Electric Scissor Lift Market Size 2024-2028

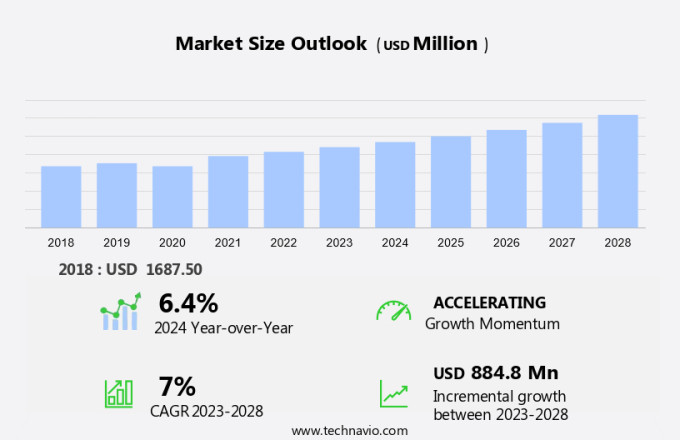

The electric scissor lift market size is forecast to increase by USD 884.8 million, at a CAGR of 7% between 2023 and 2028.

- The market is driven by the expansion of the global construction industry and the increasing demand for emission-free and efficient lifting solutions. With the construction sector's continuous growth, there is a rising need for equipment that can help streamline processes and improve productivity. Electric scissor lifts, with their versatility and eco-friendliness, have gained significant traction in this industry. However, the market faces challenges as well. Safety concerns associated with electric scissor lifts persist, as improper use or maintenance can lead to accidents and potential harm to operators and bystanders. Ensuring the highest safety standards and providing comprehensive training programs are essential for companies operating in this market.

- Additionally, advancements in technology, such as battery-powered and autonomous scissor lifts, may pose threats to traditional electric models, necessitating continuous innovation and adaptation. Data integration and automation are also becoming essential features in lifts. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on enhancing safety features, investing in research and development, and building strong customer relationships.

What will be the Size of the Electric Scissor Lift Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Electric drive systems have gained significant traction due to their energy efficiency and reduced environmental impact. Wind rating is a crucial factor in the selection of scissor lifts for outdoor applications, particularly in tree trimming and aerial work. Remote diagnostics enable real-time monitoring of operating costs, duty cycle, and event setup, enhancing fleet management and reducing downtime. Proportional controls offer precise and smooth lifting and lowering, while safety features such as emergency stop, overload protection, and fall arrest systems ensure operator safety.

The hydraulic system's efficiency and reliability have been improved through the integration of advanced features like load sensing. Operating costs are further reduced through features like battery life optimization and charging time minimization. Indoor applications, such as retail display setup and facility maintenance, benefit from scissor lifts' compact turning radius and quiet operation. Infrastructure projects and industrial maintenance require scissor lifts with extended working envelopes, jib extensions, and high-rise capabilities. Safety training and maintenance schedules are essential components of the evolving market dynamics, ensuring compliance with OSHA regulations and certification standards. Ground clearance, platform guardrails, and stabilizer jacks are critical safety features for various applications.

Fuel efficiency, noise reduction, and automated operation are ongoing trends in the market, catering to the diverse needs of industries and applications. The market's continuous dynamism is reflected in the unfolding of these patterns and the integration of features like remote control, telescopic boom, and articulating boom, among others.

How is this Electric Scissor Lift Industry segmented?

The electric scissor lift industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Construction

- Commercial

- Manufacturing

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By End-user Insights

The construction segment is estimated to witness significant growth during the forecast period.

The market encompasses various applications, including outdoor jobs such as tree trimming and aerial work, as well as indoor uses like retail display and facility maintenance. These lifts, which come in telescopic and articulating boom designs, offer features like data logging, OSHA compliance, and remote control for enhanced safety and efficiency. Industrial maintenance, power line maintenance, and high-rise maintenance are significant sectors driving market growth. Electric scissor lifts are essential for industries requiring frequent inspections and maintenance, as they offer features like emergency stop, battery life, and charging time. Fleet management systems and automated operation further streamline operations.

Ground clearance, control system, and platform height are critical factors in selecting the right lift for different applications. Infrastructure projects, including wind energy and event setup, are significant contributors to the market's growth. Operator training, maintenance schedules, and safety features like fall arrest systems and advanced safety features are essential considerations. Electric drive, wind rating, and remote diagnostics are advanced features that add value to the market. The construction industry dominates the market due to its extensive use of electric scissor lifts for renovation and general contracting projects. Infrastructure spending and the shift towards residential developments are expected to boost demand further.

Noise reduction and OSHA compliance are essential factors in the market, with certification standards ensuring safety and reliability. The market trends include the development of electric scissor lifts with longer boom lengths, increased lifting capacity, and improved fuel efficiency. Proportional controls and safety features like overload protection and stabilizer jacks ensure optimal performance and safety. The market's evolving trends reflect the industry's commitment to innovation and sustainability.

The Construction segment was valued at USD 614.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in North America, due to the surge in construction activities and infrastructure projects. The US and Canada are key contributors to this market, with the US experiencing a rise in modular construction and prefabrication projects. The American Society of Civil Engineers reports that North America's aged water and wastewater treatment facilities, hazardous bridges, and congested highways necessitate an estimated USD 2 trillion investment by 2030 from the US federal government. Outdoor applications, including tree trimming and aerial work, dominate the market, with electric scissor lifts offering the advantage of lower emissions and noise reduction.

OSHA compliance is crucial, ensuring safety features such as platform guardrails, fall arrest systems, and emergency stops. Industrial maintenance and high-rise maintenance also drive demand, with telescopic booms and articulating booms offering extended reach and versatility. Electric scissor lifts cater to indoor applications as well, with data logging and remote control enabling efficient fleet management and automated operation. Ground clearance, control systems, and battery life are essential factors, while charging time, tread width, and wheel type cater to varying applications. Safety features, such as load sensing, overload protection, and safety training, are essential, with hydraulic systems and electric drives ensuring efficient operation.

Infrastructure projects and event setup benefit from the flexibility and maneuverability of electric scissor lifts, with wind rating and remote diagnostics enhancing their utility. The market trends include advanced features like proportional controls and jib extensions, stabilizer jacks for added stability, and platform height adjustments catering to diverse applications. The focus on OSHA compliance, safety training, and maintenance schedules ensures a robust and harmonious market, emphasizing the importance of continuous improvement and innovation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electric Scissor Lift Industry?

- The expansion of the global construction industry serves as the primary catalyst for market growth.

- The market has witnessed notable growth in the global construction industry, particularly in developed economies like the US, due to the increasing need for infrastructure maintenance and renovation. With an aging infrastructure and a focus on sustainable building practices, the construction sector in these countries is experiencing significant investments and technological advancements. The market has benefited from these trends, as these lifting solutions offer several advantages, such as shorter charging times, varying platform heights, and working envelopes with jib extensions. Moreover, electric scissor lifts are increasingly being adopted for power line maintenance, retail display setup, and facility maintenance due to their compact design and maneuverability.

- Advanced features like fall arrest systems, stabilizer jacks, and operator training programs ensure safety and efficiency in various applications. Infrastructure projects in developing countries have also contributed to the market's growth, as these projects require lifting solutions to meet the increasing demand for construction and maintenance activities. Regular maintenance schedules are essential to ensure the longevity and productivity of electric scissor lifts, making this market a reliable and growing sector within the construction industry.

What are the market trends shaping the Electric Scissor Lift Industry?

- The increasing preference for emission-free and efficient scissor lifts is a notable market trend. Electric scissor lifts, in particular, are experiencing growing demand due to their eco-friendly and productive nature.

- Electric scissor lifts are gaining popularity in various industries due to their electric drive system, which offers numerous advantages over traditional hydraulic systems. These lifts are ideal for indoor use as they do not emit fumes and are quieter than their hydraulic counterparts. Their compact size and ease of maneuverability make them suitable for confined spaces. Safety is a top priority in the market, with features such as overload protection, wind rating, and remote diagnostics ensuring safe operations. Proportional controls allow for precise height adjustments, while load sensing and duty cycle monitoring help prevent damage and extend the lift's lifespan.

- Safety training is essential for operators, and electric scissor lifts come with comprehensive safety features, including guardrails, outrigger alarms, and emergency lowering mechanisms. The hydraulic system in electric scissor lifts is enclosed, reducing the need for regular maintenance and lowering operating costs. CE marking ensures compliance with European safety standards, and the lifts' digital applications, such as event setup and fuel efficiency, provide added value. With a focus on sustainability and digitalization, the market is expected to grow significantly in the coming years.

What challenges does the Electric Scissor Lift Industry face during its growth?

- The electric scissor lift industry faces significant challenges due to the inherent risks and safety concerns associated with their operation, which can hinder market growth.

- Electric scissor lifts are essential equipment for various outdoor applications, including tree trimming and aerial work. However, their use comes with certain risks, as outlined by the Occupational Safety and Health Administration (OSHA). One significant risk is electrocution, which can occur when workers get too close to power lines or if the lift is not properly insulated. Another risk is tip-overs, which can be caused by improper securing of the lift. To mitigate these risks, electric scissor lifts must comply with OSHA certification standards and undergo regular inspections. Data logging and fleet management systems help ensure compliance and facilitate maintenance.

- Additionally, features such as platform guardrails, remote control, and noise reduction enhance safety and efficiency. Telescopic and articulating booms provide greater reach and maneuverability, while OSHA-compliant certification standards ensure worker protection. Remote control operation reduces the need for workers to be in harm's way, and noise reduction technology minimizes disruption to surrounding areas. OSHA compliance, data logging, and fleet management are essential for industrial maintenance and ensure the safe and efficient operation of electric scissor lifts. Platform guardrails, articulating booms, and telescopic booms provide added safety and versatility, while remote control operation and noise reduction technology enhance convenience and productivity.

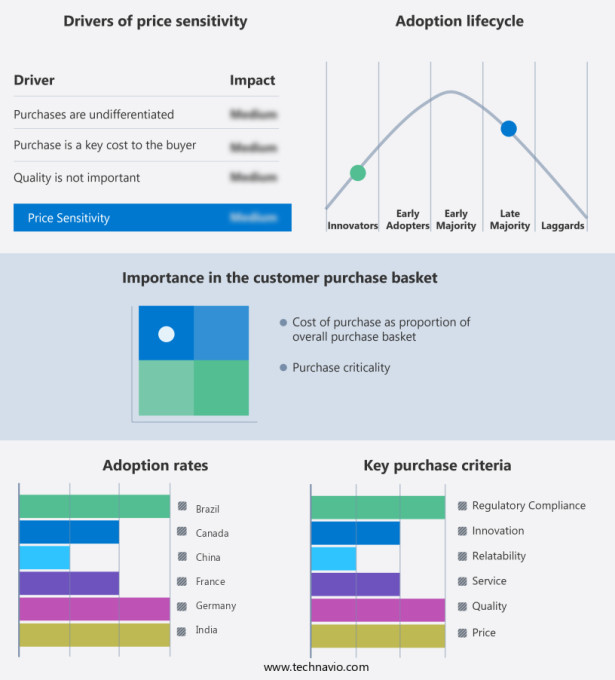

Exclusive Customer Landscape

The electric scissor lift market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric scissor lift market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric scissor lift market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Columbus McKinnon Corp. - Electric scissor lifts, engineered for diverse material handling applications, prioritize safety and efficiency. These lifting solutions elevate productivity through seamless maneuverability and reliable performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Columbus McKinnon Corp.

- Galmon Pte Ltd

- Holland Lift International B.V.

- Hunan Sinoboom Intelligent Equipment Co. Ltd.

- Linamar Corp.

- Manitou BF SA

- MEC Aerial Work Platforms

- Oshkosh Corp.

- Sany Group

- Snorkel International LLC

- Solem SAS

- Tadano Ltd.

- Terex Corp.

- Toyota Motor Corp.

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Scissor Lift Market

- In March 2023, JLG, a leading manufacturer of aerial work platforms and telehandlers, introduced the EC350EJ electric scissor lift, featuring a 35-foot (10.7 meters) working height and 500 pounds (227 kg) platform capacity (JLG press release). This new model expands the company's electric lift offerings, catering to the growing demand for sustainable and cost-effective lifting solutions.

- In June 2024, Genie, another prominent player in the aerial work platform industry, announced a strategic partnership with SolarSite, a solar installation company, to integrate solar panels into Genie's electric scissor lift models (Genie press release). This collaboration aims to reduce the carbon footprint and operating costs of electric scissor lifts, making them more attractive to environmentally-conscious customers and those working in remote locations.

- In October 2024, Hydro Mobile, a leading European manufacturer of electric scissor lifts, secured a â¬15 million (approximately USD 16.8 million) investment from a private equity firm to accelerate its growth and expand its production capacity (PE Hub Europe). The investment will enable Hydro Mobile to increase its market share and meet the rising demand for electric scissor lifts in Europe and beyond.

- In February 2025, the European Union passed new regulations requiring all construction sites with a floor area of over 5,000 square meters to use only electric or hybrid aerial work platforms by 2028 (European Parliament press release). This policy change is expected to significantly boost the demand for electric scissor lifts in Europe, as they are more environmentally friendly and cost-effective compared to traditional diesel models.

Research Analyst Overview

- The market experiences dynamic growth, driven by advancements in technology and evolving business needs. Vertical and horizontal reach capabilities of these lifts enable increased productivity and efficiency in various industries, including construction and maintenance. Wind sensors ensure safety in windy conditions, while battery technology improvements extend runtimes and reduce charging times. Emergency descent systems provide peace of mind, ensuring safe lowering in case of power loss. Motor power and efficiency, along with lowering speed, optimize performance and reduce operational costs. Platform load distribution and weight capacity enhance safety and versatility. Aluminum alloy and steel construction offer durability and lightweight design, while maintenance intervals are extended through advanced technology and materials.

- Anti-tip systems prevent instability, and swivel bases provide greater maneuverability. Lifting speed and boom extension accommodate various applications, and platform size and access cater to diverse user needs. Resale value remains strong due to the equipment's versatility and reliability. Recharging infrastructure and drive system advancements streamline the charging process and improve overall functionality. In the market, motor power and efficiency, working height, and load capacity are significant factors influencing purchasing decisions. Platform size, weight distribution, and lowering speed also play essential roles in the selection process. Service life, maintenance interval, and emergency descent systems are critical considerations for long-term investment.

- Join our newsletter to stay updated on the latest trends and developments in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Scissor Lift Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2024-2028 |

USD 884.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, China, Germany, Canada, UK, France, India, Japan, Saudi Arabia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Scissor Lift Market Research and Growth Report?

- CAGR of the Electric Scissor Lift industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric scissor lift market growth of industry companies

We can help! Our analysts can customize this electric scissor lift market research report to meet your requirements.