ESG Reporting Software Market Size 2025-2029

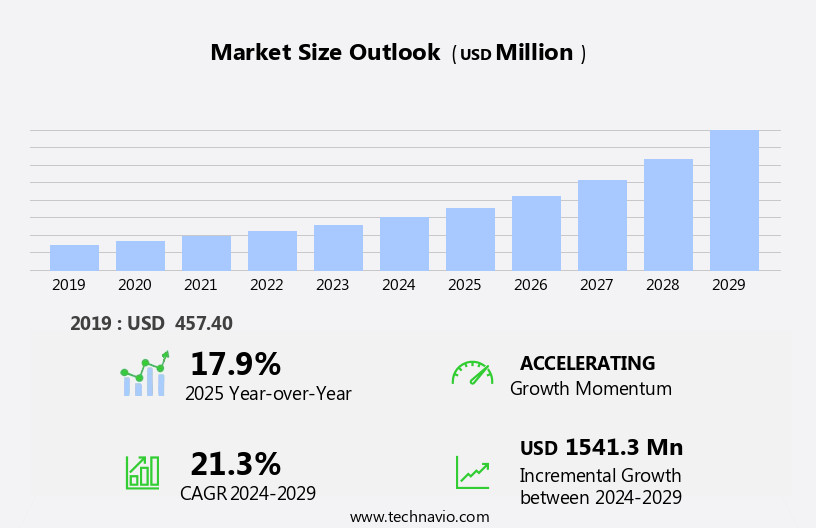

The esg reporting software market size is forecast to increase by USD 1.54 billion, at a CAGR of 21.3% between 2024 and 2029.

- The market experiences continuous expansion due to the increasing volumes of corporate data and the integration of advanced analytics capabilities. Companies are recognizing the importance of Environmental, Social, and Governance (ESG) reporting to enhance their sustainability and transparency efforts. However, the high initial capital investments required for implementing these solutions pose a significant challenge for smaller organizations. Despite this hurdle, the potential benefits, including improved stakeholder trust and regulatory compliance, make ESG reporting software a strategic priority for businesses seeking to stay competitive and responsible in today's global market.

- The growing emphasis on data-driven decision-making and stakeholder engagement further underscores the importance of robust and efficient ESG reporting solutions. Companies that effectively navigate the challenges and capitalize on these trends will be well-positioned to succeed in the evolving ESG reporting landscape.

What will be the Size of the ESG Reporting Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its landscape. Real-time reporting and data visualization are increasingly crucial for organizations to assess their Environmental, Social, and Governance (Esg) performance. Compliance management and risk management software play a pivotal role in ensuring adherence to regulatory requirements and mitigating potential risks. Reporting frameworks such as the Global Reporting Initiative (Gri) and the Sustainability Accounting Standards Board (Sasb) provide standardized guidelines for Esg reporting. Integration of these frameworks with Esg reporting software facilitates seamless data collection, analysis, and reporting. Climate change disclosure, audit trails, trend analysis, and data analytics are essential components of Esg reporting, enabling organizations to measure their carbon footprint, assess environmental risks, and monitor social impact.

Data security, API integrations, and materiality assessment are also vital considerations for Esg reporting software. Cloud-based solutions, reporting automation, custom reporting, historical data analysis, and external reporting offer enhanced flexibility and efficiency. Boards and investors require accurate, timely, and comprehensive reporting for effective decision-making. Environmental performance indicators, sustainability metrics, and social performance indicators are integrated into Esg reporting software for comprehensive performance monitoring. Workflow automation, data validation, reporting frequency, and predictive analytics further enhance the capabilities of these solutions. Supply chain transparency, stakeholder engagement, and management reporting are essential aspects of Esg reporting, ensuring organizations maintain a strong focus on their sustainability commitments.

Esg reporting software continues to evolve, offering innovative solutions for organizations to effectively manage their Esg performance and reporting requirements.

How is this ESG Reporting Software Industry segmented?

The esg reporting software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Sector

- Large enterprises

- SMEs

- End-user

- BFSI

- Energy and utilities

- Manufacturing

- Healthcare

- Others

- Type

- Environmental management software

- Social management software

- Governance management software

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

The global ESG reporting market is experiencing significant advancements, with on-premises solutions gaining traction. This shift is driven by the desire for increased data security and control, as well as the potential for energy cost savings. On-premises ESG reporting software allows organizations to reduce energy use by 80-85%, making it an attractive option for businesses. Furthermore, the high system security offered by on-premises solutions is a primary reason for their adoption. However, the deployment of on-premises software requires a robust IT infrastructure. Compliance with various reporting frameworks, such as GRI and SASB standards, is crucial, and real-time reporting and data visualization enable effective trend analysis and risk management.

ESG reporting software facilitates climate change disclosure, materiality assessment, and social impact measurement, while ensuring data integrity and providing audit trails. Additionally, workflow automation, reporting accuracy, and data quality are essential features. Cloud-based solutions also play a role in the market, offering reporting automation, custom reporting, and historical data analysis. Integration with other software and APIs, as well as predictive analytics, are valuable additions for organizations seeking to enhance their ESG reporting capabilities. Performance monitoring, environmental performance indicators, and stakeholder engagement are key aspects of ESG reporting, ensuring transparency and accountability. ESG reporting software enables organizations to meet regulatory requirements, engage with investors, and maintain good governance frameworks.

Overall, the ESG reporting market is evolving to meet the needs of businesses, offering innovative solutions for data management, analysis, and reporting.

The On-premises segment was valued at USD 331.30 billion in 2019 and showed a gradual increase during the forecast period.

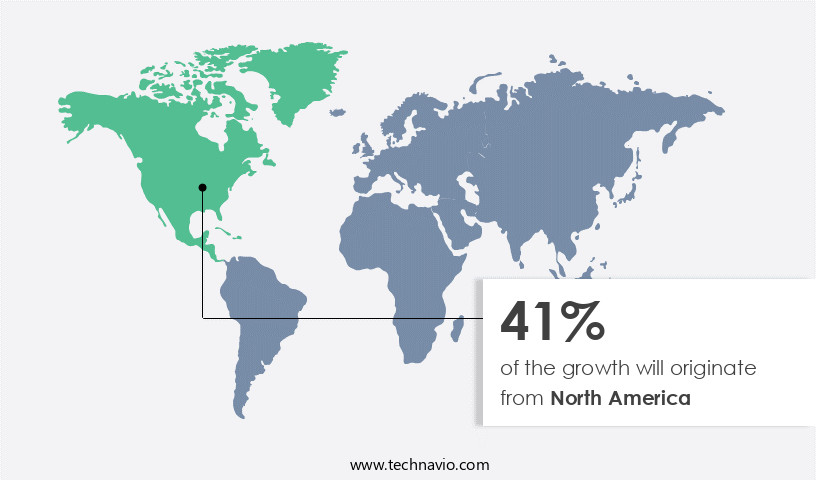

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, with the US at the forefront, is experiencing significant growth due to increasing regulatory emphasis on workplace safety and sustainability practices. Energy and utilities, chemicals and materials industries, among others, are key contributors to this market's expansion. OSHA, a prominent regulatory agency in the US, promotes workplace safety standards to ensure a healthy environment. ESG reporting software solutions are essential for companies to manage compliance, risk, and sustainability reporting. Real-time reporting, data visualization, and data analytics enable organizations to monitor and analyze their environmental, social, and governance performance. Compliance management, climate change disclosure, audit trails, materiality assessment, and trend analysis are critical features.

API integrations, data security, and reporting automation ensure data integrity and accuracy. Sustainability reporting, social impact measurement, and governance frameworks align with GRI and SASB standards. Cloud-based solutions facilitate performance monitoring, stakeholder engagement, and external reporting. Predictive analytics and custom reporting provide valuable insights for investor and regulatory reporting. Software integrations and workflow automation streamline data validation and frequency. Environmental performance indicators, data quality, and supply chain transparency are essential for continuous improvement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to businesses seeking to streamline their Environmental, Social, and Governance (ESG) reporting processes. These solutions enable organizations to manage and report on their ESG performance data, enhancing transparency and accountability. Key features include data collection, analysis, and reporting tools, as well as regulatory compliance capabilities. ESG reporting software also facilitates collaboration between various departments and stakeholders, ensuring accurate and consistent reporting. Additionally, it offers customizable templates, real-time data visualization, and integration with other systems. Companies utilizing ESG reporting software can improve their ESG performance, mitigate risks, and strengthen their brand reputation. The software market continues to evolve, incorporating advanced technologies like artificial intelligence and machine learning for enhanced data analysis and prediction.

What are the key market drivers leading to the rise in the adoption of ESG Reporting Software Industry?

- The continuous expansion of corporate data volumes serves as the primary catalyst for market growth.

- In today's digital business landscape, organizations face the challenge of managing an increasing volume of data from various sources. This data is crucial for various reporting requirements, including investor reporting, regulatory compliance, and management reporting. ESG reporting is a significant aspect of this data management, involving governance performance indicators, data validation, and supply chain transparency. To ensure data quality, organizations turn to ESG reporting software. These solutions offer data integrity, enabling accurate and consistent reporting. Furthermore, predictive analytics capabilities help organizations anticipate trends and make informed decisions. Regulatory reporting and stakeholder engagement are other essential aspects of ESG reporting.

- Regular reporting frequency is necessary to maintain transparency and build trust with investors and other stakeholders. SASB standards provide a framework for reporting material sustainability issues. Management reporting benefits from ESG reporting software as well. It offers immersive, harmonious, and thematic reporting capabilities, emphasizing the organization's commitment to sustainability and social responsibility. Data validation ensures the accuracy and reliability of the reported data, enhancing the organization's reputation and credibility. In conclusion, ESG reporting software plays a vital role in helping organizations manage their data, meet reporting requirements, and build stakeholder trust. Its benefits include data integrity, predictive analytics, regulatory compliance, and stakeholder engagement.

- By adopting a cost-effective cloud-based solution, organizations can efficiently manage their data and focus on their core business operations.

What are the market trends shaping the ESG Reporting Software Industry?

- The use of analytics in Environmental, Social, and Governance (ESG) reporting software is an emerging market trend. This integration enhances the capability of these tools to provide more insightful and actionable data for organizations.

- In today's business landscape, adhering to governance frameworks and environmental regulations is essential for organizations to maintain a good reputation and mitigate risks. ESG (Environmental, Social, and Governance) reporting software has emerged as a critical tool for businesses to monitor and report their performance in these areas. These solutions offer software integrations that enable seamless data collection from various sources, ensuring accuracy and completeness. Moreover, real-time performance monitoring and custom reporting help organizations analyze their environmental performance indicators and identify areas for improvement. Cloud-based ESG reporting software offers reporting automation, historical data analysis, and external reporting capabilities, making it easier for businesses to meet regulatory requirements and provide board reporting.

- The increasing emphasis on transparency and sustainability is driving the adoption of ESG reporting software. Organizations can leverage these tools to demonstrate their commitment to stakeholders and investors, while also gaining insights to optimize their operations and reduce costs. By automating the reporting process and providing real-time data analytics, businesses can save time and resources while ensuring compliance with various regulations.

What challenges does the ESG Reporting Software Industry face during its growth?

- The significant requirement for high initial capital investments poses a substantial challenge to the industry's growth trajectory.

- The market faces challenges in its growth due to the significant investment required for replacing existing infrastructure with more sustainable EHS solutions. Small and medium enterprises (SMEs) and industries struggle with the high initial costs, which hinder market expansion. Another challenge is the integration of ESG reporting software with enterprise resource planning (ERP) systems. With ESG standards influencing various operational activities, the full potential of these standards can be realized by seamlessly integrating them with ERP systems. Real-time reporting, data visualization, compliance management, risk management, climate change disclosure, data analytics, social impact measurement, and trend analysis are essential features of ESG reporting software.

- These features enable businesses to gain valuable insights and make informed decisions, ultimately contributing to their sustainability efforts. Despite the challenges, the market offers opportunities for businesses to enhance their transparency, improve operational efficiency, and mitigate risks.

Exclusive Customer Landscape

The esg reporting software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the esg reporting software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, esg reporting software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Benchmark Digital Partners LLC - This company provides ESG reporting solutions, including ESG Compass, enabling businesses to assess, manage, and communicate their Environmental, Social, and Governance (ESG) metrics effectively. ESG Compass is a powerful software tool that streamlines ESG data collection, analysis, and reporting processes, ensuring accurate and transparent disclosures to stakeholders. By utilizing advanced analytics and customizable reporting features, companies can gain valuable insights into their ESG performance, identify areas for improvement, and enhance their sustainability initiatives. This software solution aligns with global best practices and regulatory requirements, empowering organizations to strengthen their ESG profiles and build trust with investors and consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Benchmark Digital Partners LLC

- Brightest Inc.

- Diginex

- Diligent Corp.

- DNV Group AS

- ESG Enterprise

- insightsoftware

- Intelex Technologies ULC

- International Business Machines Corp.

- Metrix Software Solutions Pty Ltd.

- Morningstar Inc.

- Nasdaq Inc.

- Newgen Software Technologies Ltd.

- PricewaterhouseCoopers LLP

- Salesforce Inc.

- Sustain.Life Inc.

- UL LLC

- Updapt CSR Private Ltd.

- Wolters Kluwer NV

- Workiva Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in ESG Reporting Software Market

- In January 2024, Sustainalytics, a leading ESG research, data, and analytics firm, announced the launch of its new ESG reporting software, "ESG Analytics Pro," designed to help companies streamline their ESG reporting processes and enhance transparency (Sustainalytics Press Release).

- In March 2024, Moody's Corporation, a global integrated risk assessment firm, entered into a strategic partnership with ESG data provider S&P Global to expand its ESG offerings and improve its ESG risk assessments (Moody's Corporation Press Release).

- In May 2024, ESG software provider, Verisio, secured a USD10 million Series B funding round, led by Sustainable Investment Management (SIM) LP, to accelerate its product development and expand its market presence (Verisio Press Release).

- In April 2025, the European Union passed the Corporate Sustainability Reporting Directive (CSRD), which mandates extensive ESG reporting for all large companies operating within the EU, effective from 2026 (European Commission Press Release).

Research Analyst Overview

- The market is witnessing significant growth as businesses increasingly prioritize resource efficiency and integrated reporting. Non-financial reporting, including ESG ratings and disclosure frameworks, is becoming a crucial aspect of corporate governance and transparency. Risk assessment, scenario planning, and compliance certification are essential tools for managing ESG risks and ensuring business continuity. Circular economy principles, such as emissions reduction, water management, and waste management, are gaining traction as companies strive for sustainability. Green finance and impact investing are driving demand for ESG reporting software, which facilitates due diligence and stakeholder analysis. Disaster recovery, business continuity, and information security management are essential components of ESG reporting, ensuring resilience and protecting against risks.

- Social responsibility, diversity and inclusion, labor standards, and human rights are also critical areas of focus for businesses seeking to enhance their ESG performance. ESG reporting software supports scenario planning, energy efficiency, pollution control, and biodiversity conservation efforts. Assurance services, including emissions reduction verification and social responsibility audits, provide additional assurance and transparency. Shareholder activism and stakeholder engagement are facilitated through ESG reporting software, enabling effective communication and collaboration. In the realm of ESG reporting, companies must navigate a complex landscape of regulations, standards, and expectations. ESG reporting software enables businesses to manage these requirements, streamline their reporting processes, and effectively communicate their ESG performance to stakeholders.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled ESG Reporting Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.3% |

|

Market growth 2025-2029 |

USD 1541.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.9 |

|

Key countries |

US, Canada, Germany, UK, China, Brazil, Italy, France, Japan, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this ESG Reporting Software Market Research and Growth Report?

- CAGR of the ESG Reporting Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the esg reporting software market growth of industry companies

We can help! Our analysts can customize this esg reporting software market research report to meet your requirements.