US Engineering Services Outsourcing Market Size 2024-2028

The US engineering services outsourcing market size is estimated to grow by USD 187.62 billion at a CAGR of 32.14% between 2023 and 2028. The market experiences significant growth due to various factors. Primarily, businesses seek cost savings through access to lower labor wages in offshore locations. Additionally, outsourcing and engineering R&D services enable companies to tap into a vast pool of highly skilled engineering professionals, addressing potential in-house expertise gaps. This strategic approach not only reduces operational costs but also enhances project efficiency and productivity. By leveraging engineering services outsourcing and automotive engineering services outsourcing, organizations can effectively manage their resources and focus on their core competencies, ultimately contributing to their overall growth and success.

What will be the Size of the US Engineering Services Outsourcing Market During the Forecast Period?

To learn more about this market report, View Report Sample

US Engineering Services Outsourcing Market Segmentation

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Sourcing Outlook

- Offshore

- Onshore

- End-user Outlook

- Telecom

- Automotive

- Healthcare

- Aerospace

- Semiconductor and others

The market share growth by the offshore segment will be significant during the market forecasting period. The term offshore outsourcing describes the transfer of all or a portion of the engineering processes to a different organization located abroad. This segment's nominal growth can be attributed to the ease of access to skilled and talented human resources in the US as well as the availability of resources that are both cost-effective and readily available.

Get a glance at the market contribution of various segments. View the PDF Sample

The offshore segment was valued at USD 17.18 billion in 2018. However, due to a number of factors including the rate of global inflation, the high cost of training employees, high churn rates, and a growing preference for outsourcing to onshore partners, it is anticipated that the offshore segment in the US will grow more slowly than the onshore segment.

In the US, there is an increasing amount of opposition to offshore outsourcing, which claims that offshoring is to blame for the loss of job opportunities. The US government has already erected a number of onerous trade restrictions against its significant trading partners. During the forecast period, this is predicted to slow down international trade. These limitations would have a negative effect on the expansion of the US outsourcing market for engineering services and architectural engineering and construction solutions. During the forecast period, it is anticipated that value-based or collaborative partnerships between customer organizations and outsourced ESPs may experience significant growth.

US Engineering Services Outsourcing Market Dynamics

Iron ore demand and supply analysis highlights the evolving dynamics of the iron market, influenced by factors like iron ore price volatility and steel industry demand. Top iron ore exporters and producers play a crucial role in maintaining supply chain stability, while the recycling of steel and the adoption of alternative steel production methods are gaining momentum. Sustainable mining practices are increasingly prioritized to promote environmental care. The demand for high-grade iron ore continues to rise, particularly in infrastructure development, as it plays a key role in modern construction. Iron ore pricing forecasts remain essential for strategic planning, and the impact of decarbonization on iron ore demand reflects the industry's shift towards eco-friendly solutions and green steel production. Additionally, iron ore export dynamics are critical to global trade flows, further shaping the market's future.

The US engineering services outsourcing market is experiencing significant growth, driven by the adoption of advanced technologies such as cloud-based engineering software, automation mechanisms, and platform as a service (PaaS). OEMs and end application enterprises are increasingly turning to engineering service providers (ESPs) for expertise in G Technology, including the Internet of Things (IoT) and artificial intelligence (AI) to enhance their product offerings.

ESPs are leveraging AI and machine learning (ML) to streamline designing services, from computer aided design (CAD) and computer aided engineering (CAE) to computer aided manufacturing (CAM), and CNC machines. Cloud-based engineering software enables real-time collaboration and access to the latest design iterations from anywhere. Automation mechanisms and digital twins help optimize manufacturing processes and improve product performance. On-shore outsourcing ensures data security and intellectual property protection. Overall, the US engineering services outsourcing market is poised for continued growth, fueled by technological advancements and the increasing demand for innovative solutions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Cost savings from lower labor wages will drive market growth and trends. The cost savings from assigning work to a low-cost workforce and the decrease in associated costs of maintaining additional infrastructure, office space, operations, and IT staffing are the main factors propelling the growth of the market in the US. Due to the US economy's expansion, labor arbitrage has emerged. This practice focuses on moving business operations to less expensive locations. By maintaining a lean workforce and spending less on hiring and retaining staff, businesses benefit from labor arbitrage.

Employing outsourced engineering services allows businesses with a labor shortage to easily and directly access the skilled labor and cutting-edge technologies found in other nations. Additionally, outsourcing enables businesses to scale operations in accordance with demand and their operational needs. Engineering services are typically outsourced by companies or organizations in industrialized or developed nations where the cost of labor is very high. Thus, during the forecast period, the market will grow due to the cost savings from lower labor costs.

Significant Market Trends

Innovation in engineering services outsourcing services is the primary trend in the market growth. Many businesses in sectors like automotive, manufacturing, and pharmaceutical have outsourced a wide range of tasks, from unimportant back-end work to creative work. Comparing the US to China, which made significant investments in innovation and R&D, the US innovation capacity was stagnant for a while. As a result, a number of US businesses, particularly startups, outsourced creative tasks to other nations that offered cheap labor.

Numerous industries frequently outsource the development of cutting-edge technologies like cloud-based delivery, cognitive process automation, quantum cryptography, security, and augmented reality. For businesses in sectors like manufacturing, aerospace, banking, financial services, and insurance (BFSI), outsourcing functions that require innovation have emerged as a financially and strategically viable option. The market in the US will expand due to these factors over the market forecast period.

Major Market Challenge

The risk of intellectual property theft and misuse is a major challenge to the growth of the market. One major obstacle that the US market must overcome is the risk of intellectual property (IP) theft. While sharing or outsourcing their operations, the majority of US organizations maintain strict non-disclosure policies and procedures and keep their R&D operations confidential. These businesses would benefit from being able to stop the theft or leakage of important product designs and solutions. Many businesses won't outsource any work associated with engineering design and product development to other businesses due to the risk of theft of confidential designs and information.

Moreover, theft of intellectual property or other important data by businesses could lead to losing a competitive advantage. As a result, companies are hesitant to share any information with outside service providers about their next-generation products and solutions. The majority of the time, engineering service providers or vendors work under contract with their clients, and any data, designs, or developments produced or derived as a result of that contract belong to the client. Customers consequently worry about the potential loss of intellectual property (IP) technology and designs, data theft, and improper use of these technologies. For organizations that outsource, IP theft can have serious business, legal, and financial repercussions. Therefore, during the forecast period, these factors may limit the growth of the US outsourcing market for engineering services.

Customer Landscape

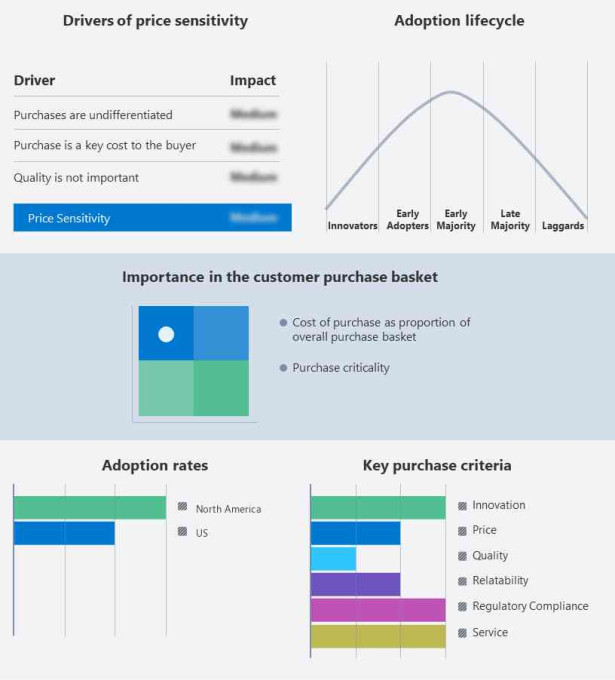

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major US Engineering Services Outsourcing Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atos SE: The company offers engineering services outsourcing which modernizes knowledge and collaboration management.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about 20 market players, including:

- Alten SA

- Backoffice Pro

- Capgemini Service SAS

- Cognizant Technology Solutions Corp.

- Cyient Ltd.

- EPAM Systems Inc.

- FEV Consulting GmbH

- Genpact Ltd.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Infosys Ltd.

- Quest Global Services Pte. Ltd.

- Siemens AG

- Sonata Software Ltd.

- SSA Business Solutions India

- Tata Consultancy Services Ltd.

- Tech Mahindra Ltd.

- Wipro Ltd.

- Flatworld Solutions Pvt. Ltd.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In November 2024, Accenture expanded its engineering services outsourcing portfolio by acquiring a leading engineering consultancy firm specializing in advanced technologies like AI and IoT. This acquisition strengthens Accenture's ability to offer end-to-end engineering services, meeting the growing demand for digital transformation in industries such as automotive and manufacturing.

-

In October 2024, Wipro announced a new partnership with a global aerospace company to provide outsourced engineering services, focusing on design, testing, and quality assurance. The collaboration is aimed at enhancing innovation and reducing time-to-market for aerospace components, addressing the increasing need for specialized engineering expertise in the sector.

-

In September 2024, TCS (Tata Consultancy Services) launched a new suite of engineering services targeting the energy and utilities sector. This offering includes solutions for smart grid development, renewable energy infrastructure, and energy efficiency, responding to the growing demand for sustainable engineering practices and digital solutions in the energy industry.

-

In August 2024, Cognizant unveiled a new engineering services platform that integrates cloud-based tools and advanced analytics to streamline product development processes. This platform is designed to help clients in industries like automotive and healthcare accelerate innovation, reduce costs, and optimize their engineering operations.

Market Analyst Overview

In the realm of ESO, the integration of advanced technologies is driving transformative changes. Cloud-based engineering software facilitates seamless collaboration across global teams, while digital twins enhance real-time simulations for product optimization. Onshore outsourcing leverages computer-aided design (CAD), computer-aided engineering (CAE), and computer-aided manufacturing (CAM) to streamline processes in industrial firms. Electronic design automation (EDA) and 3D printing solutions revolutionize product development, catering to digital technologies and smart products like mobility solutions and kitchen appliances. The Industrial Internet of Things (IIoT) and machine-to-machine systems enable automated operations and efficient resource planning in sectors such as IT services, auto designing, and construction. This convergence of smart technologies and automation fosters integrated solutions that propel the ESO market forward in innovation and efficiency.

Further, in the dynamic landscape of engineering services outsourcing (ESO), advancements in technology are reshaping industry practices. Cloud-based engineering software and digitalization enable onshore outsourcing firms to leverage computer-aided design (CAD), computer-aided engineering (CAE), and computer-aided manufacturing (CAM) for efficient product development. Industrial automation and IoT integrate seamlessly with 5G networks, enhancing remote product development and edge analytics. AI and machine learning drive innovation in digital transformational services, while digital twins optimize enterprise asset management. Smart technologies like 3D printing and extended realities (AR/VR) revolutionize industries such as healthcare and consumer electronics. As firms embrace these technologies, certified resources ensure data security and protect intellectual property (IP), fostering a robust ecosystem for engineering excellence and global competitiveness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018- 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.14% |

|

Market growth 2024-2028 |

USD 187.62 billion |

|

Market structure |

USD Fragmented |

|

YoY growth 2023-2024(%) |

24.42 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alten SA, Atos SE, Backoffice Pro, Capgemini Service SAS, Cognizant Technology Solutions Corp., Cyient Ltd., EPAM Systems Inc., FEV Consulting GmbH, Flatworld Solutions Pvt. Ltd., Genpact Ltd., HCL Technologies Ltd., Honeywell International Inc., Infosys Ltd., Quest Global Services Pte. Ltd., Siemens AG, Sonata Software Ltd., SSA Business Solutions India, Tata Consultancy Services Ltd., Tech Mahindra Ltd., and Wipro Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this US Engineering Services Outsourcing Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market vendors

We can help! Our analysts can customize this market research and growth report to meet your requirements.