Emotion Recognition and Sentiment Analysis Software Market Size 2024-2028

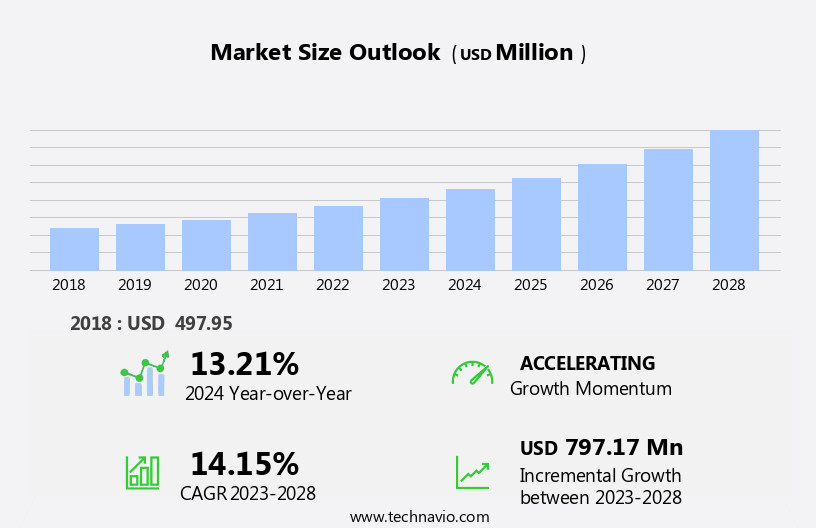

The emotion recognition and sentiment analysis software market size is forecast to increase by USD 797.17 million at a CAGR of 14.15% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing popularity of wearable devices and the adoption of real-time sensing analysis. These technologies enable more accurate and timely emotion recognition, providing valuable insights for various applications, including healthcare, marketing, and customer service. However, the market faces challenges, most notably the issue of low-quality video content hampering emotional interpretation. Regulatory hurdles also impact adoption, as organizations navigate complex data privacy and security regulations.

- To capitalize on market opportunities and navigate challenges effectively, companies must focus on improving data quality, investing in advanced algorithms, and addressing regulatory requirements. By doing so, they can differentiate themselves in a competitive landscape and drive innovation in the market.

What will be the Size of the Emotion Recognition and Sentiment Analysis Software Market during the forecast period?

- The market is experiencing significant growth, driven by the increasing adoption of conversational AI and virtual assistants. This technology enables the analysis of both textual and multimedia data, including audio and video, to extract emotional insights from user interactions. Data mining techniques, such as predictive modeling and model deployment, play a crucial role in processing and interpreting this data. Sentiment analysis dashboards and emotion recognition dashboards provide valuable insights into user experience, allowing businesses to map and optimize both the employee and customer journey. Cognitive computing and cognitive AI technologies are also integral to this market, enabling real-time analysis of user behavior and feedback.

- Data ethics and responsible AI are becoming increasingly important considerations in this market, with a focus on data governance and model training to ensure accurate and explainable AI. Biometric data and behavioral data are also being leveraged to enhance the capabilities of emotion recognition systems, further expanding their applications. Model evaluation and model training are essential components of this market, ensuring the accuracy and effectiveness of AI models. Interpretable AI and explainable AI are also gaining traction, enabling businesses to understand the reasoning behind AI decisions and build trust in the technology. Data annotation and data annotation tools are critical for training AI models, ensuring high-quality data and accurate sentiment analysis.

- Overall, the market is poised for continued growth, offering businesses valuable insights into user emotions and improving the user experience.

How is this Emotion Recognition and Sentiment Analysis Software Industry segmented?

The emotion recognition and sentiment analysis software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Customer service/experience

- Product/market research

- Patient diagnosis

- Others

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The customer service/experience segment is estimated to witness significant growth during the forecast period.

Emotion AI technology, integrated with sentiment analysis tools, is revolutionizing business operations by enabling real-time understanding of customer emotions and feedback. These solutions utilize machine learning, natural language processing, and computer vision to analyze text, voice, and facial expressions for sentiment scoring, emotion classification, and polarity analysis. Emotion lexicons and sentiment lexicons are used to identify and categorize emotions, while deep learning and predictive analytics provide insights into historical trends. Sentiment analysis plays a crucial role in various industries, including human resources for employee engagement and feedback analysis, fraud detection, and brand reputation management. It is also used in customer service to enhance customer experience through personalized communication and proactive issue resolution.

Social media monitoring and text analysis help businesses stay updated on brand mentions and customer sentiments, while voice analysis and tone analysis provide valuable insights from customer interactions. Integration with APIs, cloud computing, and data visualization tools streamlines the process, allowing for seamless implementation and data access. Biometric authentication and data security measures ensure data privacy and protection. Emotion recognition software, including facial expression analysis and voice tone analysis, can be used in virtual reality and augmented reality applications for immersive, harmonious experiences. Overall, the market for ER and SA tools is experiencing significant growth, offering businesses a valuable return on investment through improved customer engagement, risk management, and data-driven decision making.

The Customer service/experience segment was valued at USD 175.83 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

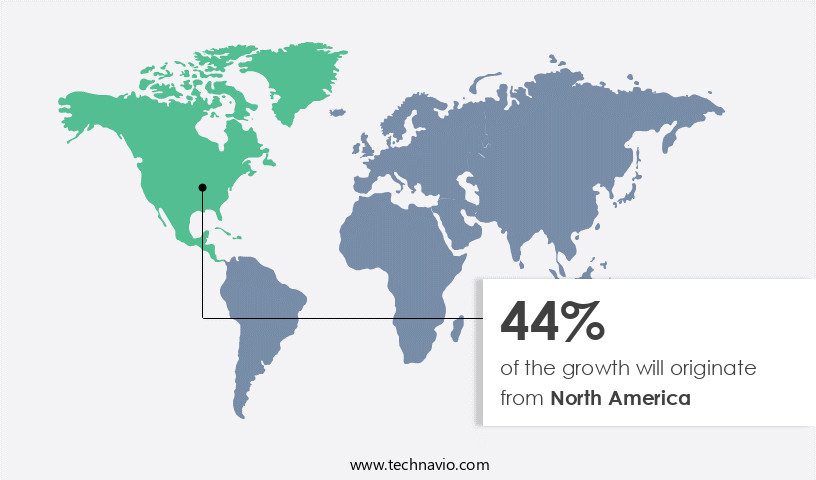

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the advanced technological landscape of North America, particularly in the US and Canada, Emotion Recognition (ER) and Sentiment Analysis (SA) software have gained significant traction. The region's robust internet connectivity and technology adoption create an ideal setting for ER and SA deployment. Artificial Intelligence (AI) and Machine Learning (ML) technologies, which are integral to ER and SA, have seen considerable adoption in North America. The e-commerce and retail sectors in North America leverage SA to decipher consumer behavior, preferences, and sentiments. This valuable data enables businesses to tailor marketing strategies, augment customer experiences, and refine product offerings. ER and SA are also instrumental in fraud detection, voice analysis, and employee engagement within human resources.

ER and SA technologies are increasingly integrated with APIs, cloud computing, and data visualization tools to streamline processes and enhance efficiency. In addition, deep learning, computer vision, and natural language processing are being employed to improve emotion detection and sentiment analysis capabilities. Brand reputation management, risk management, and customer service are other areas where ER and SA software are making a mark. Real-time sentiment analysis, predictive analytics, and data security are essential features that businesses look for in ER and SA solutions. Furthermore, ER and SA tools are being used for behavioral analytics, customer engagement, and historical sentiment analysis.

The integration of ER and SA with biometric authentication, social listening, and text analysis offers new possibilities for businesses to gain customer insights. Market research firms employ these tools to analyze customer feedback and brand reputation. ER and SA software's ability to classify emotions, detect biases, and provide tone analysis makes it an indispensable tool for businesses. The adoption of ER and SA software is not limited to the corporate sector. Virtual and augmented reality technologies are integrating ER and SA to create immersive experiences. ER and SA are also being used in voice tone analysis and sentiment analysis tools to enhance customer interactions.

The ER and SA market in North America is witnessing a harmonious blend of technological innovation and business application. The integration of ER and SA with various technologies and industries is driving growth and creating new opportunities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Emotion Recognition and Sentiment Analysis Software market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of wearable devices is the primary catalyst fueling market growth in this sector.

- Text sentiment analysis and emotion recognition software have gained significant attention in various industries for enhancing customer experience and employee feedback analysis. This software utilizes natural language processing (NLP) and sentiment lexicons to identify and extract emotions from text data. Additionally, advanced technologies like facial expression analysis and tone of voice recognition are integrated to provide more accurate results. Beyond text data, emotion recognition software can also analyze video conferencing data to gauge the emotional state of individuals during virtual interactions. This technology is crucial for risk management, as it aids in bias detection and improving overall communication effectiveness.

- Historical sentiment analysis offers valuable insights into trends and patterns, enabling businesses to make informed decisions based on customer feedback. Data security is a priority for emotion recognition software companies, ensuring that sensitive information is protected and only accessible to authorized personnel. Incorporating emotion recognition software into business operations can lead to enhanced customer insights, improved employee engagement, and better risk management. The continuous monitoring of emotional states can provide valuable information for businesses to optimize their offerings and create personalized experiences.

What are the Emotion Recognition and Sentiment Analysis Software market trends shaping the Industry?

- The market is experiencing significant growth, with increasing numbers of organizations adopting this technology. This trend reflects the growing demand for real-time data processing and analysis to enhance operational efficiency and gain competitive advantages.

- Emotion recognition software, a subset of Artificial Intelligence (AI), is gaining traction across various sectors, including automation, healthcare, and gaming. In real-time applications, this technology is being utilized to enhance user experiences and optimize business processes. For instance, in the gaming industry, Affectiva Inc.'s Nevermind uses emotion-based feedback to adjust game levels based on players' moods. Similarly, driver alertness detection systems employ emotion recognition to analyze driver attentiveness and alert drowsy drivers, thereby improving road safety. Beyond gaming and transportation, emotion recognition software finds applications in areas like human resources, where employee engagement and sentiment scoring are crucial.

- Machine learning algorithms and emotion lexicons are used to analyze voice tones and text data from social media and customer feedback to gauge employee morale and identify areas for improvement. Moreover, emotion recognition software is increasingly being adopted for fraud detection, as subtle changes in tone and sentiment can indicate deceit or suspicious behavior. The technology's ability to provide real-time insights and improve operational efficiency offers significant return on investment. Subjectivity analysis, a related field, can be used to evaluate the emotional content of text data, further expanding the potential use cases. Sentiment scoring and text analysis are essential components of emotion recognition software, enabling businesses to monitor and respond to customer feedback effectively.

- By understanding the emotional context of customer interactions, organizations can improve customer satisfaction and loyalty. Overall, emotion recognition software is revolutionizing the way businesses engage with their customers and employees, offering valuable insights and enhancing decision-making capabilities.

How does Emotion Recognition and Sentiment Analysis Software market faces challenges face during its growth?

- The growth of the industry is negatively impacted by the use of low-quality video content, which hinders emotional interpretation and engagement for audiences.

- Emotion Recognition and Sentiment Analysis Software is a vital tool for businesses seeking to enhance customer engagement, improve brand reputation, and provide superior customer service. This technology utilizes artificial intelligence, including emotion classification and sentiment classification, to analyze data from various sources, such as social media and customer interactions. API integration enables seamless implementation into existing systems. Deep learning and computer vision technologies are employed for emotion detection from facial expressions, while natural language processing is used for speech-based emotion recognition. Behavioral analytics and polarity analysis provide additional insights. Data privacy is ensured through secure data handling practices. The increasing amount of video content online offers ample opportunities for emotion recognition.

- Clear and visible facial expressions, captured through built-in cameras on devices, provide the best results. This technology is not limited to text-based sentiment analysis; it can also identify emotions from spoken language, enhancing the overall customer experience. By understanding the emotional context, businesses can respond appropriately, leading to increased customer satisfaction and loyalty.

Exclusive Customer Landscape

The emotion recognition and sentiment analysis software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emotion recognition and sentiment analysis software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emotion recognition and sentiment analysis software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adoreboard - This company specializes in emotion recognition and sentiment analysis technology through its software solution, Adoreboard.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adoreboard

- Affectiva Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Amelia US LLC

- Apple Inc.

- BirdEye, Inc.

- Creative Virtual Ltd.

- Imperson Inc.

- Infegy

- InMoment Inc.

- International Business Machines Corp.

- Kairos AR Inc.

- Komprehend, Inc

- Microsoft Corp.

- Noldus Information Technology bv

- NVISO SA

- Realeyes OU

- Sentiance NV

- Smart Eye AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Emotion Recognition And Sentiment Analysis Software Market

- In January 2024, Microsoft announced the integration of emotion recognition capabilities into its Teams communication platform, allowing users to identify and respond appropriately to the emotional tone of their colleagues during virtual meetings (Microsoft Press Release). This development underscores the increasing importance of emotion recognition technology in the realm of remote communication and collaboration.

- In March 2025, IBM and Google formed a strategic partnership to enhance their respective AI and machine learning offerings, with a focus on advancing emotion recognition and sentiment analysis capabilities (IBM Press Release). This collaboration represents a significant step forward in the development of more sophisticated and accurate emotion recognition software, as these tech giants combine their resources and expertise.

- In May 2024, Beyond Verbal, a leading emotion recognition technology company, raised USD30 million in a Series C funding round, bringing their total funding to over USD60 million (Beyond Verbal Press Release). This investment will support the expansion of their technology into new markets and industries, as well as the development of new applications and features.

- In October 2025, Amazon Web Services (AWS) launched Amazon Rekognition's new emotion detection capabilities, enabling developers to analyze facial expressions and detect emotions in real-time (AWS Press Release). This technological advancement further solidifies AWS's position as a major player in the market, offering a powerful tool for businesses and organizations looking to enhance their customer engagement and interaction strategies.

Research Analyst Overview

The market continues to evolve, driven by advancements in artificial intelligence, machine learning, and natural language processing. Emotion AI, a subset of this market, leverages virtual reality and computer vision to identify and classify emotions through facial expressions and voice tone analysis. Subjectivity analysis, another application, assesses the emotional tone of text and social media content. Return on investment is a significant consideration for businesses integrating these technologies, with sentiment scoring and lexicon-based analysis providing valuable customer insights for brand reputation management and customer service. Emotion detection APIs offer real-time analysis, while machine learning algorithms enable predictive analytics and bias detection.

Human resources departments use emotion recognition software for employee engagement and feedback analysis, while fraud detection and risk management applications ensure data security and privacy. Social media monitoring and text analysis tools facilitate social listening and customer experience improvements. Market research firms employ sentiment classification and data visualization to gain deeper customer insights, while voice recognition and biometric authentication add an extra layer of security. The continuous integration of these technologies into various sectors underscores their potential to revolutionize industries and enhance user experiences. Deep learning and cloud computing technologies further expand the capabilities of emotion recognition software, enabling advanced emotion classification and tone analysis.

Augmented reality and predictive analytics offer new possibilities for emotion detection and customer engagement. As the market evolves, businesses must navigate the complexities of emotion recognition and sentiment analysis, ensuring ethical use and data privacy. The ongoing integration of these technologies into diverse applications underscores their transformative potential and the need for continued innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Emotion Recognition and Sentiment Analysis Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.15% |

|

Market growth 2024-2028 |

USD 797.17 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.21 |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emotion Recognition and Sentiment Analysis Software Market Research and Growth Report?

- CAGR of the Emotion Recognition and Sentiment Analysis Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emotion recognition and sentiment analysis software market growth of industry companies

We can help! Our analysts can customize this emotion recognition and sentiment analysis software market research report to meet your requirements.