Enterprise Information Management (EIM) Market Size 2025-2029

The enterprise information management (eim) market size is forecast to increase by USD 106.1 billion at a CAGR of 17.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for digitalization and the extension of digital transformation initiatives into the realm of information management. As businesses continue to prioritize data-driven decision making and operational efficiency, the need for comprehensive EIM solutions has become paramount. However, the integration of disparate systems and applications poses a significant challenge. Many organizations face the issue of unscalable applications that hinder seamless data flow and prevent the realization of the full potential of their EIM investments.

- To capitalize on this market opportunity, companies must focus on addressing these integration challenges through innovative solutions and strategic partnerships. By doing so, they can effectively navigate the complexities of EIM and gain a competitive edge in today's data-driven business landscape.

What will be the Size of the Enterprise Information Management (EIM) Market during the forecast period?

- Enterprise Information Management (EIM) is a critical business function that encompasses security, warehousing, visualization, and product development. Driven by onboarding and governance, EIM is transforming businesses through compliance and driven decision making. Business intelligence catalogs and lineage enable monetization through as-a-service offerings and governance frameworks. Innovation is at the forefront, with privacy, migration, and integrity ensuring data quality. Fraud detection and driven reporting are essential components, as is driven operations and pipeline management.

- Enterprise management effectiveness is improved through driven culture and lifecycle management. Architecture and strategy are key to successful implementation, while driven marketing and transformation continue to shape the industry landscape.

How is this Enterprise Information Management (EIM) Industry segmented?

The enterprise information management (eim) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

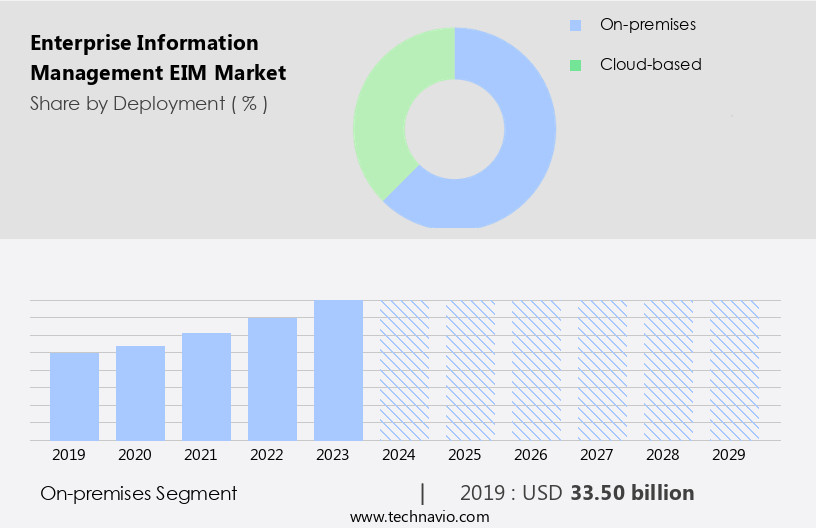

- Deployment

- On-premises

- Cloud-based

- End-user

- BFSI

- Healthcare

- Manufacturing

- Retail

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

The market's on-premises model is preferred by businesses managing sensitive data, providing them with complete control over their information and systems. This approach involves organizations owning and maintaining the necessary hardware, software, and security measures within their physical infrastructure, such as local servers and data centers. The on-premises model is particularly advantageous for industries dealing with confidential information, ensuring a higher level of security and adherence to industry regulations. Furthermore, it offers flexibility in terms of customization and seamless integration with existing enterprise systems. Effective enterprise management is crucial in various sectors, including banking, aerospace & defense, transportation and logistics, energy and power, and customer-focused industries like hospitality.

Mismanagement of business processes can lead to inaccuracies, breaches, and potential financial losses. Cloud-based software solutions have gained popularity, but on-premises models continue to be favored due to the importance of data security and customization. In the realm of IT and telecommunication, timeliness and accuracy are essential for successful operations. In the financial services sector, risk management and fraud prevention are top priorities. Insurance companies focus on accessibility and customer service, while energy and power industries require reliable and secure data management for efficient operations. Enterprise management encompasses various aspects, including security, compliance, and digital workflows.

Open-source solutions and digital transformation have influenced business management, leading to the adoption of innovative technologies and strategies. However, the on-premises model remains a viable option for organizations seeking greater control and customization in their EIM systems.

The On-premises segment was valued at USD 33.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market leads the global enterprise information management (EIM) sector due to its early adoption of technologies and intensive growth. With a technologically mature industrial sector and abundant use cases, the region's strong enterprise management and data regulatory standards fuel market expansion. However, as we look ahead, growth may plateau as the market nears saturation. Effective EIM solutions are essential for businesses in various industries, including banking, aerospace & defense, transportation and logistics, energy and power, and customer-centric sectors like hospitality. These industries rely on timely, accurate data to streamline business processes and mitigate risks. Mismanagement of data can lead to breaches, security issues, and financial losses.

Cloud-based software and digital workflows are transforming EIM, offering improved accessibility and cost savings. Open-source solutions and big data analytics are also gaining traction, enabling better risk management and fraud detection in financial services and insurance industries. Enterprise management, software development, IT and telecommunication, and other sectors are integrating EIM into their operations to enhance efficiency and productivity. The integration of EIM into business processes is crucial for maintaining a competitive edge in today's data-driven economy. Despite these advancements, challenges remain. Ensuring data security and privacy, managing the increasing volume and variety of data, and integrating disparate systems are some of the major concerns for businesses adopting EIM.

As the market evolves, addressing these challenges will be key to driving growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Enterprise Information Management (EIM) Industry?

- The primary catalyst fueling market growth is the increasing demand for digitalization.

- The digitalization trend sweeping various industries worldwide, including consumer goods, healthcare, manufacturing, and retail, is driving up the adoption of IT resources. However, this digital transformation comes with the risk of cyberattacks. In response, there is a growing demand for encryption management solutions, which serve as essential tools for preventing cyber threats. Technological innovations, such as the integration of chatbots in customer support applications and the implementation of the bring your own device (BYOD) policy, have heightened the need for proactive cybersecurity measures. The popularity of the BYOD policy is on the rise, allowing employees to access enterprise data using personal devices like smartphones and laptops.

- This trend increases the importance of robust cybersecurity measures to protect sensitive business information.

What are the market trends shaping the Enterprise Information Management (EIM) Industry?

- The digital transformation trend mandates extending the scope of Enterprise Information Management (EIM) to enhance organizational efficiency and effectiveness.

- Enterprise Information Management (EIM) is a technique aimed at efficiently managing organizational information to maximize its usability and value. The primary objective of EIM is strategic information governance. Technological innovations, such as cloud computing, blockchain, advanced analytics, big data, Internet of Things (IoT), virtual assistants, machine learning, augmented reality, and virtual reality, are driving EIM adoption. These technologies enable organizations to gain a competitive edge in the market. EIM offers cost-effective solutions for businesses to transition from conventional methods to modern models for business processes.

- With the increasing data generation, we anticipate a rise in the volume and diversity of information produced. EIM empowers enterprises to effectively manage this data influx and leverage it to drive business growth. Innovations in technology are transforming the way businesses manage and utilize their information assets.

What challenges does the Enterprise Information Management (EIM) Industry face during its growth?

- Unscalable applications pose a significant integration challenge, hindering industry growth by limiting the ability to efficiently and effectively connect and integrate various systems and components.

- Enterprise Information Management (EIM) involves integrating various applications, including Customer Relationship Management (CRM), Transportation Management Systems (TMS), and Supply Chain Management (SCM), within an organization. The integration process can be complex due to the scalability issues arising from the increasing popularity of Software as a Service (SaaS) and the use of different technologies between applications, such as SAP and cloud-based solutions. The integration of third-party applications or custom-made applications further adds to the complexity for enterprises. The technological differences between applications necessitate a thorough understanding of each system and the ability to bridge the gaps between them.

- The complexity of EIM is a significant challenge for businesses seeking to optimize their operations and gain a competitive edge. Despite these challenges, the integration of EIM applications can lead to improved data accuracy, streamlined workflows, and enhanced operational efficiency.

Exclusive Customer Landscape

The enterprise information management (eim) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the enterprise information management (eim) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, enterprise information management (eim) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABBYY Solutions Ltd. - The company specializes in enterprise information management solutions, providing innovative technologies such as Abbyy Timeline, Abbyy Vantage, and Abbyy Flexicapture. These tools streamline document processing, enabling organizations to efficiently manage and extract insights from their data. By leveraging advanced technologies like artificial intelligence and machine learning, these solutions enhance data accuracy, improve workflows, and boost operational efficiency. With a focus on innovation and customer success, the company empowers businesses to make informed decisions and drive growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABBYY Solutions Ltd.

- Adobe Inc.

- Barracuda Networks Inc.

- Cognizant Technology Solutions Corp.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- Hyland Software Inc.

- International Business Machines Corp.

- Jatheon Technologies Inc.

- Kodak Alaris Inc.

- KYOCERA Corp.

- M Files

- Microsoft Corp.

- Mimecast Ltd.

- Open Text Corp.

- Oracle Corp.

- Pagefreezer Software Inc.

- Proofpoint

- SAP SE

- Veritas Technologies LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Enterprise Information Management (EIM) Market

- The market has witnessed significant developments in recent years, with key players focusing on product launches, technological collaborations, mergers and acquisitions, and geographic expansions to strengthen their market presence. In February 2025, OpenText Corporation, a global leader in Enterprise Information Management, announced the launch of its new Intelligent Information Management solution, Media Management 2. This innovative product offers advanced capabilities in content analytics, automation, and security to help organizations manage and monetize their media assets more effectively. (Source: OpenText Press Release) In October 2024, IBM and Google Cloud entered into a strategic collaboration to integrate IBM's Watson AI capabilities into Google Cloud's portfolio.

- This collaboration is expected to enhance EIM solutions by providing advanced analytics, machine learning, and AI functionalities, enabling organizations to gain deeper insights from their data. (Source: IBM Press Release) In June 2024, Infor announced the acquisition of GT Nexus, a leading provider of supply chain visibility and collaboration solutions. This acquisition is expected to expand Infor's EIM offerings, enabling the company to cater to the growing demand for end-to-end supply chain management solutions. (Source: Infor Press Release) In March 2024, OpenText Corporation announced its expansion into the Middle East and Africa markets by opening new offices in Dubai and Johannesburg.

- This strategic move is aimed at capitalizing on the growing demand for EIM solutions in these regions and expanding the company's global footprint. (Source: OpenText Press Release) According to the latest market research by Technavio, the global EIM market is expected to grow at a CAGR of over 10% between 2021 and 2026, driven by the increasing adoption of cloud-based EIM solutions and the growing need for data security and compliance. (Source: Technavio Report)

Research Analyst Overview

Enterprise Information Management (EIM) has emerged as a critical business function in today's digital economy. Effectiveness and timeliness are two essential aspects of EIM that have gained significant importance in various industries, including IT and telecommunication, banking, aerospace & defense, transportation and logistics, energy and power, and customer-focused sectors. Enterprise management software development plays a pivotal role in enabling organizations to streamline their business processes and mitigate mismanagement. EIM solutions help in ensuring accuracy and security of information, which is crucial for risk management in the era of digital workflows. The banking sector, for instance, relies heavily on EIM to manage vast amounts of financial data.

Timely and effective access to information is essential for making informed decisions and providing superior customer service. In the aerospace & defense industry, EIM solutions help in managing complex supply chains and ensuring compliance with stringent regulations. However, the increasing reliance on EIM also brings new challenges. Data breaches and security concerns are becoming more frequent, leading to significant financial and reputational damage. Cloud-based software solutions have gained popularity due to their accessibility and cost-effectiveness. However, they also introduce new risks, such as data privacy and security. Fraud prevention is another area where EIM plays a crucial role, particularly in financial services and insurance industries.

EIM solutions help in detecting and preventing fraudulent activities, ensuring regulatory compliance, and minimizing financial losses. Open-source solutions have also gained traction in the EIM market due to their flexibility and cost-effectiveness. They offer an alternative to proprietary software and provide greater control to organizations over their data. The evolving market dynamics of EIM are driven by various factors, including the increasing demand for real-time data access, the need for greater security and compliance, and the shift towards cloud-based solutions. The market is expected to grow significantly in the coming years, driven by the increasing adoption of digital workflows and the need for better risk management.

In conclusion, Enterprise Information Management has become an essential function for businesses in various industries. Effectiveness and timeliness are critical factors that drive the adoption of EIM solutions. The market is evolving rapidly, with new challenges and opportunities emerging constantly. Organizations need to stay abreast of these trends and invest in the right EIM solutions to stay competitive and mitigate risks.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Enterprise Information Management (EIM) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.5% |

|

Market growth 2025-2029 |

USD 106.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.5 |

|

Key countries |

US, Canada, UK, Germany, China, France, Italy, Japan, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Enterprise Information Management (EIM) Market Research and Growth Report?

- CAGR of the Enterprise Information Management (EIM) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the enterprise information management (eim) market growth of industry companies

We can help! Our analysts can customize this enterprise information management (eim) market research report to meet your requirements.