What is the Size of Diphenyl Oxide Market?

The diphenyl oxide market size is forecast to increase by USD 265.3 million, at a CAGR of 6% between 2023 and 2028. The market is witnessing significant growth, driven by the increasing demand in various industries such as aroma chemicals, flame retardants, electronics, cosmetics, and pharmaceuticals. Innovations in product development, including the exploration of new applications, are propelling market expansion. However, the availability of alternative options poses a challenge to market growth. In the pharmaceutical sector, diphenyl oxide finds extensive use in the synthesis of anticonvulsants, antibiotics, and antifungals. In the chemicals industry, it serves as a valuable solvent. Furthermore, stringent fire safety regulations in various sectors are fueling the demand for diphenyl oxide as a flame retardant. The petrochemical industry also contributes to market growth due to the widespread use of diphenyl oxide as a building block in the production of other chemicals. Despite these growth factors, the market faces challenges from the high production costs and the potential health hazards associated with its use. Nevertheless, the market's potential for innovation and the expanding applications in various industries make it an attractive proposition for investors and stakeholders.

Request Free Diphenyl Oxide Market Sample

Market Segmentation

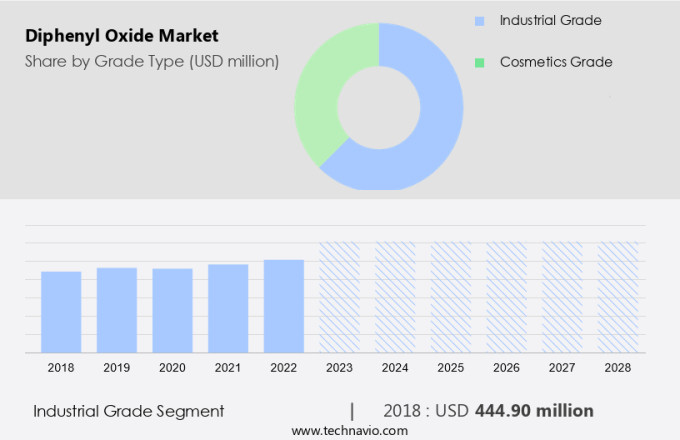

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Grade Type

- Industrial grade

- Cosmetics grade

- Type

- Liquid

- Colorless crystal

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- Middle East and Africa

- South America

- APAC

Which is the Largest Segment Driving Market Growth?

The industrial grade segment is estimated to witness significant growth during the forecast period. Diphenyl oxide is a significant form of this compound, recognized for its colorless appearance and mild, agreeable scent. The aroma of liquid diphenyl oxide is notably potent, redolent of pelargonium leaves, with a slightly phenolic, harsh-sweetish note that hints at camphor and anethole. This olfactory profile renders it an essential component in various industrial applications, predominantly in the fragrance and flavor industries. Liquid diphenyl oxide's primary use lies in the formulation of perfumes and other scented products. Its unique scent profile enables it to function as a vital ingredient in creating intricate and alluring fragrances. Its compatibility with other aromatic compounds amplifies its significance in the production of top-tier perfumes, deodorants, and personal care products.

Get a glance at the market share of various regions Download the PDF Sample

The industrial grade segment was valued at USD 444.90 million in 2018. Beyond the fragrance industry, diphenyl oxide finds applications in chemical synthesis, heat transfer agents, resins, and foaming agents. In the chemical industry, it is used as a solvent and a reagent in the synthesis of various organic compounds. In the manufacturing sector, it is employed as a heat transfer agent to facilitate efficient temperature control during industrial processes. Moreover, in the production of resins, diphenyl oxide serves as a crucial intermediate, contributing to the formation of complex polymers. Lastly, its foaming properties make it an essential component in the creation of stable foams used in various industrial applications. In summary, diphenyl oxide is a versatile compound with a wide range of applications, from the production of perfumes and other scented products to chemical synthesis, heat transfer, resin manufacturing, and foam production. Its unique properties, including its colorless appearance, mild odor, and compatibility with various compounds, make it an indispensable ingredient in numerous industrial processes.

Which Region is Leading the Market?

For more insights on the market share of various regions Request Free Sample

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific (APAC) region, particularly China and India, is witnessing significant industrial expansion, leading to a rise in demand for diphenyl oxide. This demand is primarily driven by the increasing requirement for heat transfer fluids and flame retardants in these rapidly industrializing economies. China, as a major economic powerhouse in the region, has exhibited a notable rise in industrial production.

In August 2024, industrial output in China grew by 4.5% year-on-year, despite slight underperformance against market forecasts. This growth underscores the industrial activity in the country. Rapid industrialization and urbanization in China are primary factors fueling the increasing demand for diphenyl oxide. Its essential role in high-temperature processes and safety applications makes it indispensable in various industries, including chemical plants, solar power plants, and pharmaceutical drug manufacturing. Diphenyl oxide is also extensively used in the production of fragrances, personal care products, surfactants, polymers, and emulsifying agents. Furthermore, it is a crucial component in the manufacturing of plastic products due to its excellent heat stability and insulating properties. In summary, the industrial growth in the APAC region, particularly China and India, is driving the demand for diphenyl oxide across various industries. Its versatile applications in heat transfer fluids, flame retardants, and various chemical processes make it an indispensable component in the region's industrial landscape.

How do Technavio’s company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Avantor Inc. - The company offers diphenyl oxide phenoxybenzene 101-84-8, which is utilized in a variety of industrial applications including textile auxiliaries, heat transfer media, and others.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- ALPHA CHEMIKA

- Dow Inc.

- Eastman Chemical Co.

- Ernesto Ventos SA

- Kdac Chem Pvt. Ltd.

- KUNSHAN ODOWELL CO. LTD.

- Lanxess AG

- LGC Ltd

- Loba Chemie Pvt. Ltd.

- Merck KGaA

- Muby Chem Ltd

- Otto Chemie Pvt. Ltd.

- Pell Wall Ltd.

- Schultz Canada Chemicals Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- The Good Scents Co.

- Vizag Chemical International

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2023-2024 |

5.6 |

Market Dynamic

Diphenyl oxide, also known as diphenyl ether, is a vital organic molecule with the chemical formula C12H10O. This colorless liquid is a derivative of biphenyl, a structural class of organic compounds consisting of two benzene rings linked by a methylene bridge. Diphenyl oxide undergoes various chemical reactions such as hydroxylation, halogenation, nitration, Friedel-Crafts alkylation, and sulfonation, making it a versatile compound in the chemical industry. Diphenyl oxide is widely used in various applications, including heat transfer fluids, aroma chemicals, flame retardants, and industrial surfactants. In the energy sector, it is employed in the production of polymer materials for solar power plants and oil and gas industries. Heat transfer fluids are essential in various industries, including power generation, HVAC systems, and chemical processing. Diphenyl oxide's high thermal stability and low volatility make it an ideal choice for heat transfer fluids. Aroma chemicals are essential components in the food and beverage industry, and diphenyl oxide is used as a fragrance chemical in various applications. Its unique aroma profile makes it a popular choice in the production of perfumes and personal care products, including cosmetics. Flame retardants are essential in various industries to prevent or slow down the spread of fire. Diphenyl oxide's ability to act as a flame retardant makes it a valuable compound in the production of plastics and other materials used in construction and electronics. Industrial surfactants are used in various applications, including oil recovery, paper and textile industries, and in the production of detergents and cleaning agents. Diphenyl oxide's ability to act as a surfactant makes it a valuable compound in these industries.

In the polymer industry, diphenyl oxide is used in the production of polymers for various applications, including solar power plants and oil and gas industries. Its high thermal stability and chemical resistance make it an ideal choice for these applications. Diphenyl oxide's boiling point is 256°C, making it a solid at room temperature and a liquid at high temperatures. This property makes it suitable for various applications that require a stable liquid at high temperatures. In conclusion, diphenyl oxide is a versatile organic molecule with a wide range of applications in the chemical industry. Its unique properties make it an essential component in various applications, including heat transfer fluids, aroma chemicals, flame retardants, industrial surfactants, and polymer production. Its wide range of applications and unique properties make it a valuable compound in various industries, including energy, food and beverage, and construction. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

Increasing demand for diphenyl oxide in pharmaceutical industry is notably driving market growth. Diphenyl and its high-purity derivative, diphenyl oxide, play significant roles in the pharmaceutical industry. Diphenyl functions as a vital precursor in the production of pharmaceutical intermediates. On the other hand, diphenyl oxide serves as a crucial solvent and intermediate in the synthesis of Active Pharmaceutical Ingredients (APIs). This compound is indispensable for creating various therapeutic agents, including anticonvulsants, antibiotics, and anti-inflammatory drugs like nimesulide. Diphenyl oxide's unique chemical structure imparts antimicrobial and anti-inflammatory properties, adding value to its use in developing effective medications.

Moreover, the stability and solubility of diphenyl oxide are essential factors contributing to its importance. These characteristics enhance the processability of active ingredients in pharmaceutical formulations, making diphenyl oxide a vital component in the pharmaceutical manufacturing process. Thus, such factors are driving the growth of the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

Innovations in product development are the key trends in the market. The market is witnessing a noteworthy trend in the development of advanced catalysts for the synthesis of diphenyl oxide compounds. One such innovation is the application of a metal-organic complex catalyst, specifically Cu(phen), in this process. This catalyst is synthesized through the reaction of Cu (CH3CN)4BF4 with 1,10-phenanthroline, yielding a highly efficient and selective catalyst. This innovative catalyst plays a pivotal role in the effective catalysis of phenol compounds and benzene halide compounds, resulting in the production of diphenyl oxide. The merits of this catalyst include its low consumption, high catalytic activity, and excellent selectivity, making it a valuable asset in the manufacturing sector. Beyond aroma chemicals, diphenyl oxide finds applications in various industries such as flame retardants for electronics, cosmetics, and petrochemicals. Compliance with fire safety regulations necessitates the use of effective flame retardants, and diphenyl oxide derivatives meet this requirement. Furthermore, diphenyl oxide is used in the synthesis of anticonvulsants, antibiotics, and antifungals, underscoring its importance in the pharmaceutical sector. In the realm of chemicals and fragrances, diphenyl oxide is a versatile solvent that offers numerous benefits. Its use in the production of fragrances is a growing trend, as it imparts a pleasant aroma to various products. In the petrochemical industry, diphenyl oxide is employed as a building block in the synthesis of complex organic compounds.

The market is undergoing significant advancements, with the development of innovative catalysts being a key driver. This catalyst, Cu(phen), offers numerous benefits, including high efficiency, selectivity, and low consumption, making it a valuable tool in the production of diphenyl oxide compounds. The market's applications span across various industries, including aroma chemicals, flame retardants, electronics, cosmetics, petrochemicals, pharmaceuticals, and fragrances. Market research reports from reputable firms provide valuable insights into the market's growth dynamics and future prospects. Thus, such trends will shape the growth of the market during the forecast period.

What are the Major Market Challenges?

Availability of alternative options is the major challenge that affects the growth of the market. The chemical industry faces significant competition due to the availability of substitutes for key components, particularly in the case of Diphenyl Oxide (DPO) and its related organic molecules like Diphenyl ether. DPO, with the chemical formula C12H10O, undergoes various chemical processes such as hydroxylation, halogenation, nitration, Friedel Crafts alkylation, and sulfonation. One of the primary applications of DPO is as a heat transfer fluid. However, its market position is threatened by alternative chemicals, such as benzophenone and chlorobenzene. Benzophenone, an organic compound with the molecular formula C13H10O, is widely used as an ultraviolet curing agent, flavor ingredient, fragrance enhancer, perfume fixative, and additive in plastics, coatings, and adhesive formulations. It also functions as a protective screen against ultraviolet light-induced damage in cosmetics.

Chlorobenzene, a colorless liquid, is another essential chemical in the industry, with applications in various sectors. It is used as a solvent, intermediate, and reagent in the production of pharmaceuticals, agrochemicals, and polymers. Despite its advantages, the partially soluble and flammable nature of chlorobenzene, along with its aromatic almond-like odor, poses challenges in terms of safety and environmental concerns. In conclusion, the chemical industry's success relies on the continuous innovation and improvement of existing chemicals like DPO and the development of new ones to meet the evolving market demands while addressing the challenges posed by substitutes and safety concerns. Hence, the above factors will impede the growth of the market during the forecast period.

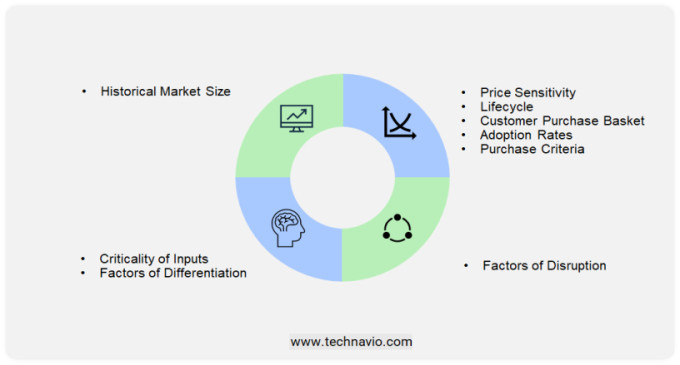

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Diphenyl oxide, also known as diphenyl ether, is a valuable organic molecule with the chemical formula C12H10O. This colorless liquid is derived from the reaction of benzene and phenol through chemical synthesis. Diphenyl oxide undergoes various chemical reactions such as hydroxylation, halogenation, nitration, Friedel-Crafts alkylation, and sulfonation, making it a versatile intermediate in the production of numerous chemicals. Diphenyl oxide finds extensive applications in various industries. In the chemical sector, it is used as a raw material in the production of heat transfer fluids, aroma chemicals, flame retardants, and high-performance polymers like polyphenylene oxide (PPO) and polyphenylene ether (PPE). It is also employed as a solvent, intermediate, and reagent in the manufacturing of pesticides, herbicides, fungicides, and anticonvulsants.

Diphenyl oxide is used in the electronics industry as a solvent and in the cosmetics industry as a fragrance ingredient. It also finds applications in the oil and gas industry as a solvent and in the renewable energy sector as a heat transfer agent. In the textile industry, it is used as a foaming agent and in the pharmaceutical industry as a drug manufacturing intermediate. With its excellent thermal and mechanical properties, diphenyl oxide is a crucial component in the production of plastic products. The market is driven by the increasing demand for heat transfer fluids, flame retardants, and high-performance polymers in various industries. The growing demand for renewable energy and the stringent fire safety regulations in different sectors are also expected to boost the market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market Growth 2024-2028 |

USD 265.3 million |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 41% |

|

Key countries |

China, US, Germany, India, UK, South Korea, France, Turkey, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALPHA CHEMIKA, Avantor Inc., Dow Inc., Eastman Chemical Co., Ernesto Ventos SA, Kdac Chem Pvt. Ltd., KUNSHAN ODOWELL CO. LTD., Lanxess AG, LGC Ltd, Loba Chemie Pvt. Ltd., Merck KGaA, Muby Chem Ltd, Otto Chemie Pvt. Ltd., Pell Wall Ltd., Schultz Canada Chemicals Ltd., Sisco Research Laboratories Pvt. Ltd., The Good Scents Co., and Vizag Chemical International |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID -19 impact and recovery analysis and future consumer dynamics, market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies