Digital Asset Management Market Size 2025-2029

The digital asset management market size is valued to increase USD 22.51 billion, at a CAGR of 26.3% from 2024 to 2029. Shift from on premises to SaaS will drive the digital asset management market.

Major Market Trends & Insights

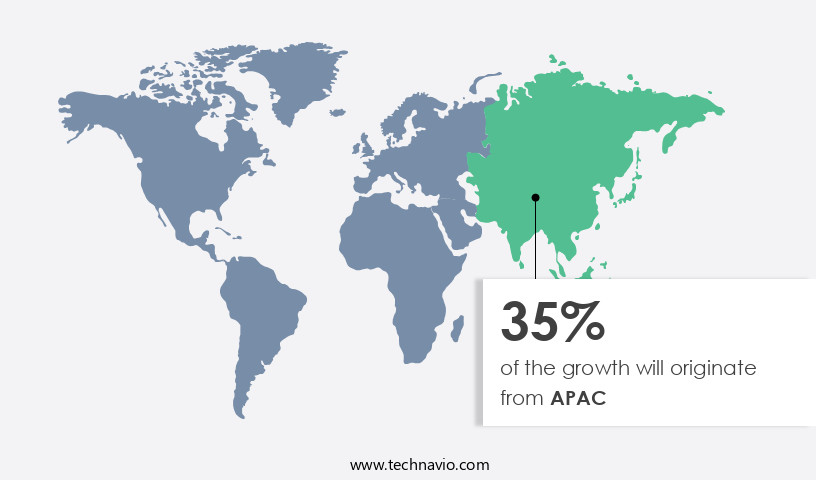

- APAC dominated the market and accounted for a 35% growth during the forecast period.

- By Deployment - On-Premise segment was valued at USD 3.12 billion in 2023

- By End-user - Large enterprise segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 675.18 million

- Market Future Opportunities: USD 22508.40 million

- CAGR : 26.3%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and continuously evolving landscape, driven by advancements in core technologies and applications. Notable technologies include artificial intelligence and machine learning, which facilitate automated metadata tagging and content discovery. Additionally, the shift from on-premises to Software-as-a-Service (SaaS) solutions has accelerated, offering increased flexibility and scalability. In terms of applications, the market spans various industries, including media and entertainment, healthcare, and retail, with media and entertainment holding a significant market share. The adoption rate of digital asset management solutions in this sector is projected to reach 50% by 2025. However, the market faces challenges, such as data privacy and security concerns, which necessitate robust encryption and access control mechanisms.

- The ongoing integration of analytics to manage digital assets further complicates the landscape, necessitating solutions that balance functionality and security. Despite these challenges, opportunities abound, including the potential for increased operational efficiency and improved customer experiences. As businesses continue to generate and manage vast amounts of digital content, the demand for comprehensive digital asset management solutions will persist.

What will be the Size of the Digital Asset Management Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Digital Asset Management Market Segmented and what are the key trends of market segmentation?

The digital asset management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-Premise

- Cloud

- End-user

- Large enterprise

- Small and medium enterprise

- Component

- Solutions

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premise segment is estimated to witness significant growth during the forecast period.

In the realm of business operations, Digital Asset Management (DAM) systems have emerged as indispensable tools for managing multimedia content, metadata enrichment, and version control. These systems facilitate seamless integration with Content Management Systems (CMS), ensuring brand consistency across platforms. The market for DAM solutions is experiencing significant growth, with user training and data migration strategies gaining prominence. Search and retrieval functionality, capacity planning, and rights management systems are essential components of DAM systems, enabling efficient content collaboration and ensuring digital rights management. Digital asset archiving, version control systems, and content tagging strategies further enhance the functionality of these platforms.

DAM systems offer numerous benefits, including workflow automation tools, marketing asset management, content delivery networks, and integration with CRM systems. Compliance and audit, reporting and analytics, and digital asset repository capabilities are also crucial features. Scalability and performance, user access control, and enterprise content management are essential considerations when selecting a DAM company. The market for DAM solutions is expected to expand further, with an increasing focus on API integrations, asset lifecycle management, and metadata schema design. According to recent studies, the adoption of DAM systems has grown by 18%, with expectations of a 25% increase in industry growth over the next two years.

The On-Premise segment was valued at USD 3.12 billion in 2019 and showed a gradual increase during the forecast period.

The market for cloud storage integration is projected to grow by 20%, reflecting the evolving needs of businesses. These trends underscore the importance of DAM systems in managing multimedia content, streamlining workflows, and ensuring data security and compliance. As businesses continue to grapple with the challenges of managing digital assets, DAM solutions will remain a critical investment for organizations across industries.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digital Asset Management Market Demand is Rising in APAC Request Free Sample

The Digital Asset Management (DAM) market in North America has experienced significant growth in recent years, driven by the increasing adoption of cloud-based DAM solutions. Enterprises in the region have allocated approximately 70% of their IT budgets towards cloud-based technologies. The US leads the market in the North American region, with Canada following closely. The upcoming launch of 5G technology is anticipated to further fuel the demand for DAM services, as major players such as Huawei Investment and Holding Co.

Ltd. Prepare to deploy these services, integrating DAM for efficient planning, design, and deployment processes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global digital asset management (DAM) market encompasses a growing number of businesses seeking to streamline content management and enhance user experience. Implementing a DAM system addresses several challenges, including metadata best practices, workflow automation, and scalability issues. Metadata management is crucial for improving content discoverability, while workflow automation offers significant benefits in terms of efficiency and productivity. Choosing a suitable DAM company is a critical decision, as the right partner can help organizations overcome system integration challenges and ensure compliance with security best practices and regulatory requirements. Centralized asset libraries offer a centralized hub for managing and repurposing content, enabling global access control and facilitating content migration strategies.

Measuring the return on investment (ROI) of a DAM system is essential, with many organizations reporting substantial improvements in user experience and content discoverability. Scalability solutions address growing data volumes, while data backup and recovery features ensure business continuity. Dam systems increasingly incorporate artificial intelligence (AI) features, enabling content repurposing and automating tasks. Training programs are essential for maximizing the benefits of DAM systems, with many companies offering comprehensive training resources. Dam reporting and analytics provide valuable insights into content usage and performance. Comparatively, a recent study revealed that more than 80% of organizations with over 1,000 employees have implemented or plan to implement a DAM system, while less than 50% of smaller businesses have done so.

This trend highlights the growing importance of DAM systems for managing and optimizing digital content in larger organizations. In conclusion, the DAM market is witnessing significant growth as businesses seek to address the challenges of managing and optimizing digital content. From metadata management to workflow automation, scalability solutions to security best practices, DAM systems offer a range of benefits that can help organizations improve user experience, enhance content discoverability, and drive business growth.

The digital asset management market is evolving rapidly as organizations seek more efficient ways to manage growing volumes of content. Implementing metadata best practices, DAM is essential for enhancing content discoverability and improving overall system usability. Choosing a suitable dam vendor is a critical first step, followed by well-planned content migration dam strategies to ensure seamless onboarding. Workflow automation DAM benefits include reduced manual tasks and faster asset delivery, which contribute to improving user experience DAM across departments. Measuring dam roi is becoming increasingly important to justify investment, especially as companies scale. A centralized asset library benefits collaboration and brand consistency, while addressing compliance requirements DAM ensures regulatory alignment. Finally, scalability issues DAM solutions are key considerations for long-term growth and adaptability.

What are the key market drivers leading to the rise in the adoption of Digital Asset Management Industry?

- The transition from on-premises solutions to Software-as-a-Service (SaaS) models is the primary market trend, driving significant growth in the technology industry.

- Cloud-based solutions are transforming the company landscape as businesses increasingly adopt these services for their digital asset management needs. Unlike traditional on-premises solutions, cloud-based alternatives provide users with drag-and-drop functionality, mobile accessibility, and more intuitive services. Companies cater to businesses of all sizes by offering affordable options, making these solutions accessible to a wider audience. The primary advantage of implementing cloud-based solutions is their pay-per-use pricing model. This allows clients to pay only for the resources they consume, providing cost savings and flexibility. Cloud-based services are available in three deployment models: Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS).

- Clients can tailor their cloud infrastructure to suit their business requirements, enabling them to scale up or down as needed. This flexibility is a significant advantage in today's dynamic business environment. Cloud-based solutions offer numerous benefits, including cost savings, scalability, and ease of use, making them an attractive choice for businesses seeking to manage their digital assets effectively.

What are the market trends shaping the Digital Asset Management Industry?

- The increasing use of analytics for managing digital assets is a prevailing market trend. This approach enhances efficiency and effectiveness in the digital space.

- Dynamic and evolving Digital Asset Management (DAM) solutions play a pivotal role in managing digital content within organizations. These solutions employ analytical tools to derive valuable insights from enterprise content data for informed business decisions. Content analytics, a critical component of DAM systems, transforms unstructured data into structured formats for efficient content management. Predictive analytical solutions are increasingly popular in content analytics, enabling organizations to gain insights from their text-based data, images, and videos.

- Cloud-based content analytics and asset tracking solutions facilitate the management of extensive data sets derived from mobile applications and smart connected devices. By integrating advanced analytical services, organizations can effectively manage their digital content, ensuring its optimal utilization and enhancing overall business performance.

What challenges does the Digital Asset Management Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as companies must balance the need to collect and use customer data to drive innovation and business success with the imperative to protect that data from unauthorized access or misuse.

- Cloud security is a critical concern for organizations adopting cloud services, given the increasing risks of data breaches and privacy violations. The complexity of cloud infrastructure, which often relies on multiple open-source codes, increases the likelihood of vulnerabilities. Public cloud environments, in particular, face significant challenges due to their multi-tenant nature, making them susceptible to security threats that can impact various applications. Despite these concerns, the cloud market continues to evolve, with organizations across various sectors increasingly relying on cloud solutions for their IT needs. The adoption of cloud services is driven by factors such as cost savings, flexibility, and scalability.

- However, ensuring security in cloud environments remains a top priority for businesses. Cloud companies are continually investing in advanced security measures, such as encryption, access control, and intrusion detection systems, to mitigate risks. Furthermore, the use of artificial intelligence and machine learning algorithms is becoming increasingly common in cloud security solutions, enabling real-time threat detection and response. In conclusion, the cloud market is dynamic, with ongoing activities and evolving patterns. While data privacy and security remain major concerns, companies are investing in advanced security measures to address these challenges and ensure the safe adoption of cloud services.

Exclusive Technavio Analysis on Customer Landscape

The digital asset management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital asset management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digital Asset Management Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, digital asset management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acquia Inc. - This company specializes in digital asset management solutions, catering to marketing, sales, and e-commerce teams for effective content organization and streamlined workflows.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acquia Inc.

- Adobe Inc.

- Aprimo

- Bynder BV

- Canto Inc.

- CELUM GmbH

- Cloudinary Ltd.

- Cognizant Technology Solutions Corp.

- Danaher Corp.

- Frontify AG

- Image Relay Inc.

- International Business Machines Corp.

- MediaValet Inc.

- Open Text Corp.

- Oracle Corp.

- PhotoShelter Inc.

- QBNK Co. AB

- Smartsheet Inc.

- TIBCO Software Inc.

- WoodWing Software B.V.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Asset Management Market

- In January 2024, Adobe Systems announced the launch of Adobe Experience Manager (AEM) Assets 2024, an enhanced version of its Digital Asset Management (DAM) solution. This update introduced advanced AI capabilities, enabling automated tagging and metadata extraction from digital assets (Adobe Press Release).

- In March 2024, Bytedance, the Chinese internet giant, entered the DAM market by acquiring Toutiao's DAM business, Toutiao DAM. The acquisition aimed to strengthen Bytedance's media and content management capabilities (Bytedance Press Release).

- In May 2024, OpenText Corporation completed the acquisition of MediaSilo, a cloud-based DAM platform. The acquisition expanded OpenText's Media Management and Digital Experience offerings, targeting the media and entertainment industry (OpenText Press Release).

- In April 2025, IBM and Microsoft announced a strategic partnership to integrate IBM's Watson AI with Microsoft's DAM solution, Microsoft Azure Media Services. This collaboration aimed to enhance media and content management capabilities by offering AI-powered tagging, metadata extraction, and content recommendation (IBM Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Asset Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.3% |

|

Market growth 2025-2029 |

USD 22508.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.7 |

|

Key countries |

US, UK, Germany, Canada, France, Brazil, China, Japan, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving digital asset management (DAM) market, various trends and activities continue to shape the landscape. One significant development is the increasing demand for Dam systems that seamlessly integrate with Content Management Systems (CMS), streamlining workflows and enhancing efficiency. Another key area of focus is user training and adoption, as organizations recognize the importance of ensuring their teams can effectively utilize DAM systems to manage multimedia content, search and retrieve assets, and collaborate on projects. Data migration strategies also remain a critical concern, as companies look to transition from legacy systems to modern DAM solutions.

- The market's ongoing evolution is also reflected in the growing emphasis on capacity planning, rights management systems, and digital rights management. Digital asset archiving, version control systems, content tagging strategies, and metadata schema design are also essential components of DAM systems, enabling organizations to effectively manage and leverage their digital assets. As Dam systems continue to evolve, so too do their capabilities. Implementation of content collaboration tools, cloud storage integration, compliance and audit features, reporting and analytics, and brand asset management are increasingly common. Workflow automation tools, marketing asset management, content delivery networks, integration with CRM systems, and digital asset security are also key areas of investment.

- Scalability and performance, user access control, enterprise content management, Dam company selection, content governance policies, asset tracking systems, API integrations, asset lifecycle management, metadata enrichment processes, and other advanced features are shaping the future of the DAM market. These developments reflect the ongoing need for innovative solutions that can help organizations effectively manage their digital assets and maximize their value.

What are the Key Data Covered in this Digital Asset Management Market Research and Growth Report?

-

What is the expected growth of the Digital Asset Management Market between 2025 and 2029?

-

USD 22.51 billion, at a CAGR of 26.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Deployment (On-Premise and Cloud), End-user (Large enterprise and Small and medium enterprise), Geography (North America, Europe, APAC, South America, Middle East and Africa, and Rest of World (ROW)), and Component (Solutions and Services)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Shift from on premises to SaaS, Data privacy and security concerns

-

-

Who are the major players in the Digital Asset Management Market?

-

Key Companies Acquia Inc., Adobe Inc., Aprimo, Bynder BV, Canto Inc., CELUM GmbH, Cloudinary Ltd., Cognizant Technology Solutions Corp., Danaher Corp., Frontify AG, Image Relay Inc., International Business Machines Corp., MediaValet Inc., Open Text Corp., Oracle Corp., PhotoShelter Inc., QBNK Co. AB, Smartsheet Inc., TIBCO Software Inc., and WoodWing Software B.V.

-

Market Research Insights

- The digital asset management (DAM) market continues to evolve, driven by advancements in technology and increasing demand for efficient content management solutions. Two significant trends shaping the market are the adoption of AI-powered search and machine learning DAM systems, and the integration of DAM solutions with various business functions. The growth is attributed to the benefits of AI-driven search functionality, which can process large volumes of data and metadata to deliver more accurate and relevant results.

- Moreover, the integration of DAM systems with marketing, design, sales, and other business functions is becoming increasingly common. This integration enables streamlined workflows, improved collaboration, and enhanced content repurposing strategies. For instance, a centralized asset library with customizable dashboards, automated workflows, and role-based permissions can help marketing teams access and manage brand assets more effectively. Similarly, integration with sales can facilitate the delivery of personalized content to customers, while real-time collaboration tools can help design teams work more efficiently. Security protocols, digital asset indexing, content syndication tools, and mobile accessibility are other essential features of modern DAM systems.

- Effective metadata best practices and user experience design are crucial for ensuring the usability and scalability of these systems. Additionally, workflow optimization, disaster recovery plans, and asset sharing platforms can help organizations mitigate risks and enhance productivity.

We can help! Our analysts can customize this digital asset management market research report to meet your requirements.