Distraction Osteogenesis Devices Market Size 2025-2029

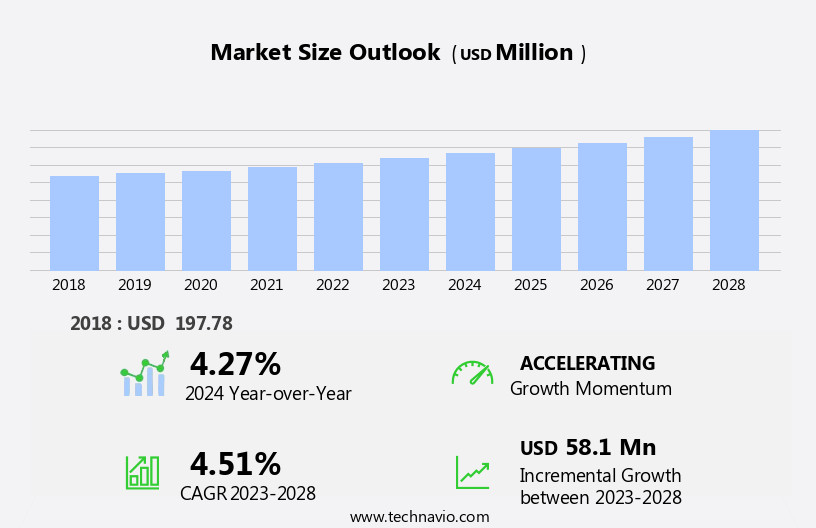

The distraction osteogenesis devices market size is forecast to increase by USD 70.9 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing incidence of genetic disorders, particularly cleft palate defects. These conditions necessitate corrective procedures using distraction osteogenesis devices. Moreover, the focus on developing new distraction osteogenesis devices is a key trend in the market. Companies such as Stryker, Medtronic, and Smith & Nephew are investing in research and development to introduce advanced distraction osteogenesis devices. For instance, Stryker's Craniofacial Distraction System and Medtronic's REDACTED Distraction System are gaining popularity due to their effectiveness and patient-friendly design.

- The market is driven by the rising prevalence of genetic disorders and the development of innovative devices, while regulatory challenges necessitate strategic planning and significant investments. Companies that navigate these challenges effectively will capitalize on the market's growth potential. Despite these opportunities, regulatory approvals and compliance remain a major hurdle, requiring companies to invest heavily in research and development and regulatory affairs. Clinical trials, precision medicine, and gene therapy are ongoing areas of research to further enhance treatment outcomes and patient satisfaction.

What will be the Size of the Distraction Osteogenesis Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The Distraction Osteogenesis (DO) devices market experiences continuous advancements in technology and materials, driven by rigorous research and development. The integration of composite materials, such as ceramics and polymers, in DO devices enhances bone strength and biocompatibility, as evidenced by retrospective studies and prospective trials. Cytotoxicity and genotoxicity testing ensure the safety and suitability of these materials for bone remodeling. Bone density assessment through radiographic imaging, including computed tomography (CT), plays a crucial role in evaluating the efficacy of DO devices. Surgical simulation and navigation systems, along with robotic surgery, improve surgical precision and reduce invasiveness.

- Bone morphogenetic proteins (BMPs) and bone-derived growth factors (BDGFs) are increasingly used in DO treatments to accelerate fracture healing. Haptic feedback and augmented reality technologies in surgical tools provide enhanced user experience and improved accuracy during procedures. Health economics and cost-benefit analysis are essential considerations in the DO devices market. Longitudinal studies and biomechanical analysis provide valuable insights into the long-term effectiveness and cost-efficiency of various DO treatments. Incorporating bioresorbable materials in DO devices ensures optimal bone regeneration and reduces the need for secondary surgeries. Virtual reality and surgical simulation tools enable better preoperative planning and training, ultimately improving patient outcomes.

How is this Distraction Osteogenesis Devices Industry segmented?

The distraction osteogenesis devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Internal

- External

- End-user

- Orthopedic specialty clinic

- Hospitals

- Application

- Limb lengthening

- Craniofacial reconstruction

- Dentofacial deformities

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Type Insights

The internal segment is estimated to witness significant growth during the forecast period. In the medical devices market, distraction osteogenesis procedures employ both internal and external devices to facilitate bone growth. Internal devices, placed within the bone, offer advantages such as discretion and precise distraction control. These devices can be situated above or below the soft tissue, or intraorally, and their placement influences the distraction process. For instance, subcutaneous placement provides a more controlled distraction compared to external devices, enabling surgeons to customize treatment plans according to individual patient needs. This tailored approach contributes to improved functional and aesthetic outcomes. Additionally, internal devices are utilized in various applications, including craniofacial reconstruction and maxillofacial surgeries.

Regulatory approvals and infection control are critical aspects of the market, with emerging technologies like 3D printing, artificial intelligence, and machine learning contributing to advancements in device design and personalized treatment. Remote monitoring, health education, and minimally invasive surgery are additional trends shaping the market.

The Internal segment was valued at USD 160.00 million in 2019 and showed a gradual increase during the forecast period.

Wearable sensors, finite element analysis, and computer-assisted surgery are employed in the design and preoperative planning stages to optimize device performance and patient safety. Biocompatible materials, such as titanium alloys, ensure the devices are safe for long-term use. Pediatric surgeons, orthopedic professionals, and maxillofacial surgeons collaborate in the implementation of these treatments, with insurance coverage and healthcare reimbursement playing essential roles in patient access. Data management, biomechanical testing, and clinical decision support systems are crucial in ensuring the quality of life for patients undergoing distraction osteogenesis procedures.

Regional Analysis

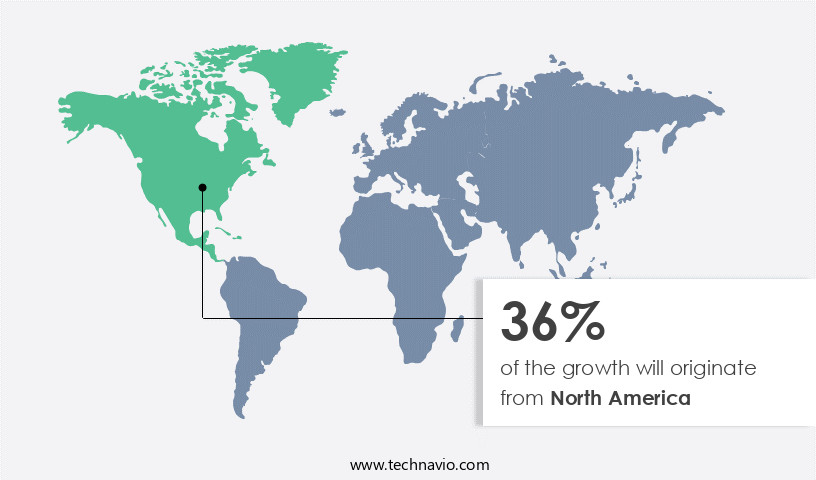

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global medical devices market, the distraction osteogenesis devices segment experiences significant growth, particularly in North America. The US, with its advanced healthcare infrastructure and medical ecosystem, is a major contributor to this trend. Renowned medical institutions like the Mayo Clinic and Cleveland Clinic lead research and clinical applications of orthopedic innovations, shaping the market. Cleft lip, a common congenital anomaly in the US, affects approximately 1 in every 1,032 births. This condition necessitates advanced medical solutions, driving the demand for distraction osteogenesis devices. These devices facilitate bone growth through gradual separation of bony segments, aiding in the reconstruction of clefts and other complex bone deformities.

Internal fixation systems, wearable sensors, and bone growth stimulators are integral components of distraction osteogenesis devices. Surgical techniques employing these technologies require meticulous planning, precision, and patient compliance. Biocompatible materials, bioactive coatings, and infection control measures are essential considerations in device design. Clinical trials and regulatory approvals ensure the safety and efficacy of these devices. Patient engagement and satisfaction are crucial factors in the market. Postoperative rehabilitation and remote monitoring enable continuous patient care and data management. Digital health technologies, such as computer-assisted surgery and artificial intelligence, enhance the precision and accuracy of surgical procedures. Pediatric surgeons and maxillofacial surgeons specialize in the application of distraction osteogenesis devices for craniofacial reconstruction and bone regeneration.

The orthopedic devices market encompasses a wide range of products, from implants to external fixation systems. Precision medicine and personalized treatment plans cater to individual patient needs, ensuring optimal treatment outcomes. Preoperative planning and device design leverage finite element analysis and 3D printing for customized solutions. Healthcare reimbursement and insurance coverage are essential aspects of the market. Big data analytics and machine learning facilitate clinical decision support, improving patient care and quality of life. Infection control, data security, and emerging technologies, such as gene therapy and stem cell therapy, expand the market's scope. The craniofacial devices market, a significant segment of the market, benefits from these trends.

The market is driven by advanced medical technologies, patient needs, and research innovations. The North American market, with its robust healthcare infrastructure and leading medical institutions, plays a pivotal role in shaping the market landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Distraction Osteogenesis Devices market drivers leading to the rise in the adoption of Industry?

- The rising prevalence of genetic disorders, most notably cleft palate defects, serves as the primary market catalyst. The market is poised for significant expansion due to the rising prevalence of genetic disorders, specifically cleft palate defects. Approximately 1.41 infants out of every 1,000 live births worldwide are born with orofacial clefts, equating to approximately 195,000 newborns annually. Over 4.62 million individuals currently live with untreated or insufficiently treated orofacial clefts, increasing their susceptibility to various life-threatening complications and malnutrition.

- Advancements in healthcare education, minimally invasive surgery, and emerging technologies, such as big data analytics, machine learning, infection control, and craniofacial devices made from titanium alloys, are driving the growth of the market. These technologies contribute to improved bone regeneration and craniofacial reconstruction through distraction osteogenesis. Children under the age of five with orofacial clefts are at a higher risk of nutritional deficiencies and malnutrition.

What are the Distraction Osteogenesis Devices market trends shaping the Industry?

- The development of new distraction osteogenesis devices is gaining significant attention in the market. This emerging trend reflects the growing emphasis on technological advancements in orthopedic treatments. The market is experiencing notable growth due to the increasing demand for advanced and innovative devices that prioritize patient comfort and compliance. This trend is driven by the rising prevalence of skeletal deformities, such as limb length discrepancies and craniofacial abnormalities. In response, medical device manufacturers are investing heavily in research and development to create more precise, patient-specific, and user-friendly distraction systems.

- The integration of these technologies aims to enhance patient empowerment and satisfaction during postoperative rehabilitation. Ambulatory surgical centers and orthopedic clinics are increasingly adopting these advanced distraction osteogenesis devices to provide superior patient outcomes and improve overall patient experience. The market is expected to continue growing as technology and surgical techniques evolve to address the unique needs of patients. These advancements include the integration of smart technologies, improved biomechanical designs, and the use of biocompatible materials to minimize patient discomfort and accelerate recovery. Additionally, the adoption of minimally invasive surgical techniques, wearable sensors for real-time monitoring, and finite element analysis for optimizing device performance are further fueling market growth.

How does Distraction Osteogenesis Devices market face challenges during its growth?

- The stringent regulatory scrutiny of medical devices poses a significant challenge to the industry's growth, requiring companies to invest heavily in research and development to ensure compliance with regulatory standards. Distraction osteogenesis devices, used in orthopedic surgery to stimulate bone growth, face regulatory hurdles that can prolong the development and commercialization process. Regulatory agencies, such as the FDA and EMA, demand extensive clinical trial data and rigorous documentation to ensure safety and efficacy. This process can lead to lengthy approval timelines. However, advancements in technology are streamlining the process.

- Bioactive coatings on orthopedic implants can enhance integration and reduce the need for secondary surgeries. Insurance coverage remains a critical factor, with healthcare reimbursement policies impacting the affordability and accessibility of these devices. The future of distraction osteogenesis devices lies in the integration of technology and regulatory compliance to provide optimal patient care. Biocompatible materials, artificial intelligence, and digital health are revolutionizing the industry. For instance, precision medicine and personalized treatment plans are possible with preoperative planning and device design using digital technology.

Exclusive Customer Landscape

The distraction osteogenesis devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the distraction osteogenesis devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, distraction osteogenesis devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acumed LLC - The company specializes in advanced medical devices, specifically distraction osteogenesis systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acumed LLC

- Arthrex Inc.

- Double Medical Technology Inc.

- Gebruder Martin GmbH and Co. KG

- Globus Medical Inc.

- Jeil Medical Corp.

- Johnson and Johnson Services Inc.

- Medicon

- Ningbo Cibei Medical Devices Co. Ltd.

- NuVasive Inc.

- Ortho Max Mfg. Co. Pvt. Ltd.

- Smit Medimed Pvt. Ltd.

- Stryker Corp.

- Titamed

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Distraction Osteogenesis Devices Market

- In February 2023, Medtronic, a global healthcare solutions company, announced the U.S. Food and Drug Administration (FDA) approval of its new distraction osteogenesis device, the NOVA Distractor II. This innovative device features wireless remote control capabilities, allowing for more precise and convenient bone lengthening procedures (Medtronic Press Release, 2023).

- In April 2024, Smith & Nephew, a leading medical device manufacturer, entered into a strategic partnership with OrthoScience, a biotech company specializing in regenerative medicine. This collaboration aimed to integrate OrthoScience's bone graft substitutes with Smith & Nephew's distraction osteogenesis devices, offering enhanced healing capabilities to patients (Smith & Nephew Press Release, 2024).

- In January 2025, Stryker, a Fortune 500 company, completed the acquisition of K2M Group Holdings, a prominent player in the spine and neuro technology market. With K2M's extensive portfolio of distraction osteogenesis devices, Stryker significantly expanded its presence in this niche market segment (Stryker Press Release, 2025).

- In June 2025, the European Commission granted marketing authorization for DJO Global's new distraction osteogenesis system, the DJO Dynamic Halo System. This system combines advanced technology with a user-friendly design, making it an attractive option for orthopedic surgeons in Europe (DJO Global Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and growing applications across various sectors. Pain management and patient compliance are key considerations in the medical devices market, with distraction osteogenesis devices offering effective solutions for bone reconstruction and regeneration. Internal fixation techniques, such as bone growth stimulators and surgical techniques, are integral to the success of these devices. Wearable sensors and finite element analysis enable real-time monitoring and analysis of patient progress, enhancing patient empowerment and improving outcomes. Ambulatory surgical centers and 3D printing are transforming the orthopedic devices market, offering cost-effective and customized solutions.

Postoperative rehabilitation and patient satisfaction are crucial factors, with digital health and computer-assisted surgery playing increasingly important roles. Biocompatible materials, pediatric surgeons, insurance coverage, and healthcare reimbursement are ongoing concerns. Artificial intelligence, bioactive coatings, clinical trials, precision medicine, external fixation, personalized treatment, preoperative planning, device design, orthopedic implants, and healthcare professionals are all integral to the ongoing dynamism of the market. Biomechanical testing, clinical decision support, quality of life, regulatory approvals, stem cell therapy, remote monitoring, health education, minimally invasive surgery, big data analytics, patient data security, machine learning, infection control, and emerging technologies are shaping the future of distraction osteogenesis devices.

Craniofacial devices, titanium alloys, bone regeneration, craniofacial reconstruction, and distraction osteogenesis are all areas of active research and development. The Distraction Osteogenesis Devices Market is advancing with innovations in platelet-rich plasma therapy, promoting faster bone regeneration. The integration of ceramic implants enhances durability and compatibility, ensuring better patient outcomes. Precision in surgical navigation plays a crucial role in improving accuracy and minimizing complications during procedures. Rigorous biocompatibility testing ensures that materials used in these devices interact safely with human tissue, while cytotoxicity testing assesses potential adverse effects. Continuous prospective studies drive research, leading to more efficient designs and improved treatment protocols.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Distraction Osteogenesis Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 70.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, UK, France, Canada, Italy, Japan, Spain, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Distraction Osteogenesis Devices Market Research and Growth Report?

- CAGR of the Distraction Osteogenesis Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the distraction osteogenesis devices market growth of industry companies

We can help! Our analysts can customize this distraction osteogenesis devices market research report to meet your requirements.