E-Learning Market Size 2025-2029

The e-learning market size is valued to increase by USD 326.9 billion, at a CAGR of 18.9% from 2024 to 2029. Learning process enhancements in academic sector will drive the e-learning market.

Major Market Trends & Insights

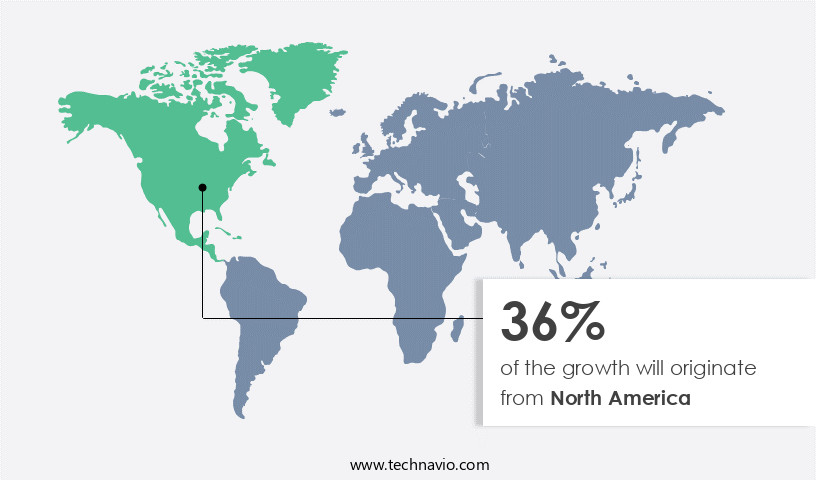

- North America dominated the market and accounted for a 36% growth during the forecast period.

- By End-user - Higher education segment was valued at USD 43.30 billion in 2023

- By Deployment - On-premises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 380.36 billion

- Market Future Opportunities: USD 326.90 billion

- CAGR from 2024 to 2029 : 18.9%

Market Summary

- The market has experienced remarkable growth, with global revenues surpassing USD70 billion in 2020. This expansion is driven by the increasing adoption of microlearning, a learning methodology that delivers content in short, focused bursts. This trend caters to the busy schedules of professionals and students, enabling them to learn at their own pace and convenience. Moreover, the rise of in-house content development has further fueled market growth. Companies recognize the benefits of creating customized training programs for their employees, leading to increased engagement and productivity. However, challenges persist, such as ensuring the quality and consistency of in-house content and addressing the diverse learning needs of a global workforce.

- Despite these challenges, the future of E-Learning looks promising. Advancements in technology, such as artificial intelligence and virtual reality, are transforming the learning experience, making it more interactive and immersive. As these trends continue to evolve, businesses and educational institutions will increasingly rely on E-Learning to meet their learning and development needs.

What will be the Size of the E-Learning Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the E-Learning Market Segmented ?

The e-learning industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Higher education

- Corporate

- K-12

- Deployment

- On-premises

- Cloud

- Provider

- Content

- Service

- Type

- Custom E-Learning

- Responsive E-Learning

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The higher education segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with educational institutions and corporations embracing technology to deliver flexible, accessible learning solutions. According to recent statistics, over 60% of Fortune 500 companies now use e-learning for training and development. This shift is driven by the availability of advanced educational technology, including multimedia learning resources, virtual reality training, and augmented reality learning. Institutions like NIIT, MIT, and Yale University develop e-learning content using course authoring tools, while learning management systems, such as Talent LMS, facilitate access and tracking of student performance metrics. Blended learning models, including asynchronous and synchronous online learning, cater to diverse learning styles and schedules.

Mobile learning applications and microlearning content enable learning on-the-go, while collaborative learning tools and virtual classroom software foster engagement and interaction. Instructor training programs ensure effective implementation of these technologies, and personalized learning paths and skill development programs cater to individual needs. Learning content management, gamified learning design, and adaptive learning platforms enhance knowledge retention and course completion rates. Social learning platforms and learning analytics dashboards provide valuable insights into student progress. Corporate e-learning solutions, such as virtual classroom software and instructor training programs, drive productivity and efficiency in the corporate sector. These evolving trends reflect the ongoing commitment to enhancing the learning experience and improving student performance.

The Higher education segment was valued at USD 43.30 billion in 2019 and showed a gradual increase during the forecast period.

In the evolving e-learning market, optimizing learning experience design principles is critical for enhancing impact learning analytics student engagement. Effective employee training programs now rely on the effectiveness microlearning employee training and designing interactive virtual classroom experience. Developing mobile learning application curriculum and creating engaging multimedia learning resources support self-paced learning modules and simulation-based training. Applying instructional design principles online and instructional design models ensures better knowledge transfer, while using gamification improve learning outcomes and promoting collaborative learning online environment foster deeper connections. Measuring knowledge retention online courses and analyzing student performance metrics dashboards enable data-driven instruction. Integrating learning technologies into curriculum and managing learning content repository effectively enhances accessibility. Implementing adaptive learning platform strategy and building personalized learning paths students allow for individualized support, while educational data mining and personalized feedback systems ensure continuous improvement.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How E-Learning Market Demand is Rising in North America Request Free Sample

The market is experiencing significant growth, with an increasing number of institutions and students adopting this model in North America. This shift is driven by the flexibility and technological advancements that e-learning offers, enabling students to access education through virtual learning environments. For instance, the Florida Virtual School caters to public, private, and homeschooled students for K-12 education. Furthermore, renowned universities like Columbia, Duke, Cornell, and Johns Hopkins provide online courses, allowing students with internet-enabled technologies to complete their coursework.

This trend underscores the robust nature of e-learning and its potential to transform traditional educational paradigms.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses and educational institutions seek innovative ways to enhance student engagement and improve learning effectiveness. One key trend in this space is the use of learning analytics to measure student performance and engagement in real-time, enabling educators to adapt instruction and improve knowledge retention in online courses. Another trend is the implementation of microlearning and adaptive learning platforms, which allow for the design of interactive virtual classroom experiences and the development of mobile learning applications with engaging multimedia curriculum. Gamification is also being used to improve learning outcomes by making education more fun and interactive.

To ensure the success of these initiatives, it's essential to analyze student performance metrics through dashboards and improve accessibility features on learning platforms. Instructional design principles must be applied online to create personalized learning paths for students, while managing learning content repositories effectively is crucial for delivering high-quality educational experiences at scale. Collaborative learning environments are also being promoted online to foster peer-to-peer interaction and knowledge sharing. Blended learning models are being evaluated to determine their effectiveness in integrating traditional classroom instruction with online components. Virtual reality simulations and augmented reality applications are also being leveraged to provide immersive training experiences, while large-scale online course deployments require optimization of learning experience design principles to ensure a seamless user experience. Ultimately, the market is transforming the way we learn, making education more accessible, engaging, and effective for learners around the world.

What are the key market drivers leading to the rise in the adoption of E-Learning Industry?

- In the academic sector, continuous enhancements to the learning process serve as the primary market driver.

- The education technology landscape has witnessed significant advancements, transitioning traditional classrooms into digital learning environments. Schools and universities have adopted fundamental hardware and software solutions, revolutionizing communication and education. This transformation enables teachers to select technologies that maintain student focus, while students immerse themselves in technology-driven learning opportunities. Innovations in the education sector have altered content access, comprehension, discussion, and sharing. Advanced educational technologies cater to a vast audience, with digital learning tools like e-learning platforms and systems fostering personalized learning experiences.

- These solutions boost student engagement and skill development. Furthermore, technology integration in K-12 and higher education fosters interactive and collaborative learning experiences. The continuous evolution of education technologies offers endless possibilities for enhancing the learning experience.

What are the market trends shaping the E-Learning Industry?

- The adoption of microlearning is becoming increasingly prevalent in the current market trend. Microlearning, a learning approach that delivers content in short, focused bursts, is gaining significant traction in today's professional environment.

- Microlearning, a form of education that delivers content in smaller, bite-sized pieces, is gaining significant traction in the e-learning industry. With the increasing focus on personalization and adaptive learning, this approach has become increasingly relevant for both educational institutions and corporations. Microlearning materials consist of various formats, including videos, audio, texts, and infographics, with video and audio sessions typically lasting between 5 and 10 minutes.

- This learning method offers learners concise and relevant content, effectively addressing knowledge gaps. In the realm of academic e-learning, companies are increasingly incorporating microlearning course content into their offerings. This shift towards microlearning reflects the evolving needs of learners and the market's continuous adaptation to meet those demands.

What challenges does the E-Learning Industry face during its growth?

- The expansion of in-house content development poses a significant challenge to the industry's growth. This trend necessitates companies to invest heavily in creating and managing their content, which can divert resources from other areas of business development. Consequently, it is crucial for organizations to strike a balance between producing high-quality content in-house and outsourcing content creation to maintain a competitive edge in the industry.

- E-learning content authoring tools, such as Adobe Captivate, Articulate Storyline, and Gomo Learning, are increasingly utilized by companies and educational institutions to develop and customize digital learning experiences. Tesco, Open University, Comcast University, and Roche Diagnostics are among the organizations leveraging these platforms. These tools facilitate the creation of interactive, multimedia course content, allowing for updates, modifications, and translations. Schools and universities prioritize engaging digital learning environments, enabling evaluation of student engagement, tracking results, and gathering feedback.

- In-house content developers collaborate with instructors, integrating images, videos, and adapting content based on learner engagement and feedback. The ongoing evolution of e-learning continues to expand its reach and applications across various sectors.

Exclusive Technavio Analysis on Customer Landscape

The e-learning market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-learning market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of E-Learning Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, e-learning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

51Talk Online Education Group - This company specializes in providing e-learning services for English education, featuring live online English lessons. Their innovative approach caters to the growing demand for flexible, effective language instruction. With a focus on interactive, real-time learning, they enable students to improve their English skills from anywhere in the world.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 51Talk Online Education Group

- Ambow Education Holding Ltd.

- Aptara Inc.

- Berlitz Corp.

- Cornerstone OnDemand Inc.

- D2L Inc.

- Designing Digitally Inc.

- Docebo Inc.

- EF Education First Ltd.

- Hive Learning Ltd.

- inlingua International Ltd.

- Instructure Holdings Inc.

- LearnWorlds CY Ltd.

- MPS Ltd.

- NIIT Ltd.

- Pearson Plc

- SAI360 Inc

- Sanako

- Skillsoft Corp.

- Teachable Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Learning Market

- In January 2024, Microsoft announced the acquisition of Minecraft Education Edition, a popular gaming platform used in schools for educational purposes, to expand its presence in the market (Microsoft Press Release).

- In March 2024, Coursera, an online learning platform, formed a strategic partnership with IBM to offer industry-recognized certificates in artificial intelligence, data science, and cloud computing (Coursera Press Release).

- In April 2024, Byju's, an Indian edtech company, raised USD200 million in a Series F funding round, bringing its valuation to USD16.5 billion, making it the most valuable edtech startup globally (TechCrunch).

- In May 2025, Google unveiled Google Workspace for Education, a suite of productivity and collaboration tools designed specifically for schools and universities, marking a significant entry into the market (Google Blog). These developments underscore the growing importance of technology in education, with companies focusing on strategic partnerships, acquisitions, and investments to expand their offerings and reach new audiences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Learning Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.9% |

|

Market growth 2025-2029 |

USD 326.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with new technologies and trends shaping the way knowledge is delivered and retained. Accessibility features, such as closed captioning and screen reader compatibility, are becoming increasingly important in expanding the reach of e-learning content. Multimedia learning resources, including videos and interactive simulations, enhance the learning experience and improve knowledge retention metrics. E-learning content development is undergoing a transformation with the integration of virtual reality training and augmented reality learning. Asynchronous online learning allows students to learn at their own pace, while engagement tracking systems help instructors monitor student performance metrics.

- Blended learning models combine traditional classroom instruction with online course platforms and learning management systems to create personalized learning paths. Microlearning content and mobile learning applications enable learning on-the-go, while social learning platforms foster collaboration and community among learners. Gamified learning design and adaptive learning platforms provide a more engaging and effective learning experience. Corporate e-learning solutions are seeing significant growth, with the industry expected to expand by 15% annually. For instance, a leading online education provider reported a 30% increase in course completion rates through the implementation of a learning analytics dashboard and collaborative learning tools.

- Virtual classroom software and instructor training programs ensure that online instruction remains effective and engaging. Course authoring tools and learning content management streamline the process of creating and managing e-learning content. Skill development programs and training and development initiatives continue to be key areas of focus for businesses and educational institutions alike.

What are the Key Data Covered in this E-Learning Market Research and Growth Report?

-

What is the expected growth of the E-Learning Market between 2025 and 2029?

-

USD 326.9 billion, at a CAGR of 18.9%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Higher education, Corporate, and K-12), Deployment (On-premises and Cloud), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Provider (Content and Service), and Type (Custom E-Learning and Responsive E-Learning)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Learning process enhancements in academic sector, Growing in-house content development

-

-

Who are the major players in the E-Learning Market?

-

51Talk Online Education Group, Ambow Education Holding Ltd., Aptara Inc., Berlitz Corp., Cornerstone OnDemand Inc., D2L Inc., Designing Digitally Inc., Docebo Inc., EF Education First Ltd., Hive Learning Ltd., inlingua International Ltd., Instructure Holdings Inc., LearnWorlds CY Ltd., MPS Ltd., NIIT Ltd., Pearson Plc, SAI360 Inc, Sanako, Skillsoft Corp., and Teachable Inc.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, continually adapting to meet the demands of learners and organizations. Two significant statistics highlight its growth and development. First, the number of learning object repositories has increased by 30% in the past year, providing educators and trainers with a wealth of digital content for curriculum development. Second, industry experts anticipate a growth rate of 15% annually over the next five years, driven by the increasing popularity of content curation tools, learning experience design, and talent development programs.

- For instance, a large corporation experienced a 20% increase in employee engagement and productivity by implementing a personalized feedback system and scenario-based learning modules.

We can help! Our analysts can customize this e-learning market research report to meet your requirements.