Electrochromic Storage Devices Market Size 2024-2028

The electrochromic storage devices market size is forecast to increase by USD 4.21 billion at a CAGR of 12.93% between 2023 and 2028.

- Electrochromic storage devices (ECDs) are gaining significant traction In the energy storage market due to the increasing demand for energy-efficient solutions. These devices offer several advantages, including high power density, long cycle life, and fast charge-discharge rates. The market is witnessing technological advancements, leading to the development of more efficient and cost-effective ECDs. However, the high initial costs associated with these devices remain a significant challenge, limiting their widespread adoption. To address this challenge, manufacturers are focusing on reducing the material costs and improving the manufacturing processes. Furthermore, government initiatives and incentives to promote the adoption of renewable energy and energy storage solutions are expected to drive the market growth. In summary, the market is poised for growth due to the increasing demand for energy-efficient solutions, technological advancements, and government initiatives, despite the high initial costs.

What will be the Size of the Electrochromic Storage Devices Market During the Forecast Period?

- The market encompasses a range of energy storage technologies, including electrochromic batteries and supercapacitors, which utilize electrochromic materials to modify their optical properties in response to electrical stimulation. These materials, often composed of conductive polymers or transition metal oxides, undergo redox reactions that result in changes in color, opacity, and reflectance. Electrochromic storage devices find applications in various sectors, such as electrochromic windows for heat gain and glare reduction, electrochromic mirrors for automobile rearview mirrors, and electrochromic displays for signage and advertising. The market's growth is driven by the increasing demand for energy-efficient and smart technologies, as well as advancements in electrochromic materials and manufacturing processes.

- Moreover, ionic conductive electrolytes and conductive glass are key components In the development of these devices, enabling faster response times and improved performance. The market is expected to grow significantly In the coming years, offering opportunities for innovation and technological advancements In the field of energy storage and optoelectronics.

How is this Electrochromic Storage Devices Industry segmented and which is the largest segment?

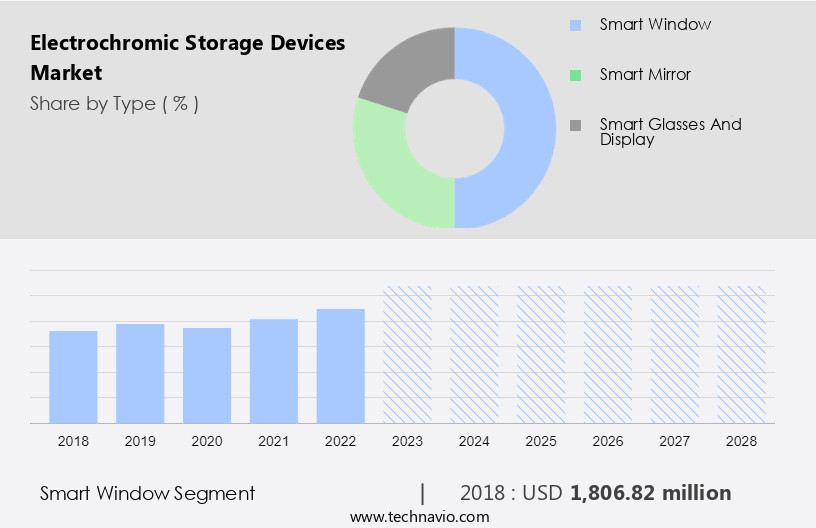

The electrochromic storage devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Smart window

- Smart mirror

- Smart glasses and display

- Application

- Automotive and transportation

- Building and construction

- Electric and electronic devices and eyewear

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Type Insights

- The smart window segment is estimated to witness significant growth during the forecast period.

Electrochromic storage devices, specifically smart windows, represent an advanced solution for controlling natural light and enhancing energy efficiency in commercial buildings. These devices employ electrochromic technology, which enables the glass to alter its optical properties in response to electrical voltage. By adjusting the tint level, smart windows regulate sunlight penetration, mitigating glare and heat gain during peak hours while maximizing daylight utilization. This dynamic control empowers occupants to create personalized environments, fostering productivity, well-being, and sustainability. Electrochromic materials, such as metal oxides and conductive polymers, play a crucial role in this technology. Ionic conductive electrolytes and ion layers facilitate voltage-driven redox reactions, altering the material's optical properties.

Get a glance at the Electrochromic Storage Devices Industry report of share of various segments Request Free Sample

The smart window segment was valued at USD 1.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth, particularly In the automotive industry in North America. Driven by increasing per capita income and consumer awareness, there is a rising demand for advanced technologies in vehicles, including electrochromic storage devices. These devices, which use smart glass for applications such as sunroofs and moonroofs, are becoming increasingly popular due to their ability to provide comfort and safety features. The adoption of electrochromic storage devices is also being driven by the growing demand for luxury and premium vehicles in Canada and Mexico. The technology behind these devices involves the use of electrodes, battery, supercapacitor, and electrochromic materials, which undergo redox reactions when electric voltage is applied.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electrochromic Storage Devices Industry?

Increasing demand for energy-efficient solutions is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for energy-efficient solutions. These devices, including smart windows and dynamic glass, enable users to regulate light and heat transmission, thereby reducing the need for artificial lighting, heating, and cooling systems. This leads to substantial energy savings and contributes to a more sustainable indoor environment. Electrochromic storage devices function through electrodes and an ionic conductive electrolyte, which facilitate ion intercalations in electrochromic materials, such as metal oxides and conductive polymers. The material properties and device structures determine the kinetics of these redox reactions, influencing the optical properties, such as voltage-controlled light transmission, reflectance, color, and opacity.

- Furthermore, applications of electrochromic storage devices extend beyond buildings to include smart glasses, mirrors, and displays in automobiles, consumer electronics, HVAC systems, and wearable electronics. The integration of nanotechnology further enhances the performance and functionality of these devices, making them an attractive solution for energy efficiency and sustainability.

What are the market trends shaping the Electrochromic Storage Devices Industry?

Technological advancements in electrochromic storage devices is the upcoming market trend.

- The market is experiencing significant advancements, propelling the industry forward with innovative solutions. Notable progress includes the development of superior electrochromic materials, such as those using suspended particle devices (SPDs) by companies like Research Frontiers Inc. SPDs consist of microscopic particles suspended in a liquid or polymer matrix, which adjust their orientation in response to an electric field, altering the material's opacity or tint. This technology is revolutionizing smart glass applications, with potential uses in various industries. Electrochromic materials are essential components of these devices, with key properties including optical properties, voltage, and material composition. Metal oxides, such as tungsten oxide and cathode electrochromic oxide, are commonly used as active layers in electrochromic windows and displays.

- Moreover, ionic conductive electrolytes and ion layers play crucial roles in facilitating redox reactions, which enable the electrochromic effect. Electrochromic storage devices offer numerous benefits, including energy efficiency, dynamic control of light transmission, heat gain reduction, and glare reduction. These advantages make them suitable for various applications, including smart windows, solar radiation management in commercial buildings, automobile mirrors, displays, and wearable electronics. Nanotechnology is also contributing to advancements In the field, enabling the development of thinner, lighter, and more cost-effective devices. The market dynamics are driven by factors such as the increasing demand for energy efficiency, the growing adoption of smart windows and displays, and the development of new materials and device structures.

What challenges does the Electrochromic Storage Devices Industry face during its growth?

High initial costs associated with electrochromic storage devices is a key challenge affecting the industry growth.

- Electrochromic storage devices, which utilize electrodes and an ionic conductive electrolyte to change the optical properties of materials through redox reactions, offer advantages such as energy efficiency, solar radiation management, and dynamic control of light transmission and reflectance. Applications include smart windows, electrochromic mirrors, and displays. However, the high initial costs, which can range from USD 50 to USD 100 per square foot for residential properties and escalate significantly for commercial buildings, pose a challenge to market growth. Factors influencing cost include window size, installation complexity, and additional features like connectivity and automation. In commercial applications, costs can reach hundreds of thousands to millions of dollars for large-scale projects.

- Furthermore, materials used in electrochromic devices include conductive polymers, transition metal oxides, and ion layer structures, which impact device structures, kinetics, and voltage performance. Applications include energy efficiency improvements in HVAC systems, solar heat gain reduction, and smart displays for consumer electronics, automobile mirrors, and wearable electronics. Nanotechnology advancements offer potential cost savings and performance enhancements.

Exclusive Customer Landscape

The electrochromic storage devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electrochromic storage devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electrochromic storage devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Apogee Enterprises Inc.

- ChromoGenics AB

- Compagnie de Saint Gobain

- EssilorLuxottica

- FlexEnable

- Gauzy Ltd.

- Gentex Corp.

- Huichi Industrial Development Co. Ltd.

- Innovative Glass Corp.

- Intelligent Glass

- Plansee SE

- Polytronix Inc.

- PPG Industries Inc.

- Prelonic technologies

- RavenWindow

- Research frontiers Inc

- Schneider Electric SE

- Siemens AG

- Smart Films International

- SMART GLASS

- Smart Glass Technologies, LLC

- Smart Window Co. Inc.

- View Inc

- YFY Inc.

- Zhuhai Shuifa Singyes New Materials Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Electrochromic storage devices represent an innovative class of energy storage technologies that offer unique advantages in various applications. These devices utilize electrochromic materials, which are capable of undergoing reversible redox reactions in response to electrical stimulation. The resulting changes in material properties lead to modifications in optical properties such as reflectance, color, opacity, and transmittance. The fundamental principle behind electrochromic devices relies on the intercalation of ions into the electrode material. The ionic conductive electrolyte facilitates the ionic transport between the electrodes, enabling the electrochromic effect. Conductive glass, a common electrode material, is often used due to its excellent ionic conductivity and optical properties.

In addition, electrochromic devices find extensive applications in various sectors, including smart windows and dynamic glass. In commercial buildings, these devices can significantly reduce energy consumption by controlling solar radiation, heat gain, and glare. The ability to modulate light transmission and reflectance in response to electrical signals offers substantial benefits in terms of energy efficiency and occupant comfort. Smart windows, incorporating electrochromic materials, can be used to create various device structures, such as electrochromic mirrors and displays. These devices can be employed in a wide range of applications, from automotive mirrors to consumer electronics. For instance, electrochromic displays can be used in HVAC systems to optimize energy usage based on solar heat gain.

Moreover, the integration of nanotechnology in electrochromic materials has led to advancements in electrochromic storage devices. This technology enables the development of high-performance materials with improved optical properties and faster kinetics. Transition metal oxides, such as tungsten oxide, have been extensively studied for their electrochromic properties due to their excellent stability and high coloration efficiency. The electrochromic effect is not limited to windows and displays. It can also be applied to various other applications, such as solar radiation management in buildings, privacy screens for wearable electronics, and auto-dimming rearview mirrors for automobiles. The potential applications of electrochromic storage devices are vast, making them an exciting area of research and development In the energy storage sector.

In summary, electrochromic storage devices offer significant advantages in energy storage and management through their unique electrochromic effect. The ability to modulate optical properties in response to electrical stimulation makes them suitable for various applications, from smart windows and displays to HVAC systems and automotive components. The ongoing research and development in this field, particularly In the area of nanotechnology, are expected to lead to further advancements and improvements In the performance and applicability of electrochromic storage devices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.93% |

|

Market growth 2024-2028 |

USD 4.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.4 |

|

Key countries |

US, Canada, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electrochromic Storage Devices Market Research and Growth Report?

- CAGR of the Electrochromic Storage Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electrochromic storage devices market growth of industry companies

We can help! Our analysts can customize this electrochromic storage devices market research report to meet your requirements.