Equity Management Software Market Size 2024-2028

The equity management software market size is forecast to increase by USD 547.5 billion at a CAGR of 18.51% between 2023 and 2028.

- Equity management software has become an essential tool for institutions and high-net-worth individuals (HNWIs) to manage their investments effectively. The market is driven by several factors, including the increasing number of HNWIs worldwide and the availability of open-source solutions. These factors have led to a surge in demand for advanced equity management software. One significant trend in the market is the integration of healthcare-related features, such as monitoring for potential blood clots and thrombosis, which can be life-threatening during surgery. These features help prevent complications and ensure the protection of vital organs. Additionally, the software is increasingly being used to manage blood loss during surgeries and perform various diagnostic tests related to blood clots. Furthermore, ensuring data security and privacy is a major concern for users, particularly in the healthcare sector. Despite these challenges, the market is expected to grow significantly due to the increasing demand for efficient and effective investment management solutions.

What will the size of the market be during the forecast period?

- The market is a significant segment in the healthcare industry, providing solutions to manage the financial aspects of hospitals and healthcare organizations. This software plays a crucial role in ensuring the efficient and effective use of resources, particularly in the context of surgeries and blood management. Hospitals face numerous challenges in managing their financial resources, especially during surgeries. The use of blood products and management of blood clots is a critical area where hospitals require strong financial management. Thrombosis, a condition characterized by the formation of blood clots, poses a significant risk during surgeries. Extracorporeal membrane oxygenation (ECMO) and extracorporeal membrane oxidation (ECMO) are common procedures used to treat various conditions, including thromboembolism. Equity management software assists hospitals in managing the financial implications of these procedures. It helps in tracking the usage and inventory of blood products, monitoring antithrombin antigen levels, and conducting activity assays and immunological assays.

- By providing real-time insights into the financial implications of thrombosis, equity management software helps hospitals in making informed decisions and optimizing their resources. In conclusion, equity management software is an essential tool for hospitals in managing their financial resources, particularly in the context of surgeries and blood management. It helps in tracking the usage and inventory of blood products, monitoring antithrombin antigen levels, and managing the financial implications of blood clots and thrombosis. By optimizing their financial resources, hospitals can improve their operational efficiency, reduce costs, and enhance patient care.

How is this market segmented and which is the largest segment?

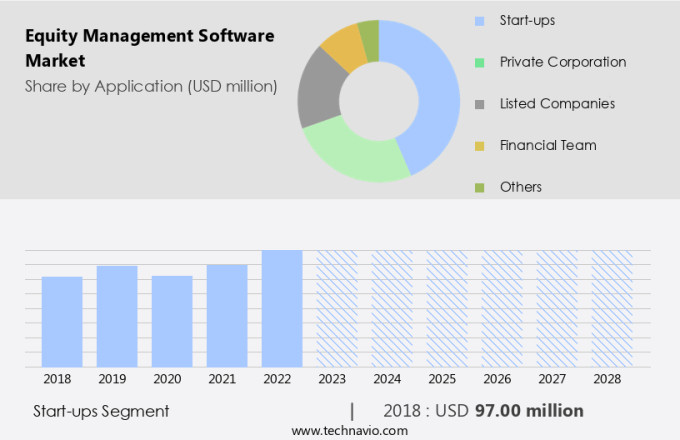

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Start-ups

- Private corporation

- Listed companies

- Financial team

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Application Insights

- The start-ups segment is estimated to witness significant growth during the forecast period.

Equity management software is a valuable tool for businesses, particularly in the healthcare industry, where accurate tracking of assets is crucial. This software enables effective control of all equity-related activities, ensuring quality and streamlining workflows. Its deployment is swift and requires minimal initial investment, making it accessible to start-ups. The increasing popularity of cloud-based solutions is driving the market's growth, as they offer several advantages over traditional methods. Cloud-based equity management software provides predictable expenses, eliminating the need for a powerful local server and maintenance fees. Additionally, it significantly reduces IT personnel costs and offers free upgrades as part of the subscription or support fees.

This platform is ideal for start-ups requiring a centralized source to share updated information. In the medical field, this software plays a vital role in managing and preventing conditions such as thrombosis and blood clots, which can lead to complications like blood loss and damage to vital organs during surgery. By utilizing advanced tests to monitor and manage blood clots, these tools contribute to improved patient outcomes and overall efficiency in healthcare operations.

Get a glance at the market report of share of various segments Request Free Sample

The Start-ups segment was valued at USD 97.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

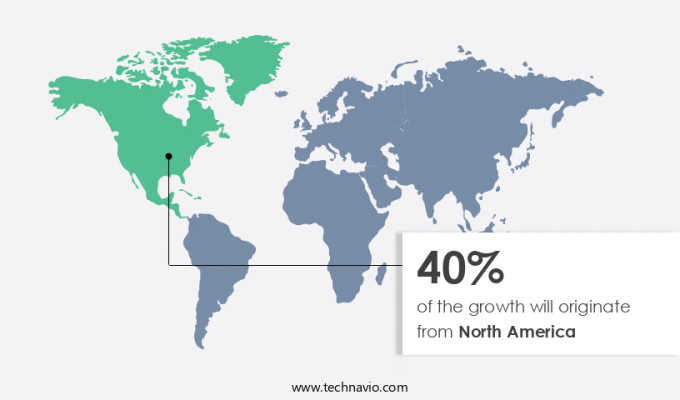

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the equities management software market is experiencing significant growth due to the increasing importance of efficient supply chain management and global trade compliance in an uncertain regulatory environment. The collapse of the Trans-Pacific Partnership and potential modifications to the North American Free Trade Agreement, as well as the US redefining its trade relationships with China, are altering trade dynamics in the region. Despite these political changes, North American enterprises continue to expand their business globally. To mitigate the potential negative effects of shifting trade regulations, they are turning to equity management automation through trade management software. This technology enables them to streamline their operations, enhance transparency, and ensure regulatory compliance.

Additionally, the therapeutic segment of the equities management software market, which includes applications for managing blood clotting disorders such as Antithrombin Deficiency, is expected to grow due to the increasing prevalence of genetic disorders and the need for effective treatments, including goat milk and lyophilized antithrombin.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Equity Management Software Market ?

Vendors pricing strategies is the key driver of the market.

- In today's competitive market, companies are adopting customer-focused pricing strategies to meet the unique needs and value perceptions of their clients. These pricing models vary based on the differentiating features and added value of software solutions. Economic and market factors, such as return on investment (ROI), availability of free models, and limited IT budgets, are crucial considerations for customers during software implementation. companies must accommodate diverse customer pricing preferences and budgets, leading to a reevaluation of software pricing and delivery models.

- For instance, in the healthcare sector, software for managing procedures related to Thromboembolism, Extracorporeal membrane oxygenation, and monitoring Antithrombin antigen levels may require customized pricing due to the critical nature of these applications. companies offering activity assays and immunological assays may also need to consider tailored pricing strategies to cater to the specific requirements of hospitals and clinics. By offering flexible pricing models, companies can build strong customer relationships and gain a competitive edge in the market.

What are the market trends shaping the Equity Management Software Market?

The rising number of high-net-worth individuals (HNWIs) globally is the upcoming trend in the market.

- High net worth individuals (HNWIs), defined as those with a net worth of over USD1 million, have seen a significant increase in number worldwide. These affluent individuals seek exclusive investment opportunities, such as private equity and hedge funds, and pre-IPO placements or pre-ICO sales. Managing their substantial financial portfolios necessitates the assistance of skilled wealth managers or advisors. These professionals specialize in wealth management, estate planning, asset protection, and tax strategies to ensure HNWIs maximize their investments and minimize risk. For instance, Acta Haematologica, a leading hematology journal, and the British Heart Foundation have highlighted the importance of effective equity management for individuals with hereditary antithrombin deficiency and AT III deficiency.

- Octapharma, a global healthcare company, offers treatments for these conditions, underscoring the importance of strategic investment in healthcare. Furthermore, research in Frontiers in Neurology and the SERPINC1 gene has shown the potential for new therapies and treatments, further emphasizing the need for HNWIs to stay informed and invest wisely. By partnering with experienced wealth managers, HNWIs can make informed decisions and optimize their financial portfolios.

What challenges does Equity Management Software Market face during the growth?

Increasing availability of open-source solutions is a key challenge affecting the market growth.

- Open-source equity management software offers organizations an efficient solution for managing their assets without the need for substantial upfront investment. Small businesses are the primary adopters of this cost-effective alternative to licensed asset management software. Cross-industry collaborations and ecosystem partnerships are fostering the growth of this market. By adopting open-source asset management software, businesses can reduce their expenses on initial investments and optimize their asset utilization.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altvia Solutions LLC

- bobsguide

- By Global Shares

- Capdesk

- Computershare Ltd.

- Diligent Corp.

- Dynamo Software Inc.

- Equiniti Group

- Eqvista Inc.

- eShares Inc. DBA Carta Inc.

- Euronext N.V.

- GS Topco GP LLC

- Gust Inc.

- HighCastle

- Imagineer Technology Group LLC

- Ledgy AG

- Papaya Global Ltd.

- Prolific Labs Inc.

- Qapita Corp.

- Vestd Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Equity management software plays a crucial role in the healthcare industry, particularly in managing and monitoring various clotting disorders, including antithrombin deficiencies and at I III deficiencies. These disorders can lead to severe complications such as blood clots, thrombosis, and even death during surgeries or in cases of septic shock. The market for equity management software in this domain is driven by the therapeutic segment, which includes the development and use of drugs to treat these conditions. The protein deficiencies associated with these disorders can be diagnosed through various tests, including activity assays and immunological assays. The importance of effective equity management in this context cannot be overstated, as timely and accurate diagnosis and treatment are vital for ensuring patient safety during hospital procedures and surgeries.

Moreover, cross-industry collaborations and ecosystem partnerships are increasingly driving innovation in the field, leading to the development of point-of-care testing devices and mobile testing apps. Equity management software also plays a crucial role in managing the production and distribution of antithrombin, which is often derived from goat milk and available in lyophilized form. This protein plays a vital role in preventing blood clotting and is essential for the effective treatment of various clotting disorders. In summary, equity management software is a critical tool for managing and monitoring various clotting disorders, ensuring patient safety during healthcare procedures, and driving innovation in the development of new treatments and diagnostic tools.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.51% |

|

Market growth 2024-2028 |

USD 547.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.88 |

|

Key countries |

US, UK, China, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch