Digital Video Content Market Size 2025-2029

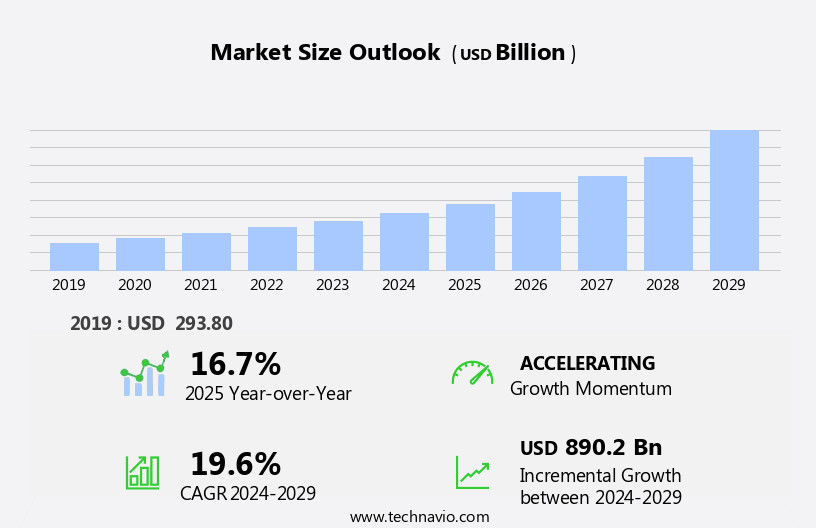

The digital video content market size is forecast to increase by USD 890.2 billion, at a CAGR of 19.6% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by an increasing number of partnerships and acquisitions in the Video on Demand (VOD) sector. These collaborations are expanding content offerings and enhancing user experiences across multiple platforms. However, the market faces a substantial challenge with the availability of pirated video content on online platforms. This issue poses a threat to content creators and distributors, requiring robust anti-piracy measures and strategic partnerships to mitigate losses.

- Companies seeking to capitalize on market opportunities must focus on content innovation, user experience, and effective piracy prevention strategies to maintain a competitive edge. The dynamic market landscape necessitates agility and continuous adaptation to emerging trends and challenges.

What will be the Size of the Digital Video Content Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with new trends and applications emerging across various sectors. Audience engagement remains a key focus, with team collaboration tools enabling more efficient video production. Royalty-free music and video editing techniques enhance content quality, while accessibility features cater to diverse viewer needs. Encoding formats and metadata tagging facilitate video search, enabling users to discover content more easily. Video compression and video quality are ongoing concerns, as is sound design and video hosting. Click-through rates (CTR) and live streaming are shaping monetization strategies, with subscription models and advertising revenue becoming increasingly popular. Visual effects (VFX) and interactive video add value, while video analytics provide insights into viewer behavior.

Frame rate, 360-degree video, color grading, closed captions, and video editing software are essential components of the production workflow. Content calendar, audio mixing, project management, and monetization strategies ensure seamless video delivery. Video scriptwriting and music licensing are crucial for creating engaging content, with stock footage and motion graphics adding visual appeal. Target audience preferences and streaming platforms influence production decisions, while conversion rates and social media integration offer opportunities for growth.

How is this Digital Video Content Industry segmented?

The digital video content industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Pay TV

- OTT

- Application

- Smart phones

- Desktop and laptop

- Smart TV

- Others

- Business Segment

- Subscription

- Advertising

- Download-to-own (DTO)

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

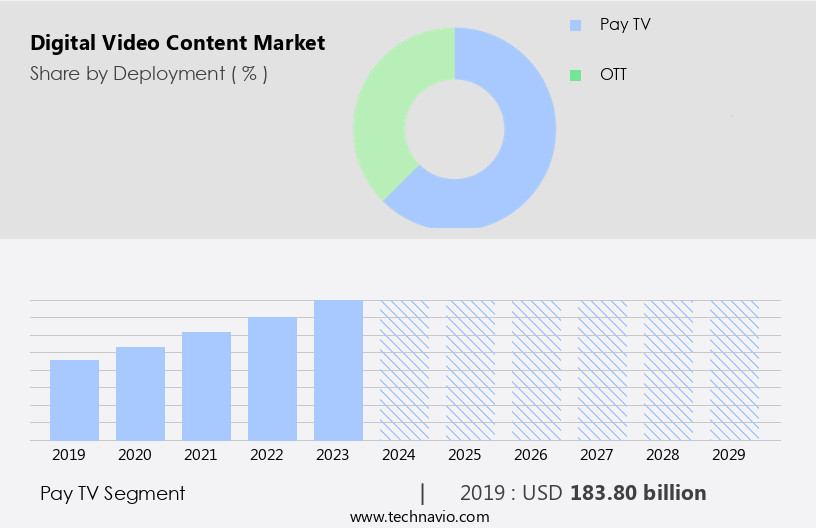

The pay tv segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing popularity of IPTV and the demand for immersive and harmonious viewing experiences. IPTV, a type of content delivery method that uses the Internet to provide live or on-demand TV programs, is propelling the market forward. While often confused with Over-The-Top (OTT) content, which is delivered via the public Internet, IPTV is differentiated by its delivery over a service provider's infrastructure. Team collaboration and audience engagement are essential components of modern video production. Royalty-free music and video editing techniques enable creators to produce high-quality content efficiently. Video conferencing facilitates remote collaboration, while accessibility features ensure inclusivity.

Encoding formats, metadata tagging, and video compression enable seamless content delivery and search. Video quality, sound design, and visual effects (VFX) are critical factors in engaging viewers. Interactive video, video analytics, and frame rate enhance viewer experience. 360-degree video and color grading offer immersive viewing options. Closed captions and video editing software enable accessibility and content customization. Monetization strategies, such as subscription models and advertising revenue, are essential for content creators. Video marketing and video production workflows are streamlined through project management tools and content calendars. Social media integration and conversion rates further expand reach and engagement.

Video hosting, click-through rates, and live streaming are essential components of the market. Motion graphics, stock footage, and music licensing provide content creators with resources to produce high-quality videos. Video scriptwriting and audio mixing ensure professional production. The target audience's preferences and streaming platforms shape the market dynamics. Video analytics and production workflows enable creators to optimize content for specific audiences. Frame rate, color grading, and closed captions are essential for accessibility and viewer experience. In conclusion, the market is evolving, with IPTV driving growth. Team collaboration, audience engagement, and high-quality production are essential components. Monetization strategies, video analytics, and social media integration are crucial for success..

The Pay TV segment was valued at USD 183.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

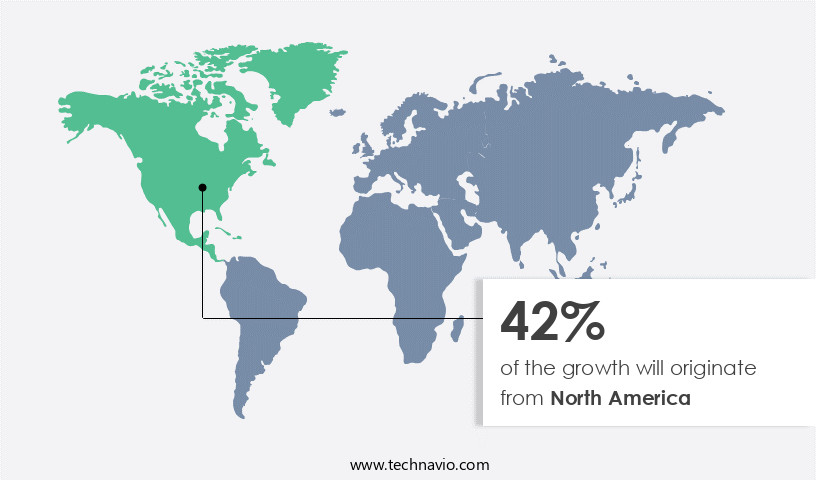

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing substantial growth, particularly in the Over-The-Top (OTT) segment. The US and Canada are leading contributors to this expansion, with a surge in subscribers opting for OTT services. The Pay TV segment, however, is showing signs of saturation as consumers increasingly prefer the flexibility and affordability of OTT platforms. In the SVOD industry, both international and domestic players, including Netflix, Amazon, Hulu, and Pluto TV, are making a significant impact. Companies are employing various strategies to boost subscription rates, such as team collaboration tools, content calendars, and personalized recommendations. Video quality, sound design, and accessibility features are crucial elements in maintaining audience engagement.

Royalty-free music, video editing techniques, and visual effects (VFX) are essential for creating compelling content. Video hosting platforms enable seamless content delivery and integration with social media, while video analytics provide valuable insights into viewer behavior. Video conferencing and click-through rates (CTR) are essential for monetization strategies. Live streaming and subscription models cater to diverse audience preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global digital video content market size and forecast projects growth, driven by digital video content market trends 2025-2029. B2B video content solutions leverage AI-driven video production tools for quality. Digital video content market growth opportunities 2025 include video content for streaming platforms and video content for marketing, meeting demand. Video content management software optimizes workflows, while digital video content market analysis highlights key providers. Sustainable video content practices align with eco-friendly video trends. Digital video content regulations 2025-2029 shapes video content demand in Asia 2025. Short-form video solutions and premium video content insights boost engagement. Video content for education and customized video production target niches. Digital video content market challenges and solutions address bandwidth, with direct procurement strategies for video tools and video content pricing optimization enhancing profitability. Data-driven video content analytics and VR-enhanced video trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Digital Video Content Industry?

- The increasing number of partnerships and acquisitions in the Video On Demand (VOD) market is the primary catalyst fueling market growth.

- The market is experiencing significant growth due to the increasing popularity of Video on Demand (VOD) services. Companies and media houses are increasingly focusing on this sector, as evidenced by Peloton's partnership with YouTube TV in December 2023. This strategic move allows Peloton members to access their preferred films, TV series, and live events directly from their Peloton equipment. Such strategies enable businesses to expand their reach, product offerings, and market share. Additionally, they help companies cater to viewer demands by producing high-quality digital video content with advanced features such as sound design, visual effects (VFX), and interactive elements.

- Furthermore, live streaming and subscription models have become essential components of the digital video content landscape. Video analytics and frame rate are crucial factors in ensuring optimal video quality and user experience. Companies prioritize these elements to enhance click-through rates (CTR) and engage viewers effectively. Overall, the market is a dynamic and evolving industry that continues to shape the way we consume media.

What are the market trends shaping the Digital Video Content Industry?

- Cross-platform partnerships are increasingly common in the current market, representing a significant trend in professional business collaborations. This growth is driven by the need for brands to expand their reach and engage audiences across multiple platforms.

- The market is experiencing substantial growth, fueled primarily by OTT (Over-The-Top) service providers. To remain competitive, Pay TV providers are forming strategic partnerships, offering SVOD (Subscription Video on Demand) and AVOD (Ad-Supported Video on Demand) services like Netflix and Amazon Prime Video. These collaborations enable both parties to expand their offerings, thereby retaining customers. For example, Verizon, a leading US cellular operator, has reinstated its Netflix one-year subscription offer through its +play platform. Launched in March 2022, Verizon +play consolidates content subscriptions into a single location.

- In addition to these collaborations, digital video content production involves various processes such as 360-degree video creation, color grading, closed captioning, video editing using software like Adobe Premiere Pro, project management using tools like Trello, audio mixing, and video scriptwriting. Monetization strategies, including music licensing, are also crucial aspects of the market.

What challenges does the Digital Video Content Industry face during its growth?

- The proliferation of pirated video content on online platforms poses a significant challenge to the growth of the industry. This issue undermines revenue generation and threatens the intellectual property rights of content creators and distributors. It is crucial for industry stakeholders to collaborate and implement effective strategies to combat piracy and safeguard the future of the industry.

- The market faces a significant challenge from the increasing prevalence of video piracy. Torrenting, a method of illegally sharing copyrighted digital video content, has gained popularity due to the availability of free content. Torrent files contain metadata that enables users to download video content using software like BitTorrent. The use of such services is illegal, as the shared content infringes on copyright laws. This trend undermines the need for subscriptions to streaming platforms and negatively impacts conversion rates, advertising revenue, and video marketing efforts..

Exclusive Customer Landscape

The digital video content market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital video content market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital video content market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - Digital video content provider enables marketers to build engaging ad campaigns, reaching a wider audience and fostering relevant brand moments. Marketers can customize video ads, increasing online presence and consumer connection. Our platform's user-friendly interface simplifies campaign creation and optimization.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Apple Inc.

- AT and T Inc.

- Chicken Soup for the Soul LLC

- Lions Gate Entertainment Corp.

- Meta Platforms Inc.

- NBCUNIVERSAL MEDIA LLC.

- Netflix Inc.

- One Day Video Ltd.

- Roku Inc.

- Snap Inc.

- Sony Group Corp.

- Stir Fry Content Kitchen

- The Walt Disney Co.

- Verizon Communications Inc.

- Viacom18 Media Pvt. Ltd.

- Walmart Inc.

- X Corp.

- Youku Tudou Inc.

- YouTube

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Video Content Market

- In January 2024, Disney+, a leading streaming platform, announced the launch of its ad-supported tier, making digital video content more accessible and affordable for a broader audience (Disney Press Release).

- In March 2024, Amazon Prime Video and MGM Studios entered into a strategic partnership, granting Amazon exclusive rights to MGM's vast film and TV library, significantly expanding its content offerings (Amazon Press Release).

- In April 2025, Netflix secured a strategic investment of USD1 billion from Sony, strengthening its financial position and enabling further investment in content production and global expansion (Netflix Securities Filing).

- In May 2025, YouTube announced the deployment of its new AI-driven video editing technology, allowing creators to produce professional-quality videos with minimal editing skills, revolutionizing the digital video content creation process (YouTube Official Blog).

Research Analyst Overview

- In the dynamic the market, brands employ various strategies to engage audiences and boost brand awareness. Content marketing and influencer marketing are prominent tactics, with HDR video and captioning services enhancing viewer experience. Owned media, such as video playlists and corporate videos, fortify brand identity. Internal communications leverage video testimonials and training videos for employee engagement. Educational videos and community building foster customer loyalty.

- Product demos, explainer videos, and remote collaboration facilitate effective communication. Intellectual property protection is crucial in content licensing, while live event streaming and paid media expand reach. Earned media, subtitle creation, and virtual events generate organic buzz. Channel management, Dolby Vision, video thumbnail optimization, video stabilization, and video player customization optimize content delivery.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Video Content Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.6% |

|

Market growth 2025-2029 |

USD 890.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.7 |

|

Key countries |

US, Canada, Germany, UK, China, France, India, Italy, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Video Content Market Research and Growth Report?

- CAGR of the Digital Video Content industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital video content market growth of industry companies

We can help! Our analysts can customize this digital video content market research report to meet your requirements.