Maize Market Size 2024-2028

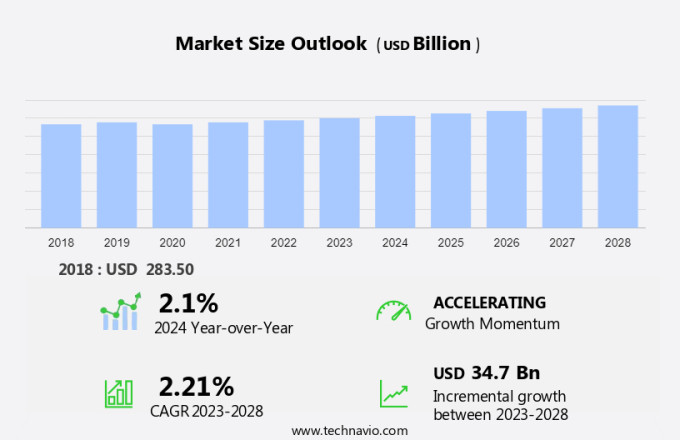

The maize market size is forecast to increase by USD 34.7 billion at a CAGR of 2.21% between 2023 and 2028. The market is driven by the rising demand for maize as a primary ingredient in various industries, including food processing and animal feed production. In the food sector, maize is extensively used in the production of corn syrup, corn flour, tortillas, and thickening agents such as cornstarch and corn oil. These products are essential in cooking and food manufacturing. However, the market faces several challenges, including logistics and distribution issues. Maize is a bulky and perishable crop, making efficient storage and warehouse management essential to maintain its quality and prevent losses. The complex supply chain, from farmers to consumers, requires effective coordination and management to ensure a steady flow of maize to meet the increasing demand. In the industrial sector, maize serves as a feedstock for the production of alcohol, with whiskey and vodka being notable examples. Furthermore, maize is also used as a raw material in the pharmaceutical industry for medication tablets. However, the market faces challenges in logistics and distribution due to the bulky nature and perishable characteristics of maize. Additionally, the increasing preference for organically cultivated maize is another trend shaping the market landscape.

What will be the Size of the Market During the Forecast Period?

Maize, also known as corn, is a significant cereal crop worldwide, with various applications in food, livestock feed, and industrial purposes. This comprehensive analysis provides an insightful exploration of The market, focusing on its role as a staple food, feed grain, and raw material for diverse industries. Maize is a vital food source for numerous populations, particularly in North America. It is consumed in various forms, including field corn, sweet corn, popcorn, baby corn, and cornmeal. Cornmeal is further processed into various food products, such as tortillas, bread, and snacks.

Furthermore, the nutritional value of maize is attributed to its rich antioxidant content, including phenols and phytosterols. Maize serves as a primary feed grain for livestock production, particularly for poultry and swine. Its high energy content, primarily derived from its oil, makes it an essential component of livestock diets. Maize is extensively used in industrial processes, including the production of corn-based biofuels, plastics, and adhesives. In the food industry, it is used as a sweetener and thickening agent. Maize and soybean are two essential crops in the agriculture industry, with maize contributing significantly to the global protein supply.

Also, while maize is a primary source of feed protein, soybean is a major source of protein for human consumption. The synergy between these crops enhances their overall value in the agriculture sector. The Green Revolution marked a significant turning point in maize cultivation, leading to increased productivity and yield through the introduction of high-yielding varieties and modern agricultural practices. Biotechnological development has further revolutionized maize production, with genetically modified varieties offering enhanced resistance to pests and improved nutritional value. Urea cultivation is a crucial aspect of maize production, as it is used as a fertilizer to enhance crop growth and yield.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Retail

- Food service

- Geography

- North America

- US

- APAC

- China

- South America

- Brazil

- Argentina

- Europe

- Middle East and Africa

- North America

By End-user Insights

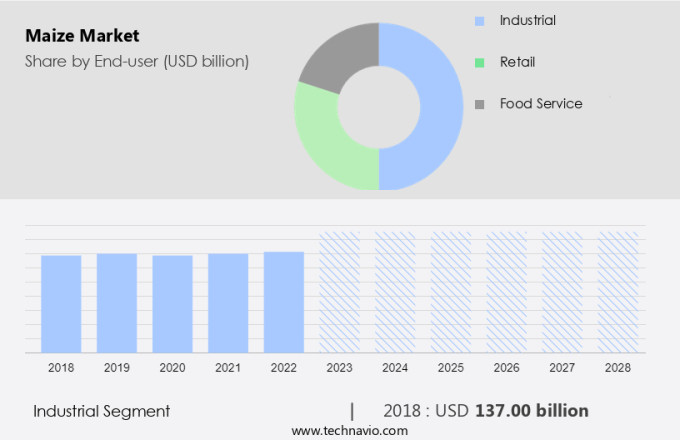

The industrial segment is estimated to witness significant growth during the forecast period. Maize and its derivatives, including corn syrup, corn flour, and cornstarch, hold significant value in various industries. In food processing, maize is utilized in the production of tortillas, thickening agents, and alcoholic beverages such as whiskey and vodka. Beyond food applications, maize is employed as a raw material and feedstock in the manufacturing of pharmaceuticals, particularly in the production of medication tablets. Maize starch, a powdered byproduct, is utilized as a filler in the fabrication of plastics, adhesives, glues, resins, and artificial leather.

Additionally, maize oil, a refined vegetable oil extracted from corn germ, is employed in cooking and industrial processes, serving as a diluent and carrier in the production of insecticides and pesticides. Furthermore, it is incorporated into soaps, inks, and paints. Maize's versatility and wide-ranging applications make it an essential commodity in numerous industries. Maize's versatility extends to industrial purposes, where it is used as a raw material in the production of various chemicals, plastics, textile, and adhesives.

Get a glance at the market share of various segments Request Free Sample

The industrial segment was valued at USD 137.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

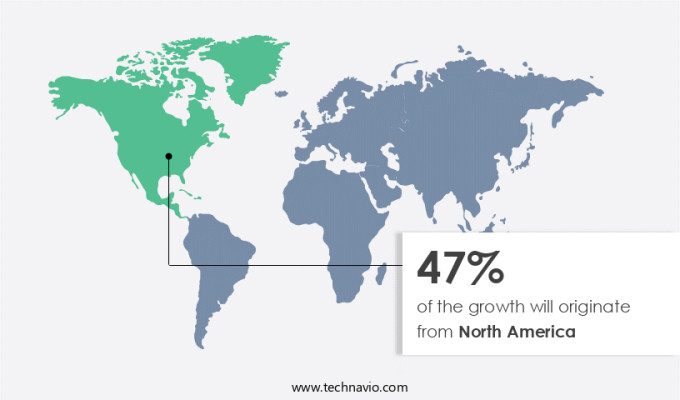

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Maize, also known as corn, holds a substantial position in the global market, with North America being a major contributor. The US and Mexico are leading producers, utilizing a significant portion of their agricultural land for maize cultivation. The US, in particular, dedicates over 90 million acres for maize production, according to the United States Department of Agriculture (USDA). In 2022, the US yielded approximately 15.1 billion bushels of maize, as reported by the USDA's National Agricultural Statistics Service (NASS). Maize serves various purposes in North America. A considerable portion is used for animal feed, providing essential nutrients like protein for livestock, contributing to the production of milk, meat, and eggs.

Additionally, maize is used as a feed grain in the poultry industry. Moreover, maize plays a crucial role in industrial purposes, such as bioethanol production. Antioxidants, phenols, and phytosterols derived from maize are valuable in various industries, including food and beverage, pharmaceuticals, and cosmetics. Cereal crops like maize are rich in these beneficial compounds. Soybean, another essential crop in North America, often competes with maize for agricultural land. However, maize's versatility and diverse applications make it an indispensable component of the agricultural sector. In conclusion, maize is a vital crop in North America, with significant economic importance. Its applications range from animal feed and industrial purposes to human consumption. The USDA's commitment to improving farming methods, selective breeding, and genetic engineering ensures the sustainability and productivity of maize production.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for maize as animal feeds is the key driver of the market. The consumption of meat and poultry in the global market is on the rise, leading to a significant increase in demand for animal feed, particularly maize. This cereal crop, often referred to as the "Queen of cereals," is essential for various livestock, including ruminants, poultry, swine, and aquaculture. In the dairy industry, maize is used to enhance milk production in cattle. Compared to other non-leguminous forage crops like sorghum, maize is easily digestible.

Additionally, yellow maize contains high levels of carotene, which contributes to the yellow color of milk and egg yolks. In developing countries, such as India, population growth and increasing consumer incomes have resulted in a growth in meat and poultry consumption. Meeting the rising demand for high-value animal protein is a pressing challenge. Maize is an essential component of compound feed, which includes by-product feeds, sorghum, wheat, and other grains, as well as alcohol and sweeteners. This versatile crop plays a crucial role in the agricultural sector and the livestock industry.

Market Trends

Growing demand for organically cultivated maize is the upcoming trend in the market. Maize, also known as corn, is a significant agricultural product in the United States, with various types such as field corn, sweet corn, popcorn, and baby corn. This versatile crop is not only a staple food for humans but also serves as livestock feed and raw material for biofuel production. Cornmeal and cornflakes are common food products derived from corn.

However, consumer preferences are shifting towards non-genetically modified (non-GMO) and organically cultivated maize due to growing concerns over the potential side effects of genetically engineered crops. This trend is gaining momentum globally, leading major food and beverage companies to source non-GMO maize from farmers and commodity traders. Furthermore, the increasing demand for renewable energy sources, such as ethanol produced from corn, contributes to the environmental sustainability of maize agriculture.

Market Challenge

Logistics and distribution challenges of maize affect the market growth. Maize, a versatile crop with various applications in the energy, food, and feed industries, faces distribution challenges for producers seeking optimal pricing in the market. Retailers, including supermarkets and large discount or convenience store chains, serve as crucial distribution channels for maize and its derived products such as oil, starch, syrup, sweeteners, and alcohol. However, these retailers operate on narrow profit margins, putting pressure on maize producers to deliver competitively priced goods.

Furthermore, logistical and distribution hurdles can pose significant challenges for maize producers. Issues may arise from inefficient order processing, inventory management, freight transportation, and storage capacity. These obstacles can stem from transportation problems, a lengthy supply chain, questionable market practices, and insufficient market intelligence. To navigate these complexities, maize producers must employ effective strategies to streamline their operations and maintain strong relationships with retailers and other stakeholders. By addressing these challenges, maize producers can ensure a stable market presence and maximize the value of their crops.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company is involved in offering maize, which is ideally used for a variety of bakery, baking mixes, and foodservice applications ranging from hot cereals to milk replacement formulas and specialty bread.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alianz Global Groups Pty Ltd.

- Archer Daniels Midland Co.

- Associated British Foods Plc

- Balaji Exim

- Bayer AG

- Bunge Ltd.

- Cargill Inc.

- CGB Enterprises Inc.

- COFCO Corp.

- Exotic Exim

- Fazaz Global Concepts LLC

- Gombella Integrated Services Ltd.

- Greenfield Global Inc.

- Groupe Limagrain

- Ingredion Inc.

- Ista International General Trading LLC

- Louis Dreyfus Holding BV

- Maeddy Impex Pvt. Ltd.

- Roquette Freres SA

- Tate and Lyle PLC

- Tereos Participations

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Maize, also known as corn, is a significant agricultural crop with various applications in food and industrial sectors. It is a staple food in many regions, consumed as cornmeal, cornflakes, tortillas, and various snacks. In food processing, maize is used as thickening agents, cornstarch, and in the production of corn syrup and corn flour. For livestock feed, maize is a primary source of energy and protein, used in compound feed for ruminants, poultry, swine, and aquaculture. Maize is also used in biofuel production, with ethanol being a major renewable energy source derived from it. Corn syrup and corn oil are used in the production of alcohol, including whiskey and vodka, and in pharmaceuticals as raw materials and feedstock.

Maize is grown on vast arable lands in regions like Iowa and Illinois, and its production is essential for the food and beverage industry, as well as for industrial purposes. The crop's versatility extends to its use as a renewable energy source, with bioethanol production reducing reliance on fossil fuels and contributing to environmental sustainability. Additionally, maize contains antioxidants, phenols, and phytosterols, making it a valuable ingredient in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.21% |

|

Market growth 2024-2028 |

USD 34.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.1 |

|

Regional analysis |

North America, APAC, South America, Europe, and Middle East and Africa |

|

Performing market contribution |

North America at 47% |

|

Key countries |

US, China, Brazil, Argentina, and Ukraine |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alianz Global Groups Pty Ltd., Archer Daniels Midland Co., Associated British Foods Plc, Balaji Exim, Bayer AG, Bunge Ltd., Cargill Inc., CGB Enterprises Inc., COFCO Corp., Exotic Exim, Fazaz Global Concepts LLC, Gombella Integrated Services Ltd., Greenfield Global Inc., Groupe Limagrain, Ingredion Inc., Ista International General Trading LLC, Louis Dreyfus Holding BV, Maeddy Impex Pvt. Ltd., Roquette Freres SA, Tate and Lyle PLC, and Tereos Participations |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, South America, Europe, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch