Drone Navigation System Market Size 2025-2029

The drone navigation system market size is forecast to increase by USD 20.8 billion, at a CAGR of 31.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the integration of advanced electronic warfare technologies and the advent of network-centric warfare. These developments enable drones to operate more effectively in complex environments, enhancing their military applications. However, the market faces challenges, primarily endurance constraints that necessitate ongoing research and development efforts to extend flight times and expand operational capabilities. Companies seeking to capitalize on market opportunities must focus on addressing these challenges through technological innovations and strategic partnerships, ensuring their drone navigation systems remain competitive in the evolving landscape.

What will be the Size of the Drone Navigation System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Remote control systems are being superseded by more sophisticated navigation systems, integrating safety standards and ensuring longer flight times. Navigation systems incorporate GNSS receivers, IMU sensors, and barometric altimeters for precise positioning and altitude control. Deep learning algorithms and real-time data processing enable object recognition, obstacle avoidance, and autonomous flight. API integrations and payload integration facilitate seamless data transmission and expand drone capabilities. Thermal management systems ensure optimal performance in extreme temperatures, while industrial inspection applications benefit from high-resolution image processing and sensor fusion.

Law enforcement agencies utilize drones for object recognition, search and rescue teams for emergency response, and delivery services for efficient distribution. Regulations governing drone use are continuously evolving, shaping the market landscape. Drone regulations address privacy concerns, air traffic management, and data security, ensuring safe and responsible drone operations. Power management, communication protocols, and battery life are crucial considerations for drone manufacturers. Brushless motors, flight controllers, and AI algorithms enhance drone performance and payload capacity. The market's ongoing dynamism reflects the integration of drones into commercial applications, military operations, and everyday life.

How is this Drone Navigation System Industry segmented?

The drone navigation system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Military drones

- Consumer and civil drones

- Type

- Manually operated

- Autonomous

- Geography

- North America

- US

- Canada

- Europe

- France

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

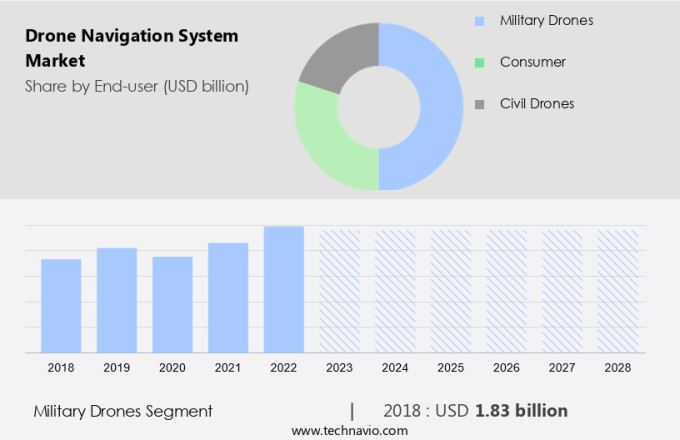

The military drones segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements, driven by the integration of various technologies such as IMU sensors, machine learning, and real-time data processing. Commercial applications, including industrial inspection, law enforcement, and delivery services, are increasingly relying on drones for efficiency and precision. Safety standards are of paramount importance, with air traffic management and obstacle avoidance systems ensuring safe flights. Data security is another critical concern, with encryption and secure data transmission protocols being prioritized. GNSS receivers and GPS modules enable accurate positioning and navigation, while autonomous flight capabilities reduce human intervention. Deep learning algorithms enhance object recognition and computer vision capabilities.

Flight controllers and power management systems optimize battery life and ensure stable, efficient power distribution. Military applications require long flight times and robust navigation systems, with MALE and HALE UAVs employing advanced astronavigation, dead reckoning, and INS technologies. Research focuses on developing autonomous sensors for reliable performance in adverse conditions, where GNSS support may be lacking. Distribution channels and API integrations streamline drone usage, enabling seamless integration with various industries and applications. Payload capacity, sensor fusion, and communication protocols are essential considerations for drone manufacturers, with brushless motors and AI algorithms optimizing performance. Path planning and delivery services are transforming retail sales, while emergency response and search and rescue missions are driving innovation in the sector.

Regulations and privacy concerns continue to shape the market landscape, with ongoing discussions surrounding the role of drones in society.

The Military drones segment was valued at USD 2.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

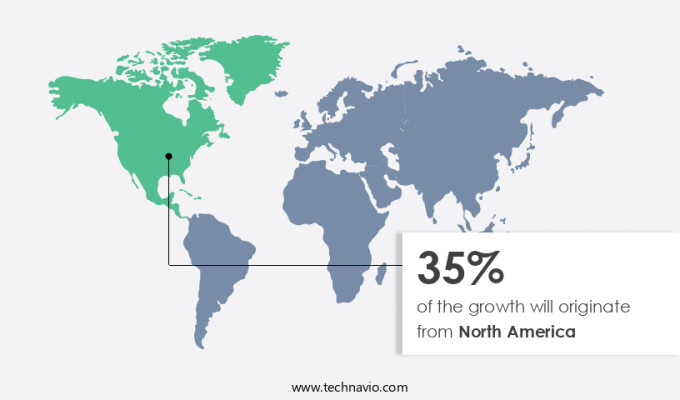

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The drone market is experiencing significant growth due to increasing commercial applications and technological advancements. Remote control systems ensure precise maneuverability, while safety standards prioritize secure flight operations. Flight time is extended with advancements in battery technology and thermal management. Data security is a priority, with IMU sensors and encryption ensuring data privacy. Machine learning and AI algorithms enable real-time data processing and object recognition for various industries. GPS modules and GNSS receivers facilitate navigation, while air traffic management systems ensure safe coexistence with manned aircraft. Regulations and drone policies are shaping the market, with distribution channels expanding through retail sales and delivery services.

Industrial inspection, obstacle avoidance, and law enforcement applications are driving demand. Payload integration, including sensors and cameras, expands drone capabilities. Deep learning and sensor fusion enhance data analytics, while communication protocols ensure seamless data transmission. Brushless motors and power management systems optimize performance and extend battery life. Autonomous flight and path planning enable efficient operations. Emergency response applications and military uses further expand the market scope. Search and rescue missions and computer vision applications are also gaining traction. In the evolving drone landscape, companies focus on software updates, API integrations, and payload capacity to meet diverse customer needs.

The market is also witnessing collaborations between drone OEMs and strategic partners to explore new opportunities and expand offerings. For instance, Drone Delivery Canada collaborated with the Canadian Armed Forces to assess its drone delivery platform, highlighting the potential for drones in logistics and defense applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the demand for advanced autonomous flight technologies increases. Drone manufacturers and developers are continuously innovating to create more precise and reliable navigation systems, integrating technologies such as Global Navigation Satellite Systems (GNSS), Inertial Measuring Units (IMU), and Visual Positioning Systems (VPS). These systems enable drones to fly more accurately and safely, even in challenging environments. Additionally, the integration of Real-Time Kinematic (RTK) and Automatic Dependent Surveillance-Broadcast (ADS-B) technologies enhances drone navigation capabilities, providing real-time location information and collision avoidance features. Furthermore, Computer Vision and Machine Learning algorithms are being utilized to improve object detection and obstacle avoidance, making drone navigation systems more versatile and efficient. The market for drone navigation systems is expected to continue growing, driven by increasing applications in industries such as agriculture, construction, surveying, and filmmaking.

What are the key market drivers leading to the rise in the adoption of Drone Navigation System Industry?

- The significant advancements in electronic warfare technologies serve as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing adoption of drones in various commercial applications. Remote control technology enables operators to fly drones with precision and flexibility, making them ideal for industries such as agriculture, construction, and infrastructure inspection. Safety standards are a top priority, with the integration of IMU sensors, GNSS receivers, and GPS modules ensuring stable flights and accurate data collection. Flight time is another critical factor, with advancements in battery technology extending the duration of drone missions. Data security is also essential, with encryption and machine learning algorithms protecting sensitive information transmitted during flight.

- Air traffic management systems help prevent collisions and ensure safe drone operations in congested airspace. Data analytics and privacy concerns are also driving market growth, with companies investing in advanced technologies to process and secure drone data. Commercial applications of drones continue to expand, with use cases ranging from delivery services to film production. Overall, the market is poised for continued growth, driven by technological advancements and increasing demand for efficient and cost-effective solutions.

What are the market trends shaping the Drone Navigation System Industry?

- Network-centric warfare is an emerging market trend, signifying the increasing importance of interconnected systems and real-time data exchange in military operations. The advent of this approach represents a significant shift towards more efficient and coordinated military strategies.

- The market is experiencing significant growth due to the increasing demand for real-time data processing and obstacle avoidance in various industries. Software updates with advanced features, such as deep learning and object recognition, are essential for enhancing drone performance and ensuring safe and efficient operations. API integrations enable seamless data exchange between drones and other systems, while payload integration and thermal management are crucial for industrial inspection applications. Drone regulations are driving the need for barometric altimeters and other safety features to ensure compliance.

- In addition, drones are being utilized in law enforcement for surveillance and search and rescue missions, further expanding the market's scope. Obstacle avoidance technology is a key factor in the market's growth, enabling drones to navigate complex environments and avoid collisions. Overall, the market is poised for continued growth as the technology becomes increasingly integrated into various industries and applications.

What challenges does the Drone Navigation System Industry face during its growth?

- The significant challenge facing industry growth is the high research and development costs imposed by endurance constraints, requiring continuous innovation to meet stringent performance requirements.

- Drones have become increasingly popular for various applications, from emergency response and delivery services to image processing and agriculture. However, the limited battery life, which is directly linked to the drone's power capacity, remains a significant challenge. The electric propulsion system, with its advantages such as quiet operation, ease of handling, and safety, has gained popularity among small- or mini-UAVs. However, enhancing drone endurance remains a challenge for the drone manufacturing industry. Communication protocols play a crucial role in drone navigation, ensuring seamless data transfer between the drone, ground control station, and distribution channels. Path planning is another essential aspect, requiring sophisticated algorithms for optimizing flight paths and ensuring efficient battery usage.

- Retail sales of drones continue to grow, driven by advancements in technology such as sensor fusion, image processing, and brushless motors. Despite these advancements, the current generation of Attitude and heading Reference System/Inertial Navigation Systems (AHRS/INS) faces challenges in adverse weather conditions, requiring further optimization for optimal performance. The market is expected to continue growing, driven by increasing demand for drones in various industries and ongoing technological advancements.

Exclusive Customer Landscape

The drone navigation system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drone navigation system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drone navigation system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Navigation Pty Ltd. - The company specializes in advanced drone navigation systems, featuring Spatial's single antenna MEMS and market-leading dual antenna technology. Additionally, we provide the industry-proven Spatial FOG dual system and more, enhancing drone navigation capabilities for improved performance and precision.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Navigation Pty Ltd.

- AeroVironment Inc.

- Elbit Systems Ltd.

- Gladiator Technologies Inc.

- Hexagon AB

- Inertial Labs

- Inertial Sense LLC

- Northrop Grumman Corp.

- Oxford Technical Solutions Ltd.

- Parker Hannifin Corp.

- Parrot Drones SAS

- Sagetech Avionics Inc.

- SBG Systems SAS

- SZ DJI Technology Co. Ltd.

- Trimble Inc.

- UAV Navigation SL

- uAvionix Corp.

- UAVOS Inc.

- VectorNav Technologies LLC

- Volocopter GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Drone Navigation System Market

- In January 2024, Swiss drone manufacturer, senseFly, announced the launch of its new drone navigation system, "eBee X3-AG," featuring real-time kinematic (RTK) positioning technology, enhancing precision and accuracy for agricultural surveying applications (senseFly press release).

- In March 2024, Intel and Microsoft entered into a strategic partnership to integrate Intel's RealSense LiDAR technology into Microsoft's Azure IoT services, enabling improved drone navigation and data processing for various industries (Intel press release).

- In April 2025, Skysense, a leading drone infrastructure provider, secured a USD15 million Series C funding round, led by Airbus Ventures, to expand its global footprint and enhance its drone navigation and management solutions (Skysense press release).

- In May 2025, the European Union Aviation Safety Agency (EASA) approved the use of drones in Class G airspace without the need for a visual observer, significantly expanding the potential applications and use cases for drone navigation systems in Europe (EASA press release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of innovative technologies such as lightweight materials, radar sensors, and automated drone charging. These developments aim to enhance data reliability and improve quality control in drone operations. However, challenges persist, including software bugs, security vulnerabilities, and the need for drone insurance. Moreover, the market is witnessing the adoption of advanced sensors, including hyperspectral and multispectral cameras, Lidar and ultrasonic sensors, and thermal cameras. These sensors enable 3D mapping, precision manufacturing, and flight training, among other applications. Furthermore, drone swarm technology and drone fleet management systems are gaining traction, necessitating the development of fault tolerance and regulations compliance.

- Material science advancements, such as the use of carbon fiber and composite materials, contribute to energy efficiency and environmental impact reduction. Despite these advancements, ethical considerations and pilot certification remain crucial. Drone maintenance software and gimbal systems ensure data integrity and camera stabilization, while GPS jamming and signal interference continue to pose challenges. In the realm of security, fail-safe mechanisms and data visualization tools are essential to mitigate risks and ensure data accuracy. Regulations compliance and drone simulation enable safe and effective drone deployment in various industries.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Drone Navigation System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.4% |

|

Market growth 2025-2029 |

USD 20804.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.7 |

|

Key countries |

US, China, France, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drone Navigation System Market Research and Growth Report?

- CAGR of the Drone Navigation System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drone navigation system market growth of industry companies

We can help! Our analysts can customize this drone navigation system market research report to meet your requirements.