Electroplating Market Size 2024-2028

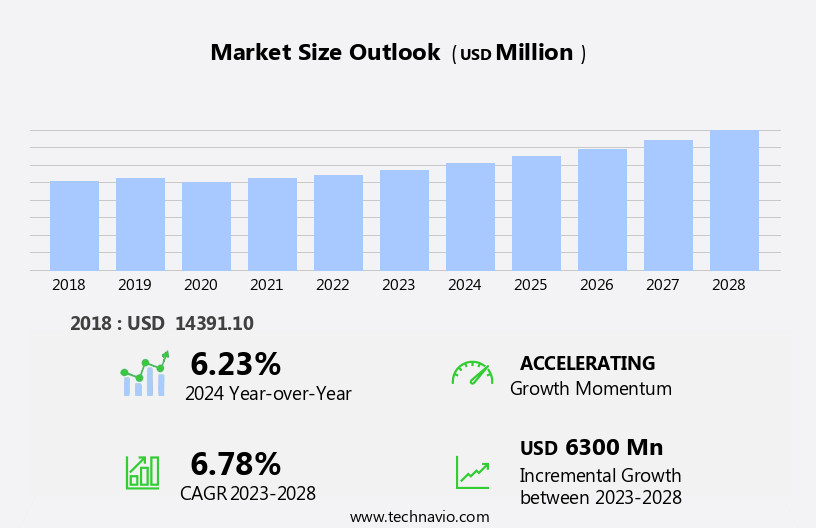

The electroplating market size is forecast to increase by USD 6.3 billion, at a CAGR of 6.78% between 2023 and 2028.

- The market is driven by the increasing demand for electroplating applications in the automotive industry and the rising production of electronic devices. The automotive sector's growth is fueled by the continuous development of advanced technologies, such as electric and autonomous vehicles, which require intricate and durable components that electroplating can provide. Simultaneously, the escalating usage of electronic devices, including smartphones, computers, and wearable technology, has led to a surge in demand for electroplating in manufacturing these products. However, the market faces significant challenges. Environmental concerns are becoming increasingly prominent, with regulatory bodies imposing stringent regulations on the disposal and recycling of electroplated materials due to their potential hazardous nature.

- Additionally, the industry must address the challenges of maintaining consistent quality and efficiency in the plating process to meet the growing demand for high-performance and cost-effective solutions. Companies seeking to capitalize on market opportunities must focus on developing eco-friendly electroplating technologies and improving process control and automation to remain competitive.

What will be the Size of the Electroplating Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the expanding applications across various sectors. Temperature control and plating baths play crucial roles in ensuring consistent coating uniformity and corrosion resistance. Power supplies and current density optimization are essential for efficient plating processes. Cadmium plating, nickel plating, and phosphate coating remain popular choices for their unique properties. Material handling systems and automated plating lines streamline production, while immersion plating and electroless plating offer alternatives to traditional methods. Aerospace components and military applications require high-performance coatings for durability and safety. Electronic components and consumer goods demand precision and uniformity.

Environmental regulations drive the development of eco-friendly plating solutions and wastewater treatment systems. Copper plating, tin plating, and black oxide coating are used for their conductive and protective properties. Pretreatment processes and jigs and fixtures ensure optimal surface finish and adhesion. Silver plating, gold plating, and paint coating add value to various industries. Plating defects and safety procedures are ongoing concerns, necessitating continuous research and innovation. Filtration systems and cleaning agents maintain plating tank hygiene, while thickness measurement tools ensure consistency. The market's dynamism extends to emerging trends, such as zinc plating, chromium plating, and powder coating in the automotive industry.

Rack plating and barrel plating cater to diverse production needs. The ongoing evolution of electroplating solutions reflects the industry's commitment to meeting the demands of diverse sectors and advancing technological innovation.

How is this Electroplating Industry segmented?

The electroplating industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Barrel plating

- Rack plating

- Continuous plating

- Line plating

- End-user

- Automotive

- Electrical and electronics

- Aerospace and defense

- Jewelry

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

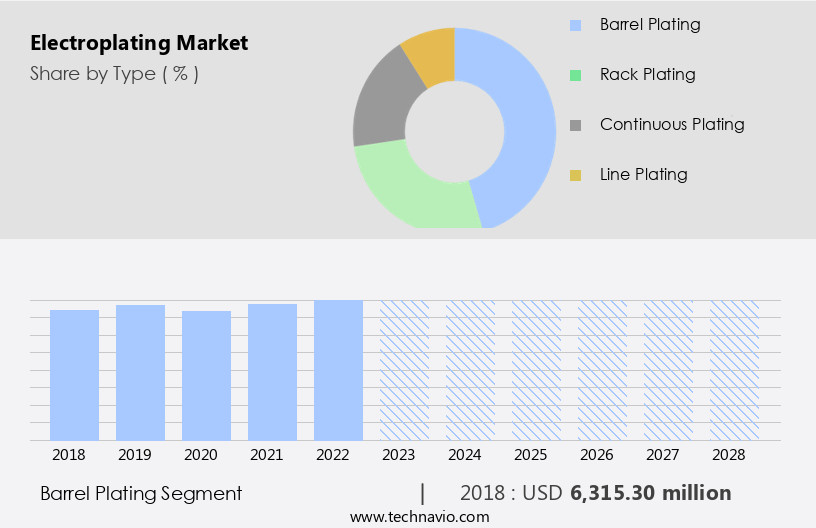

The barrel plating segment is estimated to witness significant growth during the forecast period.

In the electroplating industry, barrel plating is a popular technique for coating large quantities of small metal components. This process involves placing items in a non-conductive barrel-shaped cage and immersing it in a chemical bath for plating. The components make bipolar contact with one another, ensuring efficient plating. However, barrel plating may not be suitable for precise or aesthetic finishes due to the significant surface contact between components. Nickel plating, phosphate coating, and other electroplating solutions are commonly used for various applications, including military, aerospace, automotive, and consumer goods. Quality control measures, such as plating time and coating uniformity, are crucial for ensuring consistent results.

Power supplies, filtration systems, and temperature control are essential equipment for maintaining optimal plating conditions. Corrosion resistance, thickness measurement, and adhesion testing are key considerations for various industries, including medical devices and electronic components. Safety procedures are also paramount to prevent hazards during the plating process. Immersion plating, tin plating, black oxide coating, gold plating, and electroless plating are among the various plating techniques used. Wastewater treatment is a significant concern due to the potentially harmful chemicals involved. Automated plating lines and jigs and fixtures streamline production processes, while pretreatment processes prepare surfaces for plating. Copper plating, cadmium plating, and chromium plating are common base metals used for electroplating.

Plating defects can impact the final product's quality and must be addressed through rigorous quality control measures. Silver plating and current density are essential factors in some applications. Powder coating and paint coating are alternative finishing methods for certain industries. Overall, the market is expected to grow due to the increasing demand for corrosion resistance, improved surface finishes, and the versatility of electroplating solutions.

The Barrel plating segment was valued at USD 6.32 billion in 2018 and showed a gradual increase during the forecast period.

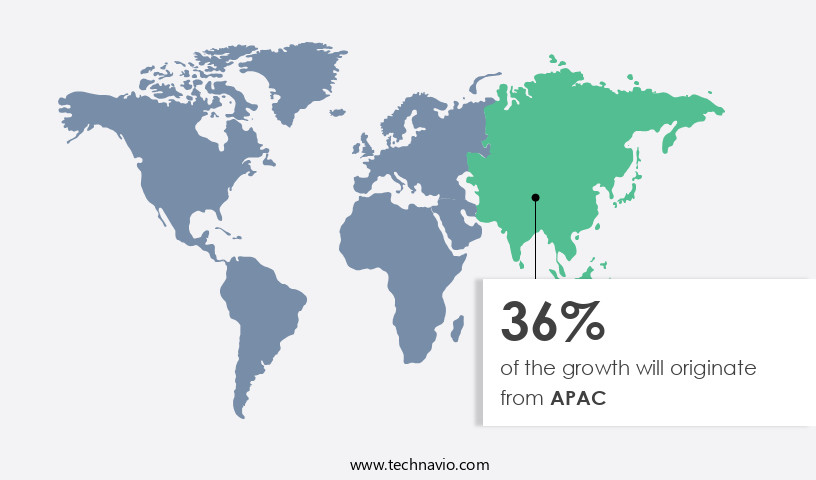

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to the expansion of the automotive and electronics industries in countries like China, India, Thailand, Malaysia, Indonesia, and Japan. The increasing sales volume of fuel-efficient vehicles, including SUVs, in emerging economies, driven by improving living standards and rising disposable incomes, is a major factor fueling this demand. Additionally, the region's favorable economic conditions and socioeconomic factors, such as low labor costs and evolving consumer preferences for larger, spacious vehicles, further boost the demand for automotive vehicles. In the electronics sector, the need for corrosion-resistant components in various applications, including military and aerospace, is driving the demand for electroplating solutions.

Nickel plating, phosphate coating, and chromium plating are commonly used for their superior corrosion resistance and surface finish. Quality control measures, such as plating time and coating uniformity, are essential to ensure the consistency and reliability of these components. Power supplies and plating tanks are crucial components in electroplating processes. Tin plating, black oxide coating, and immersion plating are popular electroplating techniques used for various applications, including automotive parts, consumer goods, and medical devices. Wastewater treatment and safety procedures are essential considerations in electroplating processes to minimize environmental impact and ensure worker safety. Electroless plating, a popular alternative to traditional electroplating, offers advantages such as uniform coating and the ability to plate complex shapes.

Cleaning agents and pretreatment processes are essential steps in the electroplating process to ensure proper adhesion and surface preparation. Automated plating lines, filtration systems, jigs, and fixtures are used to improve efficiency and reduce plating defects. Temperature control and thickness measurement are critical factors in maintaining consistent plating quality. Copper plating, cadmium plating, and gold plating are among the various types of electroplating used for various applications, including electrical components, decorative purposes, and protective coatings. Environmental regulations and safety procedures are becoming increasingly stringent, requiring electroplating companies to invest in advanced technologies and processes to minimize waste and ensure worker safety.

Plating defects, such as porosity, non-uniformity, and adhesion issues, can significantly impact the quality and reliability of electroplated components. Adhesion testing and current density measurements are essential quality control measures to ensure the consistency and reliability of electroplated components. In conclusion, the market in Asia Pacific is experiencing significant growth due to the expanding automotive and electronics industries and the increasing demand for corrosion-resistant components. Quality control measures, such as plating time, coating uniformity, and thickness measurement, are essential to ensure the consistency and reliability of electroplated components. Advanced technologies and processes, such as automated plating lines, filtration systems, and electroless plating, are being adopted to improve efficiency and reduce waste.

Environmental regulations and safety procedures are becoming increasingly stringent, requiring electroplating companies to invest in advanced technologies and processes to minimize waste and ensure worker safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electroplating Industry?

- The market is significantly driven by the surging demand for this technology in the automotive industry, where it is extensively used for various applications such as corrosion protection, decorative coating, and functional enhancement.

- The market is primarily driven by the automotive industry, which is experiencing substantial growth. This expansion is attributed to the increasing disposable income of consumers in developing economies, leading to a rise in automobile sales. Passenger cars, commercial vehicles, and automotive accessories are key markets for electroplating solutions. The demand for corrosion-resistant surfaces and enhanced aesthetic appeal has boosted the application of electroplating in the automotive sector. Nickel plating, phosphate coating, tin plating, and black oxide coating are commonly used processes.

- Quality control is paramount in electroplating, ensuring uniform coating and precise plating time. Power supplies and plating tanks are essential equipment in electroplating processes. The market is expected to continue its growth trajectory due to the increasing demand for electroplated products in various industries.

What are the market trends shaping the Electroplating Industry?

- The increasing interest in electronic devices represents a significant market trend. This demand is driven by advancements in technology and the growing preference for convenience and connectivity.

- Electroplating is a critical process in the production of electrical and electronic devices and components. This technique enhances the surface finish of substrates, providing benefits such as increased corrosion resistance, improved electrical conductivity, and enhanced protection from wear and tear. Two common electroplating methods include immersion plating and barrel plating. Immersive plating involves submerging the part in a bath containing the plating solution, while barrel plating involves placing multiple parts in a rotating barrel filled with the plating solution. The demand for electroplating is driven by the growing consumption of consumer electronics, including wearable devices, smartphones, laptops, tablets, camcorders, and portable chargers.

- The global market for these devices has experienced significant growth due to rising living standards and increasing disposable income, particularly in emerging economies. Military applications and the medical devices industry also rely heavily on electroplating for its ability to provide a durable and protective surface finish. Safety procedures are essential in electroplating processes to ensure the health and safety of workers and to minimize environmental impact. Wastewater treatment is a crucial aspect of electroplating operations, as the process generates significant amounts of wastewater that must be treated before disposal. Electroless plating is another electroplating technique that does not require an external electrical current.

- It uses chemical reactions to deposit metal ions onto the substrate's surface. Cleaning agents are used to prepare the surface for electroplating, ensuring optimal adhesion of the plated material. Gold plating is a common application of electroplating, providing a decorative and protective finish for various products. In conclusion, the market is driven by the increasing demand for electrical and electronic devices, military applications, and the medical devices industry. The process's ability to enhance surface finish, provide corrosion resistance, and improve electrical conductivity makes it an essential technology in manufacturing these products. Safety procedures, wastewater treatment, and the use of cleaning agents are crucial considerations in electroplating operations.

What challenges does the Electroplating Industry face during its growth?

- The expansion of industries faces a significant hurdle due to escalating environmental concerns, which necessitates implementing sustainable practices to ensure growth while mitigating potential negative impacts on the environment.

- The market is experiencing significant growth, yet faces challenges due to increasing environmental regulations. The use of electroplating processes in manufacturing aerospace components and electronic parts involves the application of thin metal coatings through an electrochemical process. This process, which includes plating baths, temperature control, thickness measurement, and material handling, can result in the release of harmful substances, particularly cyanide. Cyanide is a key component in electroplating baths, but its use can negatively impact sensory systems, the heart, and the lungs. Consequently, regulatory bodies impose stringent environmental regulations on companies to mitigate these risks. These regulations necessitate the implementation of pretreatment processes and automated plating lines to ensure efficient and eco-friendly electroplating.

- Despite these challenges, the market continues to expand due to its essential role in enhancing the durability and functionality of various industrial components. Cadmium plating, copper plating, and other plating processes remain in high demand for their corrosion resistance and electrical conductivity. However, the market growth may be hindered by the need for continuous compliance with environmental regulations and the associated costs. In conclusion, the market's growth is influenced by its role in manufacturing high-performance components, but it faces challenges due to the environmental concerns associated with the process. Companies must invest in eco-friendly technologies and comply with regulatory requirements to ensure sustainable growth in the market.

Exclusive Customer Landscape

The electroplating market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electroplating market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electroplating market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aalberts NV - The company specializes in electroplating services for various metals, including gold, copper, nickel, and nickel sulfamate, utilizing advanced techniques to ensure superior quality and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aalberts NV

- Allied Finishing Inc.

- Bajaj Electroplaters

- Birmingham Plating Co. Ltd.

- Dr.Ing. Max Schlotter GmbH and Co. KG

- Interplex Holdings Pte. Ltd.

- J and N Metal Products LLC

- Jing Mei Industrial Ltd.

- Klein Plating Works Inc.

- Kuntz Electroplating Inc.

- L. Possehl and Co. mbH

- MKS Instruments Inc.

- Peninsula Metal Finishing Inc.

- Pioneer Metal Finishing LLC

- Sharretts Plating Co. Inc.

- Sheen Electroplaters Pvt Ltd.

- Summit Plating

- Tanaka Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electroplating Market

- In January 2024, DuPont Electrochemicals, a leading electroplating materials supplier, announced the launch of a new line of high-performance chrome-free electroplating solutions at the annual Surfin' Conference & Tech Forum. This innovation aimed to address growing market demand for sustainable and environmentally friendly alternatives to traditional chromium-based electroplating processes (DuPont Press Release, 2024).

- In March 2024, global electroplating equipment manufacturer, Vesper Industries, entered into a strategic partnership with leading automotive manufacturer, Volkswagen Group, to develop and implement advanced electroplating technologies in Volkswagen's production facilities. This collaboration was expected to enhance the quality and efficiency of Volkswagen's electroplating processes (Vesper Industries Press Release, 2024).

- In May 2024, leading electroplating company, H.C. Starck Solutions, announced a significant investment of â¬100 million in its German production site to expand its capacity for producing high-purity nickel and cobalt powders. This expansion was in response to increasing demand for these materials in the electroplating industry, particularly in the automotive sector (H.C. Starck Solutions Press Release, 2024).

- In February 2025, the European Union's REACH regulation introduced new restrictions on the use of hexavalent chromium in electroplating processes. This regulatory change led to a surge in demand for alternative electroplating solutions, creating opportunities for companies offering chrome-free alternatives (European Chemicals Agency Press Release, 2025).

Research Analyst Overview

- The market encompasses various processes, including X-ray fluorescence (XRF) for material analysis, to ensure optimal plating efficiency and consistency. Process optimization and cost analysis are crucial aspects, with corrosion inhibitors and pretreatment chemicals playing significant roles. Plating thickness control, achieved through techniques like plasma electrolytic oxidation and automation systems, is essential for maintaining product quality. Advancements in technology bring AI and ML to the forefront, enhancing process monitoring and wastewater recycling. Current efficiency, a key performance indicator, is improved through the use of anodic and cathodic protection. Plasma electrolytic oxidation, vacuum deposition, and electrolytic polishing contribute to enhancing tensile strength and surface preparation.

- Supplier relationships are vital for securing high-quality raw materials and maintaining production efficiency. Data analytics and process monitoring enable real-time adjustments, ensuring plating thickness control and humidity testing. Brush plating and thermal spraying offer alternative solutions for specific applications. Salt spray testing remains a critical aspect of quality assurance. Overall, the market is characterized by continuous innovation and improvement, with a focus on enhancing plating efficiency, reducing costs, and ensuring product quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electroplating Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 6300 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electroplating Market Research and Growth Report?

- CAGR of the Electroplating industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electroplating market growth of industry companies

We can help! Our analysts can customize this electroplating market research report to meet your requirements.