Diuretic Drugs Market Size 2024-2028

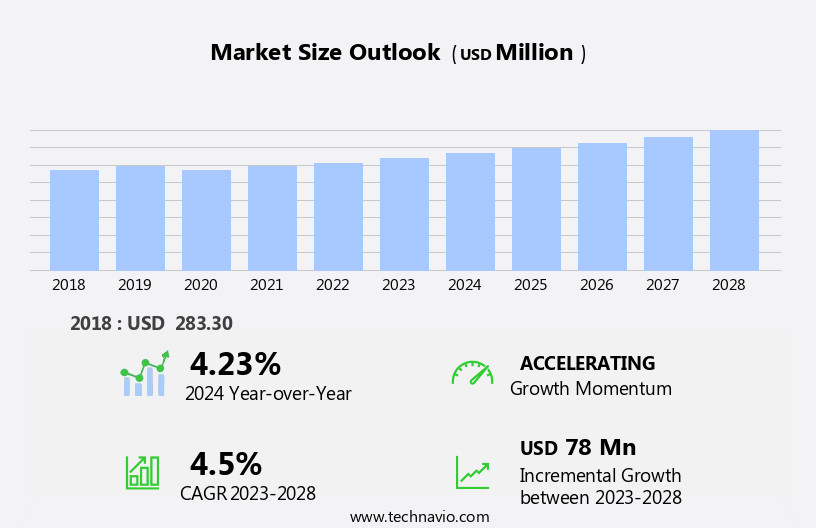

The diuretic drugs market size is forecast to increase by USD 78 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the rising prevalence of hypertension and kidney diseases. The increasing incidence of these conditions necessitates the use of diuretic drugs for managing fluid balance and blood pressure. However, market growth faces challenges. Price pressure and the availability of counterfeit drugs pose significant obstacles. The affordability of these medications is a concern for many patients, leading them to seek out cheaper alternatives, including counterfeit drugs. These unregulated products not only compromise patient safety but also undermine the credibility of the market. Companies must address these challenges by offering competitive pricing and ensuring the authenticity of their products to maintain market share and customer trust.

- To capitalize on opportunities, market players can explore collaborations with healthcare providers and insurers to make diuretic drugs more accessible and affordable for patients. Additionally, investing in research and development to create innovative, cost-effective solutions could help differentiate offerings and attract price-sensitive consumers.

What will be the Size of the Diuretic Drugs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the persistent demand for effective treatments for conditions such as renal failure and fluid retention. Medication adherence remains a critical factor, with dosage forms and oral administration being key considerations for patients. Ongoing clinical trials explore new applications and formulations, including osmotic diuretics and carbonic anhydrase inhibitors, for various indications such as liver cirrhosis and congestive heart failure. Intellectual property, supply chain, and patient education are essential components of the drug development process. The diuretic market's dynamics are shaped by the patent expiry of brand-name drugs, leading to the emergence of generic alternatives and increased competition.

Patient compliance, adverse effects, and drug interactions are ongoing concerns, necessitating continuous efforts in treatment guidelines and patient education. Over-the-counter drugs and prescription medications coexist, with healthcare providers playing a crucial role in determining the most appropriate treatment for individual patients. The manufacturing process for diuretic drugs requires stringent quality control measures to ensure electrolyte balance and minimize adverse effects. Thiazide, loop, and potassium-sparing diuretics remain popular choices, with intravenous administration offering advantages for certain patient populations. Pricing strategies and healthcare policies continue to influence market trends, making the market a dynamic and evolving landscape.

How is this Diuretic Drugs Industry segmented?

The diuretic drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

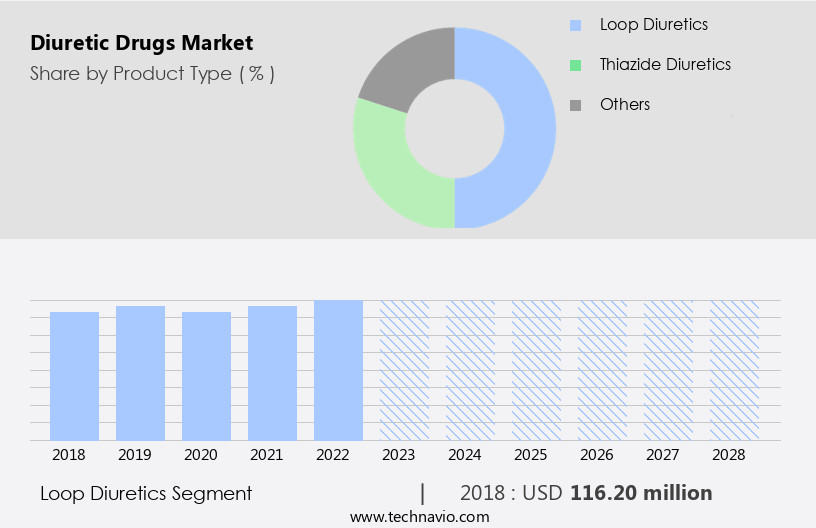

- Product Type

- Loop diuretics

- Thiazide diuretics

- Others

- Route of Adminstration

- Oral

- Parenteral (Intravenous)

- Application

- Hypertension

- Heart Failure

- Edema

- Renal Disorders

- Glaucoma

- Geography

- North America

- US

- Canada

- Europe

- Denmark

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Type Insights

The loop diuretics segment is estimated to witness significant growth during the forecast period.

Loop diuretics, a class of diuretic drugs, play a significant role in managing conditions such as high blood pressure and edema, often associated with chronic kidney disease (CKD) and congestive heart failure. These medications inhibit the sodium-potassium-chloride co-transporter in the thick ascending loop of Henle in the kidneys, enhancing the excretion of chloride, sodium, and potassium into the nephrons. This promotes proper kidney function and alleviates fluid retention. Furosemide, bumetanide, and torasemide are common loop diuretics, known for their higher potency, longer half-life, and greater bioavailability compared to other diuretics. Oral administration is the most common dosage form for these drugs, although intravenous administration is also used in certain situations.

The development of loop diuretics involves extensive clinical trials to ensure safety and efficacy. Intellectual property rights and patent expiry impact the market dynamics, leading to the availability of generic drugs. Patient education is crucial for medication adherence and managing potential adverse effects, such as electrolyte imbalance, and drug interactions. Carbonic anhydrase inhibitors, thiazide diuretics, and potassium-sparing diuretics are alternative diuretic classes. The manufacturing process requires strict quality control to maintain consistency and efficacy. Healthcare providers often prescribe brand-name drugs due to their perceived superiority, but pricing strategies can influence patient access to these medications. Treatment guidelines recommend the use of loop diuretics for specific indications, and over-the-counter diuretics should not replace prescription medications for managing fluid retention and electrolyte imbalances.

Adverse effects and drug interactions necessitate close monitoring and patient compliance. The supply chain for diuretic drugs involves various stakeholders, from drug developers to manufacturers, distributors, and healthcare providers. Renal failure, liver cirrhosis, and congestive heart failure are common conditions that necessitate diuretic therapy. Despite their benefits, loop diuretics must be used judiciously to minimize potential risks.

The Loop diuretics segment was valued at USD 116.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for diuretic drugs holds a significant share in the global industry, driven by the US and Canada as major contributors. Factors fueling this growth include the high incidence of hypertension, increased healthcare expenditure, and heightened awareness among patients regarding hypertension and its complications. In the US, the number of hospitalizations has risen substantially since 2000 due to the increasing prevalence of chronic diseases and critical illnesses. The market in North America experienced a decline in 2020 due to the COVID-19 pandemic. In Canada, diuretic drugs rank second in terms of revenue generation in the region.

Osmotic diuretics, thiazide diuretics, loop diuretics, potassium-sparing diuretics, and carbonic anhydrase inhibitors are the primary types of diuretics used for various indications, including renal failure, fluid retention, liver cirrhosis, congestive heart failure, and electrolyte imbalance. Drug development, intellectual property, and supply chain management play crucial roles in the market. Patient education, medication adherence, treatment guidelines, drug interactions, and adverse effects are essential considerations for healthcare providers. Pricing strategies and quality control are essential aspects of the market dynamics. As the patent expiry of brand-name drugs leads to the availability of generic drugs, competition intensifies. The manufacturing process for diuretic drugs requires stringent quality control to ensure efficacy and safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global diuretic drugs market size and forecast projects growth, driven by diuretic drugs market trends 2024-2028. B2B pharmaceutical solutions leverage advanced diuretic technologies for efficacy. Diuretic drugs market growth opportunities 2025 include diuretics for hypertension and diuretics for heart failure, meeting patient needs. Pharma supply chain software optimizes operations, while diuretic drugs market competitive analysis highlights key companies. Sustainable drug production practices align with eco-friendly pharma trends. Diuretic drugs regulations 2024-2028 shapes diuretic demand in North America 2025. Targeted diuretic solutions and premium diuretic drug insights boost adoption. Diuretics for kidney disease and customized diuretic formulations target niches. Diuretic drugs market challenges and solutions address side effects, with direct procurement strategies for diuretics and diuretic pricing optimization enhancing profitability. Data-driven diuretic market analytics and precision medicine trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Diuretic Drugs Industry?

- The rising prevalence of hypertension among the global population serves as the primary market driver.

- Diuretic drugs are a class of prescription medications used to treat various conditions, including hypertension and edema. These drugs work by increasing the production of urine, helping the body eliminate excess fluid. There are different types of diuretics, including thiazide diuretics, potassium-sparing diuretics, and loop diuretics. Thiazide diuretics act on the distal tubules, while potassium-sparing diuretics preserve potassium levels in the body. Loop diuretics, administered intravenously, have a more rapid onset of action. The use of diuretic drugs requires strict quality control measures to prevent electrolyte imbalances. Potassium levels, in particular, need to be monitored closely due to the risk of hypokalemia.

- Diuretics can also cause dehydration, which may lead to dizziness, weakness, and fainting. Despite their benefits, diuretics can have side effects. Thiazide diuretics may increase the risk of developing diabetes, while potassium-sparing diuretics may cause hyperkalemia. Loop diuretics can lead to an increased risk of gout and ototoxicity. Proper monitoring and dosage adjustment are essential to minimize these risks. In conclusion, diuretic drugs play a crucial role in managing various health conditions. However, their use requires careful monitoring and adherence to quality control measures to prevent electrolyte imbalances and other side effects. The professional use of these medications requires a thorough understanding of their mechanisms of action, potential risks, and proper administration techniques.

What are the market trends shaping the Diuretic Drugs Industry?

- The prevalence of kidney diseases is on the rise, emerging as a significant market trend in the healthcare industry. It is essential for healthcare professionals and organizations to stay informed about this trend and provide effective solutions to address the increasing demand for kidney disease treatment and management.

- The market is experiencing growth due to the rising prevalence of chronic kidney disease (CKD), a major cause of fluid retention. Approximately 10% of the world's population is affected by CKD, with millions more lacking access to affordable treatment. In the US, 15% of adults, or 37 million people, are estimated to have kidney disease. The increasing incidence of diabetes, high blood pressure, heart disease, and familial kidney disease are significant contributors to the growing prevalence of CKD. Diuretic drugs are essential in managing fluid retention, a common symptom of CKD. These medications promote urine production, helping to reduce excess fluid in the body.

- Osmotic diuretics, a type of diuretic, are particularly effective in drawing water from the urine and into the kidneys, increasing urine output. Clinical trials play a crucial role in the development of new diuretic drugs, ensuring their safety and efficacy. Medication adherence is also a critical factor in managing kidney diseases effectively. Dosage forms, such as oral administration, are essential in ensuring patients take their medication as prescribed. The market is expected to continue growing as the prevalence of kidney diseases increases, and new treatments and formulations are developed.

What challenges does the Diuretic Drugs Industry face during its growth?

- The pharmaceutical industry faces significant challenges from price pressures and the prevalence of counterfeit drugs, which negatively impact industry growth.

- The market experiences intense competition due to the presence of numerous global and regional players. These companies manufacture and sell diuretic drugs, which share similar compositions and product designs. To expand their market share, global companies invest heavily in marketing, promotion, and brand improvement. However, this competition leads to price wars, prompting companies to lower their product costs to boost sales and secure low-cost agreements.

- Additionally, they offer discounts to further intensify competition. Intellectual property protection plays a crucial role in the market, particularly with the patent expiry of carbonic anhydrase inhibitors. As generic drugs enter the market, patient education becomes essential to ensure patient compliance and effective treatment for conditions such as liver cirrhosis.

Exclusive Customer Landscape

The diuretic drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the diuretic drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, diuretic drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - This company specializes in manufacturing and distributing diuretic medications, including Microzide. As a research analyst, I can confirm their product portfolio focuses on addressing fluid retention and related health conditions. Their offerings undergo rigorous research and development to ensure efficacy and safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Akorn Operating Co. LLC

- Alembic Pharmaceuticals Ltd.

- Amneal Pharmaceuticals Inc.

- Aurobindo Pharma Ltd.

- Bausch Health Companies Inc.

- Casper Pharma

- Hikma Pharmaceuticals Plc

- Lannett Co. Inc.

- Monarch Pharmachem

- Novartis AG

- Padagis US LLC

- Pfizer Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Validus Pharmaceuticals LLC

- VITARIS AG

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Diuretic Drugs Market

- In January 2024, Fresenius Kabi, a leading global health care company, announced the launch of Torasemide Injection, a new diuretic drug, in the European Union. This expansion of their product portfolio aims to cater to the growing demand for effective diuretic treatments (Fresenius Kabi Press Release).

- In March 2024, Merck & Co. And Pfizer Inc. Entered into a strategic collaboration to co-develop and co-promote Zevtera and Zinplava, diuretic combination products for the treatment of heart failure. This partnership is expected to strengthen both companies' presence in the market (Merck & Co. Press Release).

- In May 2024, Novartis AG received approval from the U.S. Food and Drug Administration (FDA) for its new diuretic drug, Lazolac, to treat heart failure. This approval marks a significant milestone for Novartis, expanding their cardiovascular portfolio and addressing the increasing prevalence of heart failure (Novartis AG Press Release).

- In April 2025, AstraZeneca Plc and the Chinese pharmaceutical company, Fuzhou Huabang Pharmaceutical Co. Ltd, signed a licensing agreement for the development and commercialization of AstraZeneca's diuretic drug, Maxzide, in China. This collaboration represents AstraZeneca's commitment to expanding its market reach and addressing the growing demand for diuretic treatments in China (AstraZeneca Plc Press Release).

Research Analyst Overview

- The market encompasses a diverse range of medications used to manage various health conditions, including high blood pressure and edema. Synergistic effects of diuretics on the renin-angiotensin system and heart rate contribute to improved kidney function and enhanced quality of life for patients. Post-market surveillance is crucial to monitor drug abuse and potential side effects, such as electrolyte imbalances and drug dependence. Sodium channels, chloride channels, and potassium channels play a key role in diuretic action, affecting urine output and renal blood flow. Diuretic resistance, a common issue, can be mitigated through combination therapy and managing patient body weight.

- Drug recalls and counterfeit drugs pose risks to patient safety, necessitating stringent monitoring parameters. Therapeutic index and drug tolerance are essential considerations in managing short-term and long-term effects, including withdrawal symptoms and nootropic effects. Anti-diuretic hormone and tubular secretion/reabsorption impact urine output and water reabsorption, while side effects management is crucial to mitigate potential harm. Liver function and potassium excretion are essential monitoring parameters, especially during acute use. Diuretics can have additive effects when used in combination with other medications, affecting drug tolerance and treatment outcomes. Managing diuretic side effects, such as changes in heart rate and electrolyte levels, is crucial for optimizing patient care.

- Drug dependence and withdrawal symptoms can complicate long-term use, necessitating careful monitoring and management strategies. Effective diuretic therapy requires ongoing assessment and adjustment to ensure optimal patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Diuretic Drugs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 78 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Denmark, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Diuretic Drugs Market Research and Growth Report?

- CAGR of the Diuretic Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the diuretic drugs market growth of industry companies

We can help! Our analysts can customize this diuretic drugs market research report to meet your requirements.