Entertainment And Amusement Market Size 2025-2029

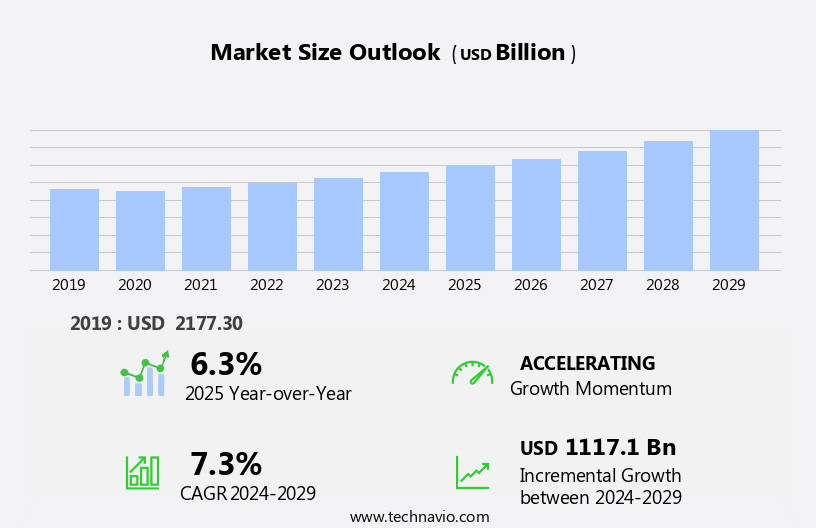

The entertainment and amusement market size is forecast to increase by USD 1117.1 billion, at a CAGR of 7.3% between 2024 and 2029.

- The market is experiencing dynamic growth, fueled by the increasing popularity of social media and the emergence of virtual theme parks. Social media platforms have become a powerful tool for engagement and promotion, enabling entertainment companies to reach larger audiences and build stronger fan communities. Virtual theme parks, offering immersive experiences through digital platforms, are gaining traction as an alternative to traditional brick-and-mortar venues, providing accessibility and convenience to consumers. However, this market is not without challenges. High maintenance costs associated with creating and maintaining engaging content and advanced technology infrastructure pose significant obstacles for players.

- Companies must navigate these challenges by investing in innovative technologies and partnerships to reduce costs and improve operational efficiency. By staying attuned to these trends and challenges, entertainment and amusement industry players can capitalize on opportunities for growth and innovation.

What will be the Size of the Entertainment And Amusement Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Ticketing systems streamline entry processes for water parks, theme parks, and live theaters, ensuring guest satisfaction. Safety regulations remain paramount, shaping the design of interactive games, sporting events, and amusement parks. Economic impact studies reveal the significant contribution of special effects, technology integration, and data analytics to the industry. Augmented and virtual reality technologies redefine immersive environments, from bowling alleys to escape rooms, enhancing the sensory experiences for consumers. Social media marketing and digital signage amplify event promotion, while employee training programs hone skills essential for attraction management and customer experience.

Environmental impact is a growing concern, with tour operators and cruise lines investing in sustainable practices and eco-friendly attractions. Lighting design and set creation are crucial elements in creating engaging and memorable experiences. Community engagement initiatives foster positive public relations and contribute to the overall success of entertainment ventures. Continuous innovation in ride design, concert venues, and interactive museums keeps the market vibrant and ever-evolving, offering endless opportunities for leisure time exploration. Mobile applications and customer experience analytics further personalize offerings, ensuring a tailored and enjoyable experience for each visitor.

How is this Entertainment And Amusement Industry segmented?

The entertainment and amusement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Theme Parks

- Arcades

- Cinemas

- Live Events

- Age Group

- 13 to 20 years

- Above 20 years

- Below 12 years

- Technology

- VR Attractions

- Mobile Apps

- Cashless Payments

- Distribution Channel

- Direct Ticketing

- Online Platforms

- Travel Agencies

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

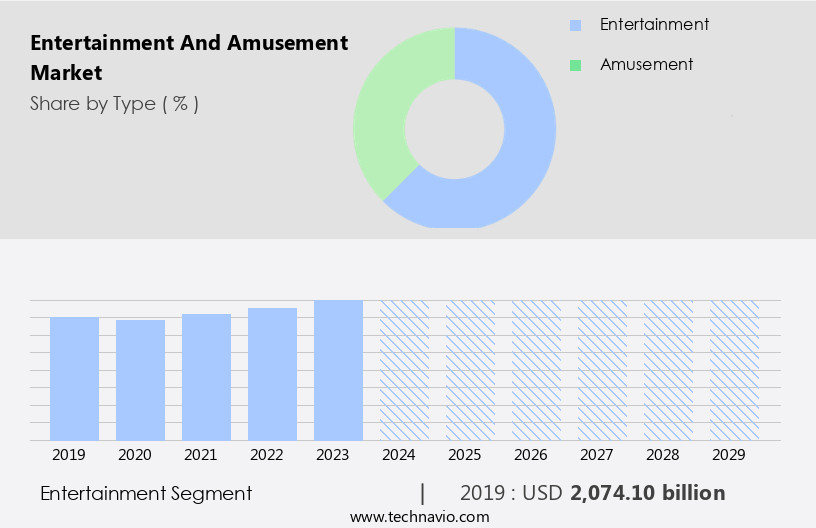

The theme parks segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with consumers seeking immersive experiences that go beyond traditional forms of entertainment. Safety regulations play a crucial role in ensuring the enjoyment and well-being of visitors at water parks, theme parks, and amusement parks. Environmental sustainability is a growing concern, with many attractions integrating technology to reduce their carbon footprint and create more eco-friendly experiences. Live theaters and interactive games offer unique sensory experiences, while sporting events and augmented reality provide opportunities for community engagement and social media marketing. Ticketing systems, sound design, and event planning are essential components of a successful entertainment experience.

Economic impact studies show that the entertainment industry contributes significantly to local economies, creating jobs and driving economic growth. Special effects, technology integration, and data analytics enhance the customer experience, with mobile applications and digital signage providing convenient access to information. Bowling alleys, tour operators, and virtual reality offer alternative forms of entertainment, catering to various demographics. Leisure time activities, such as escape rooms and interactive museums, provide educational and entertaining experiences for families. Concert venues and set design create memorable experiences for music lovers, while ride design and customer experience management ensure guest satisfaction. Employee training and sensory experiences are essential for creating engaging and harmonious work environments.

The entertainment industry continues to innovate, with new trends in ride design, customer experience, and community engagement shaping the market. Amusement parks, cruise lines, and family entertainment centers remain popular destinations for consumers seeking unique and memorable experiences.

The Theme Parks segment was valued at USD 2074.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

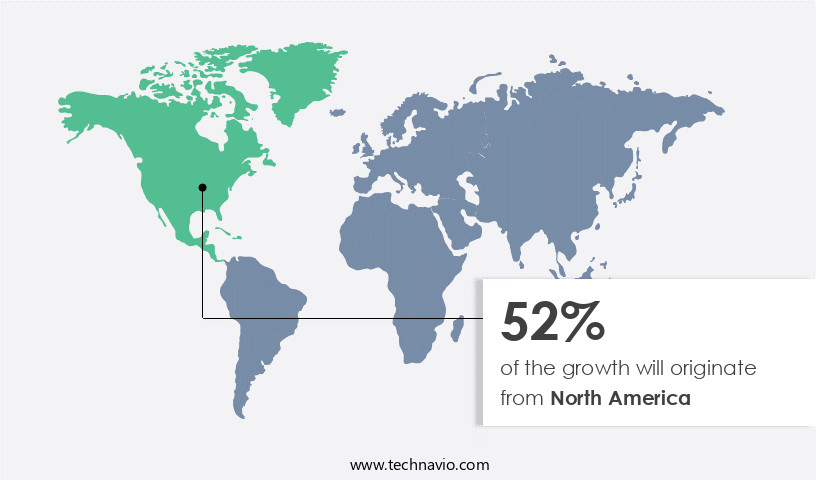

North America is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing spending on leisure activities. With an estimated 42.5-43 million youth aged 10-19 in the US alone, representing around 12.8% of the total population, the target audience for amusement parks and other entertainment venues is expanding. This demographic, along with adults, is drawn to innovative offerings such as immersive rides, advanced technology integration, and unique accommodations and merchandise. Safety regulations are a top priority in the industry, ensuring the well-being of visitors at water parks, theme parks, and other attractions. Environmental sustainability is also a concern, with many establishments implementing eco-friendly practices and technologies.

Live theaters, interactive games, and sporting events offer diverse forms of entertainment, while augmented reality and virtual reality experiences add a new dimension to guest engagement. Public relations, ticketing systems, sound design, economic impact, special effects, data analytics, and social media marketing are essential components of the entertainment industry's success. Event planning, escape rooms, employee training, and interactive museums cater to various audience segments. Concert venues, mobile applications, digital signage, set design, guest satisfaction, sensory experiences, ride design, customer experience, attraction management, community engagement, and family entertainment centers further enrich the landscape. Cruise lines and amusement parks are among the key players in the market, offering unique experiences that cater to diverse demographics.

As the industry continues to evolve, it will integrate advanced technologies, such as artificial intelligence and machine learning, to enhance the overall customer experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the ever-evolving world of consumer culture, the market continues to captivate audiences with innovative experiences. From immersive theme parks and thrilling rides to cinemas showcasing the latest blockbusters and virtual reality escapes, this market offers endless possibilities for fun and enjoyment. Movie theaters, amusement parks, gaming arcades, and live events all contribute to the vibrant landscape of entertainment and amusement. Virtual reality technology, esports, and interactive experiences add new dimensions to traditional forms of amusement. The market caters to diverse demographics, offering family-friendly options as well as adult-oriented experiences. Consumers seek out unique, engaging, and memorable experiences, driving the innovation and growth within the entertainment and amusement industry.

What are the key market drivers leading to the rise in the adoption of Entertainment And Amusement Industry?

- The expansive growth of social media serves as the primary catalyst for market expansion.

- The market experiences significant growth due to the increasing usage of social media and mass communication. With visitors eagerly sharing their experiences, photos, and videos on social networks after their visits, these platforms serve as effective marketing tools for entertainment and amusement parks. In 2024, it is estimated that approximately 75% of visitors to these parks shared their experiences online. This social media engagement inspires and motivates others to visit these attractions, thereby increasing attendance. The far-reaching impact of social media is anticipated to propel the expansion of the global entertainment and amusement industry throughout the forecast period.

- Key market drivers include the immersive and harmonious experiences offered by water parks, theme parks, live theaters, interactive games, sporting events, and the integration of augmented reality technology. Safety regulations and environmental impact are crucial considerations in the industry, ensuring a balance between enjoyment and responsibility. Public relations plays a vital role in managing the reputation of entertainment and amusement businesses, maintaining a positive image and addressing any concerns or incidents promptly.

What are the market trends shaping the Entertainment And Amusement Industry?

- The virtual theme park sector is experiencing significant growth and is emerging as the latest market trend. This dynamic industry is poised to revolutionize the way we experience entertainment.

- The market is experiencing significant transformation due to the integration of virtual reality (VR) technology. Traditional theme parks are investing heavily in VR to enhance visitor experiences, with some even developing stand-alone VR attractions. This trend is not limited to theme parks alone; billions of dollars are being invested in building purpose-built VR theme parks. The adoption of VR technology is influencing marketing and hospitality trends, creating new career opportunities. VR theme parks are based on 360-degree technology, providing users with immersive, real-time experiences. VR innovation extends beyond theme parks, with ticketing systems, sound design, special effects, and technology integration becoming more advanced.

- Data analytics and social media marketing are crucial components of this industry's growth strategy. Special effects and sound design are being enhanced using technology, while ticketing systems are becoming more streamlined and efficient. Social media marketing is essential for attracting and retaining visitors, with immersive environments and interactive experiences being key differentiators. Bowling alleys and tour operators are also embracing VR technology to provide unique experiences. The economic impact of this industry is substantial, with VR technology expected to revolutionize the way we experience entertainment and amusement. The future of this market is bright, with endless possibilities for innovation and growth.

What challenges does the Entertainment And Amusement Industry face during its growth?

- The high maintenance costs represent a significant challenge that can hinder industry growth. It is essential for businesses in this sector to effectively manage and mitigate these expenses to ensure sustainable growth and competitiveness.

- The market encompasses various sectors, including virtual reality, leisure time activities, event planning, and more. Virtual reality technology is revolutionizing the industry, providing immersive experiences for consumers. In the realm of leisure time, lighting design and interactive museums are gaining popularity, offering unique and engaging experiences. Event planning companies leverage mobile applications and digital signage to enhance attendee experience and streamline operations. Escape rooms and employee training programs are also utilizing interactive technologies to create engaging and effective learning environments. The market's dynamics are shaped by the increasing demand for innovative and engaging experiences, as well as the need for safety and maintenance management across rides and exhibits.

- Companies must invest in proper maintenance to ensure visitor satisfaction and safety, as high maintenance costs can be a significant challenge. Virtual reality technology, event planning apps, and interactive museums are just a few examples of how technology is transforming the entertainment and amusement industry.

Exclusive Customer Landscape

The entertainment and amusement market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the entertainment and amusement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, entertainment and amusement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The Walt Disney Company - This enterprise showcases an innovative entertainment hub encompassing arcades, bowling, and laser tag attractions, delivering engaging experiences for diverse audiences. Our cutting-edge Sparky concept sets us apart, ensuring a memorable visit for all.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- The Walt Disney Company

- Universal Studios

- Six Flags Entertainment Corporation

- Cedar Fair Entertainment Company

- Merlin Entertainments Group

- Parques Reunidos

- Europa-Park GmbH & Co Mack KG

- Efteling

- Tivoli A/S

- Everland Resort

- Lotte World

- Nagashima Resort

- Tokyo Disneyland

- Shanghai Disney Resort

- Chimelong Group

- OCT Parks China

- Adlabs Entertainment Ltd.

- Wonderla Holidays Ltd.

- Beto Carrero World

- Hopi Hari

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Entertainment And Amusement Market

- In January 2024, Disney+, a streaming platform by The Walt Disney Company, announced the acquisition of the rights to stream National Geographic content, expanding its content library significantly (Disney Press Release, 2024). In March 2024, Sony Pictures Entertainment and Universal Pictures formed a strategic partnership to co-produce and co-finance up to five films per year, aiming to reduce production costs and share risks in the competitive film industry (Variety, 2024).

- In April 2024, Netflix made a strategic investment of USD500 million in Indian entertainment platform Jiosaavn, marking its entry into the Indian market and strengthening its global presence (Netflix Press Release, 2024). In May 2025, the European Union approved the acquisition of WarnerMedia by AT&T, allowing the media conglomerate to merge its WarnerMedia division with Discovery, Inc., creating a global entertainment powerhouse with an estimated market value of USD150 billion (EU Commission Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, facial recognition technology is increasingly integrated into security systems for enhanced crowd control and crisis management. Game development companies leverage AI and simulation technology to create immersive experiences, while franchise opportunities in this sector continue to thrive. Retail sales are boosted by inclusive design and accessibility features, ensuring a wider customer base. Intellectual property protection is crucial in this industry, with legal compliance a top priority. Security systems employing biometric security solutions, such as facial recognition, are becoming standard in theme parks and other public spaces. Game developers harness AI for interactive storytelling and sensory integration, pushing the boundaries of immersive entertainment.

- Franchise opportunities in this sector, offering proven business models, attract investors. Accessibility features, including closed captioning and audio descriptions, are essential for inclusive design, broadening the reach of entertainment content. Projection mapping and queue management systems optimize the guest experience, while social listening and influencer marketing strategies engage audiences. Risk assessment and emergency response plans are crucial components of effective crisis management in the entertainment industry. Blockchain technology and digital marketing tools, including PPC and affiliate marketing, offer new revenue streams. Adaptive technology and sensory integration enhance the guest experience, creating a competitive edge.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Entertainment And Amusement Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 1117.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Entertainment And Amusement Market Research and Growth Report?

- CAGR of the Entertainment And Amusement industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the entertainment and amusement market growth of industry companies

We can help! Our analysts can customize this entertainment and amusement market research report to meet your requirements.