Respiratory Drugs Market Size 2025-2029

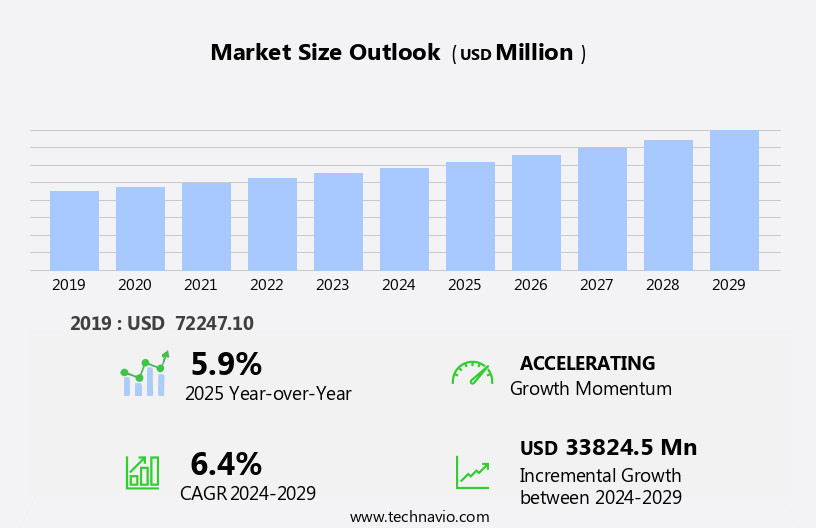

The respiratory drugs market size is forecast to increase by USD 33.82 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing prevalence of respiratory diseases and the need for sustainable and safe treatment options. According to various reports, respiratory diseases are among the leading causes of death and disability worldwide, making the market for respiratory drugs a promising one. Another key trend shaping the market is the emergence of telehealth and remote monitoring technologies, which enable patients to receive timely and effective care from the comfort of their homes. However, the market also faces challenges, including concerns associated with screening and diagnosis, which can lead to misdiagnosis and ineffective treatment.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on developing innovative solutions that address these issues while ensuring patient safety and efficacy. Additionally, collaborations and partnerships with healthcare providers and regulatory bodies can help companies gain market access and establish a strong market presence. Overall, the market presents significant growth opportunities for companies that can deliver safe, effective, and accessible treatment options to meet the evolving needs of patients.

What will be the Size of the Respiratory Drugs Market during the forecast period?

- The market is experiencing significant activity due to the rising prevalence of chronic respiratory diseases, such as COPD and asthma, driven by factors like drug resistance, air pollution, and health disparities. Combination therapies, including anti-inflammatory drugs and metered dose inhalers, are increasingly popular for managing these conditions, with a focus on improving patient satisfaction and lung function. However, challenges persist, including lung function decline, disease progression, treatment adherence, and drug interactions. Moreover, respiratory infections, pulmonary fibrosis, and sleep apnea are also contributing to market growth. Patient empowerment and public health initiatives are increasingly important, as are lifestyle modifications and smoking cessation.

- Drug addiction, adverse events, and respiratory distress syndrome are significant concerns, as is the rising burden of healthcare costs. New developments in the field include advances in clinical pharmacology, aerosol therapy, and dry powder inhalers. Other trends include the management of pulmonary hypertension, interstitial lung disease, and cystic fibrosis. Environmental factors, respiratory muscle weakness, lung cancer, and airway inflammation and remodeling are also areas of ongoing research and innovation. In the global health context, addressing health disparities and improving disease awareness are critical. The market is also impacted by the growing issue of drug abuse and the need for effective COPD management strategies.

- Overall, the market is dynamic and complex, requiring a nuanced understanding of the underlying disease states and patient needs.

How is this Respiratory Drugs Industry segmented?

The respiratory drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Asthma

- COPD

- Allergic rhinitis

- Cystic fibrosis

- Others

- Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Application

- Inhalation

- Oral

- Injectables

- Topical

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Rest of World (ROW)

- North America

By Type Insights

The asthma segment is estimated to witness significant growth during the forecast period.

The asthma market is experiencing moderate growth, driven by the rising prevalence of asthma and ongoing research and development in the field. Approximately 300 million people worldwide currently live with asthma, with the condition's prevalence increasing by 50% every decade. Major pharmaceutical companies, such as AstraZeneca and Novartis, are capitalizing on this trend by launching new drugs, including SYMBICORT, PULMICORT, Relvar Ellipta/Breo Ellipta, ARUNITY ELLIPTA, NUCALA, Seretide/Advair, and XOLAIR. In the realm of personalized medicine, researchers are developing targeted therapies for specific patient populations. For instance, dupilumab, a monoclonal antibody treatment for severe asthma, is being developed with the goal of minimizing corticosteroid use.

This innovation, a collaboration between McMaster University and the Firestone Institute for Respiratory Health, underscores the potential for emerging therapies to address unmet needs in the market. The regulatory landscape plays a crucial role in the asthma market, with regulatory agencies such as the FDA and EMA ensuring safety and efficacy of drugs. In addition, healthcare policy and health economics influence market dynamics, with value-based healthcare and digital therapeutics gaining traction. Remote patient monitoring, precision medicine, and healthcare data analytics are also transforming the industry, enabling more effective patient care and personalized treatment plans. In the realm of respiratory therapy, devices such as peak flow meters, pulmonary function tests, and home oxygen therapy are essential tools for diagnosing and managing asthma.

These devices, along with prescription drugs, generic drugs, and leukotriene modifiers, form the backbone of asthma treatment. As the market evolves, drug delivery systems, clinical trials, and patient education will continue to play important roles in improving patient outcomes. The asthma market is expected to face decelerating growth momentum during the forecast period. However, ongoing developments, such as the aforementioned dupilumab treatment, are expected to stabilize this trend. Furthermore, emerging therapies, such as gene therapy and machine learning, are poised to disrupt the market and create new opportunities. Overall, the asthma market is a dynamic and evolving landscape, shaped by a complex interplay of scientific innovation, regulatory requirements, and market trends.

Get a glance at the market report of share of various segments Request Free Sample

The Asthma segment was valued at USD 23.39 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the dynamic landscape of the US Metal Additive Manufacturing Market, several entities play pivotal roles. The North American region, spearheaded by the US, significantly contributes to the market's revenue. Key players, such as Genentech (a Roche company) and Merck, propel the market's growth through the launch of new disease-modifying therapies. AstraZeneca, GlaxoSmithKline, Genentech (Roche), and Merck are dominant players in the US market. At the American Thoracic Society (ATS) International Conference in San Diego, CA, AstraZeneca presented 59 abstracts, including 12 late-breaking posters, focusing on COPD, severe asthma, eosinophilic granulomatosis with polyangiitis (EGPA), and other chronic respiratory diseases, underscoring their commitment to addressing unmet needs.

In the realm of healthcare, entities such as Personalized Medicine, Precision Medicine, and Big Data are transforming the industry. Healthcare Data Analytics and Remote Patient Monitoring facilitate improved patient care and outcomes. Digital Therapeutics and Machine Learning are emerging trends, while Value-Based Healthcare is the new norm. Safety and Efficacy, Healthcare Policy, and Patient Education are crucial considerations. Health Economics, Drug Delivery Systems, and Clinical Trials are essential components of the drug development process. In the respiratory therapy sector, entities like Pulmonary Rehabilitation, Peak Flow Meter, Pulmonary Function Tests, Home Oxygen Therapy, and Leukotriene Modifiers are integral. Prescription Drugs, Monoclonal Antibodies, and Allergic Rhinitis are key therapeutic areas.

Gene Therapy is an emerging field with significant potential. Artificial Intelligence and Machine Learning are revolutionizing the diagnosis and treatment of various diseases. The regulatory landscape plays a vital role in shaping the market. FDA approvals and regulatory guidelines impact the development and commercialization of new therapies. Regulatory bodies like the FDA, EMA, and others ensure the safety and efficacy of medical devices and drugs. In the realm of healthcare policy, entities like Healthcare Professionals and Prescription Drugs are significant. The affordability and accessibility of prescription drugs are crucial issues. The rise of Generic Drugs and the trend towards biosimilars are impacting the market.

In summary, the US Metal Additive Manufacturing Market is driven by various entities, including pharmaceutical companies, regulatory bodies, and emerging technologies. The market is shaped by trends like Personalized Medicine, Precision Medicine, and Big Data, while the regulatory landscape plays a crucial role in its evolution. The respiratory therapy sector, with entities like Pulmonary Rehabilitation and Peak Flow Meters, and the drug development process, with entities like Clinical Trials and Drug Delivery Systems, are integral components of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Respiratory Drugs Industry?

- Need for sustainable and safe respiratory drugs is the key driver of the market.

- Respiratory diseases are a significant global health concern, ranking as the leading cause of death. In Western Europe, COPD is the third leading cause of death, and it is the fourth leading cause of death worldwide. Asthma, which is the most prevalent respiratory disease, affects individuals of all ages. Despite the availability of effective therapies, many patients continue to live with poorly controlled respiratory diseases, resulting in a diminished quality of life. Over the past four decades, only a few new classes of drug therapy have been introduced for the treatment of respiratory diseases.

- Finding new, more effective drug classes has proven to be challenging. Leukotriene receptor antagonists represent a new class of drugs, but their efficacy in controlling asthma is not sufficient. The high unmet medical need for more effective respiratory treatments underscores the importance of ongoing research and development efforts in this area.

What are the market trends shaping the Respiratory Drugs Industry?

- Emergence of telehealth and remote monitoring is the upcoming market trend.

- The COVID-19 pandemic in 2020 significantly accelerated the adoption of telehealth services, transforming healthcare delivery by enabling remote consultations, diagnosis, treatment, and monitoring for respiratory patients. Telehealth platforms allow patients to consult with pulmonologists and other specialists virtually, providing increased access to care for those who have difficulty traveling or are at higher risk during the pandemic. Healthcare providers can diagnose and assess respiratory conditions remotely using video consultations, patient histories, and shared medical data. Telehealth and remote monitoring help alleviate the burden on healthcare facilities by preventing unnecessary in-person visits and focusing resources on critical cases.

- The convenience and safety offered by telehealth services are driving their increasing adoption in respiratory care, making it an essential component of modern healthcare.

What challenges does the Respiratory Drugs Industry face during its growth?

- Concerns associated with screening and diagnosis is a key challenge affecting the industry growth.

- The market is driven by the increasing prevalence of respiratory diseases, both acute and chronic, which poses a significant global health concern. Despite advancements in medical research and the availability of therapies, the incidence of chronic respiratory diseases continues to rise. One such condition is pulmonary arterial hypertension (PAH), a serious and often misdiagnosed disease. Late diagnosis of PAH can lead to severe complications and decreased quality of life for patients.

- Symptoms of PAH, such as fatigue, weakness, and breathlessness, overlap with those of other respiratory disorders like COPD and asthma, making accurate diagnosis a challenge. Overcoming this diagnostic hurdle is crucial to ensure patients receive appropriate treatment and improve their prognosis.

Exclusive Customer Landscape

The respiratory drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the respiratory drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, respiratory drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing innovative respiratory solutions for individuals battling chronic obstructive pulmonary disease, cystic fibrosis, and respiratory failure. Our product portfolio includes Pulmocare, a range of effective drugs designed to manage and improve respiratory health. These medications are essential for patients seeking to alleviate symptoms and enhance their quality of life. By prioritizing research and development, we remain committed to delivering advanced respiratory care solutions that cater to diverse patient needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Aerogen Pharma Ltd.

- AstraZeneca Plc

- Aurobindo Pharma Ltd.

- Boehringer Ingelheim International GmbH

- Celon Pharma SA

- Cipla Inc.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Glenmark Pharmaceuticals Ltd.

- Laboratory Corp. of America Holdings

- Lupin Ltd.

- Medisol Lifescience Pvt. Ltd.

- Merck and Co. Inc.

- Novartis AG

- Sumitomo Pharma Co. Ltd.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Inc.

- Wellona Pharma

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of medications used to treat various respiratory conditions. These conditions include allergic rhinitis, asthma, chronic obstructive pulmonary disease (COPD), and other pulmonary disorders. The market is characterized by continuous innovation and evolution, driven by advances in technology, regulatory landscape, and healthcare policy. One of the key trends shaping the market is the shift towards personalized medicine and precision therapy. With the advent of big data and healthcare data analytics, healthcare professionals can now access vast amounts of patient data to identify the most effective treatments for individual patients. This approach is particularly relevant in respiratory therapy, where the variability of patient responses to different medications can be significant.

Another trend is the regulatory landscape, which is becoming increasingly complex. Regulatory bodies are placing greater emphasis on safety and efficacy, leading to longer development timelines and higher costs for new drugs. This has resulted in a growing interest in generic drugs and biosimilars, which offer cost savings without compromising on quality. In the realm of drug development, there is a focus on emerging therapies such as monoclonal antibodies, gene therapy, and machine learning-based drug discovery. These innovative approaches offer the potential for more effective treatments with fewer side effects. However, they also come with significant development costs and regulatory challenges.

Technological advancements are also transforming the market. For instance, digital therapeutics and remote patient monitoring are becoming increasingly popular. Peak flow meters, pulmonary function tests, and home oxygen therapy are now commonly used to monitor patients' respiratory health remotely. These technologies enable early intervention and improve patient outcomes, while reducing the need for hospitalizations. The use of personalized drug therapy and precision medicine is also driving the adoption of advanced drug delivery systems. These systems enable targeted delivery of medications to specific areas of the lungs, improving efficacy and reducing side effects. The healthcare policy landscape is another significant factor influencing the market.

Value-based healthcare is becoming increasingly prevalent, with payers demanding better outcomes at lower costs. This is leading to a greater focus on patient education and adherence to treatment plans. In conclusion, the market is a dynamic and evolving landscape, shaped by technological advancements, regulatory changes, and healthcare policy. The shift towards personalized medicine and precision therapy, the regulatory landscape, and the use of digital technologies are some of the key trends driving market growth. The challenges of developing new drugs and ensuring safety and efficacy, along with the need for cost savings, will continue to shape the market in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 33.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, France, Italy, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Respiratory Drugs Market Research and Growth Report?

- CAGR of the Respiratory Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the respiratory drugs market growth of industry companies

We can help! Our analysts can customize this respiratory drugs market research report to meet your requirements.