Mechanical Seals Market Size and Forecast 2025-2029

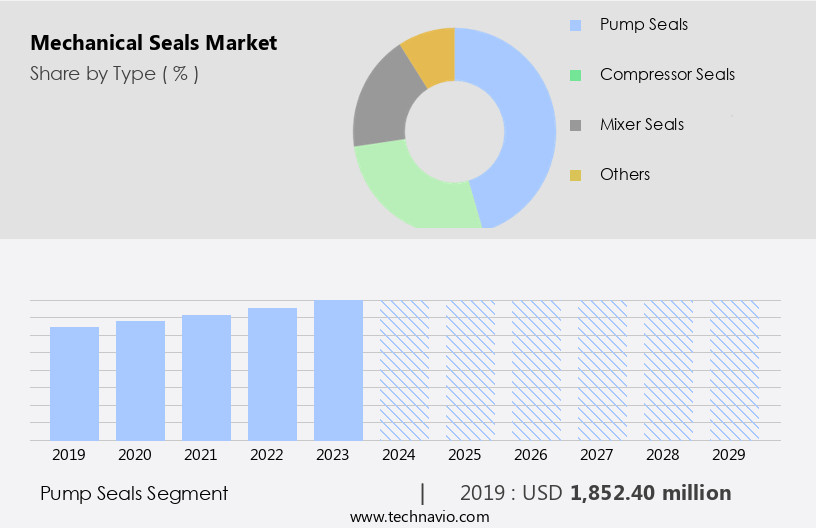

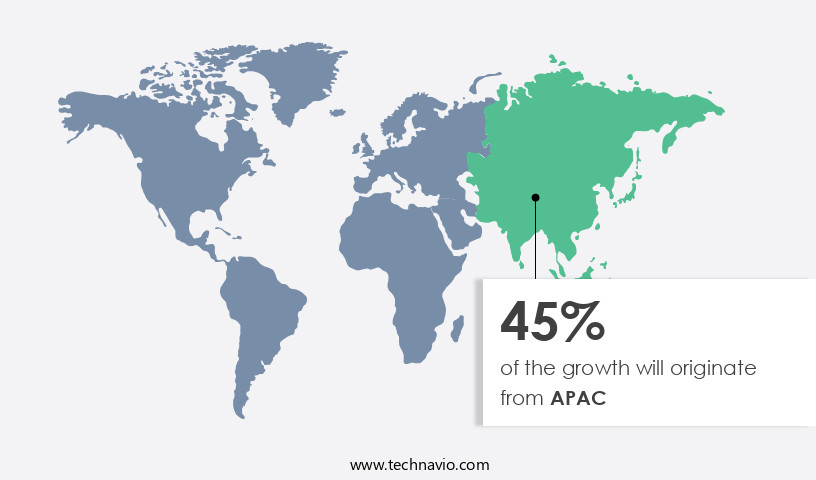

The mechanical seals market size estimates the market to reach by USD 1.75 billion, at a CAGR of 5.9% between 2024 and 2029. APAC is expected to account for 45% of the growth contribution to the global market during this period. In 2019 the pump seals segment was valued at USD 1.85 billion and has demonstrated steady growth since then.

|

Report Coverage |

Details |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

| Market structure | Fragmented |

|

Market growth 2025-2029 |

USD 1750.3 million |

- The market is experiencing significant growth in aftermarket sales, driven by the increasing demand for maintenance, repairs, and upgrades in various industries. This trend is particularly prominent in power generation, oil and gas, and water treatment sectors, where the reliability and efficiency of mechanical seals are crucial for maintaining plant operations. Another key driver in the market is the emergence of additive manufacturing technology. This innovative approach to manufacturing is enabling the production of complex mechanical seal designs and components with improved performance and durability. Additive manufacturing also offers the potential for on-demand production, reducing inventory costs and lead times for manufacturers and end-users.

- However, the market faces challenges as well. Fluctuating prices of raw materials, such as elastomers and metals, pose a significant threat to the profitability of mechanical seal manufacturers. Procurement costs can vary significantly depending on market conditions and geopolitical factors, making it essential for companies to maintain a flexible supply chain and explore alternative materials and sourcing strategies. In conclusion, the market is characterized by robust growth in aftermarket sales, the emergence of additive manufacturing, and the challenges posed by fluctuating raw material prices. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of these trends and adapt their strategies accordingly. This may involve investing in research and development, expanding their product offerings, and implementing agile supply chain solutions.

What will be the Size of the Mechanical Seals Market during the forecast period?

The market continues to evolve, driven by advancements in rotary shaft sealing technology and the expanding applications across various sectors. Material compatibility testing plays a crucial role in ensuring seals perform optimally under diverse conditions. For instance, a leading oil and gas company reported a 20% increase in seal life by implementing rigorous material testing procedures. Friction coefficient reduction is another critical area of focus, with secondary sealing systems and spring loading systems playing essential roles. Fluid dynamics simulations and seal chamber design are instrumental in optimizing volumetric efficiency and reducing vibration dampening techniques' negative effects. Seal wear mechanisms and seal cavity pressure are key concerns, with thermal stress analysis and misalignment compensation techniques addressing these challenges.

Shaft sleeve design, o-ring groove design, and surface finish specifications are vital in contaminant ingress prevention. Dynamic seal performance is enhanced through face alignment, face roughness impact, and dynamic sealing systems' implementation. Centering devices and static seal design improve static seal reliability, while lubrication methods cater to hydraulic pressure effects and pressure balancing mechanisms. Operating temperature limits and leakage detection systems are essential considerations, with ongoing research in seal face materials and seal chamber design continually pushing industry growth expectations to over 5% annually.

How is this Mechanical Seals Industry segmented?

The mechanical seals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Pump seals

- Compressor seals

- Mixer seals

- Others

- End-user

- Oil and gas

- General industries

- Chemicals and pharmaceuticals

- Water and wastewater treatment

- Aerospace and Marine

- Others

- Design Type

- Cartridge Seals

- Balanced and Unbalanced Seals

- Pusher and Non-Pusher Seals

- Conventional Seals

- Others

- Material

- Carbon

- Silicon Carbide

- Polymers

- Industrial Rubber and Fluorosilicone

- Metals

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The pump seals segment is estimated to witness significant growth during the forecast period.

Pump seals play a crucial role in ensuring the efficient and reliable operation of centrifugal pumps by preventing the leakage of fluids and gases. The demand for pump seals is driven by the wide usage of pumps in various industries for transporting fluids, making it essential to maintain operational efficiency and prevent product loss. Seals are engineered to withstand the rigorous conditions of different pump applications, including high pressures, temperature fluctuations, and corrosive or abrasive fluids. The design of pump seals varies depending on the pump type, with centrifugal pumps requiring rotary shaft sealing, reciprocating pumps utilizing secondary sealing systems, and rotary pumps employing spring loading systems.

Seal wear mechanisms, seal cavity pressure, and fluid dynamics simulations are critical factors in seal design. Seal face materials and seal chamber design are essential considerations for enhancing volumetric efficiency, while vibration dampening techniques and thermal stress analysis help improve static seal reliability. Misalignment compensation, shaft sleeve design, and centering devices are essential for addressing shaft deflection effects and ensuring proper face alignment. Contaminant ingress prevention, mechanical seal installation, hydraulic pressure effects, and pressure balancing mechanisms are other critical factors in pump seal design. Dynamic seal performance is influenced by face roughness impact, and lubrication methods are employed to minimize wear and enhance seal life. Operating temperature limits and leakage detection systems are essential safety features in pump seals, ensuring the safe and efficient operation of pumps in various industries.

As of 2019 the Pump seals segment estimated at USD 1.85 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 45% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing steady growth, with China, India, Japan, and Australia being the primary contributors to the region's revenue. China, the world's fastest-growing energy industry, is undergoing a transition in its oil and gas sector due to taxation on US imports. In response, the Chinese government is encouraging foreign investments to establish production facilities without the requirement for joint ventures. This policy shift is anticipated to boost oil production in China, consequently fueling the expansion of the market. Meanwhile, advancements in technology are shaping market trends. Material compatibility testing ensures seals perform optimally under various conditions.

Rotary shaft sealing and friction coefficient reduction enhance system efficiency. Secondary sealing systems and spring loading systems offer improved reliability. Seal wear mechanisms are being addressed through innovative materials and design. Seal cavity pressure and fluid dynamics simulations inform optimal design. Volumetric efficiency, vibration dampening techniques, and thermal stress analysis ensure robust performance. Misalignment compensation, shaft sleeve design, and static seal reliability mitigate operational challenges. O-ring groove design, fluid compatibility charts, and surface finish specifications ensure contaminant ingress prevention. Mechanical seal installation, hydraulic pressure effects, and pressure balancing mechanism optimize system operation. Face alignment and face roughness impact influence dynamic seal performance.

Centering devices and static seal design refine installation and maintenance. Lubrication methods and dynamic sealing systems extend seal life. Operating temperature limits and leakage detection systems ensure safety and reliability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is driven by the increasing demand for efficient and reliable sealing solutions in various industries, including oil and gas, power generation, and water treatment. Mechanical seals play a crucial role in maintaining process containment and preventing leaks in rotating equipment. In the selection of mechanical seal face materials, criteria such as mechanical seal flush system design, impact of shaft misalignment on seal life, and effects of operating pressure on seal performance are essential considerations. Mechanical seal failure analysis and prevention are critical aspects of maintaining seal performance. Operators must assess the impact of fluid compatibility on mechanical seal longevity, optimize mechanical seal chamber design for effective sealing, and evaluate mechanical seal performance using leakage detection systems. Mechanical seal design for high-speed applications requires assessment of different types of mechanical seal springs, improving the reliability of mechanical seals using proper lubrication, and reducing friction coefficient in mechanical seals. Design considerations for high-temperature mechanical seals include the importance of proper mechanical seal installation techniques, analyzing mechanical seal wear mechanisms and their effects, and comparing different designs of balance pistons. The role of centering devices in preventing seal damage and the impact of vibration on mechanical seal performance are also essential factors to consider. In conclusion, the market is characterized by the continuous development of advanced sealing technologies to address the unique challenges of various industries and optimize equipment performance.

What are the key market drivers leading to the rise in the adoption of Mechanical Seals Industry?

- The significant expansion in aftermarket sales of mechanical seals serves as the primary growth driver for the market. The market experiences steady growth due to the frequent replacement and upgrading of these components in various industrial applications. Mechanical seals, essential for pumps, compressors, and agitators, among others, are subjected to high pressures and temperatures that can cause leakages or damage, necessitating their replacement. Compliance with emission regulations also contributes to the market's expansion. Aftermarket sales dominate this industry, accounting for a significant market share.

- For instance, the demand for mechanical seal replacements in the oil and gas sector is projected to increase by 5% annually due to the rising number of aging assets requiring maintenance. This trend underscores the importance of the aftermarket in the mechanical seals industry's growth trajectory.

What are the market trends shaping the Mechanical Seals Industry?

- Additive manufacturing, also known as 3D printing, is emerging as the next major market trend. This advanced manufacturing technology enables the production of complex parts and structures through adding material layer by layer.

- Additive manufacturing, also known as 3D printing, is a revolutionary manufacturing technique that constructs a three-dimensional object by adding successive layers of material on top of each other, based on digital model data from a CAD model or an additive manufacturing file (AMF). Unlike traditional manufacturing methods, which involve removing material through cutting or drilling, additive manufacturing builds objects layer by layer, enabling the creation of complex geometries and structures. According to recent industry reports, the global additive manufacturing market is projected to grow by 25% in the next five years, driven by increasing demand from industries such as healthcare, aerospace, and automotive.

- This growth is attributed to the benefits of additive manufacturing, including reduced material waste, faster production times, and the ability to create lightweight and complex components. Moreover, the use of additive manufacturing in industries such as healthcare is expected to increase significantly due to its potential to produce customized medical devices and implants. For instance, the production of dental implants using additive manufacturing has grown by 30% annually over the past decade, as it allows for the creation of customized implants with precise fit and function.

What challenges does the Mechanical Seals Industry face during its growth?

- The unstable pricing of raw materials poses a significant challenge to the expansion and growth of the industry. The market is influenced by the price fluctuations of key raw materials, primarily steel, silicon carbide, tungsten carbide, and carbon. These materials' prices are subject to macroeconomic factors such as inflation, labor costs, and regulatory policy changes. For instance, the oil and gas and pharmaceutical industries' increasing production facilities have intensified competition among raw material suppliers, leading to price volatility.

- Additionally, other factors, including iron ore and steel prices, contribute to the market's dynamic nature. According to recent reports, the market is projected to grow at a robust rate, with industry experts estimating a 7% annual expansion over the next five years.This growth is driven by the increasing demand for mechanical seals in various end-use industries, including oil and gas, water and wastewater treatment, and power generation.

Exclusive Customer Landscape

The mechanical seals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mechanical seals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mechanical seals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.W. Chesterton Co. - This company specializes in manufacturing and supplying a diverse range of mechanical seals, including split seals, cartridge seals, cassette seals, gas seals, bellows seals, slurry seals, mixer agitator seals, and component seals, catering to various industries and applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.W. Chesterton Co.

- Aesseal Plc

- Anhui YALAN Seal Component Co. Ltd.

- Avon Seals Pvt. Ltd.

- Enpro Inc.

- Flexaseal Engineered Seals and Systems LLC

- Flowserve Corp.

- Freudenberg and Co. KG

- Hefei Supseals International Trade Co. Ltd.

- Hennig Gasket and Seals Inc.

- Leak Pack Engineering Pvt. Ltd.

- Meccanotecnica Umbra S.p.A.

- MICROTEM Srl

- Ningbo Mingzhi Electronic Technology Co. Ltd.

- QUANTECH SEALING SYSTEMS PVT LTD

- Quba Seals India Pvt. Ltd.

- Saisi Mechanical Seal Co. Ltd.

- Sinoseal Holding Co. Ltd.

- Smiths Group Plc

- Sulzer Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mechanical Seals Market

- In January 2024, Flowserve Corporation, a leading provider of flow control solutions, announced the launch of its new MagSeal XL mechanical seal for large pumps. This innovative product, designed to improve efficiency and reduce emissions, was showcased at the AHR Expo in Orlando, Florida (Flowserve Corporation Press Release, 2024).

- In March 2024, Dresser-Rand, a Baker Hughes business, and John Crane, a Smiths Group company, entered into a strategic partnership to jointly develop and commercialize advanced mechanical sealing technology. The collaboration aimed to enhance the performance and reliability of seals used in the oil and gas industry (Baker Hughes Press Release, 2024).

- In April 2025, Garlock Sealing Technologies, a global leader in fluid sealing solutions, completed the acquisition of Sealing Systems, a UK-based provider of mechanical seals and related services. This strategic move expanded Garlock's presence in Europe and strengthened its position in The market (Garlock Sealing Technologies Press Release, 2025).

- In May 2025, Emerson, a technology and engineering company, received regulatory approval for its new Rosemount Mechanical Seal 5300 Series. This advanced seal design, featuring improved leak detection and predictive maintenance capabilities, was expected to significantly enhance the performance and efficiency of industrial processes (Emerson Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in seal design and materials driving growth across various sectors. For instance, the demand for low-pressure seals in the chemical industry has increased by 5% in the last year due to their improved chemical inertness and abrasion resistance. In response, manufacturers are focusing on developing elastomeric seals with enhanced compensator designs to address seal failure modes. Moreover, the market is witnessing innovation in high-pressure and high-speed seals, with metal bellows seals and balance piston designs gaining popularity for their axial movement compensation capabilities. Cryogenic seals and magnetic coupling seals are also emerging as key solutions in extreme temperature applications.

- The Mechanical Seals Market is driven by innovations in sealing ring material, optimized balance piston design, and advanced high-pressure seals for demanding applications. Manufacturers are focusing on low-speed seals and designs like the single spring seal, double spring seal, and wave spring seal for various speed and pressure conditions. The use of metal bellows seal and elastomeric seal technologies enhances reliability across industries. Precision leakage rate calculation and durable compensator design play vital roles in seal performance. Proper maintenance procedures are critical to ensure longevity and minimize downtime.

- Secondary seal selection and cartridge seal assembly designs are becoming increasingly crucial for maintaining optimal system performance. Corrosion protection methods, such as the use of specific sealing ring materials, are also gaining traction to ensure longer seal life. Pressure relief valves and a troubleshooting guide are essential components of seal systems, helping to minimize leakage rates and optimize flush system design. Face deformation analysis and thermal shock resistance are critical considerations for high-temperature seals, ensuring their ability to withstand harsh operating conditions.

- In conclusion, the market is characterized by continuous innovation and adaptation to meet the evolving needs of various industries. With a focus on improving seal performance, reducing downtime, and enhancing system efficiency, manufacturers are exploring new materials, designs, and technologies to meet the demands of an ever-changing market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mechanical Seals Market insights. See full methodology.

Mechanical Seals Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 1750.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, China, Japan, Germany, UK, Canada, India, South Korea, France, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mechanical Seals Market Research and Growth Report?

- CAGR of the Mechanical Seals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mechanical seals market growth of industry companies

We can help! Our analysts can customize this mechanical seals market research report to meet your requirements.