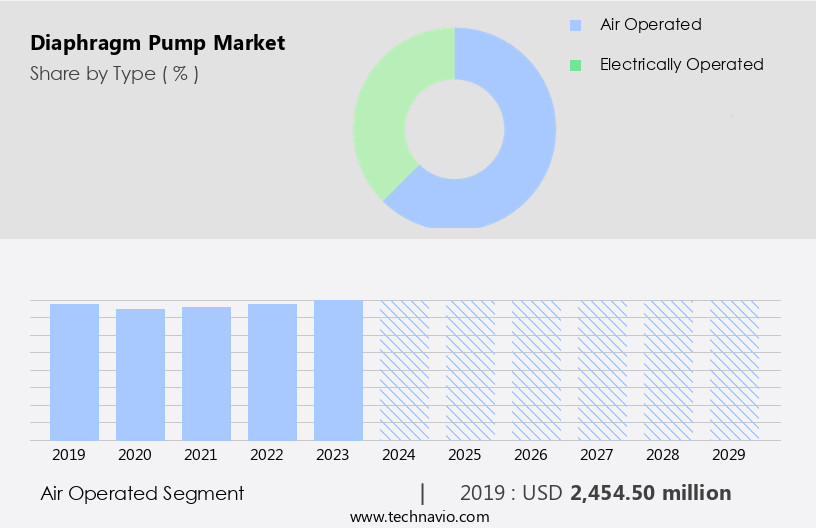

The air operated segment is estimated to witness significant growth during the forecast period.

The market, specifically the air operated double-diaphragm (AODD) pumps segment, demonstrates a broad spectrum of applications and advantages. AODD pumps operate using two flexible diaphragms that create a pumping action by alternately filling and discharging two chambers, driven by compressed air. These pumps are renowned for their versatility and are predominantly employed for transfer applications, accommodating a wide array of fluids such as sludges, slurries, and abrasive materials. Despite their reliability and robustness, AODD pumps can generate noise and are susceptible to icing. They are generally confined to low-pressure applications. In chemical processing industries, these pumps are employed for fluid metering, dosing systems, and automation, owing to their chemical resistance and process control capabilities.

AODD pumps are also extensively utilized in agricultural equipment, construction, and mining operations for fluid handling and material transfer. The pump's design ensures fluid compatibility, enabling it to transfer various fluids without causing damage or contamination. AODD pumps' pump heads and discharge sizes are customizable, allowing for efficient fluid transfer in diverse applications. The pumps' pump motors and drives are engineered for high pump efficiency and pressure rating, making them suitable for industrial automation and water treatment. AODD pumps' materials are carefully selected for corrosion resistance, ensuring their longevity in harsh environments. Pump maintenance is facilitated by the pumps' modular design, which simplifies troubleshooting and replacement of worn parts.

The pumps' fluid viscosity and temperature compatibility are extensive, enabling their use in various industries. AODD pumps' pump life cycle is extended by their design, which minimizes wear and tear on the pump shaft and seals. Their rotary design allows for smooth fluid transfer, ensuring pump performance remains consistent. These pumps' ability to handle a wide range of fluid types and their adaptability to various industries make them indispensable in numerous applications.

The Air operated segment was valued at USD 2.45 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

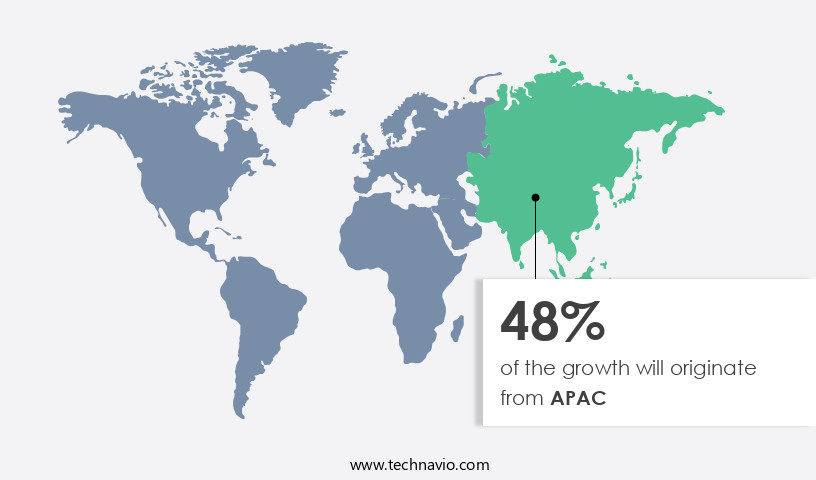

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing significant growth due to expanding manufacturing sectors in countries like China, Japan, and India. In 2023, the manufacturing sector in China accounted for approximately 26% of the country's total GDP, while India's manufacturing sector grew at a robust rate of around 9.9% in FY 2023-24. This economic expansion increases the demand for diaphragm pumps, which are crucial for various industrial processes. Moreover, water and wastewater treatment projects are on the rise in developing countries within the APAC region. The increasing focus on environmental sustainability and improving public health is driving the demand for advanced fluid handling solutions, including diaphragm pumps.

These pumps offer advantages such as chemical resistance, pump reliability, and fluid compatibility, making them ideal for chemical processing applications. In addition, the agricultural sector in the APAC region is also a significant consumer of diaphragm pumps. These pumps are used in agricultural equipment for fluid transfer, dosing systems, and fluid metering, ensuring efficient irrigation and crop growth. Furthermore, the construction industry's growing demand for fluid handling systems, particularly in large-scale projects, is contributing to the market's growth. Diaphragm pumps are also essential in various industries, including pharmaceutical manufacturing, mining operations, and wastewater treatment. Their ability to handle corrosive fluids, maintain pump efficiency, and ensure pump safety makes them a preferred choice for these applications.

The market's growth is further driven by advancements in pump design, optimization, automation systems, and pump controller technology, enabling better process control and fluid dynamics management. In conclusion, the market in the APAC region is witnessing robust growth due to expanding manufacturing sectors, increasing focus on water and wastewater treatment, and the agricultural and construction industries' growing demand for advanced fluid handling solutions. The market's evolution is characterized by advancements in pump design, optimization, automation, and material compatibility, ensuring better pump performance, reliability, and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Diaphragm Pump Industry?

- The water and wastewater treatment market is driven primarily by the rising demand for effective solutions to address increasing water scarcity and the need for improved water quality.

- The market is witnessing notable expansion due to the rising demand for efficient water and wastewater treatment solutions. The global water crisis and strict environmental regulations are primary drivers fueling the adoption of diaphragm pumps in wastewater treatment facilities. According to the World Meteorological Organization (WMO), 2023 was the driest year on record for global rivers, and the largest glacier mass loss in over 50 years was reported. Currently, over 3.6 billion people face water shortages, a number projected to reach over 5 billion by 2050. These statistics underscore the critical importance of implementing effective water management solutions to meet the United Nations Sustainable Development Goal 6 on water and sanitation.

- Diaphragm pumps are preferred for their superior pump performance in handling fluids with varying viscosity and temperature. Mining operations, in particular, benefit from their corrosion resistance and ability to handle high suction lifts. Fluid dynamics and pump automation are crucial considerations in diaphragm pump design, ensuring optimal flow rate and pump life cycle. Pump calibration and controller technology further enhance their efficiency and reliability. In conclusion, the market's growth is driven by the pressing need for water management solutions, the versatility of diaphragm pumps, and advancements in pump technology.

What are the market trends shaping the Diaphragm Pump Industry?

- The introduction of new products is a significant market trend that reflects innovation and progress in various industries. Companies continually strive to meet consumer demands and stay competitive by launching new and improved offerings.

- The market is experiencing notable progress, driven by the launch of innovative products that improve pump efficiency and adaptability for diverse industries. For instance, on February 5, 2024, KNF introduced the FP 7 and FP 25 models to its Smooth Flow diaphragm pump series in Germany. These pumps cater to varying flow requirements, with adjustable flow rates of 15-70 ml/min and 50-250 ml/min, respectively, and a maximum pressure capacity of up to 1 bar (14.5 psi). High-pressure versions, FP 1.7 and FP 25, can achieve nominal pressures of up to 6 bar (87 psi). The new models come with an integrated space-saving damper, ensuring smooth, low-pulsation flow that minimizes resistance, vibration, noise, and liquid shear forces, while also reducing bubble formation and enhancing durability.

- This development underscores the importance of pump reliability, particularly in industries such as chemical processing, agricultural equipment, and construction equipment, where fluid compatibility, abrasion resistance, and process control are crucial factors.

What challenges does the Diaphragm Pump Industry face during its growth?

- The concern regarding potential diaphragm rupture in Air Operated Diaphragm (AODD) pumps poses a significant challenge and may hinder industry growth.

- The market confronts a significant challenge with the potential for diaphragm failure in air-operated double diaphragm (AODD) pumps. The diaphragm, a vital component, undergoes significant mechanical stress during operation. Over the long term, these stresses can result in cracks and damage, negatively impacting pump performance and dependability. A primary contributor to diaphragm degradation is the pump's operating pressure. When the inlet air pressure is unusually high, the diaphragm experiences increased stress during each pump cycle. This added stress accelerates diaphragm wear, reducing its service life and increasing the risk of malfunction. Fluid metering and dosing systems, automation systems, and chemical dosing applications are essential in various industries, necessitating the use of diaphragm pumps for fluid transfer.

- Pump optimization, design, and troubleshooting are crucial aspects to ensure pump efficiency and safety. Centrifugal pumps and peristaltic pumps are alternative options for specific applications. Ensuring proper pump sizing and selection is vital for optimal performance and minimizing potential issues. Pump safety is paramount to prevent hazardous situations and maintain regulatory compliance. By addressing the challenges of diaphragm wear and focusing on pump design, optimization, and safety, the market can continue to meet the demands of various industries.

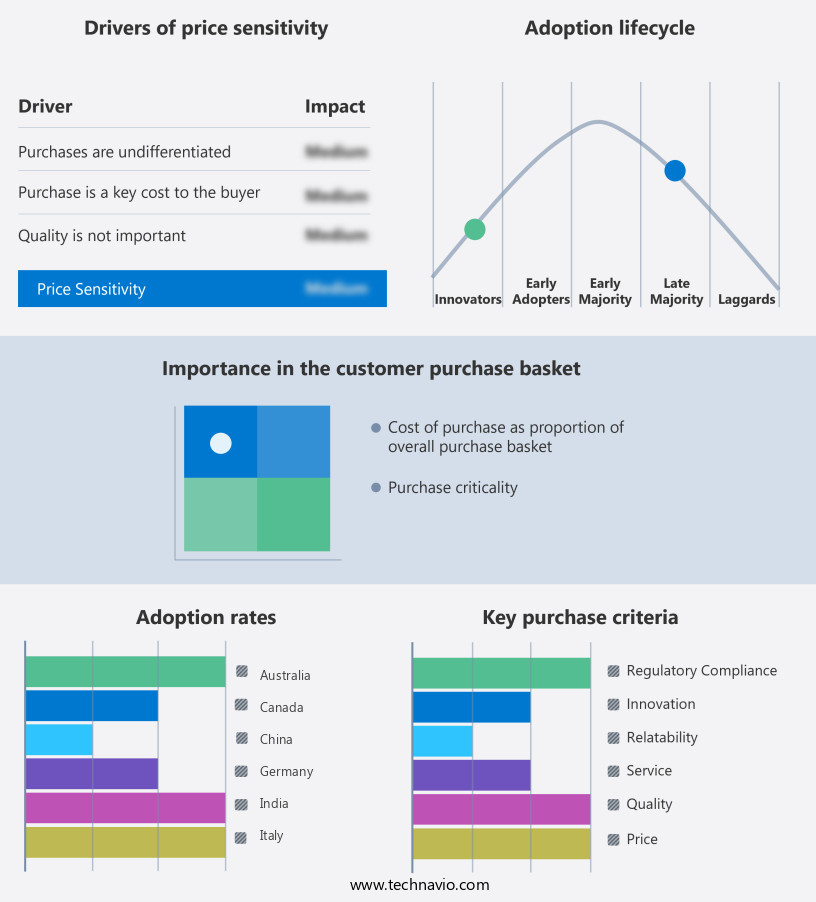

Exclusive Customer Landscape

The diaphragm pump market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the diaphragm pump market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, diaphragm pump market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Dover Corp. - The company specializes in providing advanced air-operated double-diaphragm (AODD) pump solutions, including the All-Flo and Almatec brands. These pumps offer superior performance and reliability for various industrial applications. AODD pumps utilize two flexible diaphragms to transfer fluids, delivering consistent flow rates and pressure. The absence of mechanical seals reduces maintenance requirements and minimizes downtime. With a focus on innovation and quality, the company's offerings cater to diverse industries and applications, ensuring efficient and effective fluid transfer solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Dover Corp.

- Flowserve Corp.

- Graco Inc.

- Grundfos Holding AS

- IDEX Corp.

- Ingersoll Rand Inc.

- JESSBERGER

- Kimray Inc.

- LEWA GmbH

- Price Pump

- SANDPIPER Pump

- SERFILCO

- SPX FLOW Inc.

- TAPFLO AB

- URACA GmbH and Co. KG

- Verder Liquids

- Wanner Engineering Inc.

- Wenzhou Kaixin Pump Co. Ltd.

- Xylem Inc.

- Yamada America Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Diaphragm Pump Market

- In February 2023, Gardner Denver, a leading global industrial technology company, announced the launch of its new line of Air Diaphragm Pumps, the Booster Series, designed for high-pressure applications in the oil and gas industry (Gardner Denver Press Release, 2023). This expansion represents a strategic move to cater to the growing demand for efficient and reliable pumps in the energy sector.

- In October 2024, ITT Inc., a global industrial manufacturing company, entered into a strategic partnership with KSB, a leading pump manufacturer, to develop and market diaphragm pumps with advanced digital capabilities (ITT Inc. Press Release, 2024). This collaboration aims to leverage ITT's expertise in fluid handling and KSB's digital solutions to create intelligent diaphragm pumps, enhancing operational efficiency and performance.

- In January 2025, Ebara Corporation, a leading Japanese pump manufacturer, acquired a significant stake in US-based diaphragm pump specialist, Neptune Chemical Pump Company (Ebara Corporation Press Release, 2025). This strategic acquisition strengthens Ebara's position in The market and provides Neptune with access to Ebara's extensive resources and technology.

- In March 2025, Sulzer, a global pumping solutions provider, received approval from the US Environmental Protection Agency (EPA) for its new line of diaphragm pumps, compliant with the latest emission regulations (Sulzer Press Release, 2025). This approval marks a significant milestone in the company's efforts to cater to the growing demand for environmentally friendly pumping solutions in the water and wastewater industry.

Research Analyst Overview

- The market is experiencing significant activity and trends, with a focus on pump replacement, efficiency optimization, and safety regulations. Pump market share is influenced by pump design software, pump data acquisition, and pump modeling, enabling manufacturers to innovate and improve pump technology. Pump cooling, pump control strategies, and pump simulation are crucial for enhancing pump performance and reducing pump failure modes. Pump monitoring systems and pump vibration analysis are essential for predictive maintenance and timely pump repair. Diaphragm material selection and pump lubrication play a vital role in ensuring pump durability and longevity. Pump competitors are investing in pump efficiency optimization, pump capacity expansion, and pump speed adjustment to meet diverse pump applications.

- Pump safety regulations and certifications are increasingly stringent, requiring pump manufacturers to prioritize safety features and compliance. Pump distributors are leveraging pump training and pump noise level reduction to provide better customer service and meet evolving market demands. Pump market analysis indicates continued growth, driven by the need for reliable, efficient, and safe pump solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Diaphragm Pump Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 1269.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, India, Japan, South Korea, Italy, UK, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Diaphragm Pump Market Research and Growth Report?

- CAGR of the Diaphragm Pump industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the diaphragm pump market growth of industry companies

We can help! Our analysts can customize this diaphragm pump market research report to meet your requirements.