Optoelectronics Market Size 2024-2028

The optoelectronics market size is forecast to increase by USD 40.4 billion at a CAGR of 10.86% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The expanding automotive industry is driving demand for optoelectronic components, particularly In the development of advanced driver assistance systems and autonomous vehicles.

- Additionally, the increasing application of optoelectronic technologies in the medical sector is fueling market growth, as these components are essential for various diagnostic tools and therapeutic devices. However, the high costs of optoelectronic products remain a major challenge for market expansion, limiting their adoption in certain industries and applications. Despite this, the future of the market looks promising, with continued innovation and advancements in technology expected to drive growth.

What will be the Size of the Optoelectronics Market During the Forecast Period?

- The market encompasses the production and application of optoelectronic devices, which convert light into electrical energy and vice versa. This market is driven by the increasing demand for high-speed data transmission, advanced sensing technologies, and energy-efficient lighting solutions. Optoelectronic devices include semiconductor lasers, optical fibers, photodetectors, solar cells, and light-emitting diodes (LEDs), among others. Key technological advancements in this field include the use of semiconductor alloys, multi-quantum well structures, and the exploration of 2D materials for optoelectronic applications. Emerging areas of research include the development of silicon photonics, topological crystalline insulators, and nanomaterials such as metal chalcogenides and metal oxides.

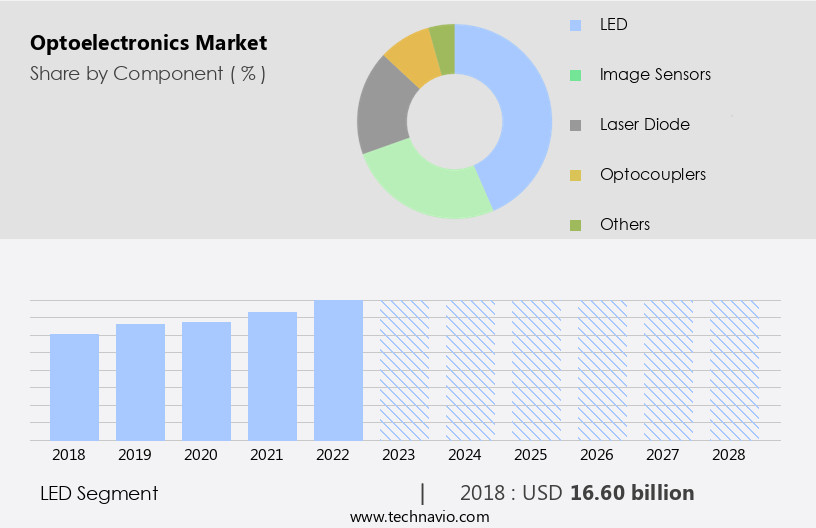

How is this Optoelectronics Industry segmented and which is the largest segment?

The optoelectronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- LED

- Image sensors

- Laser diode

- Optocouplers

- Others

- End-user

- Consumer electronics

- Automotive

- Information technology and communication

- Aerospace and defense

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Component Insights

The led segment is estimated to witness significant growth during the forecast period. The market is primarily driven by the LED optoelectronics segment, which is expected to maintain its market dominance due to the increasing demand for energy-efficient components. LED lights offer several advantages over traditional lighting sources, including longer lifespan, lower energy consumption, and comparable or superior light output. The global sales of LEDs have witnessed significant growth since 2015, fueled by government initiatives promoting their adoption. For instance, the Navi Mumbai Municipal Corporation in India replaced 35,000 streetlights with LEDs in 2022, resulting in savings of 7 billion Indian rupees (USD91 million USD). The market also encompasses electronic materials such as semiconductors, electronic devices, optoelectronic devices, semiconductor alloys, and magnetic devices.

Key technologies include multi-quantum well structures, laser active regions, optical fibers, chemical composition, integrated circuits, magneto-electronic switches, and photodetectors. Other emerging areas include solar cells, nanomaterials, and photovoltaic devices, among others. Light-matter interactions, waveguides, and electrical signals are essential components of these technologies. Photodetector performance factors, such as response time and photovoltage, are crucial in evaluating their efficiency. Ionic liquids, nanoparticle technologies, and catalytic properties of metallic and magnetic nanoparticles are also significant areas of research in optoelectronics.

Get a glance at the market report of various segments Request Free Sample

The LED segment was valued at USD 16.60 billion in 2018 and showed a gradual increase during the forecast period.

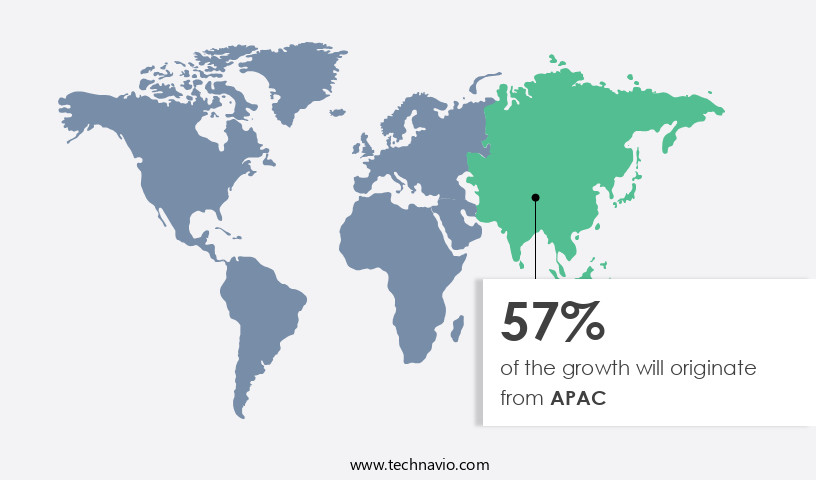

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market experienced significant growth in 2023, with APAC accounting for a substantial share. Driven by the expanding consumer electronics and automotive industries, particularly in China, Japan, and India, regional market expansion is anticipated during the forecast period. Strategic advancements, such as new automotive product launches, are expected to boost the market. However, the COVID-19 pandemic in 2020 adversely affected the market, with economies in several countries experiencing downturns and consumer demand for optoelectronics decreasing due to production facility closures and lockdowns. Optoelectronics encompasses the utilization of light in electronic devices, including semiconductors, electronic devices, and optoelectronic devices. Semiconductor alloys, multi-quantum wells, laser active regions, optical fibers, and integrated circuits are integral components.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.Optoelectronic devices exhibit diverse chemical compositions and photodetector response times, with ongoing research focusing on improving their photodetecting properties through techniques such as charge collection microscopy. Additionally, there is growing interest In the use of ionic liquids and organic solvents for photovoltaic devices, including dye-sensitized solar cells and polymer-based ionic liquids. Overall, the market is experiencing significant growth and innovation, driven by the demand for efficient and versatile optoelectronic devices.

What are the key market drivers leading to the rise In the adoption of Optoelectronics Industry?

- Expanding automotive industry is the key driver of the market.Optoelectronics, a technology that deals with the interaction between light and electronic materials, is experiencing significant growth in various industries, with a notable application In the automotive sector. In automobiles, optoelectronic devices play a crucial role by enabling functions such as occupant detection, night vision, optical immobilizers, drowsy driver detection, and automating vehicle lights and brakes. The integration of these components enhances safety and improves performance, making them essential for modern vehicles. The expansion of the automotive industry is expected to fuel the growth of the market. Optoelectronic components, including sensors and others, are integral to the functioning of powertrain systems, facilitating communication, signal detection, and activity management.

- These components are fabricated using semiconductor alloys, semiconductors, and electronic materials. Optoelectronic devices, such as multi-quantum well lasers, optical fibers, and photodetectors, are employed in various applications, including solar cells, photovoltaic devices, and magnetic devices like magneto-electronic switches. Advancements in materials science have led to the development of innovative optoelectronic materials, such as 2D materials, nanomaterials, metal chalcogenides, metal oxides, topological crystalline insulators, organic-inorganic hybrid perovskites, and semiconductor nanowires. These materials exhibit unique light-matter interactions, enabling the fabrication of high-performance waveguides, photodetectors, and photovoltaic devices. The photodetector performance is influenced by factors such as photovoltaic effect, photovoltage, photodetector response time, and nanowire dimensions.

- Ionic liquids, which are widely used in photodetecting properties, have gained significant attention due to their catalytic properties and potential applications in fuel cells, petrochemistry, and other industries. In summary, The market is driven by the increasing demand for advanced optoelectronic components in various industries, particularly In the automotive sector. The development of innovative materials and technologies is expected to further fuel the growth of this market.

What are the market trends shaping the Optoelectronics market?

- Increasing application of optoelectronic components in medical sector is the upcoming market trend.The market encompasses electronic materials and semiconductors that convert electrical signals into light and vice versa. Optoelectronic devices, including semiconductor alloys, multi-quantum wells, laser active regions, and optical fibers, play a crucial role in various applications. In the realm of electronic devices, optoelectronics finds extensive use in optoelectronic devices such as LEDs, photodetectors, solar cells, and nanomaterials like metal chalcogenides, metal oxides, topological crystalline insulators, organic-inorganic hybrid perovskites, and semiconductor nanowires. Light-matter interactions and waveguides are essential components of these devices, enabling applications such as spin information processing, silicon photonics, 2D materials, and photovoltaic effect. Optoelectronics is utilized in numerous sectors, including sensors, telecommunications, and energy.

- In the medical field, optoelectronics is employed in various applications, including endoscopic surgery and treatment, dental diagnosis, blood diagnostics, and pulse oximetry. The increasing demand for advanced medical equipment and the growing applications of optoelectronic-based products In the medical sector are expected to fuel the growth of the market. Furthermore, research and development in areas such as photodetecting properties, charge collection microscopy, nanoparticle technologies, catalytic properties, metallic NPs, fuel cells, petrochemistry, magnetic NPs, and ceramic membranes are anticipated to expand the market's scope. Optoelectronics is a dynamic and evolving field, with ongoing research and development in various areas, including photovoltaic devices, dye-sensitized solar cells, organic solvents, polymer-based ILs, electrical energy, and photodetecting properties.

- The market's growth is driven by the increasing demand for energy-efficient and high-performance optoelectronic devices, with a focus on improving photodetector performance, photodetector response time, and ionic liquids. The integration of optoelectronics into various industries, such as telecommunications, energy, and medical, is expected to create significant opportunities for market growth during the forecast period.

What challenges does the Optoelectronics Industry face during its growth?

- High costs of optoelectronic products is a key challenge affecting the industry growth.The market faces a significant challenge due to the high cost of optoelectronic-based products compared to their alternatives. For instance, LED screens are pricier than LCD screens, making the former less attractive to customers. Replacing spare parts in optoelectronic devices can also be costlier than purchasing new ones. Moreover, the manufacturing process of LEDs is complex and expensive, leading to higher prices. Consequently, the availability of cheaper alternatives, such as halogen bulbs, may negatively impact the demand for optoelectronic-based products. This cost barrier may hinder the expansion of the market, as consumers may opt for less expensive alternatives.

- Key technologies driving the market include semiconductor alloys, multi-quantum well structures, laser active regions, optical fibers, and various optoelectronic devices like LEDs, photodetectors, solar cells, and nanomaterials. These technologies enable light-matter interactions, waveguides, and electrical signal processing, among other applications. The market also encompasses magnetic devices, such as magneto-electronic switches, and photovoltaic devices, including dye-sensitized solar cells and organic solvent-based perovskites. Additionally, advancements in materials like 2D materials, metal chalcogenides, metal oxides, topological crystalline insulators, organic-inorganic hybrid perovskites, semiconductor nanowires, and nanoparticle technologies offer potential for improved photodetector performance, response time, and catalytic properties. Ionic liquids, metallic NPs, fuel cells, petrochemistry, and ceramic membranes are other areas of interest In the market.

Exclusive Customer Landscape

The optoelectronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the optoelectronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, optoelectronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AC Photonics Inc. - The market encompasses communication applications, with the company providing solutions through the use of bandpass and edge filters. These components facilitate efficient and precise signal transmission, enhancing overall system performance. Optoelectronics, a critical technology, enables data transfer via light waves, thereby driving advancements in telecommunications and data centers. The company's offerings contribute significantly to this sector, ensuring reliable and high-speed data transmission.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AC Photonics Inc.

- AFW Technologies Pty Ltd

- Agiltron Inc.

- ams OSRAM AG

- Canon Inc.

- Coherent Inc.

- Corning Inc.

- FOCI Fiber Optic Communications Inc.

- General Electric Co.

- IPG Photonics Corp.

- LG Innotek Co. Ltd.

- Lumileds Holding BV

- Luna Innovations Inc.

- Nichia Corp.

- OmniVision Technologies Inc.

- Samsung Electronics Co. Ltd.

- Seoul Semiconductor Co. Ltd.

- Sony Group Corp.

- TRUMPF SE Co. KG

- Vishay Intertechnology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Optoelectronics, a subfield of electronics that deals with the generation, modification, and detection of light, continues to be a dynamic and innovative industry. The market for optoelectronic materials and devices is driven by the increasing demand for efficient and versatile electronic components. Electronic materials play a crucial role In the optoelectronics industry. Semiconductor alloys, for instance, are widely used In the fabrication of optoelectronic devices due to their unique optical and electrical properties. Multi-quantum well structures, which consist of alternating layers of semiconductor materials with different bandgaps, are commonly employed In the laser active region of optoelectronic devices. Optical fibers, another essential component of optoelectronics, are made of materials with high refractive indices and low loss.

The chemical composition of these materials is carefully engineered to optimize their optical properties. Integrated circuits, which combine multiple electronic components into a single chip, are also used in optoelectronics to create complex systems. Magneto-electronic switches, which utilize the interaction between magnetic fields and electric currents, are another area of active research in optoelectronics. These switches offer high-speed operation and low power consumption, making them attractive for use in various applications. LEDs (Light Emitting Diodes) are widely used in optoelectronics for various applications, including lighting and display technologies. The spin information carried by the electrons In these devices is an active area of research, as it offers potential for new functionalities.

Silicon photonics, which involves the integration of optical components on silicon chips, is a rapidly growing area of optoelectronics. Two-dimensional materials, such as graphene and transition metal dichalcogenides, are also being explored for their potential use in optoelectronics due to their unique optical and electrical properties. Photodetectors, which convert light into electrical signals, are another important component of optoelectronics. The performance of these devices is influenced by various factors, including their response time and photovoltaic effect. Nanomaterials, such as metal chalcogenides and metal oxides, are being explored for their potential use in photodetectors due to their unique optical and electrical properties.

The development of topological crystalline insulators and organic-inorganic hybrid perovskites is an active area of research in optoelectronics. These materials offer unique optical and electrical properties that can be exploited for various applications, including photovoltaic devices. Semiconductor nanowires are another area of active research in optoelectronics. The unique properties of these nanostructures, which arise from their small dimensions and high surface area, make them attractive for various applications, including light-matter interactions and waveguides. The interaction between light and matter is a fundamental concept in optoelectronics. Waveguides, which confine light to a narrow path, are essential for the efficient transmission and manipulation of light.

The electrical signal generated by the interaction of light with matter can be harnessed for various applications, including fuel cells and petrochemistry. Nanoparticle technologies, including metallic and magnetic nanoparticles, are being explored for their potential use in optoelectronics. These nanoparticles offer unique optical and electrical properties that can be exploited for various applications, including catalytic properties and ionic liquids. In conclusion, the optoelectronics industry is a dynamic and innovative field driven by the development of new materials and devices. The interaction between light and matter continues to be a fundamental concept that underpins much of the research in this area.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.86% |

|

Market growth 2024-2028 |

USD 40.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.52 |

|

Key countries |

China, US, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Optoelectronics Market Research and Growth Report?

- CAGR of the Optoelectronics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the optoelectronics market growth of industry companies

We can help! Our analysts can customize this optoelectronics market research report to meet your requirements.