Drug Discovery Technology Market Size 2024-2028

The drug discovery technology market size is forecast to increase by USD 27.31 billion, at a CAGR of 9.2% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing prevalence of chronic diseases worldwide. The growing burden of diseases such as cancer, neurological disorders, and cardiovascular diseases necessitates the development of innovative drug discovery technologies. One such technology is Artificial Intelligence (AI) and Machine Learning (ML) in drug discovery, which is revolutionizing the industry by enabling the analysis of vast amounts of data to identify potential drug candidates. Another technology, RNA interference (RNAi), offers a novel approach to drug development by targeting specific genes to treat diseases. However, the market faces challenges that hinder its growth.

- Intellectual property (IP) issues are a significant obstacle, with the increasing number of patents and licensing agreements complicating the development and commercialization of new therapies. Additionally, the high cost of drug discovery and development, coupled with the lengthy regulatory approval process, creates a complex landscape for market participants. Despite these challenges, opportunities exist for companies to capitalize on the market's potential. Collaborations and partnerships between academia, biotech, and pharmaceutical companies can help reduce the financial burden and accelerate the development process. Furthermore, the integration of emerging technologies such as AI, ML, and RNAi can enhance the efficiency and effectiveness of drug discovery efforts, ultimately leading to the development of novel therapies for various diseases.

What will be the Size of the Drug Discovery Technology Market during the forecast period?

The market is a dynamic and evolving landscape, with ongoing advancements and innovations shaping its contours. Biotechnology companies are at the forefront of this progress, leveraging various technologies to tackle complex therapeutic areas such as rare diseases and cancer. Machine learning algorithms, including deep learning, are increasingly utilized for data analysis and lead optimization, enhancing the drug discovery process. Clinical trials continue to play a pivotal role in bringing new therapies to market, with a focus on improving trial design and management for greater efficiency and accuracy. Intellectual property protection remains crucial, with patent protection and licensing agreements shaping the drug development pipeline.

Cancer therapeutics and metabolic disorders therapeutics are among the most active areas of research, with a growing emphasis on personalized medicine and protein engineering. Cardiovascular disease therapeutics and antibody-drug conjugates (ADCs) are also attracting significant attention, with advances in drug delivery systems and drug resistance. Artificial intelligence and quantum mechanics calculations are transforming drug discovery, enabling drug repurposing, drug safety assessments, and target identification. Regulatory approval processes are evolving to accommodate these advancements, with a focus on precision medicine and health economics. The market for orphan drugs and infectious disease therapeutics is expanding, driven by a growing understanding of the underlying genetic and molecular causes of these conditions.

Neurological disorders therapeutics are also gaining traction, with advances in gene editing and molecular dynamics simulations. Drug pricing, drug accessibility, and drug reimbursement remain key challenges, with ongoing debates surrounding affordability and equity. The market for drug discovery platforms and ligand-based drug design is growing, with a focus on improving drug efficacy, drug toxicity, and drug interaction predictions. The drug discovery process is a complex and intricate endeavor, with ongoing research and innovation shaping its future. From target identification to regulatory approval, the market dynamics are constantly unfolding, with new technologies and applications emerging to address the challenges of discovering and developing new therapies.

How is this Drug Discovery Technology Industry segmented?

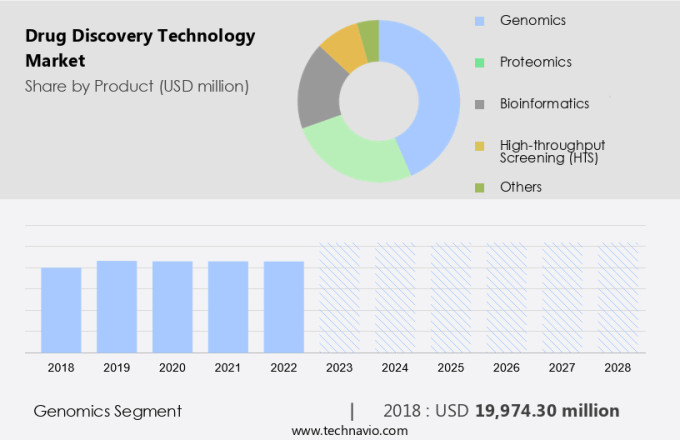

The drug discovery technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Genomics

- Proteomics

- Bioinformatics

- High-throughput screening (HTS)

- Others

- End-user

- Pharmaceutical and biotechnology companies

- Academic and research institutes

- CROs

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The genomics segment is estimated to witness significant growth during the forecast period.

The biotechnology industry is experiencing significant growth in the market, driven by innovative technologies and applications in various therapeutic areas. Machine learning and artificial intelligence are revolutionizing the field by enabling faster and more accurate target identification, lead optimization, and drug repurposing. In rare diseases therapeutics, gene editing and protein engineering are paving the way for personalized medicine and new treatments. Clinical trials are being streamlined through advanced clinical trial management systems, improving drug safety and regulatory approval. Intellectual property protection is ensured through patent protection and structure-based drug design. Cancer therapeutics and cardiovascular disease therapeutics are witnessing major advancements, with the development of antibody-drug conjugates and drug delivery systems.

Metabolic disorders therapeutics and neurological disorders therapeutics are also benefiting from these advancements, with a focus on precision medicine and molecular dynamics simulations. Deep learning and quantum mechanics calculations are enhancing drug development pipelines, while virtual screening and high-throughput screening are increasing the efficiency of lead optimization. Infectious disease therapeutics are being developed through drug repurposing and molecular docking, addressing drug resistance and drug toxicity. Health economics and academic research are collaborating to ensure drug accessibility and affordability. The drug discovery process is becoming more immersive and harmonious, with a focus on striking a balance between drug efficacy and safety.

Drug pricing and reimbursement are also being addressed through drug repositioning and regulatory approval, ensuring that innovative therapies reach patients in need. The drug discovery platforms are becoming more sophisticated, enabling ligand-based drug design and target identification. Overall, the market is witnessing a surge in innovation, driven by the integration of various technologies and applications in the biotechnology industry.

The Genomics segment was valued at USD 19.97 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

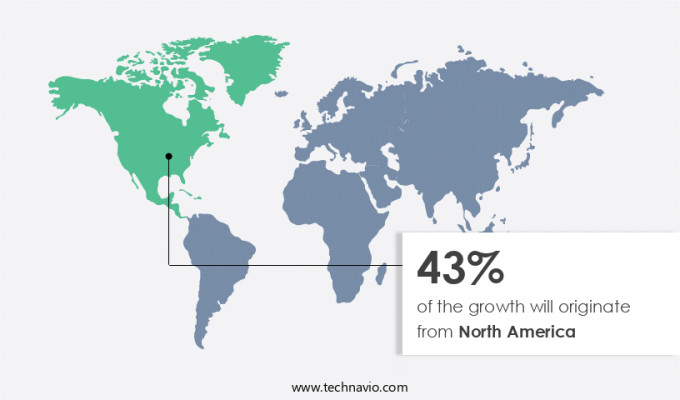

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant advancements, particularly in North America, where substantial investments from major pharmaceutical companies and strategic collaborations are driving innovation. Pharmaceutical companies based in the US, such as Pfizer and Johnson & Johnson, are leading the charge, with Pfizer investing USD2.5 billion into its research and development projects in the first quarter of 2024. These investments are crucial for maintaining a competitive edge and fostering innovation in the development of new therapeutic solutions for various diseases, including cancer, metabolic disorders, and cardiovascular diseases. Machine learning, artificial intelligence, and deep learning are increasingly being employed in drug discovery, enabling the identification of new targets, lead optimization, and personalized medicine.

Clinical trials are also being enhanced through the use of technology, with clinical trial management systems and molecular dynamics simulations improving drug safety and efficacy. Intellectual property protection is a critical aspect of drug development, with patent protection and structure-based drug design playing essential roles in the drug development pipeline. Precision medicine and gene editing are also gaining traction, offering potential solutions for rare diseases and neurological disorders. The market is further shaped by regulatory approval processes, drug pricing, and drug delivery systems, with drug repositioning and drug repurposing providing cost-effective alternatives to traditional drug development.

Academic research and preclinical studies continue to contribute significantly to the drug discovery process, with health economics playing a crucial role in ensuring drug accessibility and affordability. Infectious disease therapeutics and antibody-drug conjugates are other areas of focus, with drug resistance and drug interactions being key challenges. Overall, the market is evolving rapidly, with technology playing an increasingly important role in advancing the development of new therapeutic solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Drug Discovery Technology Industry?

- The increasing prevalence of chronic diseases serves as the primary market driver, underpinning significant growth in this sector.

- The market is experiencing significant growth due to the increasing burden of chronic diseases. According to the World Health Organization (WHO), noncommunicable diseases (NCDs) account for 74% of global deaths, with 41 million fatalities annually. Chronic conditions such as diabetes, heart disease, stroke, and cancer are leading causes of morbidity and mortality worldwide. In particular, cardiovascular diseases are the leading cause of NCD deaths, claiming 17.9 million lives annually. To address this challenge, the drug discovery process is being revolutionized through advanced technologies such as clinical trial management, molecular dynamics simulations, ligand-based drug design, target identification, and gene editing.

- Academic research and health economics are also playing a crucial role in the development of neurological disorders therapeutics and improving drug accessibility. Clinical trial design is essential to ensure the safety and efficacy of new drugs. Molecular dynamics simulations enable researchers to understand the behavior of molecules at the atomic level, facilitating the design of new drugs. Ligand-based drug design and target identification are key steps in the drug discovery process, allowing researchers to identify potential drug targets and design drugs that interact with them. Gene editing technologies offer the potential to cure genetic diseases by directly modifying the underlying genetic material.

- As health economics becomes increasingly important, drug reimbursement is a critical consideration in drug development. Understanding the economic impact of drugs and their cost-effectiveness is essential to ensure that new treatments are accessible to patients. In conclusion, the market is driven by the increasing prevalence of chronic diseases and the need to develop new, effective treatments. Advanced technologies such as clinical trial management, molecular dynamics simulations, ligand-based drug design, target identification, gene editing, and health economics are playing a crucial role in this process. By improving the drug discovery process, we can bring new treatments to market more quickly and effectively, ultimately improving patient outcomes and reducing the burden of chronic diseases.

What are the market trends shaping the Drug Discovery Technology Industry?

- The introduction of new drug discovery technologies is a significant market trend. This innovative approach to drug development is mandated by the evolving healthcare landscape and the increasing demand for more effective and personalized treatments.

- The market is experiencing substantial growth due to the integration of advanced technologies enhancing the efficiency and precision of drug development processes. One significant innovation is Fujitsu Limited and the RIKEN Center for Computational Science's AI-driven drug discovery technology. This groundbreaking solution employs generative AI to generate protein structural changes from electron microscope images, producing more accurate 3D density maps of proteins and improved estimates of protein conformations and alterations.

- Another notable advancement is BenchSci's ASCEND platform, which streamlines the drug discovery process by providing researchers with access to over 100 million experimental data points and AI-powered analysis tools. These advancements underscore the market's dynamic nature and commitment to innovation.

What challenges does the Drug Discovery Technology Industry face during its growth?

- The intellectual property (IP) landscape poses a significant challenge in the development and commercialization of new therapies, impacting the growth of the industry. IP issues, such as patent disputes and infringement concerns, can hinder innovation, delay market entry, and increase costs for pharmaceutical and biotech companies. Effective IP strategy and management are crucial for navigating this complex and ever-evolving landscape.

- In the biotechnology industry, intellectual property (IP) disputes pose substantial challenges in The market. These disputes can lead to intricate legal battles and potential delays in bringing new therapies for rare diseases, cancer, metabolic disorders, cardiovascular diseases, and other conditions to market. One recent example of this involves GlaxoSmithKline (GSK) filing a lawsuit against Pfizer and BioNTech in Delaware federal court on April 25, 2024. GSK alleges that Pfizer and BioNTech's COVID-19 vaccine, Comirnaty, infringes on its patents related to mRNA technology.

- GSK claims that its patents, developed a decade prior to the pandemic, are essential for the vaccine's development, specifically for the delivery of mRNA into human cells. This lawsuit highlights the importance of IP protection and the potential complications that can arise during the development and commercialization of new therapies, including those using advanced technologies like machine learning, protein engineering, and antibody-drug conjugates.

Exclusive Customer Landscape

The drug discovery technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drug discovery technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drug discovery technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - This organization specializes in drug discovery, employing advanced cell-based assays for identification, screening, and toxicity evaluations. Our technology streamlines the development cycle, enhancing search engine visibility and delivering valuable insights from the research phase. By utilizing cellular models, we ensure accuracy and efficiency in identifying potential therapeutics, while minimizing risks associated with preclinical testing. Our commitment to innovation and scientific rigor sets us apart in the competitive landscape of drug development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Amgen Inc.

- AstraZeneca Plc

- Bayer AG

- Bruker Corp.

- Charles River Laboratories International Inc.

- Danaher Corp.

- Eli Lilly and Co.

- General Electric Co.

- GlaxoSmithKline Plc

- Illumina Inc.

- Merck KGaA

- Novartis AG

- Novo Nordisk AS

- Promega Corp.

- QIAGEN N.V.

- Revvity Inc.

- Sanofi SA

- Takeda Pharmaceutical Co. Ltd.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Drug Discovery Technology Market

- In February 2024, Merck KGaA, a leading player in the market, announced the launch of their new AI-driven small molecule discovery platform, "Next discovery platform (NDP)." This innovative technology is designed to accelerate the early-stage drug discovery process by using machine learning algorithms to analyze vast amounts of data and identify potential drug candidates (Merck KGaA, 2024).

- In March 2025, a significant strategic partnership was formed between Roche and Insilico Medicine, a pioneering AI-driven biotech company. This collaboration aims to leverage Insilico's advanced AI and machine learning technologies to discover new targets and develop novel therapeutics for various diseases (Roche, 2025).

- In May 2024, Illumina, a global leader in genomic sequencing and analysis, raised USD1.2 billion in a secondary offering to fuel its expansion in the market. The company plans to invest in research and development, as well as in strategic acquisitions and partnerships (Illumina, 2024).

- In October 2025, the US Food and Drug Administration (FDA) approved the use of BenevolentAI's advanced AI and machine learning technology to support the identification of new drug targets and potential treatments. This marks a significant milestone in the adoption of AI in drug discovery and could lead to faster and more efficient drug development processes (FDA, 2025).

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of various technologies and approaches. Targeted drug delivery systems, utilizing drug delivery routes to enhance therapeutic efficacy, are gaining prominence. Computational chemistry plays a crucial role in lead discovery through in silico screening and hit-to-lead optimization. Drug resistance mechanisms continue to challenge researchers, necessitating the development of new strategies, including fragment-based drug discovery and combination therapy. Gene therapy and car T-cell therapy are revolutionizing the treatment landscape. Clinical trial recruitment and endpoints are undergoing transformation, with a focus on safety pharmacology, pharmacokinetic profiling, and drug use monitoring. Drug registration, marketing, labeling, and safety biomarkers are essential components of the drug development process.

- Biosimilar drugs are increasingly popular, requiring rigorous comparative studies to ensure similar safety and efficacy profiles. Toxicology studies and drug stability assessments are critical for ensuring patient safety and product quality. Drug formulation and drug resistance mechanisms are key areas of research, with a focus on improving therapeutic outcomes and overcoming treatment barriers. Clinical trial phases and clinical trial phases' successful completion are vital for bringing new drugs to market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Drug Discovery Technology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.2% |

|

Market growth 2024-2028 |

USD 27.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.9 |

|

Key countries |

US, Germany, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drug Discovery Technology Market Research and Growth Report?

- CAGR of the Drug Discovery Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drug discovery technology market growth of industry companies

We can help! Our analysts can customize this drug discovery technology market research report to meet your requirements.