Elastomeric Infusion Pumps Market Size 2024-2028

The elastomeric infusion pumps market size is forecast to increase by USD 813.9 million, at a CAGR of 6.78% between 2023 and 2028.

- The market is characterized by the increasing prevalence of chronic diseases and the resulting high demand for advanced infusion pumps. These devices offer improved patient comfort and convenience through their portable design and extended infusion durations. However, the market faces significant challenges due to stringent regulatory standards on medical devices. Compliance with these regulations adds to the manufacturing costs and may limit the entry of new players. Furthermore, the continuous advancements in technology, such as smart infusion pumps and wireless connectivity, are driving innovation in the market.

- Companies seeking to capitalize on these opportunities must invest in research and development to stay competitive and navigate the regulatory landscape effectively. Additionally, collaborations and partnerships with healthcare providers and regulatory bodies can help streamline the approval process and ensure market success.

What will be the Size of the Elastomeric Infusion Pumps Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The elastomeric infusion pump market continues to evolve, driven by advancements in technology and increasing demand for sophisticated medical devices. Ambulatory infusion pumps, a key segment of this market, are designed to deliver controlled doses of medication over extended periods. These pumps require tubing compatibility, user-friendly interfaces, and elastomer material selection that ensures durability and biocompatibility. Infusion pump design plays a crucial role in minimizing power consumption while maintaining continuous infusion capability. Disposable pumps, featuring single-use systems, offer advantages in terms of cost-effectiveness and ease of use. Ongoing research focuses on improving occlusion detection, syringe pump technology, and bolus delivery functions.

Developments in elastomeric materials have led to enhanced durability and resistance to degradation. Safety interlocks and patient safety features are increasingly important considerations, as is regulatory compliance. Fluid compatibility testing, volume measurement accuracy, and leak detection methods are essential aspects of pump design. The market's dynamic nature is reflected in the ongoing research and development efforts in areas such as pump priming methods, maintenance protocols, and pump lifetime prediction. Electronic control units, alarm system design, and sterilization validation are also critical components under constant review. In the ever-changing landscape of the elastomeric infusion pump market, continuous innovation and improvement are key.

From material selection to user interface design, each aspect is subject to rigorous testing and evaluation, ensuring the delivery of safe, efficient, and effective medical devices.

How is this Elastomeric Infusion Pumps Industry segmented?

The elastomeric infusion pumps industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pain management

- Antibiotic or antiviral

- Chemotherapy

- Others

- End-user

- Hospitals

- Ambulatory service centers

- Clinics

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Application Insights

The pain management segment is estimated to witness significant growth during the forecast period.

Elastomeric infusion pumps have gained significant traction in the healthcare industry, particularly for pain management applications. Their popularity stems from their ease of use, portability, and cost-effectiveness compared to traditional infusion pumps. These devices deliver a consistent flow of medication to patients over extended periods, ensuring reliable pain control. Design considerations for elastomeric infusion pumps include pressure regulation systems, reliability testing protocols, and air bubble detection to ensure medication accuracy and patient safety. Biocompatibility assessment and long-term stability testing are essential to ensure the durability and safety of the elastomeric material. Proper reservoir design, priming methods, and maintenance protocols are crucial for optimal pump performance.

Ambulatory infusion pumps offer the advantage of mobility, allowing patients to move around while receiving treatment. Tubing compatibility, user interface design, and elastomer material selection are essential factors in the design of these pumps. Power consumption metrics and disposable pump features contribute to their cost-effectiveness and ease of use. Safety interlocks, occlusion detection, and syringe pump technology are essential features for patient safety. Single-use pump systems and durability testing ensure the elimination of cross-contamination risks and maintain pump performance. Material degradation analysis and regulatory compliance are critical aspects of pump design to ensure safety and efficacy. The drug delivery system, electronic control unit, and alarm system design are integral components of elastomeric infusion pumps.

Fluid compatibility testing, continuous infusion capability, bolus delivery function, and pump lifetime prediction are essential for accurate and consistent medication delivery. Filling system integration and sterilization validation ensure the safety and purity of the medication. Volume measurement accuracy and leak detection methods are crucial for ensuring proper medication dosage and preventing potential complications.

The Pain management segment was valued at USD 700.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

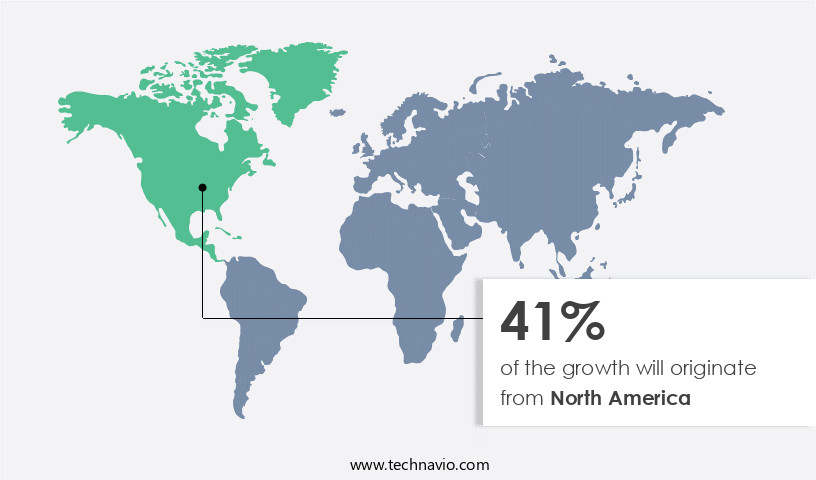

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the advanced healthcare infrastructure, comprised of hospitals, clinics, and other medical facilities, relies heavily on infusion pumps for the precise administration of medications and fluids to patients. The region's well-established healthcare system, coupled with a strong focus on patient safety, fuels the demand for elastomeric infusion pumps. With a significantly rising geriatric population in North America, prone to chronic diseases like diabetes, cardiovascular conditions, and cancer, these pumps become essential for managing these conditions through the delivery of insulin, chemotherapy drugs, pain medications, and various therapies. Elastomeric infusion pumps offer advantages such as long-term stability testing, power consumption metrics, patient safety features, and drug delivery system.

They come with pump failure modes, fluid compatibility testing, disposable pump features, bolus delivery function, occlusion detection, air bubble detection, and pump lifetime prediction. Leak detection methods, alarm system design, material degradation analysis, and regulatory compliance are also integral components. Infusion pump design considers elastomer material selection, user interface design, electronic control unit, continuous infusion capability, filling system integration, biocompatibility assessment, durability testing, tubing compatibility, pump priming methods, maintenance protocols, reservoir design considerations, syringe pump technology, pressure regulation system, and volume measurement accuracy. Reliability testing protocols and sterilization validation, along with safety interlocks, further ensure the effectiveness and safety of these pumps.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Elastomeric Infusion Pumps Industry?

- The rising incidence of chronic diseases serves as the primary market catalyst, underpinning its significant growth.

- Elastomeric infusion pumps have gained prominence in the healthcare industry due to their ability to deliver precise and controlled doses of medications, particularly in intravenous therapy. The rising prevalence of chronic diseases and an aging population are driving the demand for these pumps, as they enable long-term medication management and improve patient convenience and compliance. Elastomeric infusion pumps operate through a pressure regulation system, ensuring consistent flow rates. Their reliability is crucial, and manufacturers employ rigorous testing protocols, including pressure regulation system testing, pump priming methods, and long-term stability testing. Air bubble detection is another critical feature, as air bubbles can obstruct medication flow and compromise patient safety.

- Biocompatibility assessment is essential to ensure the safety and effectiveness of elastomeric infusion pumps. The materials used in their design must be compatible with various medications and body fluids. Reservoir design considerations, such as size, shape, and material, also impact the pump's functionality and patient experience. Maintenance protocols are vital to ensure the longevity and proper functioning of elastomeric infusion pumps. Regular inspections and timely replacement of components can prevent pump failure modes and maintain the quality of care for patients.

What are the market trends shaping the Elastomeric Infusion Pumps Industry?

- The trend in the medical device market is characterized by a growing demand for advanced infusion pumps due to their precision and effectiveness in delivering medications. Infusion pumps that offer advanced features, such as wireless connectivity and customized dosing, are particularly sought after by healthcare professionals and patients.

- Elastomeric infusion pumps have evolved with advanced features and technologies, transforming the healthcare industry. These pumps, including ambulatory infusion pumps, offer improved patient safety, medication accuracy, and user convenience. Advanced infusion pumps boast precise infusion rate programming, dosage limits, and delivery schedules. They feature intuitive user interfaces with touchscreens, enabling healthcare professionals to easily program and adjust parameters. These pumps can calculate medication dosages based on patient-specific factors, such as weight and body surface area. Integration with electronic medical records (EMRs) and barcode scanning systems further enhances medication administration accuracy and reduces errors. Additionally, advanced infusion pumps may incorporate sensors for occlusion detection and employ syringe pump technology.

- Power consumption metrics are also considered during infusion pump design, ensuring energy efficiency. Disposable pump features, such as tubing compatibility, are essential for maintaining hygiene and reducing the risk of infection. Overall, the advanced elastomeric infusion pump market is driven by the need for improved patient safety, medication accuracy, and user convenience.

What challenges does the Elastomeric Infusion Pumps Industry face during its growth?

- The stringent regulatory standards posing significant challenges to the medical device industry represent a key factor impeding its growth.

- Elastomeric infusion pumps, categorized as medical devices, are subject to regulatory oversight in accordance with regional regulations. In the US, the Food and Drug Administration (FDA) governs these pumps under the Federal Food, Drug, and Cosmetic Act (FD&C Act) and Code of Federal Regulations (CFR) Title 21. Compliance with safety and performance standards is essential to ensure patient safety, encompassing drug delivery accuracy, alarm and safety feature effectiveness, electromagnetic compatibility, mechanical and electrical safety, software validation, and usability. Non-compliance may lead to penalties, product recalls, loss of market authorization, and reputational damage, potentially hindering the growth of the global elastomeric infusion pump market.

- To maintain safety and reliability, elastomeric infusion pumps undergo rigorous testing. Durability testing evaluates the pumps' resistance to wear and tear, while material degradation analysis ensures the compatibility of the pump's materials with the infused fluids. Fluid compatibility testing guarantees that the pump does not react adversely with the medication or other substances. Safety interlocks prevent the pump from functioning if it detects potential hazards, such as air bubbles or incorrect medication dosages. Patient safety features, such as alarm system design, are also crucial to alert healthcare professionals of any issues. The electronic control unit, the heart of the pump, must be reliable and precise to ensure accurate drug delivery.

- All these factors contribute to the stringent regulatory environment for elastomeric infusion pumps.

Exclusive Customer Landscape

The elastomeric infusion pumps market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the elastomeric infusion pumps market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, elastomeric infusion pumps market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambu AS - The Action Fuser Pain Pump, a cutting-edge elastomeric infusion device, sets industry standards for efficient medication delivery and patient comfort.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambu AS

- Avanos Medical Inc.

- B.Braun SE

- Baxter International Inc.

- Daiken Medical Co. Ltd.

- Epic Medical

- Fresenius SE and Co. KGaA

- Heka srls

- Infusystem Holdings Inc.

- Medline Industries LP

- MicroPort Scientific Corp.

- Nipro Corp.

- Owens and Minor Inc.

- pfm medical ag

- Promecon

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Smiths Group Plc

- Vygon SAS

- Werfenlife SA

- WooYoung Medical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Elastomeric Infusion Pumps Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the FDA approval of its new elastomeric infusion pump, the SynchroMed II EL, for the delivery of opioid patient-controlled analgesia (PCA) and continuous epidural analgesia (CEA) (Medtronic Press Release, 2024). This approval marked a significant expansion of Medtronic's pain therapy portfolio.

- In March 2024, Smiths Medical, a leading global medical device manufacturer, entered into a strategic partnership with B. Braun Melsungen AG to co-develop and commercialize a new line of elastomeric infusion pumps. The collaboration aimed to leverage Smiths Medical's expertise in pump design and B. Braun's strength in pharmaceutical solutions (Smiths Medical Press Release, 2024).

- In May 2024, Grifols, S.A., a leading global healthcare company, completed the acquisition of Braun Melsungen's Infusion Systems business, including its elastomeric infusion pump portfolio. The acquisition strengthened Grifols' presence in the infusion systems market and expanded its product offerings (Grifols Press Release, 2024).

- In April 2025, Fresenius Kabi AG, a global healthcare company, received European Commission approval for its new elastomeric infusion pump, the Space Infusor, designed for the administration of a wide range of infusion therapies. The approval marked Fresenius Kabi's entry into the European elastomeric infusion pump market (Fresenius Kabi Press Release, 2025).

Research Analyst Overview

- The elastomeric infusion pump market is characterized by rigorous compliance standards and a focus on ensuring patient safety and efficacy. Elastomer properties, such as material characterization and sterility assurance, play a crucial role in pump design and manufacturing. Electronic circuitry and software algorithms, including pump control, flow control, and dose accuracy verification, are essential for optimal device performance. Compliance with regulatory approval processes is paramount, requiring extensive clinical validation, system validation testing, and process validation. User training materials are essential to ensure proper use and understanding of infusion set design and clinical trial data.

- Sensor technology and patient monitoring features are increasingly important trends, with data logging capabilities and real-time performance monitoring enhancing overall system functionality. Error handling mechanisms and calibration procedures are also critical components of quality assurance. Infusion pumps employ various designs, including positive displacement and peristaltic pumps, each with unique advantages. Manufacturing processes and power supply designs must adhere to stringent quality standards to ensure consistent product output. Device validation testing, including clinical trial data analysis and pump chamber design evaluation, is essential for regulatory approval and market success. Regulatory bodies require thorough testing and documentation of infusion pumps' compliance with various standards, from material properties to pump function and software algorithms.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Elastomeric Infusion Pumps Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 813.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Elastomeric Infusion Pumps Market Research and Growth Report?

- CAGR of the Elastomeric Infusion Pumps industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the elastomeric infusion pumps market growth of industry companies

We can help! Our analysts can customize this elastomeric infusion pumps market research report to meet your requirements.