North America Energy Bar Market Size 2024-2028

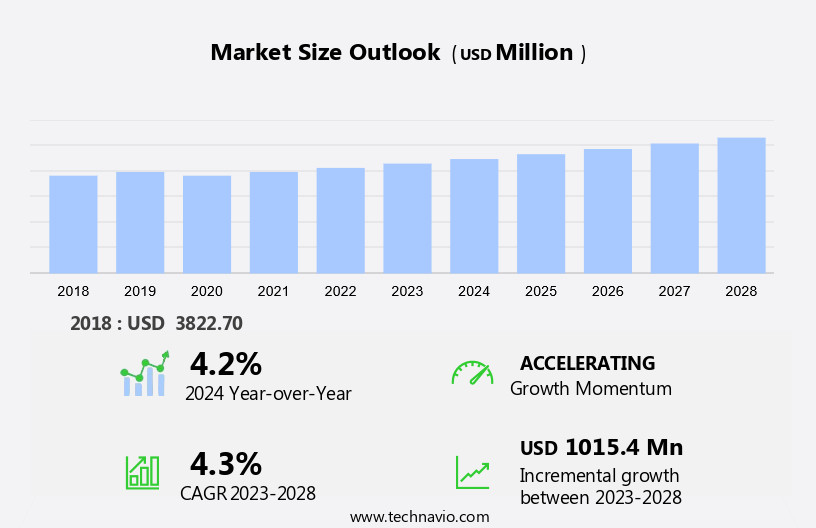

North America energy bar market size is forecast to increase by USD 1.02 billion billion at a CAGR of 4.3% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for convenient and nutritious sports and nutrition solutions. With consumers prioritizing active lifestyles and healthier food choices, energy bars have become a popular option for on-the-go sustenance. Additionally, the sales of energy bars through online retailing channels are on the rise, making these products more accessible than ever before. However, the market faces challenges from the easy availability of substitutes, such as protein bars and other energy-dense snacks.

- As the market continues to evolve, players must innovate to differentiate their offerings and meet the unique needs of various consumer segments. Stay tuned for a comprehensive analysis of these trends and more in our Market Trends and Analysis report.

What will be the size of the North America Energy Bar Market during the forecast period?

- In the dynamic North American energy bar market, supply chain optimization plays a crucial role in ensuring efficient manufacturing processes. Manufacturing equipment is continually evolving to meet the demand for high-quality, ethical sourcing of ingredients. Packaging design, with its focus on transparency and sustainability, is a key trend, as consumers increasingly demand ingredient traceability. Sales data analysis and customer feedback are integral to new product development, with health claims and nutritional information driving consumer interest. Product testing and quality assurance are essential to maintaining brand awareness and adhering to food safety regulations. Marketing campaigns and advertising strategies leverage promotional materials to reach consumers directly, while ethical sourcing and sustainability initiatives resonate with environmentally-conscious buyers.

- The distribution network, encompassing wholesale and e-commerce sales, is a critical component of a successful pricing model. Ingredient suppliers and distribution partners collaborate to optimize the product lifecycle, with direct-to-consumer sales and retail distribution channels complementing one another. Brand awareness and consumer research inform ingredient choices and product testing, shaping the competitive landscape and driving innovation in the energy bar market.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

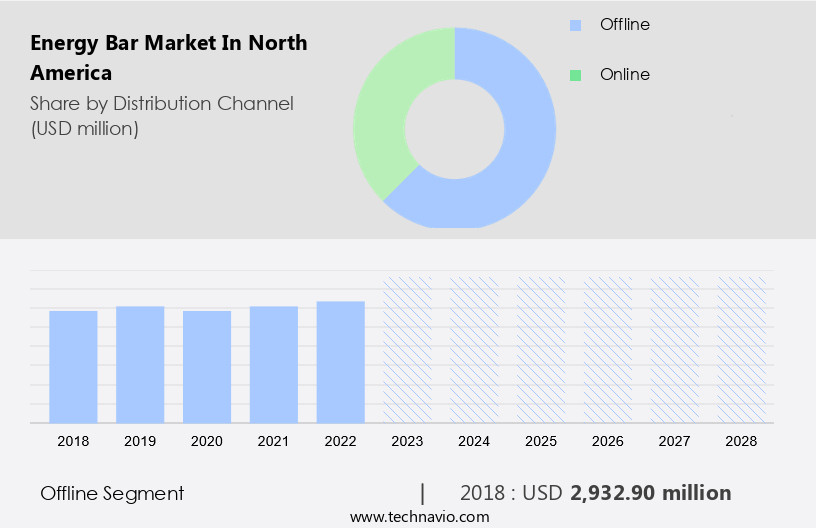

- Distribution Channel

- Offline

- Online

- Type

- Protein Bars

- Nutrition Bars

- Meal Replacement Bars

- Others

- End-User

- Athletes

- Health-Conscious Consumers

- General Consumers

- Flavor

- Chocolate

- Fruit

- Nut-Based

- Others

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

In the North American market, energy bars continue to gain popularity due to their nutritional value claims, with organic certification and vegan formulations catering to diverse consumer preferences. Flavor profile development and ingredient sourcing are key focus areas for manufacturers to differentiate their offerings. Production efficiency and food safety standards are essential for maintaining competitiveness, while cost analysis models help optimize pricing strategies. Competitor benchmarking and quality control metrics ensure product consistency and customer satisfaction. Gluten-free options and high-protein formulations cater to specific consumer segments. Product diversification, including protein bars and low-sugar options, broadens market reach. Functional ingredients, such as vitamins and minerals, enhance product appeal.

Distribution channels, including supermarkets, hypermarkets, convenience stores, and discount stores, play a significant role in energy bar sales. Supermarkets and hypermarkets, with their wide product offerings and competitive pricing, dominate the market. Consumer preference data informs marketing strategies and brand positioning. Texture optimization and product innovation keep the market dynamic. Regulatory compliance, sales performance tracking, and supply chain management are crucial for maintaining a competitive edge. Shelf life extension and promotional campaigns further boost sales. Overall, the market is characterized by continuous innovation, consumer-centric strategies, and a focus on operational efficiency.

Get a glance at the market share of various segments Request Free Sample

The Offline segment was valued at USD 2932.90 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Energy Bar Market?

- Increasing demand for sports nutrition is the key driver of the market. The North American energy bar market is experiencing notable growth due to the expanding consumer base, comprised of professional athletes and fitness enthusiasts. These consumers seek nutritionally balanced foods, including carbohydrates, protein, healthy fats, vitamins, and minerals, to meet their energy demands. Energy bars, alongside shakes and other supplements, are popular choices for enriched and fortified food intake. The market demographic is evolving, with a shift from core and casual users to lifestyle users. Core users are professional athletes, while casual users are recreational athletes. To cater to this market, energy bar manufacturers focus on various aspects such as nutritional value claims, organic certification, flavor profile development, ingredient sourcing, and vegan formulations.

- Cost analysis models and food safety standards are essential for production efficiency. Ingredient sourcing involves selecting high-quality, natural, and sustainable ingredients to meet the evolving consumer preferences. Additionally, manufacturers prioritize vegan formulations to cater to the increasing demand for plant-based products. The market's future growth is expected to be driven by these trends and the ongoing consumer focus on health and wellness.

What are the market trends shaping the North America Energy Bar Market?

- Increasing sales of energy bars through online retailing is the upcoming trend in the market.The online market for packaged nutritional foods, including energy bars, in North America is experiencing significant growth. Factors such as the increasing urban population, growing millennial demographic, and rising disposable income are key drivers. The online grocery channel's sales value is increasing due to the elimination of supply chain intermediaries. Energy bars are a popular choice among consumers, with both pure-play online retailers and traditional food retailers' websites seeing increased sales. The proliferation of mobile users and their use of health and wellness apps, trackers, and wearables is also crucial to the online sale of energy bars. Modern consumers, particularly fitness enthusiasts, value convenience when purchasing nutritional foods.

- Nutrient content labeling, functional ingredients, and texture optimization are essential considerations for brands seeking to differentiate themselves. Pricing strategies and consumer segmentation are also critical elements in brand positioning. Product innovation, including low-sugar options, is essential to cater to evolving consumer preferences.

What challenges does North America Energy Bar Market face during the growth?

Easy availability of substitutes is a key challenge affecting the market growth.

- Energy bars continue to be a popular choice for individuals seeking a quick energy boost, particularly among those engaged in physical activities and outdoor pursuits. However, the market faces competition from alternative snack bars, such as protein bars, cereal bars, and granola bars. Consumers increasingly demand functional and convenient foods, prioritizing taste, wholesome ingredients, and organic materials. Yet, energy bars often contain higher sugar content than their counterparts, leading to concerns. Transparency regarding ingredient composition is crucial for consumer satisfaction, with many seeking high-protein options and gluten-free alternatives.

- Product diversification is essential for companies to cater to these preferences, ensuring quality control metrics are met. Effective competitor benchmarking and understanding consumer preference data are vital for success in this dynamic market. Distribution channels also play a significant role in reaching the target audience effectively.

Exclusive North America Energy Bar Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Amrita Health Foods

- Bearded Brothers LLC

- Caveman Foods

- Clif Bar and Co.

- Empact Bars LLC

- Garuka Bars

- General Mills Inc.

- Hormel Foods Corp.

- Kellogg Co.

- Mars Inc.

- McKee Foods

- Mondelez International Inc.

- Nestle SA

- NuGo Nutrition

- PepsiCo Inc.

- Post Holdings Inc.

- PROBAR Inc.

- The Hershey Co.

- The Simply Good Foods Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by consumer preferences for convenient, nutritious, and sustainable food options. Nutritional value claims, such as high protein, low sugar, and gluten-free, are increasingly important, leading to the development of vegan formulations and organic certification. Flavor profile development and ingredient sourcing are key areas of focus, with a trend towards functional ingredients and locally-sourced materials. Cost analysis models are essential for energy bar manufacturers, balancing production efficiency and ingredient costs. Food safety standards and regulatory compliance are non-negotiable, with ongoing efforts to improve quality control metrics and production processes. Competitor benchmarking and consumer preference data inform pricing strategies and brand positioning.

Texture optimization and product innovation are crucial for differentiating offerings in a crowded market. Product diversification, including protein bar formulations and low-sugar options, cater to various consumer segments. Shelf life extension and promotional campaigns are effective marketing tools, while distribution channels and nutrient content labeling ensure transparency and customer satisfaction. Regulatory compliance, sales performance tracking, and supply chain management are critical aspects of the energy bar market's ongoing dynamism. The bar manufacturing process is continually refined to meet evolving consumer demands and industry standards, ensuring the production of high-quality, nutritious, and sustainable energy bars.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2024-2028 |

USD 1015.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch