Emulsified Shortenings Market Size 2025-2029

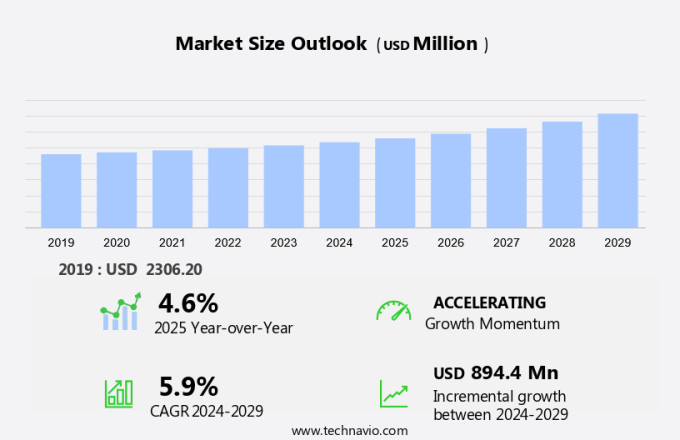

The emulsified shortenings market size is forecast to increase by USD 894.4 million, at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expansion of the bakery industry and new product launches by companies. The bakery sector's continuous growth is fueled by increasing consumer preference for baked goods, particularly in developing regions. This trend presents a lucrative opportunity for emulsified shortenings manufacturers. However, rising raw material costs pose a substantial challenge for market participants. The price volatility of key raw materials, such as palm oil and soybean oil, can significantly impact the profitability of emulsified shortenings production.

- Companies must carefully manage their supply chains and explore alternative raw material sources to mitigate these costs and maintain competitiveness. Effective supply chain management and raw material sourcing strategies will be crucial for market success.

What will be the Size of the Emulsified Shortenings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and consumer preferences. These complex food ingredients, which consist of a continuous oil phase stabilized by an emulsifier, offer various benefits such as improved texture, flavor stability, and viscosity control. The thermal analysis of Dispersive DSC (Differential Scanning Calorimetry) plays a crucial role in understanding the melting behavior of shortenings, impacting their performance in applications like baking and frying. The triglyceride structure, glyceride composition, and polymorphism analysis are essential factors influencing the melting point range and crystallization control. Emulsifier stability and fat bloom prevention are critical aspects of emulsion rheology, ensuring the desired texture and appearance in various food applications.

Shortening plasticity and hydrogenation degree are essential factors in determining the shortening's functionality and applicability in different sectors, such as confectionery and bakery. Coating applications, phase behavior, and texture modification are also significant considerations, as shortenings are used to enhance the sensory attributes and extend the shelf life of various food products. The interesterification process, oxidative stability, and frying stability are essential aspects of product formulation optimization. In the realm of food applications, shortenings are utilized in various sectors, including confectionery, bakery, and frying. Their unique properties, such as viscosity control, solid fat content, water activity, and fatty acid profile, enable them to contribute significantly to the desired texture, flavor, and performance in these applications.

As market dynamics continue to unfold, research and development efforts are focused on optimizing the production process, enhancing the functional properties, and expanding the applications of emulsified shortenings. The ongoing exploration of new emulsifiers, processing techniques, and formulation strategies will undoubtedly shape the future of this dynamic market.

How is this Emulsified Shortenings Industry segmented?

The emulsified shortenings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments

- End-user

- Food and beverage

- Cosmetics and personal care

- Pharmaceuticals

- Source

- Plant-based shortenings

- Animal-based shortenings

- Type

- Vegetable-Based

- Animal-Based

- Blended

- Form

- Solid

- Liquid

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

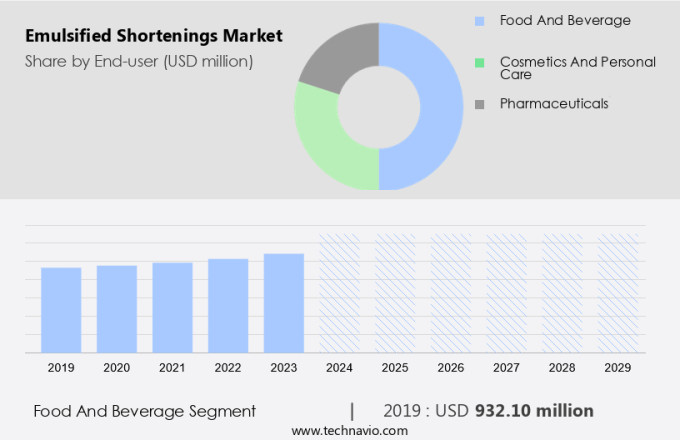

The food and beverage segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth in the food and beverage sector due to the essential role these shortenings play in enhancing texture, moisture retention, and shelf life in various products, including bakery items, snacks, confectionery, and prepared foods. The market is driven by the increasing demand for healthier and cleaner label alternatives, leading to a shift towards plant-based and trans-fat-free emulsified shortenings. This trend is fueled by consumers' growing awareness of health and wellness, as well as their preference for natural and minimally processed ingredients. Emulsifier stability, fat bloom prevention, and emulsion rheology are critical factors influencing the market's dynamics.

Triglyceride structure, solid fat content, water activity, and thermal analysis DSC are essential considerations in the production process. The interplay between these factors impacts the shortening's plasticity measurement, viscosity control, and phase behavior. Texture modification, coating application, and crystallization control are essential applications for emulsified shortenings. The fatty acid composition and hydrogenation degree significantly impact the shortening's melting point range, oxidative stability, and frying stability. Product formulation optimization, particle size distribution, and sensory attributes are crucial factors in ensuring baking performance and shelf life extension. Furthermore, the market is witnessing advancements in technologies such as polymorphism analysis, glyceride composition analysis, and process optimization techniques, enabling manufacturers to produce high-quality emulsified shortenings with improved functional properties and enhanced food applications.

The Food and beverage segment was valued at USD 932.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

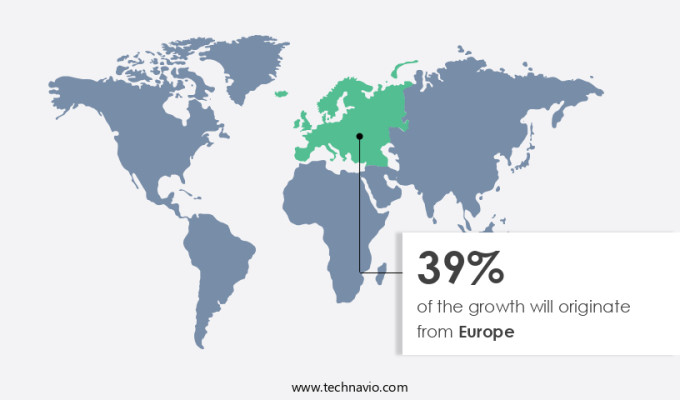

Europe is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is driven by the region's thriving food processing industry and increasing consumer demand for high-quality food products. Germany, as a major player in this market, reflects the industry's robustness with its significant role in the country's economy. In 2022, the production of processed food and beverages in Germany reached an impressive USD240 billion, marking a substantial growth of approximately 17% compared to the previous year. This expansion underscores the industry's adaptability to evolving consumer preferences and market conditions. Emulsified shortenings play a crucial role in the food processing sector due to their unique properties, including plasticity measurement, rheological properties, and viscosity control.

Triglyceride structure, emulsifier stability, and fat bloom prevention are essential factors in maintaining the desired texture and shelf life of various food applications. Emulsion rheology, solid fat content, water activity, and thermal analysis DSC are integral to understanding the behavior and performance of these shortenings. Flavor stability, emulsion viscosity, shortening plasticity, fatty acid composition, hydrogenation degree, and coating application are essential aspects of emulsified shortenings that influence the final product's sensory attributes and functionality. Phase behavior, texture modification, glyceride composition, polymorphism analysis, melting point range, and crystallization control are critical factors in optimizing the production process and ensuring consistent product quality.

Furthermore, oxidative stability, frying stability, fatty acid profile, baking performance, and shelf life extension are essential considerations in the food application of emulsified shortenings. The interesterification process, particle size distribution, and product formulation are essential aspects of the manufacturing process that impact the final product's properties and performance. In conclusion, the European the market is characterized by its dynamic nature, driven by the food processing industry's adaptability and the growing demand for high-quality food products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B shortening strategies utilize functional fat technologies for bakery applications. Emulsified shortenings prospects 2025 include shortenings for industrial baking and plant-based shortening blends, driving demand. Shortening logistics analytics optimize supply, while emulsified shortenings benchmarks highlight AAK. Sustainable shortening sourcing aligns with clean-label bakery trends. Shortening regulations 2025-2029 guide shortening demand in Europe 2025. Premium shortening products and emulsified shortenings forecasts enhance growth. Shortenings for confectionery and custom shortening formulations target niches. Emulsified shortenings hurdles and innovations address health concerns, with shortening supplier networks and shortening cost tactics boosting margins. Emulsified shortenings insights and functional fat breakthroughs accelerate momentum.

What are the key market drivers leading to the rise in the adoption of Emulsified Shortenings Industry?

- The expansion of the bakery industry serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the expanding bakery industry. In 2023, the bakery sector surpassed USD600 billion in value, underscoring the substantial demand for baked goods worldwide. This trend is driven by increasing consumer preference for convenient and ready-to-eat food products, leading to a surge in the consumption of bakery items such as bread, cakes, pastries, and cookies. One key market in this regard is India, which was valued at approximately USD11 billion in 2022. This market is projected to nearly double, reaching around USD20 billion by 2028. Factors contributing to this growth include urbanization, rising disposable incomes, and changing dietary habits.

- Emulsified shortenings play a crucial role in the production of these bakery items, providing desirable rheological properties, viscosity control, and emulsifier stability. These shortenings also help prevent fat bloom and ensure optimal emulsion rheology. The triglyceride structure of emulsified shortenings is carefully formulated to optimize solid fat content and water activity, ensuring the best possible baking results. As the bakery industry continues to expand, the demand for emulsified shortenings is expected to grow in tandem.

What are the market trends shaping the Emulsified Shortenings Industry?

- The current market trend involves numerous new product launches from companies. It is an essential aspect of staying informed and competitive in this dynamic business environment.

- The market is experiencing notable advancements as companies introduce innovative products to cater to the demands of food manufacturers and consumers. One recent example is Vantage Food's patent-pending SIMPLY KAKE emulsifier, launched on August 31, 2023. This product supports cleaner-label initiatives, a growing consumer preference for transparency and natural ingredients. The SIMPLY KAKE emulsifier improves baking performance for cakes and sweet goods, offering superior operational tolerance and enhancing cake volume. Consequently, it ensures a consistent and even crumb structure. Thermal analysis through DSC (Differential Scanning Calorimetry) plays a crucial role in understanding the phase behavior and texture modification of emulsified shortenings.

- Flavor stability, emulsion viscosity, shortening plasticity, fatty acid composition, and hydrogenation degree are essential factors influencing the market dynamics. The ability of emulsified shortenings to function effectively in coating applications further expands their utility in the food industry. companies continue to focus on research and development to optimize these properties and cater to evolving consumer preferences.

What challenges does the Emulsified Shortenings Industry face during its growth?

- The industry's growth is significantly impacted by the escalating costs of raw materials, which poses a major challenge.

- The market experiences challenges due to the volatile prices of key raw materials, primarily glycerides like palm and soybean oils. These price fluctuations significantly impact production costs, making it difficult for manufacturers to maintain consistent profit margins and pricing strategies. The unpredictability of raw material costs places financial pressure on producers, requiring them to adapt to market changes while remaining competitive. For instance, since mid-September 2024, the price of palm oil has risen by approximately 35%-40%, reaching around USD16 per metric ton. This volatility necessitates careful crystallization control, interesterification processes, and particle size distribution management in the formulation of emulsified shortenings.

- Sensory attributes, such as melting point range and polymorphism analysis, are crucial to ensure the desired texture and mouthfeel in various applications, including confectionery use. Manufacturers must focus on optimizing their processes and formulations to mitigate the impact of raw material price fluctuations and deliver high-quality emulsified shortenings to their customers.

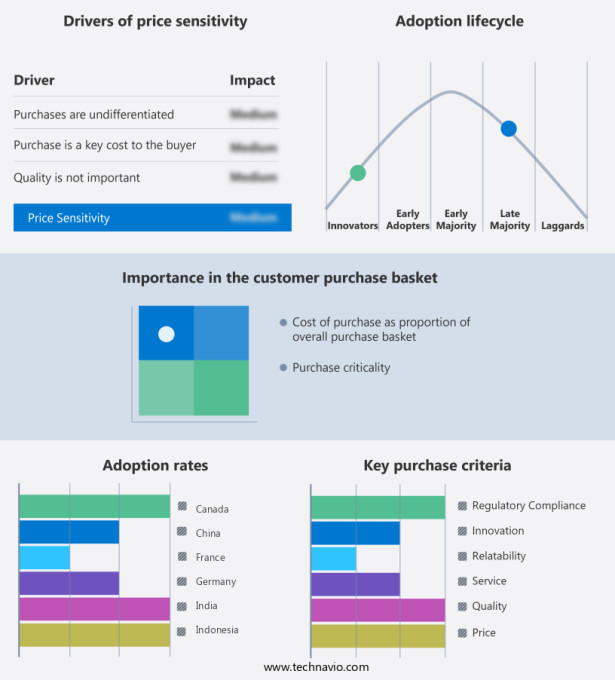

Exclusive Customer Landscape

The emulsified shortenings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emulsified shortenings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emulsified shortenings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Mauri UK Ltd. - This company specializes in the production and supply of emulsified shortenings, including fluid shortening and mauri shortening, which enhance food texture and shelf life for various industries. These innovative products contribute significantly to the food manufacturing sector by improving baking and frying processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Mauri UK Ltd.

- Archer Daniels Midland Co.

- Bakels Philippines

- BASF SE

- Bunge Ltd.

- Cargill Inc.

- Giiava

- Henan Chemsino Industry Co. Ltd.

- IOI Oleo GmbH

- Kerry Group Plc

- MOI Foods U.S.A. Inc

- Palsgaard AS

- PT. PACIFIC MEDAN INDUSTRI

- Tate and Lyle PLC

- The J.M Smucker Co.

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Emulsified Shortenings Market

- In January 2024, AarhusKarlsen, a leading Danish producer of specialty fats and oils, announced the launch of its new emulsified shortening product line, "FlexiFry," designed for the foodservice sector. This innovation addresses the growing demand for healthier frying alternatives (AarhusKarlsen press release).

- In March 2024, Cargill and Archer Daniels Midland (ADM) joined forces to expand their joint venture, WILD Flavors and Specialty Ingredients, focusing on the development and production of emulsified shortenings for the baking industry. This strategic collaboration aims to strengthen their market position and enhance their product offerings (Cargill press release).

- In April 2025, the US Food and Drug Administration (FDA) approved the use of a new emulsifier, Sorbitan Tristearate, in emulsified shortenings. This approval opens up new possibilities for manufacturers to create healthier, more stable shortening products (FDA press release).

- In May 2025, the Dutch multinational company, DSM, announced the acquisition of a leading Brazilian producer of emulsified shortenings, Solanova Alimentos. This strategic move expands DSM's global footprint and strengthens its position in the South American market (DSM press release).

Research Analyst Overview

- The market experiences continuous evolution, driven by advancements in manufacturing processes and quality control measures. Lipid oxidation, a key challenge in shortening production, is mitigated through stability assessment and crystal network optimization. Yield optimization and application versatility are crucial for food ingredient suppliers, requiring a deep understanding of product consistency and processing technology. Emulsion technology plays a pivotal role in shortening functionality, with quality attributes heavily influenced by ingredient interaction and chemical composition. Thermal stability is essential for maintaining shortening's functional properties under various storage conditions. Manufacturers focus on cost optimization through process parameters fine-tuning and rheological measurements, ensuring product consistency and desirable texture analysis.

- Physical properties, such as melting point and viscosity, are critical in shortening formulation design. Sensory evaluation and functional properties are integral to shortening's success in the food industry. Quality control measures, including strict adherence to process parameters, ensure the desired shortening characteristics are maintained. Ingredient selection and fat blend design are crucial aspects of shortening production, with each component's impact on shortening's thermal stability and sensory attributes carefully considered. Overall, the market demands a comprehensive understanding of ingredient interaction and processing technology to meet evolving consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Emulsified Shortenings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 894.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emulsified Shortenings Market Research and Growth Report?

- CAGR of the Emulsified Shortenings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emulsified shortenings market growth of industry companies

We can help! Our analysts can customize this emulsified shortenings market research report to meet your requirements.