District Heating Market Size and Trends

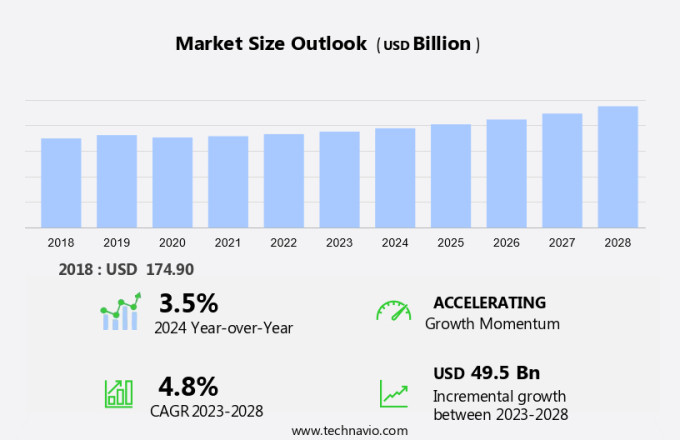

The district heating market size is forecast to increase by USD 49.5 billion at a CAGR of 4.8% between 2023 and 2028. The market is witnessing significant growth due to decarbonization goals and government initiatives to promote sustainable energy solutions. Energy management and smart grids are becoming essential components of district heating systems, enabling efficient energy distribution and demand response. Waste heat recovery is another trend gaining traction, as it offers an opportunity to reduce energy consumption and costs. Waste heat recovery, when combined with smart sensors, can be improved at the central plants. However, technical and economic barriers persist, including high upfront costs and complex retrofitting processes. Space heating applications are a major market for district heating, providing cost-effective and environmentally friendly alternatives to traditional heating methods. Irregularities in the pricing of district heating networks remain a challenge, necessitating regulatory intervention to ensure fair and transparent pricing structures.

Market Overview

The market is witnessing significant growth due to the increasing adoption of renewable sources and sustainable energy practices. The shift towards sustainable energy is driven by the need to reduce carbon footprints and mitigate climate change. Renewable sources, such as biomass, geothermal, and solar, are gaining popularity in district heating systems. Biomass, derived from organic materials, is a carbon-neutral fuel source that can be used to generate heat. The integration of Internet of Things (IoT) technologies in combined heat and power (CHP) systems within new-generation district heating plants enhances the efficiency of district energy system by enabling smarter management and recycling of waste energies in the power sector. However, the implementation of district heating systems faces regulatory and permitting hurdles. Infrastructure development and the installation of central heat plants, district heat networks, insulated pipes, boilers, and heat pumps require extensive permitting processes and adherence to strict regulations. Despite these challenges, the market is expected to grow significantly in the coming years.

Furthermore, the adoption of decentralized heating systems and the recycling of waste energies are also contributing to the market's growth. Space heating applications, both residential and industrial, are the primary consumers of district heating systems. For instance, high-capacity chillers or boilers can perform more efficiently when placed at centralized locations. These systems provide efficient and cost-effective heating solutions, making them a popular choice for consumers. The use of renewable energy sources, efficient heat production, and the recycling of waste energies are key drivers of growth in the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Source

- Fossil fuels

- Renewables

- Others

- End-user

- Residential

- Commercial

- Industrial

- Geography

- Europe

- Germany

- UK

- Sweden

- Denmark

- APAC

- China

- Japan

- South Korea

- North America

- US

- South America

- Middle East and Africa

- Europe

By Source Insights

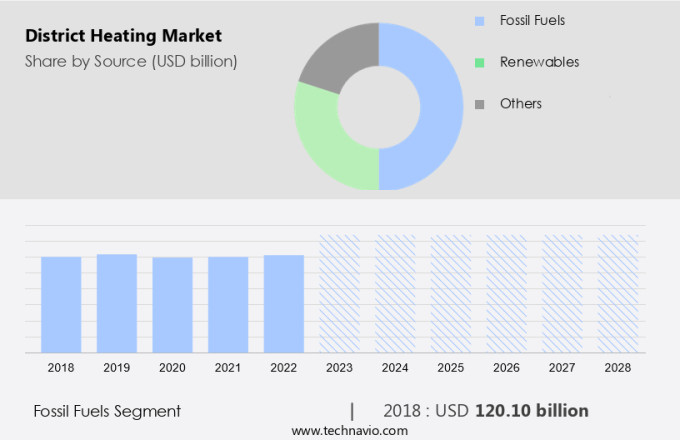

The market share growth by the fossil fuels segment will be significant during the forecast period. District heating networks offer an efficient and economical means of supplying low-carbon heat to residential areas on a large scale. This heavy reliance on non-renewable energy sources poses a significant hurdle for the shift towards more sustainable heating solutions

Get a glance at the market share of various segments Download the PDF Sample

The fossil fuels segment was the largest segment and was valued at USD 120.10 billion in 2018. In colder countries, there is a growing push to replace traditional fossil fuel heating sources, such as oil and gas, with renewable energy alternatives to minimize greenhouse gas emissions from district energy systems. However, the demand for fossil fuel-based heat is predicted to persist and increase in the coming years due to population growth. Central heat plants, which are responsible for heat production in district energy systems, can be upgraded to use insulated pipes and renewable energy sources like biomass, geothermal, or solar energy to reduce reliance on fossil fuels. Boilers, a common heat production technology in district heating systems, can also be retrofitted with advanced technologies to improve efficiency and reduce emissions.

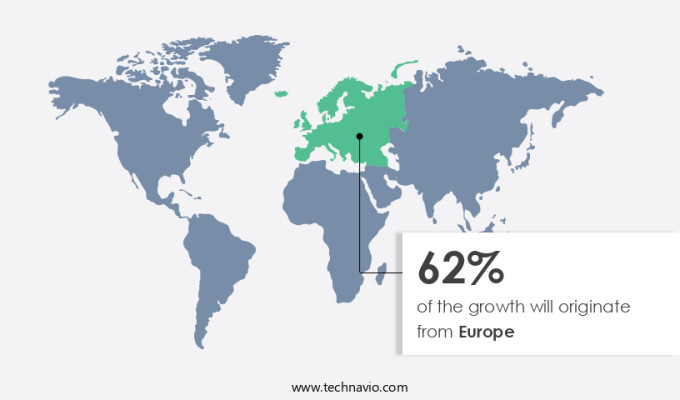

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

Europe is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market is witnessing notable progress, fueled by advanced technologies and substantial investments in sustainable infrastructure. This intelligent algorithm uses spatial machine learning to assist landowners, energy firms, developers, and authorities in identifying optimal routes for district heating and cooling networks. By analyzing local data, District One generates efficient designs, expediting the planning and installation process for citywide systems. This technology determines the most suitable locations for heating network installation, thereby enhancing the performance and productivity of district energy systems.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

District Heating Market Driver

Decarbonization goals is notably driving market growth. The market is witnessing significant growth due to the increasing focus on energy management and decarbonization. With the integration of smart grids and waste heat recovery, district heating systems are becoming more efficient and sustainable. However, there are both technical and economic barriers to the widespread adoption of district heating, particularly in retrofitting existing buildings. In October 2024, Veolia, a leading energy solutions provider, announced the construction of a new district heating network in London.

Furthermore, this network will utilize low-carbon heat generated from the SELCHP Energy Recovery Facility (ERF), which processes non-recyclable waste. The project aims to supply heat to approximately 5,000 homes, including schools and social housing units. Veolia will oversee the entire project, from design and construction to commissioning and operation. Once operational, the network is expected to deliver heat with a renewable content of around 60%, thanks to the biogenic component of the treated waste. This initiative is a significant step towards reducing carbon emissions and enhancing sustainability in the built environment. Thus, such factors are driving the growth of the market during the forecast period.

District Heating Market Trends

Government initiatives to promote district heating projects is the key trend in the market. The market is witnessing notable expansion due to increasing government initiatives aimed at promoting energy efficiency and sustainability. This funding, which covers approximately 40% of the project's estimated USD1 billion cost, underscores the government's dedication to advancing renewable energy solutions. In the UK, the Heat Network Efficiency Scheme (HNES) continues to play a crucial role in enhancing district heating systems.

Furthermore, energy management, a key aspect of district heating, is being addressed through the implementation of smart grids and waste heat recovery systems. However, technical and economic barriers hinder the widespread adoption of district heating, particularly in retrofitting existing buildings. Despite these challenges, the market's potential for space heating applications makes it an attractive proposition for energy providers and consumers alike. Thus, such trends will shape the growth of the market during the forecast period.

District Heating Market Challenge

Irregularities in pricing of district heating networks is the major challenge that affects the growth of the market. The district heating market encounters substantial challenges due to pricing inconsistencies, which can significantly affect consumer affordability and the viability of new projects. This substantial increase in tariffs has sparked affordability concerns among residents, straining their living expenses. Energy management and cost-effectiveness are crucial factors in the implementation of district heating systems.

Furthermore, smart grids and waste heat recovery can mitigate these challenges by optimizing energy usage and reducing reliance on traditional energy sources. However, technical and economic barriers hinder the retrofitting of existing buildings with district heating systems. Addressing these obstacles through government incentives and technological advancements is essential to expand the market's growth potential in space heating applications. Hence, the above factors will impede the growth of the market during the forecast period

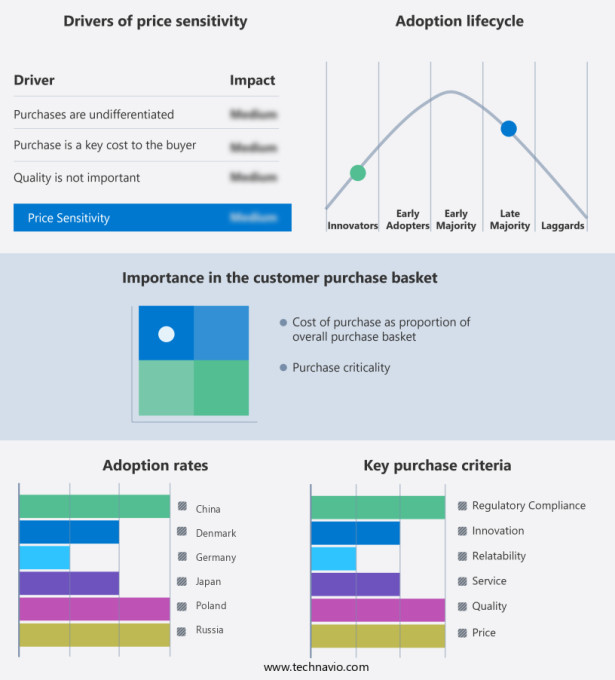

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alfa Laval AB - The company offers district heating distribution technology that connects users to a variety of heating sources, including renewable or recycled energy.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BRUGG Rohrsystem AG

- Danfoss AS

- E.ON UK Plc

- ENGIE SA

- Fortum Oyj

- FVB Energy Inc

- Helen Ltd.

- LOGSTOR Denmark Holding ApS

- Ramboll Group AS

- REHAU Ltd.

- Statkraft AS

- STEAG GmbH

- Thermaflex

- Uniper SE

- Uponor Corp.

- Vattenfall UK

- Veolia Environnement SA

- Viessmann Werke GmbH and Co. KG

- Vital Energi Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The district heating market is witnessing significant growth due to the increasing adoption of renewable sources for sustainable energy practices. Biomass, geothermal, solar, and other renewable energy sources are increasingly being used for heat production in central heat plants and district heat networks. The shift towards renewable energy is driven by the need to reduce carbon footprints and mitigate climate change. However, the district heating market faces regulatory and permitting hurdles, which can hinder its growth. Infrastructure development and technical barriers are also challenges that need to be addressed. Smart meters, sensors, real-time monitoring, load balancing, data analytics, energy management, and smart grids are being employed to optimize district heating systems and reduce economic barriers.

Furthermore, waste heat recovery from industrial processes and decentralized heating systems are emerging trends in the market. Radiant heat and low-temperature supplies are gaining popularity in residential applications. The use of non-renewable heat sources, such as fossil fuels, is decreasing as climate goals are being met through the recycling of waste energies. District heating systems are being retrofitted with boilers, heat pumps, and insulated pipes to improve efficiency and reduce greenhouse emissions. Demand-based heating systems and home automation are also being integrated into district energy systems to enhance user experience and optimize energy usage.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 49.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 62% |

|

Key countries |

Denmark, Russia, China, Sweden, Germany, Poland, UK, Japan, US, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alfa Laval AB, BRUGG Rohrsystem AG, Danfoss AS, E.ON UK Plc, ENGIE SA, Fortum Oyj, FVB Energy Inc, Helen Ltd., LOGSTOR Denmark Holding ApS, Ramboll Group AS, REHAU Ltd., Statkraft AS, STEAG GmbH, Thermaflex, Uniper SE, Uponor Corp., Vattenfall UK, Veolia Environnement SA, Viessmann Werke GmbH and Co. KG, and Vital Energi Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch