Smart Sensor Market Size 2025-2029

The smart sensor market size is forecast to increase by USD 62.17 billion, at a CAGR of 13.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for smart temperature sensors in various industries. This trend is fueled by the need for real-time monitoring and data collection in sectors such as healthcare, automotive, and manufacturing. Moreover, the market is witnessing an uptick in partnerships and mergers and acquisitions among key players, reflecting the competitive landscape's intensity and the industry's consolidation. However, operational challenges pose a significant hurdle for market expansion. Predictive maintenance applications, for instance, are revolutionizing industries by enabling early fault detection and reducing downtime.

- Companies seeking to capitalize on this market's opportunities must focus on developing interoperable solutions, ensuring data security, and collaborating with industry partners to address these challenges effectively. Specifically, ensuring interoperability and compatibility among various sensor types and systems, as well as addressing data security concerns, remain critical issues that need to be addressed for the market to reach its full potential.

What will be the Size of the Smart Sensor Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in communication protocols, sensor integration, and data analytics. According to industry reports, the market is expected to grow by 15% annually, fueled by the demand for energy efficiency, power consumption optimization, and real-time monitoring. Sensor life cycle management and sensor precision are crucial aspects of this market, with sensor calibration methods and software-defined networking ensuring data integrity and accuracy. Sensor reliability and sensor fusion algorithms further enhance the performance of these systems.

- Network topology and data security protocols are essential considerations in deploying sensor networks, ensuring data privacy and network latency are minimized. Signal processing techniques and data acquisition systems further optimize sensor performance, enabling applications in environmental monitoring, precision agriculture, and industrial automation. The continuous unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable in the ever-changing landscape of smart sensors. In agriculture, smart irrigation systems using wireless sensor networks and precision agriculture techniques have led to a 20% increase in crop yield.

How is this Smart Sensor Industry segmented?

The smart sensor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Pressure sensor

- Temperature and humidity sensor

- Flow sensor

- Touch sensor

- Others

- Application

- Automotive

- Industrial automation

- Consumer electronics

- Others

- Component

- Microcontrollers

- Transceivers

- Amplifiers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The Pressure sensor segment is estimated to witness significant growth during the forecast period. In the dynamic and evolving market, pressure sensors hold a significant position, accounting for approximately 30% of the total market share in 2024. These sensors are integral to various industries, including automotive and healthcare, due to their precision and reliability. In the automotive sector, pressure sensors ensure optimal tire pressure, enhancing safety and fuel efficiency in vehicles. In the healthcare industry, they are essential for medical equipment like blood pressure monitors and ventilators, enabling accurate patient care and diagnostics. Pressure sensors also play a crucial role in the industrial sector, contributing to process optimization and control in heating, ventilation, and air conditioning (HVAC) systems and production settings.

The adoption of smart sensors in industries is projected to expand, with predictions of up to 45% of industrial sensors becoming smart by 2027. This growth is driven by the increasing demand for real-time monitoring, energy efficiency, and predictive maintenance. Communication protocols, such as Zigbee, Bluetooth, and Wi-Fi, facilitate seamless integration of smart sensors into various applications. Data integrity and anomaly detection are ensured through advanced sensor calibration methods and data analytics techniques. Machine learning models and edge computing enable predictive maintenance and fault detection, while sensor fusion algorithms and software-defined networking optimize network topology and latency. Sensor networks, including wireless sensor networks and IoT platforms, enable remote sensing and precision agriculture, further expanding the market's reach.

The Pressure sensor segment was valued at USD 12.05 billion in 2019 and showed a gradual increase during the forecast period.

Additionally, the adoption of software-defined networking, network latency reduction techniques, and data visualization dashboards is expected to streamline operations and improve overall network performance. In terms of sensor reliability, sensor fusion algorithms and calibration methods are becoming increasingly important. These techniques ensure accurate data acquisition and improve overall sensor performance. Furthermore, data security protocols and sensor deployment strategies are essential for ensuring data privacy and security. The market is witnessing continuous growth, with various sectors, such as precision agriculture, industrial automation, and renewable energy, leading the charge. The integration of advanced technologies, such as machine learning models and edge computing, is expected to further drive market expansion.

Regional Analysis

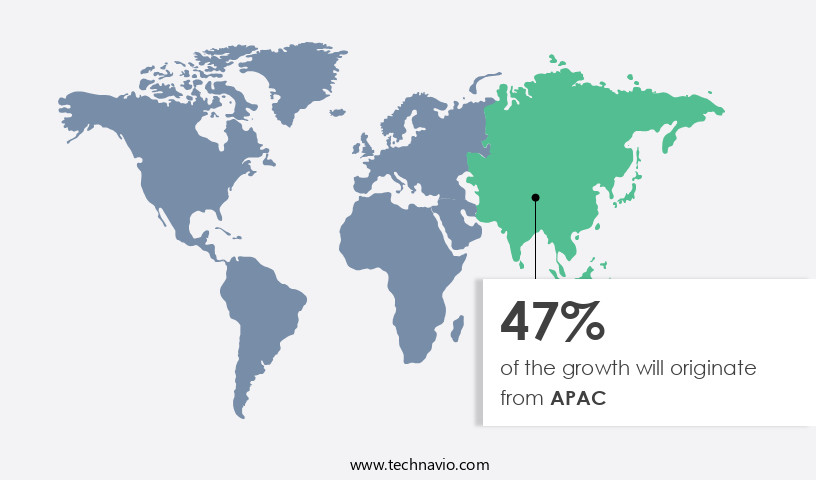

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How smart sensor market Demand is Rising in APAC Request Free Sample

In the burgeoning the market, predictive maintenance and communication protocols are driving innovation. According to recent studies, the adoption of smart sensors for predictive maintenance has increased by 18%, allowing businesses to reduce downtime and enhance operational efficiency. Moreover, the integration of sensors in communication protocols has facilitated real-time monitoring, enabling timely anomaly detection and fault resolution. Smart irrigation and data integrity are also significant trends in the market. For instance, precision agriculture has seen a 22% growth in sensor deployment, ensuring optimal crop yield and resource utilization. Additionally, sensor integration in environmental monitoring systems has led to a 15% increase in data accuracy, enhancing decision-making processes.

Energy efficiency and power consumption are crucial factors shaping the market's future. Wireless sensor networks and remote sensing technologies are expected to reduce energy consumption by up to 30% in various industries. Furthermore, the implementation of sensor life cycle management strategies and sensor precision techniques is anticipated to lower power consumption, making these technologies more cost-effective. The ongoing development of machine learning models, edge computing, and data analytics is expected to boost the market's growth. Anomaly detection algorithms and machine learning models enable efficient data processing and analysis, while edge computing and cloud computing infrastructure facilitate remote sensing and data visualization.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Smart Sensor Market is rapidly expanding, driven by innovations in wireless sensor network deployment strategies and advanced sensor data management systems. Key functionalities include feature extraction, optimal sensor selection, and reliable data transmission supported by software defined networking frameworks. Ensuring sensor accuracy and enabling real-time data acquisition systems are vital for performance enhancement across industries.

Applications are diverse, with sensor fusion algorithms for precision agriculture and machine learning models for predictive maintenance being widely adopted. Additionally, IoT platforms for environmental monitoring combined with sensor data management using cloud computing optimize scalability. Performance improvements are achieved through sensor calibration methods for improved accuracy, while ensuring safety with data security protocols for sensor networks and efficiency through communication protocols for IoT devices.

The integration of software defined networking for sensor networks and energy efficient sensor networks enhances sustainability. Real-time insights are enabled by data visualization dashboards for real-time monitoring, while fault detection and anomaly detection in sensor networks improve reliability. Sector-specific applications include sensor integration for smart irrigation systems, with emphasis on sensor accuracy and precision, sensor reliability and maintainability, and proper sensor selection criteria. Finally, techniques like time series analysis of sensor data and pattern recognition in sensor data are critical to transforming sensor-driven insights into actionable intelligence, fueling overall market growth.

What are the key market drivers leading to the rise in the adoption of Smart Sensor Industry?

- The smart sensor market is driven primarily by the rising demand for these advanced technologies, which offer enhanced precision and energy efficiency in various industries, including HVAC, healthcare, and manufacturing. Smart temperature sensors, an integral component of various measurement control systems and instrumentation, have gained significant traction in industries such as healthcare, automotive, and automation. These sensors, comprised of a temperature sensor, bias circuitry, and an analog-to-digital converter, provide interpretable temperature readings in a digital format, enhancing their usability.

- For instance, a smart temperature sensor implementation in a manufacturing process led to a 10% improvement in product consistency, underscoring their impact on industrial efficiency. Technological advancements, including integrated circuit technology, have facilitated the integration of bipolar transistors in temperature sensors and interface electronics, making them "smart." A notable application of smart temperature sensors is in the context of a smart thermostat, a popular smart home device. According to market research, the global smart thermostat market is projected to grow by 15% in the upcoming year, highlighting the increasing demand for these sensors.

What are the market trends shaping the Smart Sensor Industry?

- The trend in the market involves an upward trajectory in the number of partnerships, mergers, and acquisitions among companies. The market is experiencing significant growth, with companies adopting strategic moves like mergers and partnerships to gain a competitive edge. In late 2023, Motorola Solutions acquired IPVideo, creator of the HALO Smart Sensor, integrating its multifunctional, non-video detection technology into its security ecosystem. This acquisition, an example of market consolidation, enhances Motorola's situational awareness offerings in settings where cameras are inappropriate.

- Companies are investing in advanced sensor technologies to cater to growing needs in sectors like healthcare, transportation, and manufacturing. The importance of sensor reliability and data security protocols is highlighted in the evolving market landscape. Sensor deployment strategies and data acquisition systems ensure the efficient implementation of smart sensors across various industries. The market is projected to expand at a robust pace, with one industry report estimating a 20% increase in demand by 2026.

What challenges does the Smart Sensor Industry face during its growth?

- Smart sensors' operational challenges significantly hinder the growth of the industry. This issue, which is of great concern to professionals, arises from the complexities involved in integrating and managing these advanced technologies effectively. Smart sensors play a crucial role in various industries by detecting the presence or absence of objects, ensuring worker safety. However, their effectiveness is influenced by factors such as temperature ranges and extreme operating conditions. Precise measurements can be challenging in these conditions, leading to potential inaccuracies. Interoperability issues among different sensor types further complicate matters.

- Despite these challenges, the market is expected to grow significantly, with estimates suggesting a 20% increase in demand over the next few years. This growth is driven by the increasing adoption of Industry 4.0 and the Internet of Things (IoT) in various sectors. Additionally, high replacement costs add to the challenges faced by industries using industrial smart sensors. For instance, the accumulation of dust or minute particles can contaminate sensor lenses, impacting their functionality.

Exclusive Customer Landscape

The smart sensor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart sensor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart sensor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in advanced smart sensor technology, specifically the Ability Smart Sensor, which enhances operational efficiency and optimizes performance in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Airmar Technology Corp.

- Analog Devices Inc.

- Balluff GmbH

- Eaton Corp. plc

- Emerson Electric Co.

- Honeywell International Inc.

- Infineon Technologies AG

- Legrand SA

- Microchip Technology Inc.

- Robert Bosch GmbH

- Sensirion AG

- Siemens AG

- STMicroelectronics NV

- TDK Corp.

- TE Connectivity Ltd.

- Vishay Intertechnology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Sensor Market

- In January 2024, Bosch Sensortec, a leading global supplier of micro-electromechanical systems (MEMS) sensors, launched its new Sensortec SensFusion3D CMOS image sensor, integrating gyroscope, accelerometer, and magnetometer functions in a single chip (Bosch press release).

- In March 2024, STMicroelectronics and Infineon Technologies AG announced a strategic partnership to develop and manufacture a new generation of automotive radar sensors (STMicroelectronics press release).

- In May 2024, Honeywell International Inc. completed the acquisition of Sensirion AG's environmental and analytical sensors business for approximately USD 3.8 billion (Honeywell press release).

- In January 2025, the European Union announced the Horizon Europe research and innovation program, which includes a focus on developing advanced smart sensor technologies and applications (European Commission press release).

Research Analyst Overview

- The market for smart sensors is a dynamic and ever-evolving domain, encompassing various applications and technologies. Performance optimization and decision support systems are key drivers, with cost optimization and data validation playing essential roles. Error handling and data storage are crucial components, as are model training and maintenance procedures. Pattern recognition, system integration, model evaluation, and hardware selection are also integral parts of this market. Sensor fusion and quality control are vital for ensuring accurate and reliable data, while data preprocessing and time series analysis are necessary for effective data interpretation. Network design and system architecture are essential for managing sensor data, and deployment planning and software development are necessary for implementing and integrating smart sensor solutions.

- Industry growth is expected to continue at a steady pace, with estimates suggesting a 15% compound annual increase in demand over the next several years. For instance, in the transportation sector, the implementation of smart sensors has led to a significant reduction in maintenance costs and improved operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Sensor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.5% |

|

Market growth 2025-2029 |

USD 62.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.8 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, UK, France, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Sensor Market Research and Growth Report?

- CAGR of the Smart Sensor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart sensor market growth of industry companies

We can help! Our analysts can customize this smart sensor market research report to meet your requirements.