Disposable Respirator Market Size 2024-2028

The disposable respirator market size is forecast to increase by USD 850 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand from the manufacturing industry for personal protective equipment. This sector's expansion is fueled by the rising awareness of workplace health and safety regulations and the need to mitigate respiratory hazards. However, the market faces challenges, including regulatory hurdles that impact adoption due to stringent approval processes and evolving standards. Additionally, low consumer compliance with the use of disposable respirators, despite their importance, poses a significant challenge. Manufacturers must address these concerns by providing ergonomically designed respirators that offer improved comfort and ease of use.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory changes, invest in research and development for innovative product offerings, and focus on consumer education and awareness initiatives. By doing so, they can differentiate themselves in the competitive landscape and meet the evolving needs of their customers.

What will be the Size of the Disposable Respirator Market during the forecast period?

- The market experiences dynamic growth, driven by various factors. Government regulations mandate workplace hazard assessments, leading to increased safety awareness campaigns and consumer demand for effective respiratory protection. Training programs for proper usage and fit testing methods, such as quantitative and qualitative tests, ensure optimal particle capture efficiency. Emergency response teams require respirators with high particle size filtration efficiency, airflow rate, and adjustable head straps for optimal performance. Sustainable packaging and bio-based materials are gaining popularity, aligning with public health concerns and consumer preferences. B2B sales dominate the market, with supply chain management playing a crucial role in ensuring timely delivery and inventory management.

- Direct-to-consumer sales are on the rise, driven by pandemic preparedness and consumer convenience. Advanced filtration technologies, such as HEPA, activated carbon, electrostatic filtration, nanofiber, and anti-viral, offer superior particle capture and protection against various contaminants. Exhalation valves and facial seals ensure user comfort and efficiency. Anti-microbial technology and PPE maintenance programs are essential for prolonging the lifespan and effectiveness of disposable respirators. The market trends towards innovative designs, including earloop designs and adjustable head straps, for enhanced user experience and fit.

How is this Disposable Respirator Industry segmented?

The disposable respirator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- N-series

- P-series

- R-series

- End-user

- Healthcare

- Manufacturing

- Construction

- Oil and gas

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

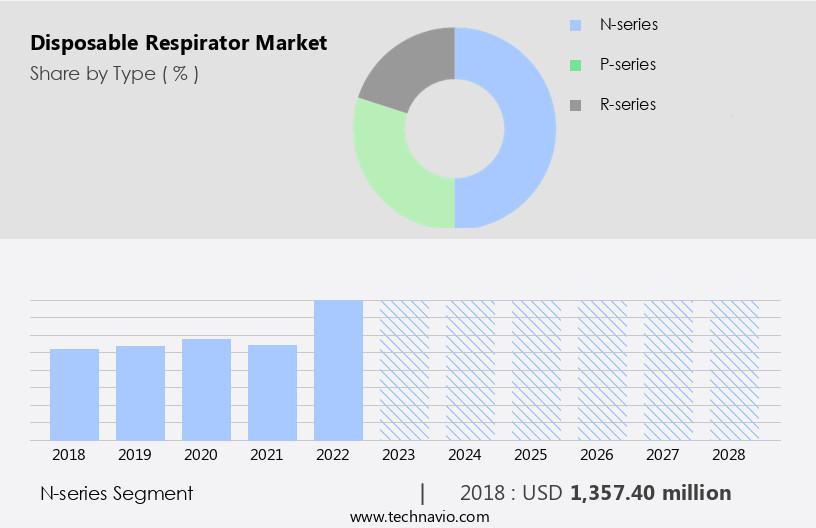

The n-series segment is estimated to witness significant growth during the forecast period.

Disposable respirators, specifically those in the N-series, play a crucial role in protecting individuals from various airborne particulates. These respirators offer protection against solid and liquid aerosol particulates that do not contain oil, such as dust particles from coal, iron ore, flour, metal, wood, pollen, and other non-oil-based materials. The N95, N99, and N100 respirators differ in their filtration efficiency levels. An N95 respirator, which is commonly used, provides 95% efficiency against non-oil-based solid and liquid particulates. The aerospace industry, manufacturing sector, food processing industry, agricultural sector, and healthcare settings are significant end-users of disposable respirators. The importance of respiratory protection extends to industrial hygiene, workplace safety, and infection control.

Comfort level, leakage rate, breathing resistance, and respirator fit testing are essential considerations in ensuring effective use. Disposable respirator cartridges, half-mask respirators, full-face respirators, surgical masks, valve respirators, and respirator filters are various types available to cater to diverse applications. The respiratory protection standard is essential in occupational health and safety regulations, with respiratory diseases such as lung cancer being a concern for those exposed to respirable dust and hazardous materials.

The N-series segment was valued at USD 1357.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

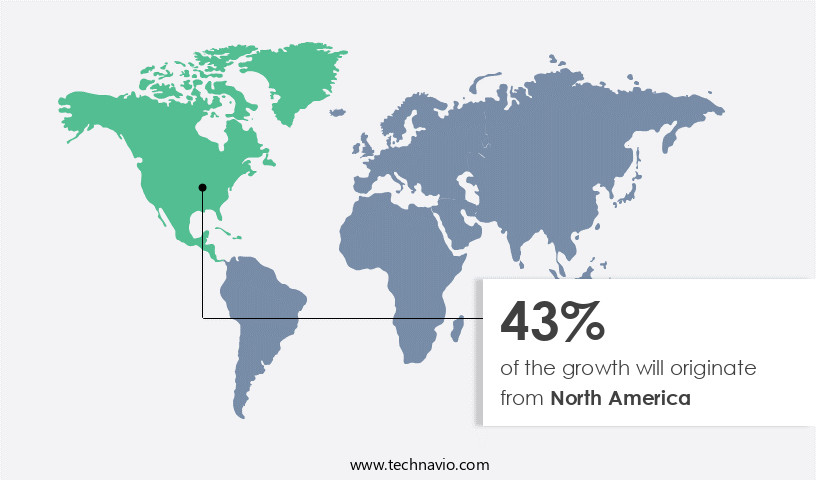

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Disposable respirators, a crucial component of respiratory protection equipment, have gained significant traction in North America due to stringent worker safety regulations and potential compensation claims. These respirators, including dust masks, half-mask respirators, and full-face respirators, cater to various industries and applications. For instance, the manufacturing sector, which comprises significant industries such as steel, aerospace, oil and gas, food processing, and chemical, necessitates the use of respirators to safeguard workers from airborne particulates, hazardous materials, and respirable dust. Moreover, industries like agriculture and healthcare prioritize respiratory protection to mitigate infection control risks and ensure occupational health. The comfort level, filtration efficiency, and leakage rate are essential factors determining the choice of respirators.

For instance, N95 respirators, which offer a filtration efficiency of 95%, are widely used in the healthcare sector for infection control. In contrast, half-mask respirators, with their lower breathing resistance, are popular in the manufacturing industry. Additionally, full-face respirators with valves offer enhanced protection against high-risk environments. Respirator training, fit testing, and the use of disposable respirator cartridges are essential aspects of effective respiratory protection. Industrial hygiene and workplace safety regulations mandate regular respirator fit testing and training to ensure optimal protection against respiratory diseases, such as lung cancer. Furthermore, respirator filters and nose clips play a vital role in maintaining the efficiency and comfort of the respirators.

The aerospace industry's growing demand for lightweight and efficient respiratory equipment has led to advancements in respirator technology. Meanwhile, the food processing industry focuses on ensuring indoor air quality to maintain product safety and quality. The market for disposable respirators in North America is driven by stringent safety regulations, the increasing demand for worker protection, and the expansion of various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Disposable Respirator market drivers leading to the rise in the adoption of Industry?

- The manufacturing industry's demand plays a pivotal role in driving market growth.

- Disposable respirators serve a crucial role in safeguarding individuals from inhaling harmful airborne contaminants, including wood dust, oil-based particulates, metal particles, and aerosols. These pollutants are prevalent in various industries, such as paper mills, wood sawmills, metal fabrication, and food processing plants, where manufacturing activities disperse fine particles that can negatively impact eye health and cause respiratory issues. Furthermore, industrial processes in chemical plants release hazardous gases into the immediate environment, which can enter the human body through inhalation, leading to severe or chronic respiratory problems.

- Infection control and occupational health are essential components of workplace safety, making respiratory protection a significant concern. Disposable respirators, featuring various filtration efficiencies and respirator straps, play a vital role in ensuring indoor air quality and maintaining a healthy work environment.

What are the Disposable Respirator market trends shaping the Industry?

- The provision of ergonomically designed disposable respirators is currently a significant market trend. These respirators, which prioritize user comfort and effectiveness, are increasingly being adopted by industries to ensure worker safety and productivity.

- Disposable respirators, also known as air purifying respirators, play a crucial role in protecting workers from inhaling airborne particulates, such as dust, fumes, and smoke, during various hazardous activities. Comfort is a significant concern for users, with issues like pinching nosepieces, heat, static posture, and confined spaces making prolonged use challenging. companies in the market recognize these concerns and are innovating ergonomically designed disposable respirators, ensuring reduced breathing resistance and enhanced protection with comfort. These advancements aim to address the discomfort experienced by users, making it essential for industries, including aerospace, to prioritize the provision of ergonomically designed disposable respirators to their workforce.

- The focus on comfort and protection is essential in mitigating the risks associated with respiratory diseases and ensuring a safer working environment.

How does Disposable Respirator market faces challenges face during its growth?

- Low consumer compliance poses a significant challenge to the industry's growth trajectory. This issue, which refers to consumers' failure to adhere to industry standards or follow through on commitments, can hinder the industry's ability to expand and thrive.

- The market faces challenges related to compliance and fit issues. These concerns are significant for both companies and employers, particularly in developed regions, due to stringent worker safety regulations. Non-compliance can lead to inefficient filtration of hazardous particulates, and discomfort or improper fit can result from various factors, such as facial scarring, cosmetic surgery, or dental enhancements. Employers in developed regions may face legal and financial consequences for non-compliance. To ensure effective use of disposable respirators, it is crucial for both companies and employers to prioritize addressing these challenges through proper training and product development.

- Proper respirator training can help ensure a proper fit and improve overall compliance. In the manufacturing and food processing industries, where air quality is essential, addressing these challenges is crucial for maintaining a safe and productive work environment.

Exclusive Customer Landscape

The disposable respirator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the disposable respirator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, disposable respirator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a range of disposable respirators, including Health Care Particulate Respirators, Medical Respirators, and Particulate Respirators.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AERO PRO Co. Ltd.

- Alpha Pro Tech Ltd.

- Alpha Solway Ltd.

- Ansell Ltd.

- Avantor Inc.

- Bunzl Plc

- Cardinal Health Inc.

- Dragerwerk AG and Co. KGaA

- Gateway Safety Inc.

- Honeywell International Inc.

- Kimberly Clark Corp.

- Kowa Co. Ltd.

- Makrite

- Moldex Metric

- Prestige Ameritech

- Shanghai Dasheng Health Products Manufacturing Co. Ltd.

- Shanghai Gangkai Purification Products Co. Ltd.

- The Gerson Co.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Disposable Respirator Market

- In March 2022, 3M, a leading manufacturer of personal protective equipment, announced the launch of its new half-mask disposable respirator, the 3M Cool Flow 60000 Series, designed for oil, gas, and petrochemical industries. This innovative respirator offers improved comfort and fit, as well as enhanced protection against particulate matter and gases (3M Press Release, 2022).

- In July 2021, Honeywell International, another major player in the market, entered into a strategic partnership with the University of California, Berkeley, to develop advanced filtration technologies for N95 respirators. This collaboration aims to improve the efficiency and durability of N95 respirators, addressing the ongoing challenges of supply shortages and contamination concerns (Honeywell Press Release, 2021).

- In December 2020, MSA Safety, a global leader in safety equipment, completed the acquisition of the Airgo Solutions business from 3M. This acquisition significantly expanded MSA Safety's portfolio of disposable respirators, providing the company with a stronger presence in the market and enabling it to cater to a broader customer base (MSA Safety Press Release, 2020).

- In April 2019, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposed new requirements on disposable respirators, mandating that they be classified as personal protective equipment and comply with specific safety standards. This regulatory development has led to increased demand for disposable respirators that meet these stringent requirements (European Chemicals Agency, 2019).

Research Analyst Overview

The market continues to evolve, driven by the diverse needs of various industries and the ongoing concern for respiratory health. Air purifying respirators, including dust masks and half-mask respirators, play a crucial role in protecting individuals from airborne particulates in sectors such as industrial hygiene, manufacturing, and food processing. Comfort level and leakage rate are essential factors in ensuring effective respiratory protection. AS/NZS 1716 standards guide the selection of appropriate respirators for specific applications, while respiratory diseases, such as lung cancer, underscore the importance of proper respiratory protection. In the aerospace industry, high-performance respirators are essential for maintaining air quality during aircraft manufacturing and maintenance.

N95 respirators, surgical masks, valve respirators, and full-face respirators each offer unique advantages, with filtration efficiency, breathing resistance, and fit being critical considerations. Disposable respirator cartridges and respirator training are essential components of an effective respiratory protection program. The agriculture industry, infection control, and workplace safety also rely on disposable respirators to mitigate risks associated with hazardous materials, respirable dust, and indoor air quality. Respirator fit testing, nose clips, straps, and filters are essential components of these applications. The continuous unfolding of market activities and evolving patterns underscore the importance of ongoing research and development to meet the evolving needs of industries and individuals.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Disposable Respirator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 850 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Disposable Respirator Market Research and Growth Report?

- CAGR of the Disposable Respirator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the disposable respirator market growth of industry companies

We can help! Our analysts can customize this disposable respirator market research report to meet your requirements.