Orphan Drugs Market Size 2024-2028

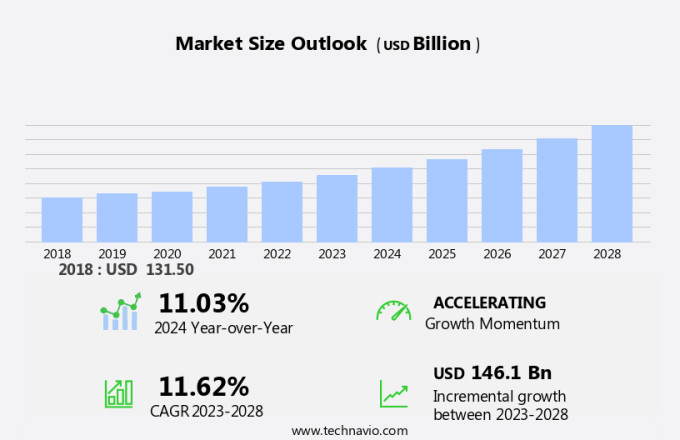

The orphan drugs market size is forecast to increase by USD 146.1 billion at a CAGR of 11.62% between 2023 and 2028. The market is witnessing significant growth due to several key drivers. The powerful pipeline and recent approvals of novel therapies, particularly in the oncology therapy area, are fueling market expansion. Immunomodulators, biologics, and non-biologics are witnessing considerable demand, especially for the treatment of non-life-threatening diseases. Strategic collaborations, partnerships, and mergers and acquisitions among industry players are also contributing to market growth. However, challenges such as the delay in diagnosis and the high cost of these specialized treatments remain significant barriers. The report further highlights trends in outpatient hospital visits, clinical research, and the increasing prevalence of hematology, neurology, endocrinology, and immunotherapy indications.

The pharmaceutical industry is continuously evolving to cater to the unique requirements of various medical conditions. Among these, the focus on orphan drugs, also known as rare disease drugs, has gained significant traction. Orphan drugs are pharmaceutical agents designed to treat or prevent specific rare medical conditions that affect a small population. These conditions include, but are not limited to, oncological diseases such as Hodgkin lymphoma and acute myeloid leukemia, metabolic diseases like cystic fibrosis, hematologic diseases, immunologic diseases, infectious diseases, neurological diseases, and various other rare conditions. The development of orphan drugs involves extensive clinical trials and screening services to ensure their safety and efficacy. The clinical research process for orphan drugs is critical due to the complex nature of these conditions and the limited patient population. This process includes various stages, from preclinical testing to regulatory approval. Orphan drugs play a crucial role in the healthcare landscape, particularly in the therapy areas of oncology, hematology, neurology, and immunology.

Further, the oncology therapy area accounts for a significant portion of the market due to the high prevalence of oncological diseases. Biological orphan drugs are derived from living organisms or their products, while nonbiological orphan drugs are synthesized chemically. Both types of orphan drugs offer unique advantages and challenges in their development and application. The demand for orphan drugs is driven by the unmet medical needs in the treatment of rare diseases. According to the World Health Organization (WHO), about 350 million people worldwide are affected by rare diseases.

Despite this significant number, many of these conditions lack effective treatments, leading to a high unmet need. Outpatient hospital visits for the management of rare diseases are frequent, making the market an essential component of the healthcare services. The increasing focus on personalized medicine and the growing awareness of rare diseases are further fueling the growth of this market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Hospital Pharmacy

- Specialty pharmacy

- Retail pharmacy

- Others

- Product

- Biologics

- Non-biologics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Distribution Channel Insights

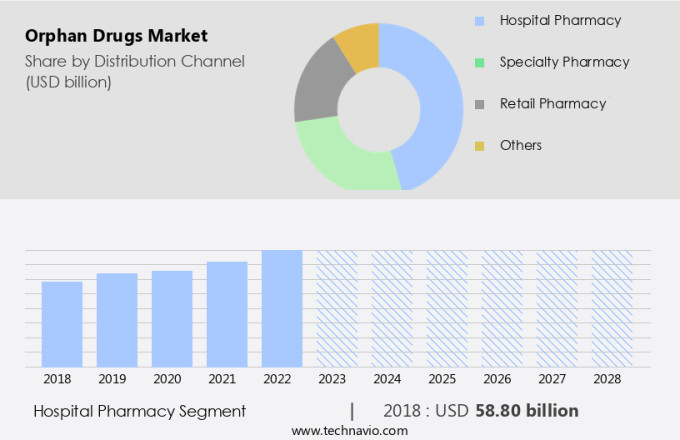

The hospital pharmacy segment is estimated to witness significant growth during the forecast period. Orphan drugs are medications designed to treat rare diseases, including neurological disorders, transplantation diseases, gastrointestinal conditions, dermatologic diseases, congenital abnormalities, pancreatic cancer, ovarian cancer, multiple myeloma, renal cell carcinoma, Hunter syndrome, Fabry disease, and Gaucher disease, among others. Hospital pharmacy departments play a crucial role in the preparation, compounding, storage, and distribution of these specialized medications. The accessibility and convenience of hospital pharmacies make them an ideal source for obtaining orphan drugs. One significant advantage of hospital pharmacies is their ability to create personalized dosing regimens tailored to each patient's unique needs. This individualized approach helps healthcare professionals make informed drug-based decisions and enables patients to better understand and adhere to their medication schedules.

Consequently, the hospital pharmacy segment contributes significantly to the expansion of the market. According to recent research, there were approximately 37,000 orphan drugs approved in the United States, Europe, and Japan as of 2021. This underscores the importance of hospital pharmacies in providing essential care and treatment for patients with rare diseases.

Get a glance at the market share of various segments Request Free Sample

The hospital pharmacy segment accounted for USD 58.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

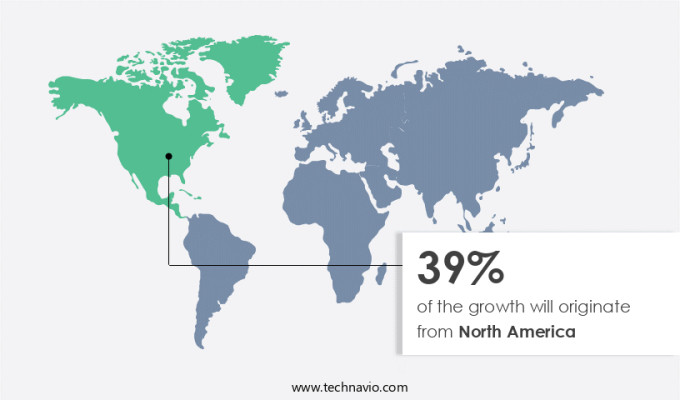

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market has witnessed significant expansion due to several key factors. These factors include the approval of new drugs, increasing diagnosis rates for rare diseases, availability of reimbursement programs, high pricing of these medications, the presence of major orphan drug companies, and incentives from regulatory agencies and non-profit organizations.

Further, the healthcare sector in North America has seen increased expenditure on orphan drugs due to their high cost and the availability of reimbursement schemes. The Cardiovascular, Endocrine, and Respiratory disease segments have been major consumers of orphan drugs in the region. In the retail and hospital pharmacy sectors, as well as online sales channels, these medications have gained significant traction. The market's growth is expected to continue, driven by these factors and the ongoing efforts of key players to develop and bring new treatments to market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Powerful pipeline and recent drug approvals is the key driver of the market. Orphan drugs, designed to treat rare diseases, have gained significant attention in the pharmaceutical industry over the past two decades. The American Cancer Society and other health organizations have played a crucial role in advancing research and development in this area. As a result, the number of approved orphan drugs has seen a remarkable increase, with over 30% of new drug approvals in the US during the last five years being for rare diseases. Some of these conditions include Yellow Fever, von Willebrand Disease, Waardenburg Syndrome, Diabetes Macular Edema, Abetalipoproteinemia, and Yellow Nail Syndrome. Biopharmaceutical companies have been granted FDA exemptions to bypass rigorous drug development requirements for these conditions due to their rarity.

Further, this has enabled the production of specialized treatments for these diseases, which would otherwise be neglected. For instance, conditions like Classic homocystinuria have seen the introduction of effective treatments, significantly improving the lives of affected individuals. The shift from blockbuster to niche-buster drugs is a growing trend among large pharmaceutical players. This strategic move allows companies to cater to the unique needs of patients with rare diseases, ensuring they receive the necessary treatments. The future of orphan drug development holds great promise, with continued advancements expected in this field.

Market Trends

Strategic focus on alliances, partnerships, and mergers and acquisitions is the upcoming trend in the market. The market has seen an increase in strategic alliances and partnerships in recent years. In 2021 and 2022 alone, hundreds of such collaborations have been formed. These partnerships expand companies' reach to broader geographical areas, enlarge product offerings, and result in higher returns on investment as products are co-developed and co-marketed. As a result, market participants are anticipated to continue seeking innovative strategies to capitalize on the lucrative opportunities, thereby fostering market expansion during the forecast period.

Moreover, Mergers and Acquisitions (M&A) have emerged as a popular trend in the market. This trend is driven by the approaching patent expirations and the necessity to replenish pipelines. By engaging in M&A activities, companies can acquire new technologies, expand their product portfolios, and strengthen their market presence. Consequently, the market is poised for steady growth.

Market Challenge

Delay in diagnosis is a key challenge affecting the market growth. In the realm of healthcare, the timely identification of rare diseases is crucial for initiating appropriate treatments and enhancing patient care. However, due to the complexities involved in diagnosing rare diseases, patients often face prolonged periods of uncertainty. This delay can significantly impact the effectiveness of treatments and lead to severe, irreversible disease progression. The oncology therapy area, including immunomodulators, plays a vital role in managing various rare diseases. Clinical research in this sector continues to expand, focusing on hematology, neurology, endocrinology, immunotherapy, and biologics, among others.

In summary, the diagnosis and treatment of rare diseases are essential for improving patient outcomes. The oncology therapy area, with its focus on various disease areas and treatment modalities, is at the forefront of this effort. Clinical research, driven by advancements in biologics and non-biologics, continues to provide new avenues for addressing the needs of patients with rare diseases. The use of online pharmacies further enhances access to these treatments, ensuring that patients receive the care they need in a timely and convenient manner.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc.: The company offers orphan drugs such as Humira and Venetoclax.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alnylam Pharmaceuticals Inc.

- Astellas Pharma Inc.

- AstraZeneca Plc

- bluebird bio Inc.

- Bristol Myers Squibb Co.

- CSL Ltd.

- F. Hoffmann La Roche Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Ipsen Pharma

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Novo Nordisk AS

- Pfizer Inc.

- Ractigen Therapeutics

- Sanofi SA

- Takeda Pharmaceutical Co. Ltd.

- Vertex Pharmaceuticals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The orphan drug market refers to the segment of the pharmaceutical industry that focuses on developing and commercializing therapies for rare medical conditions and diseases. These conditions, also known as rare diseases or orphan diseases, affect a small percentage of the population and often require specialized treatment. Orphan drugs can be biological or non-biological and are used to treat various types of diseases, including oncological diseases such as pancreatic cancer, ovarian cancer, and multiple myeloma, metabolic diseases like hypoparathyroidism and Fabry disease, hematologic diseases such as hemophilia and sickle cell anemia, immunologic diseases like Huntington's disease and Alzheimer's disease, neurological diseases like Hodgkin lymphoma and cystic fibrosis, and transplantation diseases. Clinical trials play a crucial role in the development of orphan drugs, with screening services and oncology centers being key players in the process.

Further, the market for orphan drugs is diverse, encompassing a range of therapeutic areas such as oncology, metabolic diseases, hematology, neurology, and endocrinology. The use of immunomodulators and biologics is common in the development of orphan drugs. The market for orphan drugs is driven by the high unmet medical need for treatments for rare diseases, including neurologic disorders therapeutics and autoimmune hemolytic anemia therapeutics, the increasing number of clinical trials, and the availability of reimbursement policies. The market is also influenced by healthcare expenditure and the FDA's exemptions for drug development in the orphan drug space. The market for orphan drugs is diverse and includes sales through hospital pharmacies, retail pharmacies, and online sales. Diseases covered by the orphan drug market include but are not limited to, hypertension, diabetes, cardiovascular diseases, and various types of cancer.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.62% |

|

Market growth 2024-2028 |

USD 146.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.03 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, UK, Canada, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Alnylam Pharmaceuticals Inc., Astellas Pharma Inc., AstraZeneca Plc, bluebird bio Inc., Bristol Myers Squibb Co., CSL Ltd., F. Hoffmann La Roche Ltd., Gilead Sciences Inc., GlaxoSmithKline Plc, Ipsen Pharma, Johnson and Johnson Services Inc., Merck and Co. Inc., Novartis AG, Novo Nordisk AS, Pfizer Inc., Ractigen Therapeutics, Sanofi SA, Takeda Pharmaceutical Co. Ltd., and Vertex Pharmaceuticals Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch