Electronics Manufacturing Service Market Size 2025-2029

The electronics manufacturing service market size is forecast to increase by USD 188 billion, at a CAGR of 6.6% between 2024 and 2029.

- The Electronics Manufacturing Services (EMS) market is experiencing significant growth due to the increasing number of providers in economies with low hourly wages, offering cost advantages to original equipment manufacturers (OEMs). This trend is driving competition and innovation in the industry, enabling OEMs to outsource production more cost-effectively and focus on their core competencies. However, the market also faces challenges, with the risk of intellectual property theft and misuse being a major concern. As EMS providers gain access to sensitive information during the manufacturing process, safeguarding intellectual property becomes a critical issue. Collaborative co-innovation partnerships between EMS providers and OEMs can help mitigate this risk by establishing clear agreements and guidelines for intellectual property ownership and protection.

- In summary, the EMS market is characterized by intense competition and innovation, driven by the growing number of low-cost providers. However, the risk of intellectual property theft and misuse poses a significant challenge that must be addressed through strategic partnerships and clear agreements between OEMs and EMS providers. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on building strong relationships with trusted EMS partners and implementing robust intellectual property protection measures.

What will be the Size of the Electronics Manufacturing Service Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The electronics manufacturing services market continues to evolve, driven by the dynamic interplay of various factors. Electronic component distributors play a crucial role in sourcing components, ensuring regulatory compliance and environmental sustainability. Through-hole technology (THT) and surface-mount technology (SMT) coexist in the industry, with global supply chains intricately linking manufacturers, assemblers, and distributors. Electronics assembly encompasses various processes, from high-volume manufacturing to low-volume prototype production. Production planning and inventory management are essential, with just-in-time (JIT) inventory and lean manufacturing optimizing resources. Computer-aided design (CAD) and computer-aided manufacturing (CAM) streamline design and production, while digital twins facilitate virtual prototyping and predictive maintenance.

Quality control is paramount, with IPC standards guiding processes. Functional testing, circuit board testing, and x-ray inspection ensure product reliability. Preventive and corrective maintenance, six sigma, and root cause analysis minimize downtime and improve yield. Wave soldering and reflow ovens are essential for component attachment, while material handling systems facilitate efficient production. Capacity planning and order fulfillment are critical for meeting customer demands. Data analytics and yield improvement drive continuous process optimization. The electronics manufacturing services market is a complex ecosystem, with constant innovation and adaptation to market demands. The interconnectedness of various processes and technologies ensures a continuous and evolving landscape.

How is this Electronics Manufacturing Service Industry segmented?

The electronics manufacturing service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- C and CA

- Telecommunication

- Industrial

- Automotive

- Others

- Service Type

- Electronics design and engineering

- Electronics assembly

- Electronics manufacturing

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- Taiwan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The c and ca segment is estimated to witness significant growth during the forecast period.

In the realm of computing and consumer appliances (C and CA), the segment experiences significant growth due to escalating demand for advanced consumer electronic devices, encompassing smartphones, tablets, laptops, augmented reality/virtual reality (AR/VR) devices, gaming consoles, and wearable technology. The expansion of telecommunication network infrastructure fuels this demand. Competition in the global smartphone market, fueled by the emergence of affordable alternatives, propels innovation. New offerings in this sector include multi-lens cameras, artificial intelligence (AI), virtual assistants, fingerprint sensors, and facial recognition. Electronics manufacturing services (EMS) are integral to the production of these devices. Computer-aided design (CAD) facilitates the creation of intricate designs, while functional testing ensures product reliability.

Inventory management maintains a steady flow of components, and reflow ovens optimize the soldering process. High-volume manufacturing caters to the mass production of devices, and production planning aligns manufacturing with market demand. Regulatory compliance and contract manufacturing ensure adherence to industry standards, such as IPC, and environmental regulations. Process optimization and six sigma methodologies enhance efficiency and minimize defects. Component sourcing and through-hole technology (THT) enable the assembly of complex circuit boards. Global supply chains, digital twins, and smart manufacturing streamline production and improve yield. Packaging and shipping, corrective maintenance, and preventive maintenance ensure product readiness and longevity. Data analytics, capacity planning, and order fulfillment optimize operations, while root cause analysis and quick turn manufacturing address production issues promptly.

Lean manufacturing and material handling systems minimize waste and improve efficiency. Quality control, computer-aided manufacturing (CAM), and circuit board testing ensure product excellence. Low-volume manufacturing caters to customized and niche products, while yield improvement and failure analysis address production challenges. Capacity planning and just-in-time (JIT) inventory management maintain optimal production levels, while supply chain management ensures seamless delivery to customers. Smart manufacturing integrates technology into the manufacturing process, enhancing efficiency and flexibility.

The C and CA segment was valued at USD 127.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is characterized by the integration of various technologies and processes to produce high-quality electronic devices. In this dynamic industry, computer-aided design (CAD) and computer-aided manufacturing (CAM) play crucial roles in the production process, enabling efficient design and manufacturing. Functional testing, inventory management, and production planning ensure the timely delivery of products while maintaining quality. Reflow ovens and wave soldering processes are essential for the assembly of electronic components. High-volume manufacturing and lean manufacturing techniques optimize production, reducing waste and increasing efficiency. Contract manufacturing services offer cost savings and scalability for businesses, especially those requiring quick turnaround times.

Regulatory compliance, including IPC standards and environmental compliance, is a significant concern for electronics manufacturers. X-ray inspection and circuit board testing ensure product reliability and quality. Digital twins and data analytics facilitate predictive maintenance and yield improvement. Global supply chains, electronic component distributors, and material handling systems enable seamless component sourcing and logistics. Six Sigma and preventive maintenance strategies improve production processes and minimize defects. Through-hole technology (THT) and surface-mount technology (SMT) coexist in the market, catering to various manufacturing requirements. The APAC region, particularly China, remains a dominant player in the market due to its favorable business environment and cost advantages.

Countries like India, Vietnam, Malaysia, and Thailand are emerging as attractive manufacturing destinations, contributing to the region's growth. The implementation of supportive policies and initiatives in these countries further bolsters their manufacturing capabilities across various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative electronics manufacturing services market, providers leverage advanced technologies and specialized expertise to deliver high-quality, efficient, and cost-effective solutions for various industries. These services encompass design for manufacturing, printed circuit board assembly, surface mount technology, through-hole technology, automated soldering, testing and inspection, and box-build and final assembly. Collaborating closely with clients, electronics manufacturing services companies ensure compliance with industry standards, including RoHS, WEEE, and ITAR. They also offer engineering services, such as design and prototyping, to help bring new products to market swiftly. By combining agility, flexibility, and technical proficiency, electronics manufacturing services play a pivotal role in the global electronics industry.

What are the key market drivers leading to the rise in the adoption of Electronics Manufacturing Service Industry?

- The proliferation of electronics manufacturing services providers in economies characterized by low hourly wages serves as the primary market driver.

- The global Electronics Manufacturing Service (EMS) market's expansion is driven by substantial cost savings that businesses achieve by outsourcing manufacturing to EMS providers in economies with lower labor costs. The significant reduction in expenses for these providers in areas such as technology infrastructure, manufacturing space, operations, and staffing, has fueled their growth in low-cost countries. EMS providers leverage labor arbitrage by maintaining a lean workforce and minimizing spending on employee hiring and retention. Additionally, easy access to skilled labor and advanced technologies in these economies has increased the market's presence there. Process optimization, functional testing, inventory management, and regulatory compliance are essential services offered by EMS providers to ensure high-quality production.

- Utilizing Computer-Aided Design (CAD) and process optimization techniques, EMS providers ensure efficient manufacturing processes. Functional testing, reflow oven processes, and x-ray inspection are crucial for ensuring product quality. Inventory management and production planning are critical for maintaining a steady supply of components and finished goods. EMS providers adhere to IPC standards for regulatory compliance, ensuring the production of reliable and high-performing electronic devices.

What are the market trends shaping the Electronics Manufacturing Service Industry?

- Collaborative co-innovation partnerships with electronics manufacturing services providers have emerged as a significant market trend. By working together, companies can leverage each other's expertise and resources to develop innovative solutions and improve manufacturing processes.

- Electronics Manufacturing Services (EMS) providers play a pivotal role in the global supply chains of businesses, acting as strategic partners in the production process. Collaborative partnerships between EMS providers and customer organizations require a shared risk and value approach. Co-innovation is a key aspect of these relationships, allowing both parties to exchange knowledge and develop new solutions and products that add value. Despite the increasing complexities and challenges in the EMS market, many companies have successfully navigated these issues through strong collaborations and co-innovations. Environmental compliance, component sourcing, and through-hole technology are critical areas of focus.

- Digital twins, packaging and shipping, corrective maintenance, six sigma, and lead-free soldering are essential processes that require continuous improvement. EMS providers must ensure the highest level of quality and efficiency in their operations to meet the evolving needs of their clients. This involves staying updated on the latest industry trends and adopting advanced technologies to streamline processes and minimize errors. By maintaining a strong focus on innovation and collaboration, EMS providers can help their clients stay competitive in the market while ensuring environmental sustainability and regulatory compliance.

What challenges does the Electronics Manufacturing Service Industry face during its growth?

- The risk of intellectual property theft and misuse poses a significant challenge to the industry's growth, requiring vigilant efforts to protect innovative ideas and creations from unauthorized use or duplication.

- The market is driven by the need for advanced manufacturing techniques and quality control in the production of electronic devices. Preventive maintenance, such as regular inspections and upkeep of equipment, is crucial for maintaining efficiency and reducing downtime. Wave soldering and computer-aided manufacturing (CAM) are common processes used in electronics manufacturing, ensuring precise component placement and reliable soldering. Lean manufacturing and material handling systems are essential for optimizing production and reducing waste. Quality control measures, including circuit board testing and failure analysis, are implemented to ensure the highest standards are met. Data analytics is increasingly being used to improve yield and identify trends in manufacturing processes.

- Despite the benefits, the market faces challenges, particularly regarding intellectual property (IP) theft. Electronics businesses keep their manufacturing designs classified and have strict policies to prevent theft or leakage of critical product designs. EMS providers work on a contract basis, serving multiple businesses, making IP security a significant concern. Detailed documentation and agreements are necessary to mitigate these risks.

Exclusive Customer Landscape

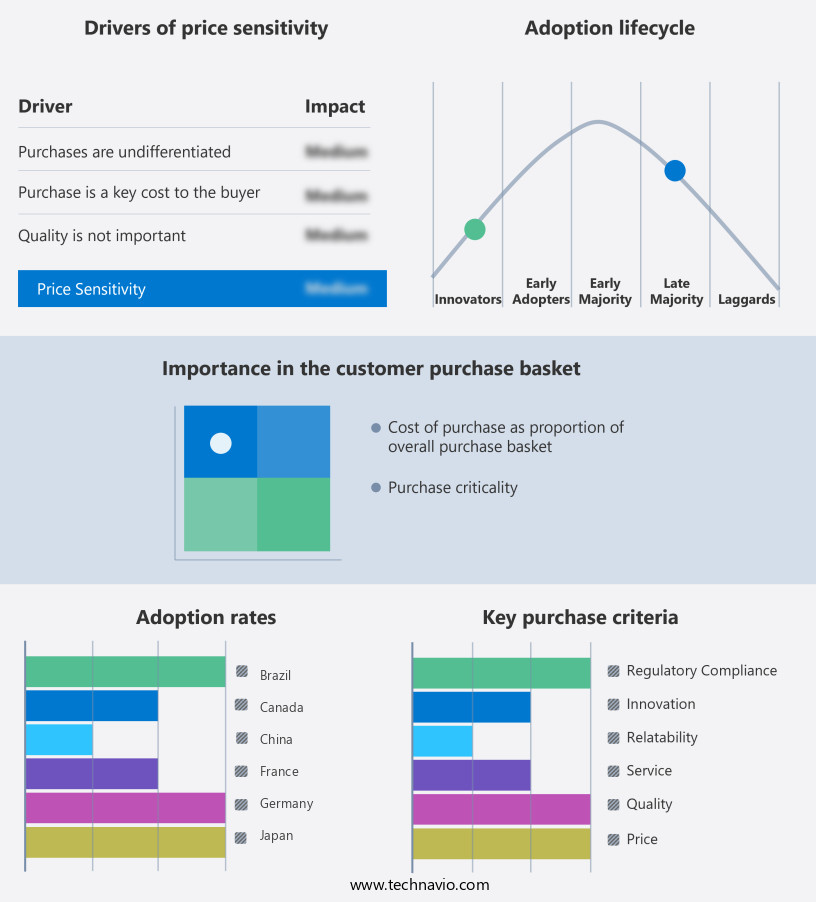

The electronics manufacturing service market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electronics manufacturing service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electronics manufacturing service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3CEMS Group - This company specializes in providing comprehensive electronics manufacturing solutions, encompassing Printed Circuit Board (PCB) assembly, Printed Circuit Board Assembly (PCBA), and advanced Box-Build, System Build Integration, and Joint Design services. By combining these capabilities, we ensure seamless production of complex electronic systems from prototype to mass production. Our expertise lies in delivering high-quality, reliable, and efficient manufacturing processes, enabling clients to bring their innovative products to market swiftly and effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3CEMS Group

- Accton Technology Corp.

- Benchmark Electronics Inc.

- Celestica Inc.

- Compal Electronics Inc.

- Creation Technologies LLC

- Data IO Corp.

- Elbit Systems Ltd.

- ESCATEC Sdn. Bhd.

- Flex Ltd.

- Hon Hai Precision Industry Co. Ltd.

- Integrated Micro Electronics Inc.

- Jabil Inc.

- Key Tronic Corp.

- Kimball Electronics Inc.

- Kitron ASA

- Neo Tech Inc.

- Plexus Corp.

- Sanmina Corp.

- Venture Corp. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electronics Manufacturing Service Market

- In January 2024, Flextronics International, a leading Electronics Manufacturing Services (EMS) provider, announced the launch of its new 'Smart Factory' in Thailand. This state-of-the-art facility, valued at USD100 million, focuses on automotive electronics production and is expected to create over 5,000 jobs (Flextronics International Press Release, 2024).

- In March 2024, Intel Corporation and Taiwan Semiconductor Manufacturing Company (TSMC) formed a strategic collaboration to expand Intel's foundry services. Under this partnership, TSMC will manufacture Intel's logic products using its advanced semiconductor technology, marking a significant shift in Intel's manufacturing strategy (Intel Corporation Press Release, 2024).

- In May 2024, Jabil Inc., another major EMS player, completed the acquisition of Wurth Elektronik eiSos, a German manufacturer of electronic and electromechanical components. This acquisition expanded Jabil's capabilities in design, manufacturing, and supply chain services, making it a more comprehensive EMS provider (Jabil Inc. Press Release, 2024).

- In April 2025, the European Union passed the 'European Chips Act,' a regulatory initiative aimed at boosting Europe's semiconductor industry. The Act includes funding of â¬43 billion for chip manufacturing and research, as well as incentives for companies to establish and expand their operations in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The electronics manufacturing services market is experiencing significant trends and dynamics, with a focus on personalized products and thermal management. Mass customization enables the production of unique items while maintaining efficiency, making it a key driver in the industry. Product traceability ensures on-time delivery and enhances customer satisfaction, as businesses prioritize data-driven decision making. Additive manufacturing, including 3D printing, and advanced PCB design software, such as schematic capture and PCB layout, are revolutionizing the manufacturing process. Circular economy initiatives and sustainability efforts are reducing costs through e-waste management and component libraries. First pass yield and defect rate are crucial quality metrics, with power integrity and signal integrity essential for EMI/EMC compliance.

- Industry-specific software and automated material handling streamline manufacturing processes, while cost reduction strategies continue to be a priority. Thermal management and sustainability initiatives are intertwined, as power consumption and waste reduction become increasingly important. Cloud-based manufacturing and manufacturing process simulation enable real-time collaboration and improved efficiency. Blockchain technology enhances product traceability and data security, while Gerber files and industry-specific software facilitate communication between stakeholders. Sustainability, cost reduction, and quality are the cornerstones of digital transformation in the electronics manufacturing services sector.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electronics Manufacturing Service Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 188 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

China, US, Taiwan, Japan, Canada, Germany, Brazil, UK, UAE, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electronics Manufacturing Service Market Research and Growth Report?

- CAGR of the Electronics Manufacturing Service industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electronics manufacturing service market growth of industry companies

We can help! Our analysts can customize this electronics manufacturing service market research report to meet your requirements.