Empty Capsules Market Size 2024-2028

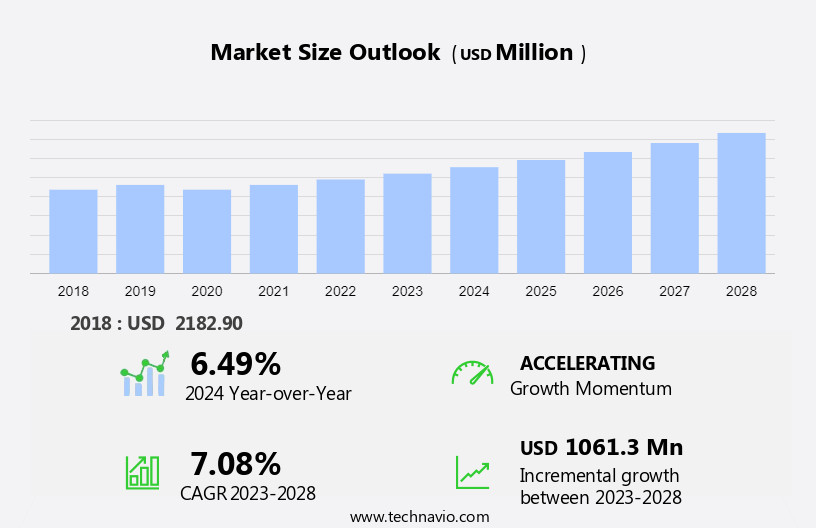

The empty capsules market size is forecast to increase by USD 1.06 billion at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to increasing applications In the pharmaceutical industry. The demand for generic drugs is driving market expansion, as these drugs often come In the form of empty capsules that can be filled with various active ingredients. However, the market also faces challenges, including the risk of counterfeiting In the pharmaceutical industry. Counterfeiters may produce and fill empty capsules with substandard or even harmful substances, posing a serious threat to public health. Hydroxypropyl methylcellulose, starch, pullulan, and other materials are commonly used in capsule production. To mitigate this issue, regulations and standards are being implemented to ensure the authenticity and quality of empty capsules. Additionally, advancements in technology are enabling the production of high-quality, cost-effective empty capsules, further fueling market growth. Overall, the market is expected to continue its upward trajectory, driven by these key trends and challenges.

What will be the Size of the Empty Capsules Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for nutraceuticals and dietary supplements in addressing non-communicable diseases such as diabetes and cancer. Health-conscious consumers prioritize personal health and seek out nutraceutical ingredients that cater to dietary restrictions and cultural practices. In response, the market offers various capsule formulations, including those that are vegan, free of gelatin, and environmentally friendly.

- Moreover, the pharmaceutical sector also leverages empty capsules for drug delivery innovations, as they serve as inert substances for medicinal agents. The aging population and the cosmeceutical industry further expand the market's reach, as empty capsules are utilized for various applications beyond nutritional supplements. The trend toward plant-based alternatives and minimizing negative effects on the environment fuels the development of new capsule technologies.

How is this Empty Capsules Industry segmented and which is the largest segment?

The empty capsules industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Gelatin capsules

- Non-Gelatin capsules

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

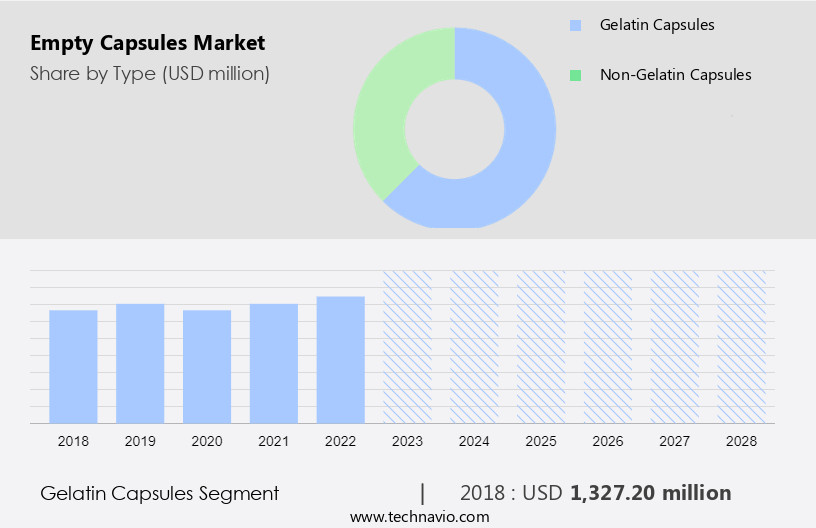

By Type Insights

- The gelatin capsules segment is estimated to witness significant growth during the forecast period.

The gelatin capsules segment dominates the market due to its widespread usage In the pharmaceutical sector. These capsules are derived from hydrolyzed collagen, which can be of animal origin or cellulose-based. Gelatin's advantages include being odorless, tasteless, gluten-free, GMO-free, and offering a benign oral dosage. In the pharmaceutical industry, gelatin acts as a thickener, foaming agent, plasticizer, and binder. Its texture also makes it suitable for various applications. The convenience of gelatin capsules lies In their reliable dosing, portability, and high consumer compliance. The nutraceutical industry also utilizes gelatin capsules for dietary supplements, including anti-anemic preparations, anti-inflammatory drugs, and cardiovascular therapy drugs.

Get a glance at the Empty Capsules Industry report of share of various segments Request Free Sample

The gelatin capsules segment was valued at USD 1.33 billion in 2018 and showed a gradual increase during the forecast period.

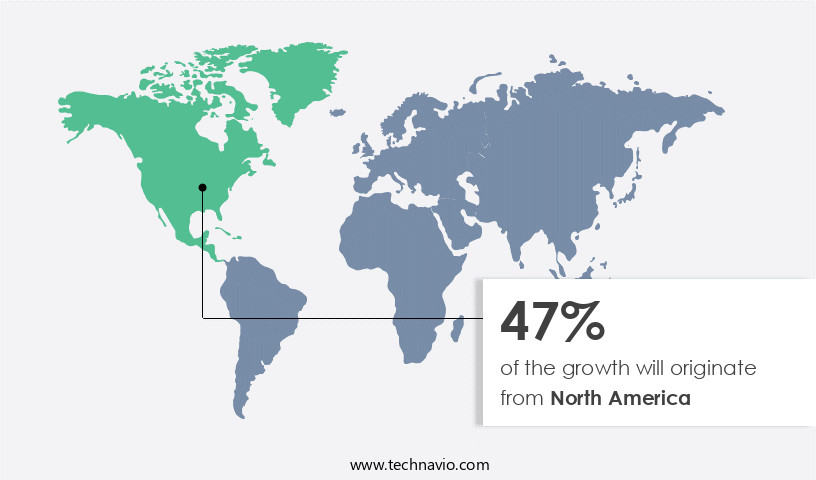

Regional Analysis

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to expand significantly due to the increasing demand for pharmaceutical drugs, particularly In the US and Canada. The US market growth is attributed to the presence of numerous pharmaceutical companies, the introduction of new branded drugs, and the rising demand for FDA-approved generic medicines, primarily from the elderly population. In Canada, the market is driven by the increasing healthcare expenditure and the demand for advanced pharmaceutical drugs. Nutraceutical industry growth, including dietary supplements, anti-anemic preparations, anti-inflammatory drugs, and cardiovascular therapy drugs, also contributes to the market expansion. Both gelatin and non-gelatin capsules, such as vegetarian and vegan capsules, are in demand due to dietary restrictions, cultural practices, and consumer preferences for plant-based alternatives and environmentally friendly options.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Empty Capsules Industry?

Increasing applications in pharmaceutical industry is the key driver of the market.

- The market is experiencing significant growth due to the increasing production of therapeutics for treating various non-communicable diseases such as diabetes, cancer, and cardiovascular conditions. The elderly population's expansion is a primary factor driving this growth, as the demand for geriatric-friendly medicine solutions increases. Additionally, the nutraceutical industry's growth, including dietary supplements, anti-anemic preparations, anti-inflammatory drugs, and cardiovascular therapy drugs, is contributing to the market's expansion. Factors such as rising healthcare awareness and the growing knowledge of medicines among people due to the high penetration of the Internet are boosting sales of over-the-counter drugs. The dietary restrictions and cultural practices of health-conscious consumers are leading to the demand for vegan capsules and plant-based alternatives to animal origin-based products, such as those derived from hides, bones, hooves, cattle, pigs, fish, horses, and poultry.

- Moreover, the market is segmented into gelatin capsules and non-gelatin capsules. Gelatin capsules, including type-B gelatin capsules, are widely used due to their convenience and taste masking properties. However, the non-gelatin capsules segment, which includes vegetarian shells and hydroxypropyl methylcellulose, starch, pullulan, and capsule formulations, is gaining popularity due to its environmental friendliness and suitability for vegan and vegetarian consumers. The pharmaceutical sector's innovation in drug delivery systems, including immediate-release, sustained-release, and delayed-release capsules, is further driving the market's growth. The nutraceutical sector, including vitamins, minerals, herbal formulations, and cosmeceutical industry, is also contributing to the market's expansion. The market is expected to grow further due to the increasing demand for personalized medicine, customizable dose forms, and patient-centric medications.

What are the market trends shaping the Empty Capsules Industry?

Increasing demand for generic drugs is the upcoming market trend.

- The market encompasses the production and supply of capsules used In the health nutrition industry, particularly for nutraceuticals and pharmaceuticals. Capsules are essential for encapsulating various nutraceutical ingredients, including those used for addressing non-communicable diseases such as diabetes and cancer. Capsule production sources include animal origin-based products like gelatin from hides, bones, hooves, and collagen from slaughtered animals, including cattle, pigs, fish, horses, and poultry. However, vegan capsules made from plant-based alternatives like Hydroxypropyl Methylcellulose, Starch, Pullulan, and Capsule formulations are gaining popularity among health-conscious customers and those with dietary restrictions or cultural practices that prohibit animal products. The Nutraceutical industry, including dietary supplements, anti-anemic preparations, anti-inflammatory drugs, and cardiovascular therapy drugs, is a significant contributor to the demand for empty capsules.

- Moreover, the Dietary Supplements segment, which includes immediate-release, sustained-release, and delayed-release capsules, dominates the market. The Nutraceutical industry's research laboratories and pharmaceutical manufacturers are continually innovating drug delivery systems, including gelatin-based capsules (type-B gelatin capsules) and non-gelatin capsules, to cater to various consumer needs. The elderly population's increasing demand for geriatric-friendly medicine solutions and personalized medicine is also driving the growth of the market. The market is expected to witness significant growth during the forecast period due to the convenience offered by capsules, taste masking, and customizable dose forms, such as vegetarian shells and IV bags. The pharmaceutical sector's automation and adherence to Good Manufacturing Practices further ensure the production of high-quality empty capsules.

What challenges does the Empty Capsules Industry face during its growth?

Risk of counterfeiting in pharmaceutical industry is a key challenge affecting the industry growth.

- The market encompasses the production and supply of capsules used In the health nutrition industry, particularly In the production of nutraceuticals. These capsules are essential for the encapsulation of various nutraceutical ingredients, including those used for addressing non-communicable diseases such as diabetes and cancer. Capsules are available in two main types: gelatin and non-gelatin. The Gelatin Capsules Segment dominates the market due to its widespread use In the pharmaceutical sector. However, the Non-Gelatin Capsules Segment is gaining popularity among health-conscious consumers due to dietary restrictions and cultural practices. The Nutraceutical Ingredients Market is a significant contributor to the demand for empty capsules.

- Furthermore, the market is significant in industrial regions, with Gelatin-based capsules, Type-B Gelatin Capsules, and Vegetarian shells being the most common. However, the risk of counterfeit products In the pharmaceutical supply chain poses a significant challenge to the market. Counterfeit drugs can have severe health consequences and financial impacts on companies. Producers of pharmaceutical compositions must adhere to Good Manufacturing Practices and automation to minimize the risk of counterfeit products. The market for empty capsules also includes the Cosmeceutical Industry and the Nutraceutical Sector, which use empty capsules for Vitamins, Minerals, and Soft gelatin capsules. Liquid encapsulation and Liquid-filled Hard Capsules are also essential in various applications.

Exclusive Customer Landscape

The empty capsules market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the empty capsules market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, empty capsules market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACG

- Ajix Inc.

- Bright Pharma Caps Inc.

- Healthcaps India Ltd.

- Lonza Group Ltd.

- Mitsubishi Chemical Group Corp.

- Nectar Lifesciences Ltd.

- Qingdao Yiqing Biotechnology Co. Ltd.

- Roxlor LLC

- Shanxi Guangsheng Medicinal Capsule Co. Ltd.

- Shanxi JC Biological Technology Co. Ltd.

- Snail Pharma Industry Co. Ltd.

- Suheung Co. Ltd.

- Sunil Healthcare Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of products used in various industries, including the health nutrition sector and the pharmaceutical industry. Empty capsules serve as vital components In the production of nutraceuticals, dietary supplements, and medicines. These capsules are available in different forms, such as gelatin and non-gelatin, each offering unique advantages. Gelatin capsules have been a long-standing choice due to their versatility and affordability. They are widely used In the production of various pharmaceutical compositions, including anti-anemic preparations, anti-inflammatory drugs, and cardiovascular therapy drugs. The gelatin capsules market has seen significant growth due to the increasing prevalence of non-communicable diseases, such as diabetes and cancer, which require regular medication intake.

However, the demand for non-gelatin capsules is on the rise, driven by various factors. Health-conscious consumers are increasingly seeking vegan and environmentally friendly alternatives to animal origin-based products. This has led to the growth of the non-gelatin capsules market, which includes capsules made from plant-based materials like hydroxypropyl methylcellulose, starch, and pullulan. The nutraceutical industry, which includes research laboratories and producers of nutritional supplements, herbal formulations, and medicines, is a significant consumer of empty capsules. The convenience and taste masking properties of capsules make them a preferred choice for consumers who dislike the taste or texture of certain nutraceuticals.

Moreover, the trend toward personalized medicine and customizable dose forms is driving innovation In the empty pill industry. The pharmaceutical sector also relies heavily on empty capsules for drug delivery innovations. The elderly population, with its unique medication administration needs, is a significant consumer of geriatric-friendly medicine solutions. Pharmaceutical manufacturers are continually striving to develop smaller, easier-to-swallow capsules, such as size "0" capsules, to cater to this demographic. The cosmeceutical industry also utilizes empty capsules for liquid encapsulation and the production of liquid-filled hard capsules. These capsules offer advantages such as improved stability, longer shelf life, and better taste masking for various cosmetic and personal care products.

Furthermore, the market is expected to continue growing due to the increasing prevalence of chronic diseases and the ongoing research and development efforts In the pharmaceutical and nutraceutical sectors. The market dynamics are driven by factors such as the aging population, consumer preferences for plant-based alternatives, and the ongoing quest for drug delivery innovations. The market is also influenced by regulatory requirements, such as good manufacturing practices and automation, which ensure the quality and safety of empty capsules.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 1.06 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Empty Capsules Market Research and Growth Report?

- CAGR of the Empty Capsules industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the empty capsules market growth of industry companies

We can help! Our analysts can customize this empty capsules market research report to meet your requirements.