Online Education Market Size 2025-2029

The online education market size is forecast to increase by USD 141.3 billion, at a CAGR of 11.1% between 2024 and 2029.

Major Market Trends & Insights

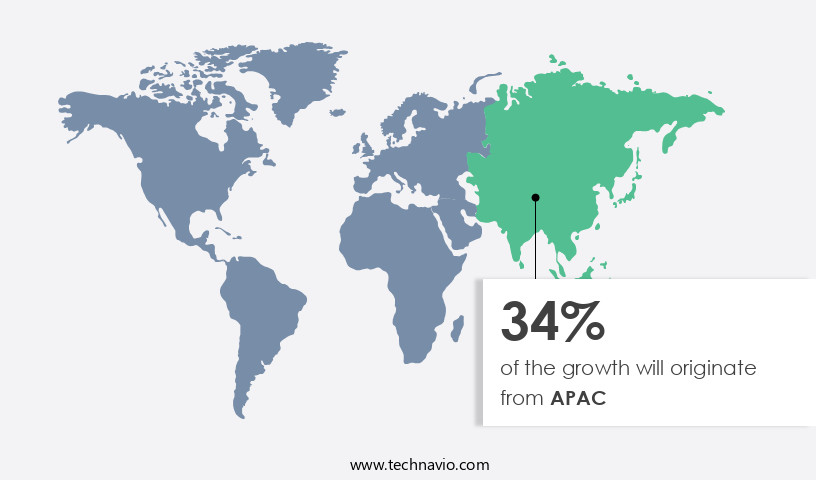

- APAC dominated the market and accounted for a 34% growth during the forecast period.

- By the Application - PSSE segment was valued at USD 43.30 billion in 2023

- By the End-user - Academic segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 156.12 billion

- Market Future Opportunities: USD 141.30 billion

- CAGR : 11.1%

- APAC: Largest market in 2023

Market Summary

- Online education is a dynamic and evolving market, witnessing significant shifts in adoption rates and technological advancements. According to recent studies, the global e-learning market is projected to reach a value of USD325 billion by 2026, growing at a steady pace. This expansion is driven by the increasing availability of high-speed internet, the proliferation of mobile devices, and the need for flexible learning solutions. In the corporate sector, e-learning has become an integral part of employee training programs, with 77% of Fortune 500 companies using online education platforms (Forbes, 2020). In the K-12 and higher education sectors, the adoption of online learning has seen a notable increase, with 65% of students taking at least one online course (National Center for Education Statistics, 2019).

- Despite these advancements, online education faces challenges, particularly in the area of cybersecurity. In 2020, education institutions reported over 1,000 data breaches, exposing sensitive student information. As the market continues to grow, addressing these security concerns will be crucial for maintaining trust and ensuring the success of online education initiatives. In conclusion, the market is experiencing substantial growth and transformation, with various sectors embracing e-learning solutions for their unique advantages. While challenges persist, ongoing advancements in technology and increasing adoption rates suggest a promising future for online education.

What will be the Size of the Online Education Market during the forecast period?

Explore market size, adoption trends, and growth potential for online education market Request Free Sample

- The global online education market is undergoing a transformative shift, driven by the need for flexible, technology-enabled learning solutions. Institutions are leveraging advanced course authoring tools and applying instructional design principles to deliver engaging and scalable programs. Strategic emphasis on learning experience design and user experience design ensures that platforms meet diverse learner expectations, while robust educational content strategy and strict adherence to accessibility standards make education inclusive.

- Data-driven decision-making is central to this evolution, with providers utilizing data visualization techniques, performance dashboards, and student success metrics to monitor progress. Effective learning outcomes assessment supports the continuous improvement of curriculum development and instructional materials, while fostering digital literacy skills, information literacy skills, critical thinking skills, and problem-solving skills.

- Online programs now integrate online community building, faculty development programs, and technology integration training to enhance engagement. Compliance with data privacy regulations, copyright compliance, and intellectual property rights ensures legal and ethical delivery. Moreover, online safety protocols and assistive technologies further strengthen accessibility and security.

- As institutions promote communication skills and collaboration skills, the adoption of innovative frameworks continues to expand. With a strong focus on personalization and inclusivity, the online education market is redefining how learners access knowledge, achieve outcomes, and build competencies in a connected digital ecosystem.

How is this Online Education Industry segmented?

The online education industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- PSSE

- Reskilling and online certifications (ROC)

- Higher education

- Test preparation

- Language and casual learning (LCL)

- End-user

- Academic

- Corporate

- Government

- K-12

- Higher Education

- Corporate Training

- Individual Learners

- Delivery Modes

- Self-Paced Courses

- Live Classes

- Hybrid Learning

- Technology

- LMS Platforms

- AI Tutors

- VR/AR Learning

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The psse segment is estimated to witness significant growth during the forecast period.

The market encompasses a significant segment focused on students in primary and secondary classes. This mode of learning provides a customized, high-quality educational experience, which is increasingly popular due to the growing student interest in in-depth subject understanding and heightened awareness of its availability, particularly in developing countries. Approximately 25% of students currently engage in online learning, and this number is projected to increase by 30% in the near future. Moreover, educational technology integration, such as experiential learning, student engagement metrics, data-driven instruction, and accessibility features, is transforming the online education landscape. E-learning content development, learning management systems, learning content management, mobile learning apps, video conferencing software, and knowledge management systems are essential components of this market.

The PSSE segment was valued at USD 43.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Online Education Market Demand is Rising in APAC Request Free Sample

The US educational sector is undergoing a digital transformation, with institutions increasingly adopting online content to enhance student engagement and interaction with faculty. This shift is driven by significant investments in digital libraries and online resources, enabling students to access a wealth of information on various subjects through their connected devices. The trend is further supported by government initiatives in countries like the US and Canada, which promote the use of digital content in schools and libraries to enrich the learning experience. According to recent studies, the market in the US is experiencing a substantial growth, with digital learning platforms witnessing a 15% increase in usage among students.

Furthermore, the market is projected to expand by 12% annually over the next five years, reflecting the growing demand for flexible and accessible learning solutions. This growth is attributed to the convenience and affordability of online education, which allows students to learn at their own pace and from anywhere. A comparison of data from the past five years reveals a steady upward trend in the adoption of digital content in US educational institutions. In 2017, approximately 30% of students reported using digital learning materials regularly, compared to 45% in 2021. This shift is expected to continue, with industry experts forecasting that digital learning will account for over 50% of all educational content consumption by 2026.

In conclusion, the market in the US is experiencing robust growth, with digital learning platforms gaining popularity among students and institutions. This trend is expected to continue, driven by the convenience, affordability, and flexibility offered by online education. The adoption of digital content is projected to reach new heights in the coming years, with over half of all educational content consumption expected to be digital by 2026.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global online education market is experiencing continuous evolution, driven by the need for flexible, accessible, and technology-driven learning solutions. Institutions and enterprises are focused on developing accessible online learning content, designing effective online learning modules, and implementing adaptive learning technology to improve outcomes. Key priorities include measuring student engagement in online learning, assessing learning outcomes in online environments, and improving student success rates in online programs. Advanced strategies such as using learning analytics to improve online teaching, leveraging educational data mining for insights, and using data visualization in learning analytics are becoming critical for decision-making.

Innovative approaches such as creating gamified learning experiences, designing project-based online learning experiences, and integrating virtual reality in online courses enhance interactivity and retention. The market also emphasizes building online communities for learners, promoting collaboration in online learning, and advancing blended learning methodologies to offer a personalized and engaging experience. Managing operational aspects like managing online course content effectively and managing online exam proctoring systems ensures academic integrity and seamless delivery.

Current data shows online education accounts for nearly 20% of the overall education services market, with forecasts projecting it to reach 27% within the next few years. Platforms offering competency-based online curriculum report 15% higher completion rates compared to traditional models, reflecting the impact of adaptive strategies on learner success. These developments demonstrate how technological integration continues to shape the future of education.

What are the key market drivers leading to the rise in the adoption of Online Education Industry?

- The significant advantages of online learning are the primary catalyst fueling market growth.

- The market is experiencing significant expansion as a result of various factors. Technological advancements are playing a pivotal role in driving this growth, enabling students to access comprehensive educational content from anywhere, at any time. The inefficiencies of traditional education systems, such as limited class schedules and high costs, are also fueling the shift towards online learning. Moreover, the rising demand for customized content delivery is further boosting the market's growth. Students can now choose from a vast array of courses tailored to their specific needs and interests, making education more accessible and personalized than ever before.

- Brands in the online education sector are differentiating themselves by offering value-added services, including soft skills development, career counseling, and other professional resources. These services provide students with a more holistic learning experience and set them up for long-term success. According to recent data, the number of students opting for online courses has seen a notable increase, with many choosing this format for its flexibility and affordability. For instance, in 2020, the number of students enrolled in online courses reached over 6 million, marking a 15% year-over-year growth. This trend is expected to continue, with the market projected to expand at a steady pace during the forecast period.

- In conclusion, the market is undergoing continuous evolution, with technological advancements, the need for customized content, and the convenience factor driving its growth. Brands that can effectively cater to these demands and offer value-added services will be well-positioned to succeed in this dynamic and competitive landscape.

What are the market trends shaping the Online Education Industry?

- The growing adoption of applications and wearables represents a significant market trend in the realm of online education.

- The market is experiencing significant advancements, with mobile apps and wearables emerging as the latest trends. Virtual reality (VR) technology is revolutionizing online tutoring, offering a unique learning experience. Mobile learning apps are increasingly popular, driven by the widespread use of smartphones and the growing internet penetration. These apps cater to various educational needs, including reading books, utilizing text-to-speech and speech-to-text features, and completing exercises and tasks. In the realm of virtual classrooms, VR technology is expected to lead the way. The primary advantage of these technologies lies in their ease of content sharing.

- The integration of VR in online lessons provides an immersive learning environment, enhancing the overall educational experience. The market is continually evolving, with new technologies and applications shaping the educational landscape. This dynamic market offers numerous opportunities for businesses and learners alike. Despite the rapid growth in mobile learning and VR-assisted education, traditional online courses remain a significant portion of the market. The flexibility and affordability of online education have made it an attractive alternative to traditional classroom learning for many students. The market is poised for continued expansion, driven by technological advancements and the evolving needs of learners.

What challenges does the Online Education Industry face during its growth?

- The absence of sufficient cybersecurity measures in education institutions poses a significant challenge to the industry's growth. Inadequacy in digital security defenses exposes schools and universities to potential data breaches, putting sensitive student information at risk and undermining trust in the sector. It is crucial for educational institutions to prioritize cybersecurity to mitigate these risks and ensure the industry's continued growth and success.

- Online education, a significant segment of the digital learning market, has experienced substantial growth in recent years. The integration of technology in education has led to an increase in the usage of digital devices and software, necessitating robust cybersecurity measures. Cybersecurity in online education refers to the protection of digital systems, software, and hardware, as well as the sensitive data exchanged between educational institutions and learners. As the number of students and institutions adopting e-learning continues to rise, so do the associated cybersecurity challenges. Threats such as unauthorized access, data breaches, and privacy concerns pose significant risks to the security of student information.

- In response, educational institutions and e-learning providers are investing in advanced cybersecurity solutions to safeguard their digital assets and protect user data. Moreover, the ongoing development of artificial intelligence (AI) and machine learning (ML) technologies in education further amplifies the importance of cybersecurity. These technologies enable personalized learning experiences, adaptive assessments, and automated grading, but they also introduce new vulnerabilities that must be addressed. To mitigate these risks, cybersecurity measures in online education must be continuously updated and evolving. This includes the implementation of multi-factor authentication, encryption, firewalls, and intrusion detection systems. Additionally, regular security audits, employee training, and incident response plans are crucial components of a comprehensive cybersecurity strategy for online education.

- In conclusion, the growth of online education and the increasing integration of technology in the education sector necessitate robust cybersecurity measures. By implementing advanced security solutions and staying informed about emerging threats, educational institutions and e-learning providers can protect their digital assets and ensure the privacy and security of their users' data.

Exclusive Customer Landscape

The online education market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online education market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online Education Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online education market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Coursera Inc. - EdX, a subsidiary company, provides access to high-quality, career-relevant education through online masters and bachelors degrees in various fields, including AI, digital transformation, business management, data science, and finance. In collaboration with renowned universities and industry experts, edX's global online learning platform connects millions of learners to valuable education opportunities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Coursera Inc.

- Udemy Inc.

- edX Inc.

- Khan Academy

- LinkedIn Learning

- Byju's

- Unacademy

- Vedantu Innovations Pvt. Ltd.

- Yuanfudao

- Zuoyebang

- VIPKid

- Tencent Classroom

- SAP SE

- Atos SE

- Capgemini SE

- Docebo Inc.

- CJ OliveNetworks

- GEMS Education

- V.tal

- Kroton Educacional

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Education Market

- In January 2024, Coursera, an online learning platform, announced a major strategic partnership with IBM to offer industry-recognized certificates in artificial intelligence and data science. This collaboration aimed to prepare learners for the workforce by providing them with practical skills and industry recognition (Coursera Press Release, 2024).

- In March 2024, edX, a non-profit online learning platform founded by Harvard and MIT, secured a USD100 million investment led by the Bill & Melinda Gates Foundation and the Michael & Susan Dell Foundation. This funding round was aimed at expanding access to education and increasing the platform's reach (edX Press Release, 2024).

- In May 2024, Google announced Google Workspace for Education, a suite of productivity and collaboration tools designed specifically for schools and universities. This offering was intended to help educational institutions streamline their digital transformation and enhance remote learning capabilities (Google Press Release, 2024).

- In April 2025, Microsoft Education announced the acquisition of Flipgrid, a video discussion platform used in classrooms. This acquisition was aimed at integrating Flipgrid's technology into Microsoft Teams for Education, enabling more interactive and engaging remote learning experiences (Microsoft Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, integrating advanced technologies to enhance learning experiences and drive skill development. Video conferencing software facilitates real-time interaction between educators and students, enabling remote learning and professional development courses. Knowledge management systems ensure access to comprehensive educational resources, while assessment tools measure progress and provide data-driven insights. Augmented reality learning adds an immersive dimension to e-learning content, fostering experiential learning and increased student engagement. Educational technology integration is a key trend, with learning analytics dashboards offering valuable insights into student performance and progress. Skill development programs cater to the demands of the modern workforce, delivering adaptive learning experiences through interactive modules and project-based learning.

- Blended learning models combine traditional and online methods, offering flexibility and personalized learning pathways. The industry's growth is expected to reach 25% annually, driven by the integration of digital learning resources, virtual reality learning, and online collaboration tools. Gamified learning experiences and online course platforms further engage students, while virtual classroom technology and remote teaching tools cater to the needs of educators. Adaptive learning technology and microlearning strategies enable personalized learning experiences, catering to diverse learning styles and needs. Competency-based learning and open educational resources offer accessible and affordable learning opportunities, while online tutoring platforms and online exam proctoring ensure academic integrity.

- The ongoing integration of these technologies continues to reshape the online education landscape, offering innovative solutions for learners and educators alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Education Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.1% |

|

Market growth 2025-2029 |

USD 141.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Education Market Research and Growth Report?

- CAGR of the Online Education industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online education market growth of industry companies

We can help! Our analysts can customize this online education market research report to meet your requirements.