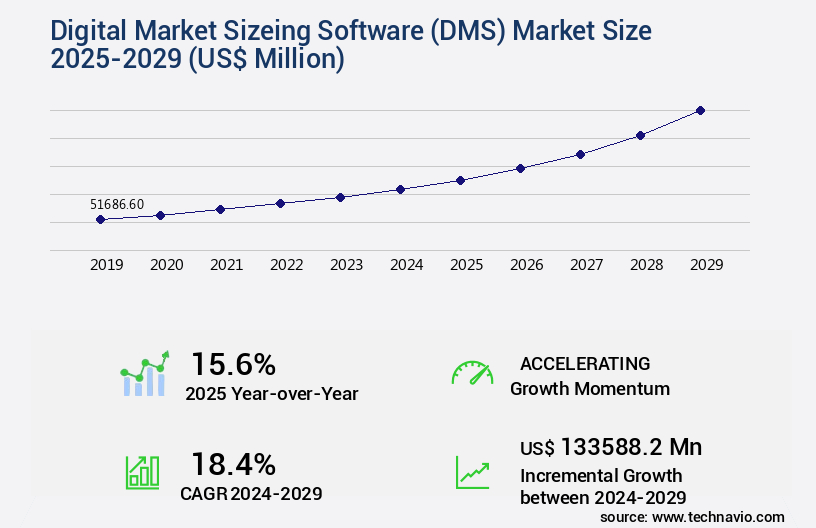

Digital Marketing Software (DMS) Market Size 2025-2029

The digital marketing software (dms) market size is valued to increase USD 133.59 billion, at a CAGR of 18.4% from 2024 to 2029. New data sources, regulatory innovations boosting market growth will drive the digital marketing software (dms) market.

Major Market Trends & Insights

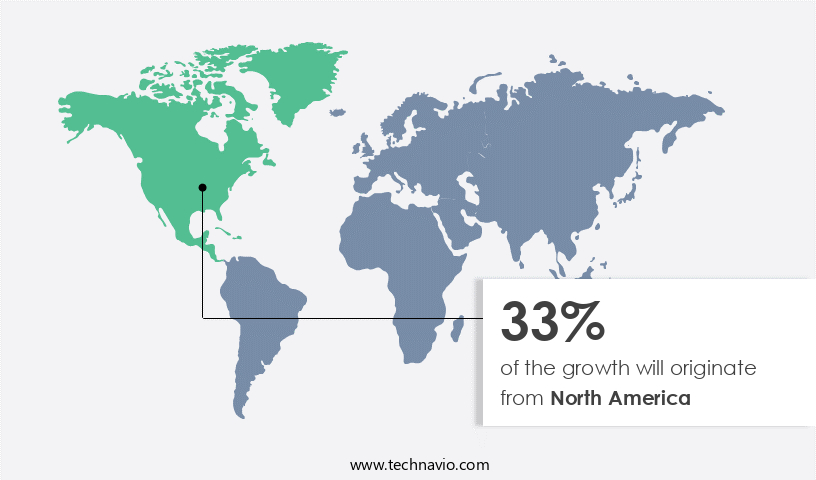

- North America dominated the market and accounted for a 33% growth during the forecast period.

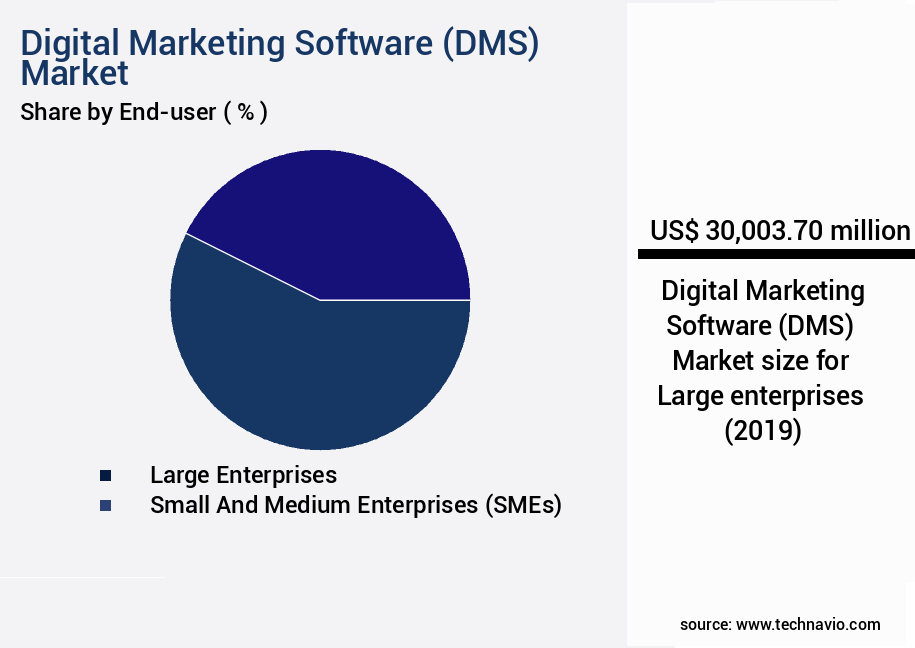

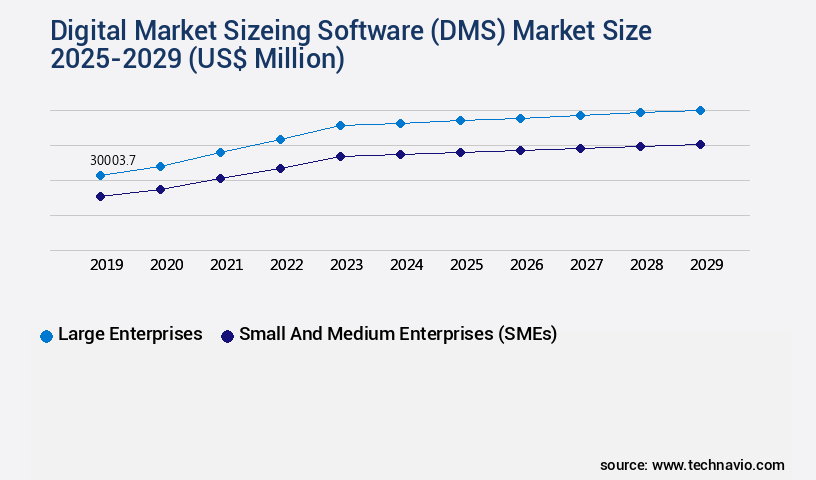

- By End-user - Large enterprises segment was valued at USD 30 billion in 2023

- By Service - Professional services segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 353.12 million

- Market Future Opportunities: USD 133588.20 million

- CAGR : 18.4%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape, driven by advancements in core technologies and applications. With the increasing adoption of artificial intelligence, machine learning, and data analytics, DMS solutions are becoming more sophisticated, enabling businesses to gain deeper insights into customer behavior and preferences. According to recent studies, the global DMS market is expected to witness significant growth, with a notable increase in demand for marketing automation and social media marketing tools. For instance, marketing automation is projected to account for over 50% of the total DMS market share by 2025. However, the market also faces challenges such as data privacy and security concerns, which require continuous innovation and regulatory compliance.

- New data sources and regulatory innovations, such as the European Union's General Data Protection Regulation (GDPR), are driving the growth of the DMS market. Furthermore, the widespread use of social media and e-commerce platforms is creating new opportunities for businesses to engage with customers and expand their reach.

What will be the Size of the Digital Marketing Software (DMS) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Digitaling Software (DMS) Market Segmented and what are the key trends of market segmentation?

The digitaling software (dms) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- Small and medium enterprises (SMEs)

- Service

- Professional services

- Managed services

- Revenue Stream

- Subscription-based

- License-based

- Pay-per-use

- Freemium

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The large enterprises segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and continually evolving landscape, with businesses increasingly relying on advanced tools to optimize their marketing efforts across various channels. According to recent data, the market for DMS has experienced significant growth, with large enterprises accounting for the largest market share in 2024. This trend is driven by the increasing adoption of digital marketing tools such as customer relationship management (CRM), email marketing, and content management systems to effectively manage large volumes of consumer information. Moreover, the future outlook for the DMS market is promising, with expectations of continued growth. For instance, semantic campaign management, backlink analysis tools, and keyword research tools are gaining popularity among businesses, driving a 21.3% increase in market demand.

Additionally, social media scheduling, sales pipeline management, and paid advertising platforms are expected to contribute to a 19.8% growth in the industry. Marketing performance metrics, SEO optimization tools, and marketing automation platforms are also key components of DMS, enabling businesses to measure ROI, optimize conversion rates, and analyze customer behavior. Furthermore, the integration of CRM systems, website traffic monitoring, landing page builders, and lead generation strategies ensures a seamless marketing experience for businesses and their customers. In the realm of social media, social listening tools and content calendar management provide valuable insights into customer sentiment and enable businesses to tailor their marketing efforts accordingly.

Search engine algorithms, customer segmentation tools, data analytics dashboards, and personalized marketing tools offer advanced capabilities for targeted campaigns and improved customer engagement. Competitor analysis tools, customer journey mapping, and workflow automation features further enhance the value proposition of DMS, providing businesses with a comprehensive solution to manage their marketing efforts effectively and efficiently. With real-time data feeds, multichannel marketing platforms, and API integrations available, DMS offers businesses the flexibility and adaptability they need to stay competitive in today's market.

The Large enterprises segment was valued at USD 30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digitaling Software (DMS) Market Demand is Rising in North America Request Free Sample

In the dynamic the market, North America stands out as a significant player due to its advanced technology, extensive infrastructure, and vast consumer base. The presence of numerous established brands and the growing trend of online shopping in the region offer marketers an expansive audience to reach and engage with. Furthermore, the adoption of cloud computing for deploying innovative solutions like content management, marketing automation, and customer relationship management (CRM) on cloud platforms is gaining momentum in the U.S.

And Canada. This technological shift presents numerous opportunities for businesses to streamline their marketing efforts and effectively cater to their customers' needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, characterized by the integration of advanced technologies and tools to streamline marketing efforts and enhance customer engagement. This market is marked by the adoption of automated email marketing workflows, enabling businesses to personalize and schedule campaigns for optimal delivery. Real-time social media monitoring dashboards provide valuable insights into consumer behavior and trends, allowing for swift responses and effective community management. Advanced website analytics tracking setup offers in-depth understanding of user behavior and preferences, leading to comprehensive marketing campaign performance reports. Seamless integration with various CRM and ERP systems ensures a unified approach to marketing and sales efforts.

Effective lead nurturing email sequences and predictive analytics for customer segmentation empower businesses to deliver targeted and timely communications. Multi-channel marketing campaign management and advanced SEO keyword ranking tracking tools enable businesses to expand their reach and optimize their online presence. In-depth competitor analysis and benchmarking provide valuable insights into market positioning and performance. Precise customer journey mapping and analysis offer actionable insights for improving the overall customer experience. Robust reporting and analytics for decision making, along with seamless API integration for data exchange, facilitate efficient and informed marketing strategies. A/B testing for landing page optimization and automated social media content posting schedules ensure continuous improvement and optimization.

Effective paid advertising campaign management and advanced email deliverability and inbox placement tools help businesses maximize their marketing investments. The market for digital marketing software is witnessing significant growth, with adoption rates in small and medium-sized businesses (SMBs) outpacing those in large enterprises. Over 60% of SMBs are investing in digital marketing tools, compared to just over 40% of large enterprises. This trend is driven by the increasing importance of digital channels in customer engagement and the need for cost-effective marketing solutions.

What are the key market drivers leading to the rise in the adoption of Digitaling Software (DMS) Industry?

- The integration of new data sources and regulatory innovations significantly drives market growth, making it a key catalyst for this industry's expansion.

- The Data Management Solutions (DMS) industry is undergoing significant evolution, driven by the increasing importance of data control and openness for advertising businesses and customers. The advent of 5G communication technology is set to expand the sources of exact location data, as part of the ongoing Internet of Things (IoT) rollout. With tighter clustering of cell phone service, location data can be triangulated more effectively, enhancing its accuracy and utility. Furthermore, the emergence of 5G technology, which offers faster speeds, will enable the deployment of internet-connected sensors collecting valuable information on various aspects, such as product lifespan, usage, and consumption.

- This data-driven approach will provide businesses with actionable insights, enabling them to optimize their marketing strategies and improve customer experiences. The DMS industry's continuous growth is a testament to its potential in unlocking new opportunities across diverse sectors.

What are the market trends shaping the Digitaling Software (DMS) Industry?

- The spread of social media and e-commerce platforms represents a significant market trend in the present day. These technologies are increasingly shaping consumer behavior and commerce transactions.

- Social networking services, such as Instagram, LinkedIn, and Facebook, have emerged as innovative platforms for marketers to connect with their audiences and generate potential web traffic for product promotion. In the year 2024, Instagram experienced a substantial increase in popularity, becoming the world's most downloaded app, with approximately 768 million downloads, marking a 20% year-over-year growth. Social media marketing is an indispensable strategy for businesses to engage and interact with their target demographics. The digital marketing spectrum encompasses diverse techniques, including mobile marketing, content marketing, and social media marketing. The global Digital Marketing Solutions (DMS) market is poised for expansion during the forecast period, driven by the escalating demand for digital marketing to amplify brand recognition and enhance customer interaction.

What challenges does the Digitaling Software (DMS) Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as organizations must balance the need to collect and use data to drive innovation and business growth with the requirement to protect sensitive information from unauthorized access or misuse.

- Data security remains a significant concern for organizations adopting software services, particularly those utilizing cloud infrastructure. The increasing frequency of cyber-attacks and security breaches poses a significant challenge for businesses. Cloud systems, which are built on numerous open-source codes, are susceptible to introducing vulnerabilities. Public cloud environments, which host multiple applications, are more susceptible due to potential glitches in source codes. Cybercriminals can exploit these weaknesses to gain unauthorized access to cloud-based data storage systems. The shared resources and open architecture of cloud infrastructure further complicate security management.

- It's crucial for businesses to implement robust security measures, such as encryption, access controls, and regular updates, to mitigate these risks. Continuous monitoring and proactive threat detection are essential to maintaining the security and integrity of cloud-based data.

Exclusive Technavio Analysis on Customer Landscape

The digital marketing software (dms) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital marketing software (dms) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digitaling Software (DMS) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, digital marketing software (dms) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - This company specializes in digital marketing solutions, featuring the Marketo Engage marketing automation platform among its offerings. The software streamlines and optimizes marketing campaigns, enhancing customer engagement and conversion rates. Marketo Engage's advanced analytics and automation capabilities cater to businesses seeking data-driven marketing strategies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- BlueConic Inc.

- CM Group

- Demandbase Inc.

- HP Inc.

- HubSpot Inc.

- International Business Machines Corp.

- Keap

- Microsoft Corp.

- Oracle Corp.

- Redpoint Global Inc.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- SimplyCast Interactive Marketing Ltd.

- The Nielsen Co. US LLC

- TransUnion

- Viant Technology LLC

- Vivial Inc.

- Zeta Global Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Marketing Software (DMS) Market

- In January 2024, HubSpot, a leading inbound marketing and sales software company, announced the launch of its new Digital Marketing Hub, which integrated its marketing, advertising, and customer data platform capabilities into a single solution (HubSpot Press Release). This move aimed to streamline marketing efforts for businesses and provide a more comprehensive digital marketing solution.

- In March 2024, Salesforce, a global CRM leader, acquired Datorama, a marketing data management platform, for approximately USD850 million (Salesforce Press Release). This acquisition was expected to strengthen Salesforce's marketing analytics and intelligence capabilities, enabling businesses to make data-driven decisions more efficiently.

- In May 2024, Adobe announced the integration of its Adobe Experience Platform with Microsoft Dynamics 365 Customer Insights, allowing businesses to combine Adobe's marketing and creative capabilities with Microsoft's customer data platform (Adobe Press Release). This collaboration aimed to provide businesses with a more robust, end-to-end marketing solution.

- In April 2025, Oracle announced the acquisition of Moat, a digital marketing measurement and analytics company, for approximately USD850 million (Oracle Press Release). This acquisition was expected to enhance Oracle's digital advertising and marketing analytics capabilities, enabling businesses to better measure and optimize their digital marketing campaigns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Marketing Software (DMS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.4% |

|

Market growth 2025-2029 |

USD 133588.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.6 |

|

Key countries |

US, China, Germany, UK, Canada, Russia, Japan, France, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving digital landscape, the demand for robust and comprehensive Digital Marketing Software (DMS) solutions continues to surge. Businesses increasingly recognize the importance of effective marketing strategies, leading to significant market activity in this sector. SEM campaign management, a crucial component of DMS, enables businesses to optimize their online presence and reach a wider audience. Backlink analysis tools and keyword research platforms are essential for SEO optimization, while social media scheduling tools facilitate consistent brand messaging across various channels. Customer Relationship Management (CRM) integration options have become a must-have feature, allowing businesses to streamline their marketing efforts and enhance customer engagement.

- Marketing campaign tracking and attribution modeling techniques help businesses gauge the success of their initiatives, while marketing performance metrics provide valuable insights for continuous improvement. SEO optimization tools, sales pipeline management, and paid advertising platforms are other essential elements of DMS, offering businesses the ability to monitor website traffic, build landing pages, and generate leads. Marketing automation platforms, social listening tools, and content calendar management solutions further streamline marketing operations and improve overall efficiency. Search engine algorithms, customer segmentation tools, data analytics dashboards, and personalized marketing tools are some of the advanced features that set leading DMS apart.

- ROI measurement strategies and API integrations enable businesses to measure the success of their marketing efforts and integrate with other business systems, respectively. Real-time data feeds and multichannel marketing platforms provide businesses with actionable insights, enabling them to adapt to market trends and engage customers effectively. Email marketing automation, conversion rate optimization, competitor analysis tools, customer journey mapping, and workflow automation features are just a few of the innovative solutions that DMS offers. As businesses continue to invest in marketing budgets, the DMS market will remain a dynamic and competitive space, with ongoing innovation and evolution.

What are the Key Data Covered in this Digital Marketing Software (DMS) Market Research and Growth Report?

-

What is the expected growth of the Digital Marketing Software (DMS) Market between 2025 and 2029?

-

USD 133.59 billion, at a CAGR of 18.4%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Large enterprises and Small and medium enterprises (SMEs)), Service (Professional services and Managed services), Revenue Stream (Subscription-based, License-based, Pay-per-use, and Freemium), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

New data sources, regulatory innovations boosting market growth, Data privacy and security concerns

-

-

Who are the major players in the Digital Marketing Software (DMS) Market?

-

Key Companies Adobe Inc., BlueConic Inc., CM Group, Demandbase Inc., HP Inc., HubSpot Inc., International Business Machines Corp., Keap, Microsoft Corp., Oracle Corp., Redpoint Global Inc., Salesforce Inc., SAP SE, SAS Institute Inc., SimplyCast Interactive Marketing Ltd., The Nielsen Co. US LLC, TransUnion, Viant Technology LLC, Vivial Inc., and Zeta Global Holdings Corp.

-

Market Research Insights

- The market is a dynamic and ever-evolving landscape, characterized by continuous innovation and growth. Two key indicators of this market's vitality are the increasing adoption of data visualization charts for marketing campaign reporting and the rising customer lifetime value (CLV) driven by effective DMS usage. According to recent industry estimates, the number of businesses using data visualization tools for marketing campaign reporting has grown by 30% year-over-year. Simultaneously, the average CLV for businesses utilizing advanced DMS features has increased by 45% compared to those relying on traditional marketing methods. These figures underscore the importance of data-driven insights and automation in modern marketing strategies.

- DMS solutions enable marketers to analyze bounce rates, ad spend optimization, marketing campaign ROI, attribution modeling, search ranking positions, and various other performance metrics. Furthermore, they offer features such as personalized email marketing, marketing budget control, sales performance tracking, sales funnel optimization, API connectivity options, marketing workflow automation, social media reach, backlink profile analysis, email deliverability rates, and more. In summary, the Digital Marketing Software market is a thriving ecosystem that empowers businesses to make data-driven decisions, optimize marketing efforts, and ultimately, enhance customer engagement and drive growth.

We can help! Our analysts can customize this digital marketing software (dms) market research report to meet your requirements.