Business Information Market Size 2025-2029

The business information market size is forecast to increase by USD 79.6 billion, at a CAGR of 7.3% between 2024 and 2029.

- The market is characterized by the increasing demand for customer-centric solutions as enterprises adapt to evolving customer preferences. This shift necessitates the provision of real-time, accurate, and actionable insights to facilitate informed decision-making. However, this market landscape is not without challenges. The threat of data misappropriation and theft looms large, necessitating robust security measures to safeguard sensitive business information. As businesses continue to digitize their operations and rely on external data sources, ensuring data security becomes a critical success factor. Companies must invest in advanced security technologies and implement stringent data protection policies to mitigate these risks. Navigating this complex market requires a strategic approach that balances the need for customer-centric solutions with the imperative to secure valuable business data.

What will be the Size of the Business Information Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In today's data-driven business landscape, the continuous and evolving nature of market dynamics plays a pivotal role in shaping various sectors. Data integration solutions enable seamless data flow between different systems, enhancing cloud-based business applications' functionality. Data quality management ensures data accuracy and consistency, crucial for strategic planning and customer segmentation. Data infrastructure, data warehousing, and data pipelines form the backbone of business intelligence, facilitating data storytelling and digital transformation. Data lineage and data mining reveal valuable insights, fueling data analytics platforms and business intelligence infrastructure. Data privacy regulations necessitate robust data management tools, ensuring compliance and protecting sensitive information.

Sales forecasting and business intelligence consulting offer valuable industry analysis and data-driven decision making. Data governance frameworks and data cataloging maintain order and ethics in the vast expanse of big data analytics. Machine learning algorithms, predictive analytics, and real-time analytics drive business intelligence reporting and process modeling, leading to business process optimization and financial reporting software. Sentiment analysis and marketing automation cater to customer needs, while lead generation and data ethics ensure ethical business practices. The ongoing unfolding of market activities and evolving patterns necessitate the integration of various tools and frameworks, creating a dynamic interplay that fuels business growth and innovation.

How is this Business Information Industry segmented?

The business information industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Healthcare and life sciences

- Manufacturing

- Retail

- Others

- Application

- B2B

- B2C

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW).

- North America

By End-user Insights

The bfsi segment is estimated to witness significant growth during the forecast period.

In the dynamic business landscape, data-driven insights have become essential for strategic planning and decision-making across various industries. The market caters to this demand by offering solutions that integrate and manage data from multiple sources. These include cloud-based business applications, data quality management tools, data warehousing, data pipelines, and data analytics platforms. Data storytelling and digital transformation are key trends driving the market's growth, enabling businesses to derive meaningful insights from their data. Data governance frameworks and policies are crucial components of the business intelligence infrastructure. Data privacy regulations, such as GDPR and HIPAA, are shaping the market's development.

Data mining, predictive analytics, and machine learning algorithms are increasingly being used for sales forecasting, customer segmentation, and churn prediction. Business intelligence consulting and industry analysis provide valuable insights for organizations seeking competitive advantage. Data visualization dashboards, market research databases, and data discovery tools facilitate data-driven decision making. Sentiment analysis and predictive analytics are essential for marketing automation and business process optimization. Data ethics and real-time analytics are emerging areas of focus, ensuring transparency and accountability in data usage. Financial reporting software and data cataloging are essential for maintaining accurate financial records and managing data assets effectively.

Marketing automation, salesforce automation, and competitive intelligence software are critical for businesses aiming to optimize their operations and stay ahead of the competition. Predictive analytics and customer churn prediction help businesses retain their customers and improve their overall customer experience. The market for business intelligence software is expected to grow significantly due to the increasing demand for data-driven insights and the need for efficient decision-making processes. The market is witnessing significant growth as businesses increasingly rely on data to drive their strategic decisions. The market offers a range of solutions, including data integration, data quality management, data warehousing, data analytics, and business intelligence tools, to help organizations make informed decisions and gain a competitive edge.

The market's evolution is shaped by trends such as digital transformation, data-driven decision making, and the increasing importance of data governance and ethics.

The BFSI segment was valued at USD 53.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

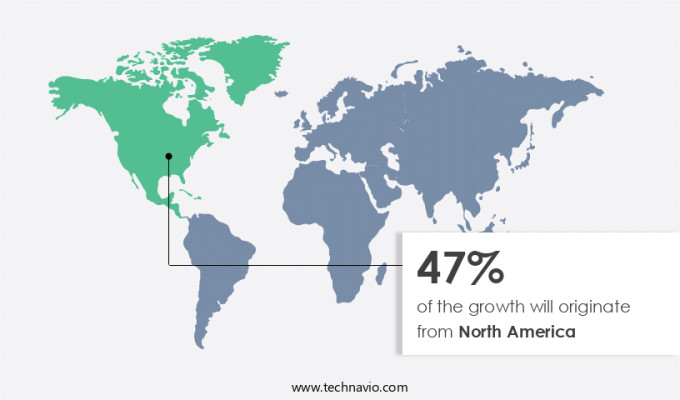

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, valued at USD55.5 billion in 2023 and projected to reach USD82.7 billion by 2032, expanding at a Compound Annual Growth Rate (CAGR) of 5.46%. North America dominates The market due to the maturity and development of various sectors such as finance, healthcare, retail, automotive, information technology, telecommunications and utilities, insurance, media, government, and public sector.

Companies in these sectors utilize various business information products and services, including company-related information, financial, tax, and accounting solutions, and governance, risk, and compliance solutions, to expand their customer base and increase revenues.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global business information market size and forecast projects growth, driven by business information market trends 2025-2029. B2B business intelligence solutions leverage AI-driven business analytics platforms for insights. Business information market growth opportunities 2025 include market research for enterprises and business data for startups, supporting decision-making. Business intelligence software optimizes operations, while business information market competitive analysis highlights key providers. Sustainable business information practices align with eco-friendly data trends. Business information regulations 2025-2029 shapes business information demand in North America 2025. Real-time business data solutions and premium business information insights boost value. Business information for SMEs and customized business analytics target niches. Business information market challenges and solutions address data accuracy, with direct procurement strategies for analytics and business information pricing optimization enhancing profitability. Data-driven business information analytics and AI-enhanced business data trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Business Information Industry?

- Adapting enterprise business strategies to evolving customer preferences is a crucial market trend, as companies that effectively respond to shifting preferences are more likely to remain competitive and successful.

- In today's business landscape, companies face the challenge of adapting to evolving customer behaviors and preferences. To remain competitive, organizations require a deep understanding of their customers and the ability to swiftly modify their offerings. The market services play a crucial role in this regard. These services offer data integration solutions that enable seamless data flow between cloud-based business applications, ensuring data quality management and accurate data warehousing. Moreover, data pipelines facilitate the transfer of data from various sources to the data warehouse, allowing for strategic planning and customer segmentation. Data storytelling is another essential aspect of business information services, which helps organizations make data-driven decisions by presenting complex data in an immersive and harmonious manner.

- Digital transformation is a significant trend driving the adoption of business information services. Cloud-based applications and Salesforce automation are becoming increasingly popular, and data lineage ensures that organizations can trace the origin and evolution of their data, enhancing transparency and accountability. Businesses can leverage these services to gain valuable insights, modify their products and services, and tailor their marketing and promotional strategies to reach their consumers effectively. By staying informed of the latest trends and customer requirements, organizations can create a competitive edge and ensure long-term success.

What are the market trends shaping the Business Information Industry?

- Customer-centric solutions are increasingly in demand in the current market trend. Provision of services tailored to meet the unique needs and preferences of individual customers is a mandatory approach for businesses aiming for success.

- The market caters to the provision of quantitative and qualitative data and insights for businesses. With a growing focus on maximizing returns on investment, there is a rising demand for solutions that deliver quick results. To meet this need, business information providers are developing more customer-centric offerings. These solutions aim to help businesses achieve their objectives, such as cost reduction, productivity improvement, and revenue growth. For instance, in the financial services sector, business information providers offer automation solutions to reduce organizational headcount. In the realm of business intelligence, competitive intelligence software, data analytics platforms, and data lakes are becoming increasingly popular.

- Data management tools, data mining, and industry analysis are also crucial components of business intelligence infrastructure. Data privacy regulations necessitate the implementation of data governance frameworks to ensure data security and compliance. Business intelligence consulting services can provide valuable insights to help businesses make informed decisions. Overall, the market is evolving to meet the changing needs of businesses, offering innovative solutions to drive growth and success.

What challenges does the Business Information Industry face during its growth?

- The threat of data misappropriation and theft poses a significant challenge to the industry's growth, requiring robust cybersecurity measures to safeguard valuable information and maintain trust with stakeholders.

- The market plays a crucial role in enabling data-driven decision making for organizations by providing access to valuable insights from big data analytics. This includes data modeling, business intelligence reporting, business process modeling, predictive analytics, customer churn prediction, and more. Business intelligence software, data discovery tools, market research databases, data visualization dashboards, sentiment analysis, and other advanced tools are utilized to extract meaningful information from vast amounts of data. However, the handling of critical and confidential business data comes with significant risks. Data breaches, whether intentional or accidental, can result in severe financial losses for businesses and individuals.

- The increasing use of cloud services and digital file sharing between organizations and information providers necessitates robust security measures to prevent data theft. Such incidents can not only lead to financial losses but also damage the reputation of information providers and hinder market growth. Therefore, ensuring secure data handling practices is essential for the growth and success of the market.

Exclusive Customer Landscape

The business information market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the business information market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, business information market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bloomberg LP - The company delivers comprehensive business insights through Bloomberg Businessweek, a leading source for global news and analysis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bloomberg LP

- Capita Plc

- CQG

- Deloitte Touche Tohmatsu Ltd.

- Dun and Bradstreet Holdings Inc.

- Equifax Inc.

- Ernst and Young Global Ltd.

- Experian Plc

- FactSet Research Systems Inc.

- Informa PLC

- KPMG International Ltd.

- Moodys Corp.

- Morningstar Inc.

- News Corp.

- PricewaterhouseCoopers LLP

- Refinitiv

- RELX Plc

- S and P Global Inc.

- Thomson Reuters Corp.

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Business Information Market

- In February 2024, IBM announced the acquisition of HCL Technologies' marketing and sales analytics business, W12 Studios, to strengthen its Business Intelligence (BI) capabilities and expand its portfolio of AI and analytics solutions (IBM Press Release, 2024). This strategic move is expected to help IBM better cater to the growing demand for data-driven insights and advanced analytics in various industries.

- In May 2024, Microsoft launched Power BI Premium per user, a flexible pricing model for its business intelligence and analytics platform, Power BI. This new offering enables organizations to pay based on the number of users, providing more flexibility and cost savings for businesses of all sizes (Microsoft Blog, 2024). This development is expected to attract a broader range of customers and intensify competition in the BI market.

- In September 2024, Google Cloud Platform (GCP) announced a major partnership with Snowflake, a leading cloud-based data warehousing platform. The collaboration enables seamless integration between Snowflake and GCP's BigQuery, allowing users to easily transfer data and perform advanced analytics in BigQuery (Google Cloud Blog, 2024). This strategic alliance is expected to enhance GCP's data analytics capabilities and attract more businesses to its cloud platform.

- In January 2025, SAP announced the acquisition of Qualtrics, a leading customer experience management (CEM) software company, for approximately USD15.3 billion. This acquisition is expected to help SAP expand its offerings beyond traditional business intelligence and enterprise resource planning (ERP) solutions, positioning the company as a comprehensive provider of customer experience and business intelligence solutions (SAP Press Release, 2025). This development is expected to create significant synergies and growth opportunities for SAP in the rapidly growing CEM market.

Research Analyst Overview

- In today's data-driven business landscape, market opportunities and challenges coexist, shaping the evolution of industries. Disruptive technologies, such as mobile technology and blockchain, are transforming product development and data culture. Market penetration strategies are being redefined through digital transformation and customer behavior analysis. Despite these opportunities, market challenges persist. Industry regulations and data privacy compliance are becoming increasingly complex, requiring heightened data literacy. M&A activity and investment trends reflect the industry's ongoing quest for business intelligence maturity. Emerging technologies, like cloud computing and data-driven innovation, are fueling market growth. The competitive landscape analysis reveals a race to adopt advanced business intelligence tools and strategies.

- Competitors are leveraging disruptive technologies to gain a competitive edge. Moreover, the industry trends indicate a shift towards data-centric strategies, with companies investing in emerging technologies to enhance their competitive positioning. The future of business intelligence lies in harnessing the power of data to drive innovation and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Business Information Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 79.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, UK, China, Germany, Canada, Japan, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Business Information Market Research and Growth Report?

- CAGR of the Business Information industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the business information market growth of industry companies

We can help! Our analysts can customize this business information market research report to meet your requirements.