Drip Emitters Market Size 2024-2028

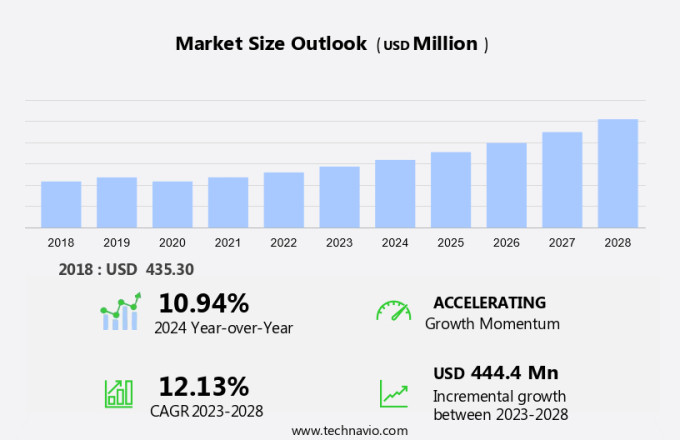

The drip emitters market size is forecast to increase by USD 444.4 million at a CAGR of 12.13% between 2023 and 2028. The market is experiencing significant growth due to the increasing water constraint and the trend towards technological progress in agriculture. The focus on efficient use of natural resources is driving the demand for automatic drip irrigation systems, particularly in specialty greenhouse plants production. Drip emitters, available in inline and online configurations, are essential components of these systems, ensuring precise water delivery directly to the plant roots. Technological advancements have led to the development of advanced emitters, capable of responding to soil moisture levels and optimizing water usage. However, challenges such as filtration and clogging issues persist, necessitating ongoing research and innovation from market leaders to ensure the continued reliability and effectiveness of drip emitters in modern agriculture.

The drip emitters market is experiencing significant growth, driven by innovations such as Bayer's Defense Program and the integration of S5 Smart Spacing technology. These advancements enhance the efficiency of Heavywall Dripline systems, ensuring optimal water delivery. In sectors like agriculture, the use of nematodes in pest control complements drip irrigation systems, promoting healthier crops. Meanwhile, EPC and Microjet Irrigation Systems offer versatility for various outdoor environments. Companies like Covidien are pushing boundaries with products like Catalyft PL and PL40, enhancing graft delivery methods. The Space-D Access System and Accelerate Graft Delivery initiatives, including Grafton DBF, further demonstrate the market's commitment to sustainability and efficiency. As demand rises, the drip emitters market is poised for transformative growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Agriculture

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- France

- South America

- Middle East and Africa

- North America

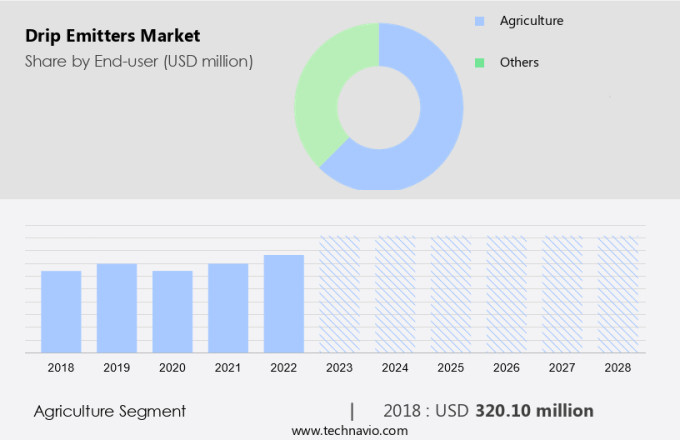

By End-user Insights

The agriculture segment is estimated to witness significant growth during the forecast period. Drip emitters are essential components of irrigation systems, widely used in agriculture to ensure efficient water usage in various crops. Two common types of drippers are on-line and in-line emitters. In-line drippers are popular in row and field crops, including maize, soybeans, wheat, and cotton. The global population growth necessitates an increase in food production, leading farmers to adopt advanced irrigation systems. Drip emitters, such as those manufactured by Rain Bird, enable farmers to control water usage and minimize water waste. In-line drippers are particularly effective in field crops, ensuring optimal water distribution and improving crop yields.

Get a glance at the market share of various segments Request Free Sample

The agriculture segment was valued at USD 320.10 million in 2018 and showed a gradual increase during the forecast period.

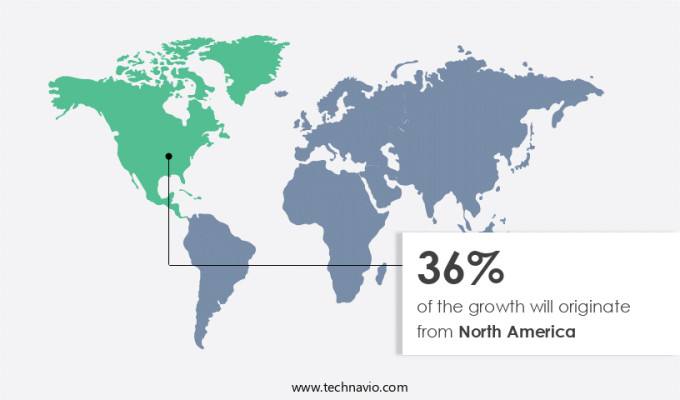

Regional Insights

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is primarily driven by the extensive use of drip irrigation systems in agriculture, particularly in North America. Drip irrigation is an efficient water management technique, making it ideal for use in drought-prone areas and large farms, which are common in North America. According to the United States Department of Agriculture (USDA), agriculture is a significant consumer of water in the US, accounting for approximately 80% of the nation's consumptive water use. Farmers in North America, including those in the US and Canada, rely on water-efficient irrigation methods to maintain their crops, such as maize, soybeans, wheat, and cotton.

Moreover, leading irrigation system manufacturers, including Rain Bird, are capitalizing on this trend by offering advanced drip emitter technologies to enhance crop yields and reduce water wastage. Overall, the North American region is anticipated to dominate The market due to its large agricultural sector and the increasing adoption of water-efficient irrigation systems.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing focus on efficient use of natural resources is the key driver of the market. In the agricultural sector, water scarcity has emerged as a significant challenge, particularly in regions experiencing drought, such as Europe. To address this issue, farmers are increasingly adopting water-efficient irrigation systems, with drip irrigation systems gaining popularity. Drip irrigation systems, offered by companies like Hunter Industries, ensure the optimal application of water to the soil, enhancing crop growth and yield. These systems are more water-efficient than traditional irrigation methods, with Rivulis' drip irrigation systems utilizing 85%-90% less water. Moreover, micro-irrigation systems, including drip emitters, enable precision agriculture by delivering water directly to the plant roots, reducing water loss through evaporation and runoff.

Moreover, greenhouse vegetable production also benefits significantly from drip irrigation systems, ensuring consistent water supply and optimal growing conditions.

Market Trends

The rising adoption of greenhouse agriculture is the upcoming trend in the market. The global market for drip emitters is experiencing significant growth due to the increasing adoption of agriculture methods that optimize water usage, particularly in greenhouse vegetable production. Companies like Hunter Industries are major players in this market, providing advanced micro-irrigation systems for farmers.

Moreover, with water scarcity becoming a pressing issue, precision agriculture through drip irrigation systems is gaining popularity. This trend is especially prominent in the expansion of greenhouse agriculture, as farmers seek to increase output and efficiency. Government initiatives in various countries are further promoting the use of greenhouse agriculture, leading to an increase in demand for drip irrigation systems and, consequently, The market.

Market Challenge

Filtration and clogging issues is a key challenge affecting the market growth. In the agricultural sector, the use of drip emitters in micro-irrigation systems has gained significant traction due to their efficiency in water usage and precision in delivering nutrients to plants. However, one challenge that farmers face is the clogging of emitters in drip irrigation lines. This issue can arise due to the presence of bacteria, sediments, and chemicals in the water supply, leading to poor water quality and ultimately affecting the performance of the system. The clogging can occur rapidly, particularly when the irrigation systems operate under inadequate pressure. To mitigate this problem, it is crucial for farmers to implement proper filtration and maintenance practices.

Furthermore, companies such as Hunter Industries offer advanced drip irrigation solutions that cater to the specific needs of greenhouse vegetable cultivation and address the challenges of water scarcity in agriculture. By prioritizing the maintenance of drip irrigation systems, farmers can ensure optimal crop yield and reduce water wastage.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

DripWorks Inc: The company offers drip emitters or emitters with basic and pressure compensating water drippers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chamartin Group

- Chinadrip Irrigation Equipment Co. Ltd.

- DIG Corp.

- Elgo Irrigation Ltd.

- Golden Key Middle East FZE

- Hunter Industries Inc.

- Irritec SpA

- Jain Irrigation Systems Ltd.

- KSNM DRIP

- Lindsay Corp.

- Mahindra and Mahindra Ltd.

- NORMA Group SE

- Orbia Advance Corp. S.A.B. de C.V.

- Rain Bird Corp.

- Rivulis Irrigation Ltd.

- Sujay Irrigations Pvt. Ltd.

- The Toro Co.

- T.L. Irrigation Co

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of micro-irrigation systems in agriculture. Drip emitters are essential components of micro-irrigation systems, enabling precise water delivery directly to the plant root zone. In agriculture, drip emitters are widely used for growing greenhouse vegetables and field crops such as maize, soybeans, wheat, cotton, and others, especially in areas affected by water scarcity. Technological progress in precision agriculture, including sensors for soil moisture monitoring and automation, is driving the market. Drip emitters come in various types, including inline and online emitters, and are offered by major players.

Furthermore, end users in the market include farmers, plantation crops, and ranch yields. The market is also witnessing growth in the use of drip emitters in specialty greenhouse plants and outdoor environments for applications such as outdoor lighting and field crops. Water constraints and the need for efficient water usage are key factors driving the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.13% |

|

Market growth 2024-2028 |

USD 444.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.94 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, Canada, France, China, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Chamartin Group, Chinadrip Irrigation Equipment Co. Ltd., DIG Corp., DripWorks Inc., Elgo Irrigation Ltd., Golden Key Middle East FZE, Hunter Industries Inc., Irritec SpA, Jain Irrigation Systems Ltd., KSNM DRIP, Lindsay Corp., Mahindra and Mahindra Ltd., NORMA Group SE, Orbia Advance Corp. S.A.B. de C.V., Rain Bird Corp., Rivulis Irrigation Ltd., Sujay Irrigations Pvt. Ltd., The Toro Co., and T.L. Irrigation Co |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch